Deepwater drilling remains steady worldwide

DRILLING MARKET FOCUS

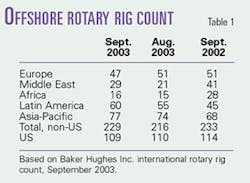

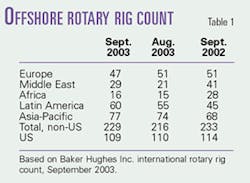

According to the international offshore rig counts provided by Baker Hughes Inc. for September 2003, offshore rig activity was up 13 rigs internationally since August and was particularly strong in Latin America and Asia Pacific, while offshore Europe an activity was flat (Table 1).

Latin America had 60 rigs working offshore in September, up 5 from August and up 15 from September 2002, predominantly due to increased drilling off Mexico.

The Asia Pacific region had 77 rigs operating offshore in September, up 3 from August and up 9 from September 2002, predominantly from increased drilling off India and to a lesser extent Malaysia.

There were 47 rigs drilling offshore Europe in September, down 4 from August, predominantly due to rigs being shed in Norway. The UK had 3 fewer rigs drilling than in September 2002.

In the Middle East, 29 rigs were drilling offshore in September, up 8 from August, due to increased drilling off Egypt, Saudi Arabia, Dubai, and Abu Dhabi. But the rig count was down 11 from September 2002, predominantly due to rigs dropped in Qatar, Iran, and Egypt.

Monthly offshore rig counts in the US were 109 for September, down from 110 in August (21%) and 114 in September 2002 (24%).

There were 105 rigs drilling offshore US during the weeks of Oct. 24 and Oct. 31 in Louisiana (81), Texas (19), California (3), Alaska (1), Florida (1), down from 106 rigs drilling during the weeks of Oct. 10 and 17.

SCORE

GlobalSantaFe Corp.'s worldwide SCORE, or Summary of Current Offshore Rig Economics, for September 2003 was up 4.2% from the previous month, the company reported in late October. The largest gains were seen in the North Sea (up 7.8%) and West Africa (up 5.9%). The Gulf of Mexico and Southeast Asia SCORE values dropped off 0.7 and 0.8%, respectively.

The SCORE increased for both jack ups (5.5%) and semisubmersibles (1%) since August, but only the semi SCORE represented an increase from a year ago (7.5%). This suggests that the market for deepwater drilling rigs is improving.

The SCORE is calculated by comparing "the profitability of current mobile offshore drilling rig dayrates to the profitability of dayrates at the 1980-1981 peak of the offshore drilling cycle."1

In a company announcement on Oct. 21, GlobalSantaFe President and Chief Executive Officer Jon Marshall said, "While the worldwide jack up market appears to be strengthening, we expect to see continued softness in the midwater depth floater markets and a marginal over supply in the deepwater markets."

Deepwater rig fleet

There are 64 rigs (24 drillships and 40 semisubmersibles) capable of drilling in water depths 5,000 ft and greater.2 Transocean Inc. owns 13 of the drillships, Houston-based GlobalSantaFe has 3, Pride International Inc. and Noble Drilling Corp. each has 2; other individual owners are Houston-based Diamond Offshore Drilling Inc., Stavanger-based Dolphin AS (a unit of Fred. Olsen Energy ASA), Saipem SPA, and Smedvig Offshore ASA.

Control of the deepwater semi fleet is more widely distributed: Transocean, 11; Diamond, 8; Noble, 7; Pride, 4; Atwood Oceanics Inc., 2; Ocean Rig ASA, 2; and 1 each for Dallas-based Ensco International Inc., GlobalSantaFe, Petróleo Brasileiro SA (Petrobras), Saipem, Smedvig, and Aberdeen-based Stena Drilling, a subsidiary of Stena AB.

Transocean fleet

According to the "Monthly Fleet Update," issued Oct. 28 by Transocean Inc., all 13 of the drilling units in Transocean's "fifth-generation" fleet are currently under contract and capable of drilling in water depths from 10,000 to 4,500 ft.

Of the 13, eight are working in the Gulf of Mexico, three off Brazil for Petrobras (two ships, one semi), and two off Nigeria for ChevronTexaco (one ship, one semi).

Transocean's newest dynamically positioned, double-hull drillship, the Discoverer Deep Seas, began service in 2001 and is working in the Gulf of Mexico for ChevronTexaco, under a 5-year contract ending January 2006 ($205,000/day).

The Discoverer Enterprise, which began working in 1999, is the first ultradeepwater drillship with dual activity drilling technology.

It is currently working in the Gulf of Mexico for BP PLC, under contract through December 2004 ($198,600/day).

Transocean has 13 other deepwater drilling units, capable of drilling in water depths from 4,500 to 7,200 ft. Nine are working and 4 are idle. Four are drilling off Brazil for Petrobras, 1 in the UK North Sea (Transocean Leader, for BP), 4 off West Africa (Transocean Richardson off the Ivory Coast; M.G. Hulme, Jr. and Sedco 709 off Nigeria; Transocean Rather off Angola), and the Jim Cunningham off Egypt for Gulf of Suez Petroleum Co. (GUPCO).

The 30 rigs in Transocean's midwater fleet are capable of drilling in water from 1,000 ft (Sedco 704 and 706, both idle) to 4,200 ft (Peregrine III, idle). Nearly half of this fleet was idle as of Sept. 30. Of the 16 units under contract, 9 are working in the North Sea (7 in UK sector, 2 in Norwegian sector), 2 in Brazil, and 1 each in E. Guinea, Canada, Australia, Indonesia, and Angola.

Canadian offshore

Two rigs were drilling offshore Canada during the week of Oct. 31, representing less than 1% of all Canadian rigs. This is down from 6 offshore rigs drilling in Canada the week of Sept. 12, according to the Baker Hughes rig count.

Transocean's Henry Goodrich, a Sonat/Mitsui SES 5000 design propulsion-assisted semi drilling unit built in 1985, is drilling at Terra Nova off Newfoundland for the PetroCanada Corp. alliance.

Norwegian contractor Ocean Rig spud the $26 million (Can.) deepwater Weymouth well off Nova Scotia for EnCana Corp. on Oct. 19. The well will take 122 days to complete at a rate of $204,000/day for the semi drilling rig Eirik Raude. In 2001, PanCanadian Energy Inc., Calgary, and Ocean Rig formed an East Coast drilling partnership for use of the Eirik Raude in deepwater projects (OGJ, Jan. 21, 2002, p. 54-7).

According to Atlantic Canadian News, "Ocean Rig has entered into a farm-out agreement with EnCana to participate in the Weymouth well, with a right to convert to a working interest in the license. Ocean Rig's 22.5% share of the budgeted cost to drill the well is $13.5 million [Can.]."3

Gulf of Mexico

Eight of the 13 deepwater drilling vessels in Transocean's fifth-generation fleet are currently under contract in the Gulf of Mexico. The 5 drillships are commanding dayrates of $166,900 to $205,000/day. The three semisubs are contracted to Dominion ($125,000/ day for the Cajun Express, through November), BP ($200,000/day for the Deepwater Horizon, through September 2004), and Shell ($201,800/day for the Deepwater Nautilus, through June 2005).

ChevronTexaco Corp. (operator, 50% working interest), Devon Energy Corp. (25% WI), and EnCana Gulf of Mexico (25% WI) announced a deepwater drilling success at the Sturgis prospect in the Gulf of Mexico, Atwater Valley Block 183, about 150 miles southeast of New Orleans (OGJ, Oct. 20, 2003, p. 9). The well was drilled in July in 3,700 ft water, and the companies plan additional appraisal wells.

"Successful conclusion of this operation is the latest in a series of successful deepwater drilling results," said Ray Wilcox, vice-president of ChevronTexaco and president of ChevronTexaco Exploration and Production Co.

ChevronTexaco also has the ultradeepwater drillship Discoverer Deep Seas under contract from Transocean Sedco Forex Inc. to work in the Gulf of Mexico through 2007.

J. Michael Lacey, senior vice-president of exploration and production at Oklahoma City-based Devon, said, "We are committed to drill two additional exploratory wells in the joint venture, which will earn us interests in 71 exploratory blocks in the deepwater Gulf."

The Sturgis wells were drilled from Global Marine's Glomar Explorer (Fig. 1), a ship with an interesting history. It was built in 1973 for Global Marine Development Inc., a subsidiary of Howard Hughes' Summa Corp., ostensibly to mine manganese nodules in the deep Pacific Ocean, under the auspices of the Deep Ocean Mining Project (DOMP).

However, the real mission of the Hughes Glomar Explorer was to surreptiously raise the K-129, a Golf-2 class Soviet nuclear submarine that sunk in March 1968, in nearly 17,000 ft. of water, about 750 miles northwest of Hawaii.

The Hughes Glomar Explorer reached the sub and made a partial recovery in June-July 1974. The "Jennifer Project" is estimated to have cost $350-550 million.

Devon's Chairman and CEO J. Larry Nichols told OGJ that, "As an independent, we have the largest acreage in the deep waters of the Gulf of Mexico" (OGJ, Sept. 22, 2003, p. 38). Devon has interests in more than 500 deepwater blocks, covering about 1,140,000 net acres, 96% of which is undeveloped. Earlier this year, the company said it planned to drill as many as 30 deepwater exploration wells in the Gulf of Mexico during 2003.

Nichols added "we have rank wildcat exploration in the deep waters of the Gulf of Mexico and internationally, so we're balanced between having a lot of low-risk drilling but yet having some high-risk exploration opportunities."

Mississippi-based Callon Petroleum Co. announced plans earlier this year to drill two new deepwater test wells in Mississippi Canyon during 2003. A stepout in North Medusa finished drilling in July, and a deepwater wildcat was spudded in September and still drilling on Oct. 31, according to Thomas Schwager, VP, engineering & operations.

Until now, Callon's drilling and production has been predominantly from the shallow Miocene, but production from the deepwater Medusa and Habanero fields is coming on line in October and November, respectively.

According to a presentation given at the IPAA Oil & Gas Investment Symposium-West, in early October, Callon has already spent about $25 million of the $30 million projected for deepwater development in 2003, predominantly at Habenero. The company anticipates spending approximately $10 million on deepwater development in 2004, predominantly at Medusa and North Medusa in Mississippi Canyon.

North Sea

John Crum, executive vice-president North Sea for Apache Corp., is upbeat about North Sea drilling. Oil discoveries from "fallow" North Sea assets (those which have lain idle for 4 years or longer) could potentially generate revenue of $50 billion, he told Newsquest (Sunday Herald) Ltd., Glasgow, in early September.

Crum said "By world standards the North Sea is not so densely drilled."

He is convinced that the North Sea contains another massive field like Buzzard, discovered in 2002, with reserves of 400 million bbl, and said "Absolutely no question, there is at least one more Buzzard out there."

Crum said that Apache would consider acquisitions of all sizes and might be interested in drilling a group of 20 fallow fields as small as 20 million bbl each.

Others are not so upbeat.

"North Sea rig utilization dropped to 75% in August, a decline of 2.6% from July, in what is likely to be the first step in a steep decline in rig usage into the winter months. Limited demand for second-half 2003 starts suggests the number of idle rigs in the North Sea could peak at over 25 in December, the majority being stacked in Invergordon. Lack of demand will put excess rig capacity into stark relief this winter," reported Platts North Sea Letter in early September.

The report added, "The semi-submersible market will be worst hit, with utilization 6 months forward falling close to 20% in the UK sector. Norway will maintain higher utilization, owing to the predominance of long-term contracts, but the 6-month forward rate still falls below 50%. The jack up market has softened, but still appears significantly stronger than that for semi-submersibles."

CEO Ketil Lenning of Odfjell Drilling AS, Norway, announced at the Offshore Europe 2003 Exhibition and Conference in Aberdeen in September that Odfjell will take over drilling and maintenance services on seven UK North Sea platforms, under a £13-million contract from Calgary-based Talisman Energy Inc.

West Africa deep water

Houston-based Pride International Inc. has two dynamically positioned, Gusto 10,000-design drillships operating in West Africa, both built in 1999: Pride Africa, under contract through June 2005 at $163,000/day, and Pride Angola, under contract through May 2005 at $162,000/day.

Pride also has two semisubmersibles under contract in West Africa: Pride North America, a Bingo 8000-design rig built in 1999, working through August 2004 at $164,000/day; and Pride South Pacific, a Sonat-design rig built in 1975, working through March 2004 at $98,000/day.

Pride is managing Ocean Rig's semisubmersible Leiv Eiriksson, which is continuing to drill under contract for BP off Angola. BP Exploration (Angola) Ltd. exercised options for the fourth and fifth wells in ultradeepwater Block 31, about 170 km off Angola and will employ the semi into 2004, the company announced last month. The discovery well on Block 31, Saturno-1, was drilled to 4,707 m TD in 1,804 m of water and tested 5,000 b/d of oil (OGJ Online, July 28, 2003; and OGJ, Aug. 4, 2003, p. 8).

BP is one of the "new players," expected to have Angola production over 2003-07, Merrill Lynch analysts said. In terms of total spending, "BP has the second highest capex exposure over the period with approximately $3.7 billion slated for its developments in Blocks 15, 17, and 18 (OGJ, Aug. 18, 2003, p. 29)."

Vanco Energy Co., a Houston-based independent, is a leading deepwater license holder offshore Africa with more than 20 million net acres offshore Ivory Coast , Equatorial Guinea, Gabon, Ghana, Madagascar, Morocco, and Namibia.

In an interview with Washington, DC-based Reed Kramer last January, Vanco President and CEO Gene Van Dyke said, "All our licenses are for deep water, deeper than a thousand feet. A thousand feet going up to 10,000 ft. We have licenses for up to 30 million acres in eight different countries. We are the largest license owner in deepwater West Africa. Deep water in West Africa has phenomenal potential, primarily because of these turbidite sands that come off the shelf."

Van Dyke added, "In Morocco, we have to drill a well by the end of 2003. We're going to drill a well in Cote d'Ivoire, probably in late 2003. We plan to drill three wells in Equatorial Guinea toward the end of 2003. And probably at the end of 2003, we'll also drill a well in Namibia. All wildcat wells."4

Asia-Pacific

Offshore rig counts show steady upward growth for drilling in the Asia Pacific region. In September, there were 77 rigs operating offshore, up 3 from August and up 9 from September 2002.

According to its Monthly Fleet Update, Transocean has two deepwater drilling units working in Southeast Asia as of Sept. 30. The Sedco 601 MODU was under contract for Australia's Santos Ltd. in Indonesia in September-October and will drill for ConocoPhillips in October-November for $58,000/day.

Santos was awarded a new production sharing contract in the East Java basin in August and will drill an exploratory well within 12 months (OGJ Online, Aug. 26, 2003).

Transocean's Sedco 703 semi was drilling off Australia for Melbourne-based BHP Petroleum Pty. Ltd. in September-October, went under contract to Woodside Petroleum Pty. Ltd. for October-December, is scheduled to work for Austria-based OMV Aktiengesellschaft in December-January, and goes back to work for BHP in January-February 2004, at rates ranging from $67,000 to $72,000/day.

The Discoverer 534 drill ship had been working in Malaysia but became idle in September. The Sedco 602 and 600 semisubs are in Singapore, idle since February and April, respectively.

Transocean's Discoverer Seven Seas will begin a 3-year, $137 million contract with Oil & Natural Gas Corp. Ltd. (ONGC) to drill off India in February 2004 at $125,000/day (OGJ Online, Aug. 12, 2003). The ship should complete its shipyard renovations during fourth quarter 2003.

Maersk.Contractors, Denmark, took delivery of a new deepwater semi, "Lider" (Maersk Explorer) in Azerbaijan. The Lider is capable of drilling in water 75-1,000m deep, enabling it to operate in 40% of the Caspian Sea (OGJ Online, June 7, 2001).

References

1. "GlobalSantaFe worldwide SCORE continues upward climb," GlobalSantaFe SCORE News Release, Oct. 20, 2003.

2. "World Fleet of Deep-Water Drilling Rigs," www.coltoncompany.- com/shipbldg/worldsbldg/rigbldg/dwrigs.htm, Oct. 22, 2003.

3. Atlantic Canadian News, a service of Atlantic Oil & Gas Works Online, www.oilworks.com/New/atcannews.html, Oct. 21, 2003.

4. Kramer, R., "Finding Africa's 'Big Oil'—in Deep Water," www.sidsnet.- org/latestarc/coastal-newswire/msg- 00002.html and http://allafrica.com- /stories/ 200301210053.html, Jan. 21, 2003.