Market Movement

null

OPEC-9 under pressure to perform

Even if both Iraq and Venezuela suffer serious disruptions to their respective oil production through the rest of this year, "crude prices would likely be in the $30-40(/bbl) range but would not 'go ballistic,'" veteran market analyst Stephen Smith, president and founder of Stephen Smith Energy Associates, Natchez, Miss., reported last week.

That's because the other nine members of the Organization of Petroleum Exporting Countries, with help from the emergency oil storage systems in the US and other major oil-consuming nations, could effectively make up at least most of the production lost by the group's two problem members, said Smith.

Worse possible case

Under the worst scenario envisioned by Smith, the current general strike aimed at ousting Venezuelan President Hugo Chávez could degenerate into "a long-term civil war," with Venezuela's oil production never averaging more than 700,000 b/d for the rest of this year, down from 2.8 million b/d last November.

Smith also envisions war in Iraq driving a desperate Saddam Hussein to dynamite many of his own oil fields and pumping stations "effective Apr. 1," slashing that country's average oil production to 400,000 b/d for the rest of this year, from an average 2.4 million b/d during the fourth quarter of 2002. That damage "would take the longest to correct," he said. In such a situation, Smith said, the remaining nine OPEC members would have to operate at 93% of their combined production capacity to meet the group's new production quota of 24.5 million b/d effective Feb. 1, reducing their remaining spare capacity to 1.69 million b/d.

Release of additional oil from the US Strategic Petroleum Reserve and other stockpiles among Organization for Economic Cooperation and Development (OECD) countries should cap world oil prices at $40/bbl or less, said Smith.

Other analysts declared $40/bbl oil as "survivable" at an energy forum in Houston last week (OGJ Online, Jan. 20, 2003).

Betting the best case

However, Smith gives "the strongest odds" to his best-case scenario, in which "Venezuela production gradually recovers from currently depressed levels, and the confrontation with Iraq is resolved without a sustained material loss of Iraq's (or other Middle East) production."

In that most optimistic outlook, Smith assumes "that somehow in the next 2-3 months the current impasse between Chávez and his opponents is resolved. Then, over a period of 3-4 months, field production is restored from its recent 30% of capacity to about 95% of capacity."

He also assumes "that any military engagement (against Iraq) would begin with an intensive program of air strikes that would reduce the odds of damage to any Persian Gulf oil loading ports outside Iraq. Iraqi oil loadings might be temporarily delayed for a month or 2, butUno structural damage to oil fields, key pumping stations, or loading ports would occur."

Under that scenario, Smith foresees market prices for benchmark West Texas Intermediate crude hovering "in the upper $20s to lower $30s" through the first part of this year prior to "some military or political action to remove Saddam Hussein in the second or third quarter. This would likely be followed by an inventory glut and a postwar production squabble (among the major producing countries) that could pressure the WTI price to the low $20s(/bbl) for a while, followed by an agreement that restores WTI to the $20-25(/bbl) range."

In that case, he said, the OPEC-9 would face the opposite problem of having to reduce production in phases from an "expected first quarter utilization rate of 89%" to "80% by the fourth quarter to prevent an inventory glut from developing." Moreover, Smith said, "This does not consider the added pressure that might come from a postwar Iraq that would likely be free to export as it wished."

To meet its objective of stablizing prices, OPEC must maintain global oil inventories near seasonal norms. "But with output from two producers now being highly uncertain, the task of the OPEC-9 is to swing their production so as to offset the random production swings of the (unreliable) OPEC-2," Smith said.

Smith's third, midlevel scenario involves a drastic reduction of Venezuela's production by civil war, while the expected conflict in Iraq is resolved with no sustained loss of that country's current oil output.

Venezuela costs international majors

The general strike that has paralyzed business in Venezuela and brought its oil industry to its knees is costing the 10 largest international companies in that country a whopping $6.7 million/day in combined lost revenue, said analysts at Wood Mackenzie Ltd. in a Jan. 22 report. They estimated Venezuela's current national production at 400,000-600,000 b/d, down from a 2003 projection in excess of 3 million b/d.

With the biggest exposure through its interests of 47% in the Sincor heavy oil project and 55% in Jusepín field, TotalFinaElf SA is projected to be losing $1.4 million/day as a result of the strike, Wood Mackenzie reported. ConocoPhillips is next with an estimated loss of $1 million/day. Other projected daily losses include ENI SPA $870,000, ExxonMobil Corp. $770,000, ChevronTexaco Corp. $640,000, Royal Dutch/Shell Group $530,000, Statoil ASA $470,000, Repsol-YPF SA $380,000, BP PLC $310,000, and PetroCanada Ltd. $290,000.

Analysts said it is more difficult to measure the cost of the strike to "the biggest loser of all"—state-owned Petroleos de Venezuela SA (PDVSA). "By the government's own admission," they reported, "the effects of the strike will cut national average annual production by 23% in 2003—a disaster for a country that relies on oil for around 25% of GDP, 80% of total exports, and 50% of government revenue."

They said, "In reality, production is likely to average much less than 2.3 million b/d in 2003."

Most of the Venezuelan fields in which the international majors are involved were shut down in a controlled manner. "However, it is still possible that some reservoirs may have been damaged and that facilities on heavier or more-waxy (crude oil producing) fields may require significant cleaning, and wells may require stimulation," Wood Mackenzie noted.

Moreover, it said, "A shortage of gas is limiting reinjection for enhanced oil recovery, critical for pressure maintenance and a high proportion of Venezuelan output. Only upon the resumption of operations will the full implications for both near-term rehabilitation and longer-term reservoir management be known."

Conventional heavy oil fields such as Boscán will perhaps suffer the worst. Boscán has been kept producing in order to maintain its oil above the pour point level and to avoid heat loss from facilities. "However, with half of the wells on the field currently shut in and produced oil stored in (open) pits, it is possible that output will never recover to preshutdown levels," analysts said.

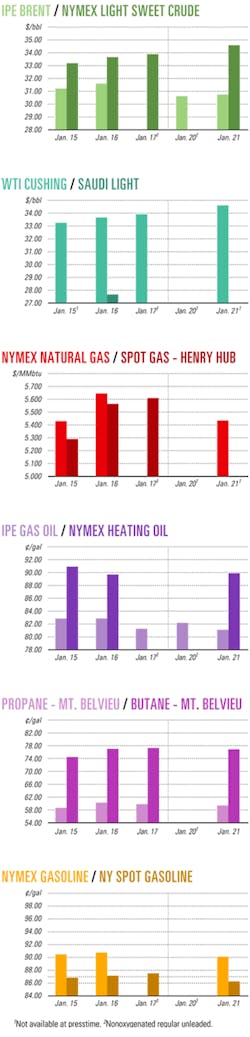

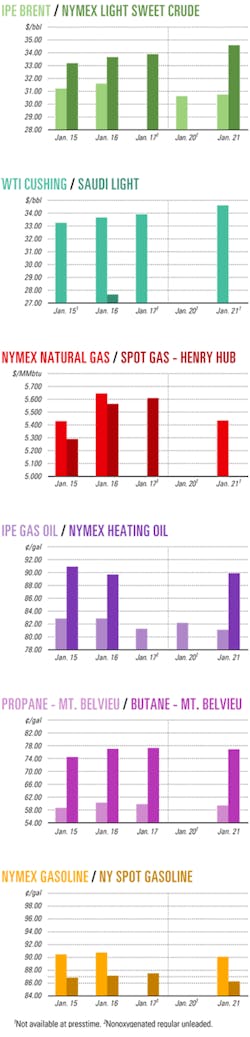

Industry Scoreboard

null

null

Industry Trends

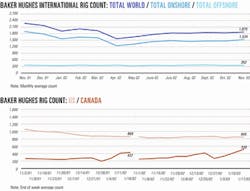

US integrated oil companies' upcoming fourth quarter 2002 results are expected to improve on both a sequential and year-over-year basis, two analysts have forecast.

UBS Warburg LLC issued a Jan. 15 research note outlining its fourth quarter 2002 earnings preview for US integrated oil companies. Separately, A.G. Edwards released a Jan. 14 research note giving its fourth quarter earnings preview for worldwide integrated oil and gas companies.

"In aggregate, we forecast fourth quarter 2002 adjusted earnings from the US integrated oil sector to increase 59% year over year to $6.2 billion, said Matthew Warburton, an analyst with UBS Warburg. "This should end five consecutive quarters of double-digit, year-over-year earnings declines," he said.

Going forward, UBS Warburg anticipates a continued earnings recovery for integrated companies on a YOY basis—helped in part by favorable commodity price comparisons and weak downstream margins during most of 2002.

"However, we forecast a sequential quarterly decline from second quarter 2003 onward as crude oil prices gradually return to our midcycle estimate of $20/bbl West Texas Intermediate," Warburton said. "We currently expect aggregate adjusted net income for the US oil majors to increase by 126% YOY in first quarter 2003.

"Thereafter, given our oil and natural gas price forecasts, normalized (refining and marketing) margins, and a further improvement in chemical fundamentals, we forecast earnings to rise 37% YOY in 2003 and to decline 6% in 2004," he said. Improved refining margins are expected to be partially offset by declining performance for marketing operations because of sluggish volume growth and weaker retail margins YOY in some regions, he said.

Meanwhile, A.G. Edwards's research note stated, "Group earnings are estimated to increase 51% vs. the same period a year ago." Analyst L. Bruce Lanni said, "Sequentially, group earnings should improve by 18%." Lanni expects integrated firms to report their strongest earnings of 2002 in the fourth quarter, crediting improved downstream margins and high commodity prices.

Exploration and production profits are expected to be up 81%, refining and marketing down 45%, and petrochemicals up by 204% in the fourth quarter, Lanni said.

"Given the general uncertainties in the market, the anticipation of continued commodity price volatility, along with the potential impact of geopolitical events in the Middle East and Venezuela, we remain focused on the international integrated oil and gas companies, particularly those with a proven ability to generate above-average returns throughout any phase of the cycle," said Lanni.

Government Developments

The International Energy Agency's governing board has elected France's Claude Mandil as the agency's new executive director, effective Feb. 1, to replace Robert Priddle, who retired last year after 8 years at the post.

Paris-based IEA is the energy watchdog of the Organization for Economic Cooperation and Development, a group of the world's major oil importers.

The IEA board met Jan. 17 and is slated to meet again Feb. 20. Despite some media reports to the contrary, the January agenda did not include discussion about the strategic reserves of any of IEA's 26 member countries, a source at IEA told OGJ.

Such an issue could be put on IEA's governing board agenda if member governments were to request discussion of this topic. However, the decision of delving into strategic oil reserves is the responsibility of the governments of the countries concerned rather than IEA.

Mandil has more than 30 years experience in energy policy, both at national and international levels. He is leaving his post as CEO of France's Institut Français du Pétrole, a job he has held since April 2000. Mandil was chairman of the IEA governing board during October 1997-October 1998 when he was appointed managing director of Gaz de France.

While working as director general for energy and raw materials at the Ministry of Industry, Mandil was instrumental in convincing a previously reluctant France to become a member of IEA in 1991.

The 10-month standoff between British Gas PLC and India's state-owned Oil & Natural Gas Corp. (ONGC) over operatorship of the Panna-Mukta and Tapti oil and gas fields, although still unresolved, appears headed for a compromise.

BG has agreed to involve its two Indian partners in financial discussions. Mumbai-based Reliance Industries Ltd. is the third partner in the fields. In December, BG proposed involving ONGC and Reliance in the award of multimillion-dollar contracts—a step that ONGC Chairman and Managing Director Subir Raha called "a welcome change."

ONGC, which earlier stated that it would not settle for anything less than a joint operatorship, is looking at the latest offer to resolve the issue.

BG, which assumed interim operatorship of the fields after buying failed Enron Corp.'s 30% equity stake, also promised transparency and a greater participation by Indian partners in the decision-making process.

ONGC, which owns 40% of the equity, and Reliance, with 30%, had been expected to invoke a termination notice to remove BG from interim operatorship at a joint operating committee meeting in New Delhi on Dec. 4 (OGJ Online, Nov. 27, 2002). However, the issue was shelved "pending study of the fine print of the proposal."

An $800 million development plan for the fields is pending clearance.

Meanwhile, the joint venture is losing an estimated $310,000/ day from unrealized production potential.

Quick Takes

BP PIPELINES VIETNAM BV has started production from the $1.3 billion development of Nam Con Son natural gas fields off Viet Nam. The project includes development of Lan Tay and Lan Do gas fields on Block 06.1, with a steel production platform, construction of 399 km of pipeline to shore, onshore processing facilities, and erection of the 716 Mw Phu My 3 power plant, currently under construction (OGJ Online, June 3, 2002).

The fields contain reserves of 58 billion cu m (bcm) and are expected to supply gas for 20 years, BP said.

In Phase 1, as much as 3 bcm/year of gas will flow ashore. BP and partners, Viet Nam Oil & Gas Corp. (Petrovietnam), India's Oil & Natural Gas Corp. unit NGC Videsh Ltd., and ConocoPhillips Vietnam, estimate the gas could be used to generate about 40% of Viet Nam's electricity supply.

The new gas source provides needed fuel for Viet Nam's greatly increased electric power generation capabilities. The Phu My 3 power plant operations are slated to begin in late 2003. Gas from the Nam Con Son gas project will be sold directly to Petrovietnam for end users in the Phu My industrial zone.

Statoil ASA shut down production Jan. 19 on the Åsgard B platform in the Norwegian Sea because of damage to a leaking flare system, the company said. Åsgard B normally produces about 36 million cu m/day of export gas and 125,000 b/d of condensate.

The leak has been plugged and the position "normalized," platform manager Rune Hansen said. Production was expected to have resumed as soon as strong winds in the area abated, allowing technicians to inspect the damage and secure some loose equipment. Repairs will be completed during the regularly scheduled maintenance turnaround planned for September, Statoil said.

EUROIL LTD., a Cameroon-based, wholly owned subsidiary of the UK's BowLeven PLC, signed a joint venture agreement Jan. 14 with Tulsa-based Syntroleum Corp. to negotiate a joint production-sharing agreement with Cameroon for natural gas-condensate production from Block MLHP-4 off Cameroon and to assess, develop, and produce gas from Sanaga Sud field within the block.

The companies bid on the block in mid-2002 under Cameroon's New Petroleum Code, and EurOil received formal notice of acceptance in December. Sanaga Sud field is in the Douala-Kribi-Campo offshore basin, 20 km northwest of Kribi. Mobil Producing Cameroon Inc. (MPCI) drilled the discovery in 1979 and appraised it in 1981. However, lack of gas markets has precluded further drilling activity on Block MLHP-4. Sanaga Sud field's recoverable gas is estimated at more than 600 bcf, said Mobil. Productive intervals for the field fall at 1,000-1,600 m subsea in waters less than 20 m deep.

Syntroleum and EurOil each have a 50% working interest in Block MLHP-4 and will equally share costs for assessment, development, gas-to-liquids processing, and developing other natural gas marketing applications. Syntroleum, with support from EurOil, also will complete a gas reserves and project assessment study for a proposed GTL plant in Cameroon to utilize gas produced from the block. Phase 1 would involve analysis of previous data developed for the block to determine the field's reserves.

The companies intend to complete the negotiation and execution of a joint operating agreement by mid-2003.

TrueNorth Energy Corp., Calgary, has deferred development of the Fort Hills oil sands project 90 km north of Fort McMurray, Alta., in part because of "escalating costs, challenging capital markets, and general uncertainty" about the potential impact of implementation of the Kyoto Protocol on Climate Change, TrueNorth Chairman Dave Robertson said. "When conditions improve, we will reevaluate today's (board) decision," he added. Last year, TrueNorth received all necessary permits and approvals for the development, and the company said it intends to preserve the assets' value and its options to proceed. The project previously had targeted production of 95,000 b/d of bitumen in 2005 and 190,000 b/d in 2008 (OGJ Online, June 25, 2001). TrueNorth Energy LP, an affiliate of Koch Petroleum Canada LP, with 78% interest was operator, and UTS Energy Corp. holds 22%.

BRAZILIAN STATE OIL COMPANY Petroleo Brasileiro SA (Petrobras) has completed oil production tests on the Caravela Sul discovery, said partner Coplex Petroleo do Brasil Ltda. Petrobras also announced that oil production from Coral field is imminent.

Both Caravela Sul and Coral are on Block BS-3 in the Santos basin off Southeast Brazil. Petrobras, the operator, encountered various technical problems in Coral field, each of which "was minor," Coplex said, but took longer than expected to resolve. Meanwhile, all necessary environmental and governmental licenses for Coral have been obtained.

Coplex is in a joint venture with Petrobras to develop oil and natural gas from known fields in the Santos basin. The agreement also provides for further exploration (OGJ, Apr. 26, 1999, p. 27). Coplex has a 27.5% interest in Block BS-3.

The Caravela Sul discovery was made with the SCS-10 exploration well in 4,761-5,126 m of water. The well is 175 km off Santa Catarina state in 200 m of water. Three pay zones were found, and production tests on two zones were completed in the SCS-10A appraisal well, Coplex said.

The deepest of the three zones, B3, flowed 3,000 b/d of oil through a 3/8-in. choke. The oil is light and similar to that from Coral field 15 km to the north, Coplex said. Petrobras has increased its preliminary reserve estimate for the Caravela Sul discovery to 60 million bbl, up from an earlier estimate of 40 million bbl, Coplex reported. SCS-10A also tested zone B1 but without successful flows. Petrobras reported limited permeability in the area, Coplex said, adding that technical problems prevented the testing of zone B2.

OMAN has awarded Chiyoda-Foster Wheeler & Co. LLC a contract for the detailed engineering, procurement, and construction of an LNG train at Qalhat, near Sur, Oman.

The new train will be built next to the existing Oman LNG LLC complex, where two identical LNG trains, each with a capacity of 3.3 million tonnes/year, have been operating since early 2000.

The new LNG train, expected to be on stream by yearend 2005, is to begin supplying LNG to Spain's Union Fenosa SA in early 2006.

The contract, which includes an option for construction of additional LNG storage facilities, later will be transferred to a new joint venture that the Omani government is forming with Oman LNG and Union Fenosa to develop and operate the train.

Chiyoda Corp. said that Chiyoda-Foster Wheeler also completed engineering for the existing two trains for Oman LNG, with Shell Global Solutions International BV serving as the project's technical advisor.

LYONDELL-CITGO REFINING LP (LCR)—a joint venture of Houston-based Lyondell Chemical Co. and Tulsa-based Citgo Petroleum Corp.—reported that it has restarted its second crude distillation unit, which now is operating at 220,000-230,000 b/d. The increase, says Lyondell, is due to "improved availability of both spot and Venezuelan contract crude." The JV added, "Based on currently available information, LCR expects to be able to sustain these rates."

Citgo, the fifth-largest retailer of gasoline in the US, had been one of the hardest hit by the oil industry strike in Venezuela because it relies on that country for about half of its crude under long-term contracts (OGJ, Jan. 6, 2003, p. 5). LCR's Houston plant recently cut its production by half due to the lack of Venezuelan oil.

Other companies, including ConocoPhillips and Amerada Hess Corp., also have reduced runs at refineries that rely on Venezuelan crude.

CONCERNS ARE RISING over the security of the Baku-Tbilisi-Ceyhan (BTC) pipeline following increased threats to the project.

Azerbaijan's Defense Minister Safar Abiyev told British government officials that Armenia's "aggressive policy" and arms and hardware accumulation posed a threat to security in the region, including the BTC pipeline. Azerbaijan and Armenia have been involved in a long-running military standoff over the enclave of Nagorno-Karabakh, isolated within Armenia but which bothcountries claim, sparking a 5-year war in the early 1990s.

In April 2002, Azerbaijan's President Heidar Aliyev ordered the creation of a special state security service to protect BTC, along with the existing Baku-Novorossiysk and Baku-Supsa pipelines and the massive Azeri-Chirag-Guneshli (ACG) offshore oil fields complex.

Meanwhile, Giorgi Chanturia, president of Georgian International Oil Corp. (GIOC), said that the Baku-Supsa oil pipeline was deliberately damaged Jan. 18—the "second incident of this nature."

The attack took place at Sveneti in the Gori District, but Chanturia said only a small amount of oil was lost due to quick responses of pipeline technicians.

Georgian President Eduard Shevardnadze announced Jan. 14 that the Georgian Special Protection Service (GSPS) would guard the 244 km Georgian sections of BTC and the Baku-Tbilisi-Erzurum gas pipeline. Chanturia said earlier this month that Georgian servicemen are to be trained by US military instructors (OGJ Online, Jan. 7, 2003), and that the US would allocate $11 million to the project, in addition to a $64 million "train and equip" program already under way. According to Chanturia, the training of the 400-man special pipeline protection battalion, which will coordinate with the GSPS, is due to begin in February.

Meanwhile, Georgian Security Minister Valeri Khaburdzania is in discussions with Japan and US security officials about cooperation on antiterrorism measures. Khaburdzania said several Japanese nationals were arrested in Georgia, one of whom is suspected of links with terrorist organizations and has been remanded to Japanese authorities.

Georgia also is involved in talks with Northrop Grumman of the US over electronic surveillance systems aimed at increasing security of the pipeline and its adjacent areas.

Under terms of the BTC agreement, Azerbaijan, Georgia, and Turkey assume responsibility for ensuring pipeline security and the costs of compensating BTC consortium members for losses incurred as a result of new social and environmental laws over the next 40 years. Individual firms are responsible for operational integrity of the pipeline.

Work on the 1,800 km BTC pipeline is scheduled to start this spring, with completion set for the beginning of 2005. When complete, the pipeline is expected to carry 1 million b/d of crude oil from Baku to Ceyhan.

Participants in the BTC project are: Operator BP Group LLC 30.1%, Azerbaijan's state-owned SOCAR 25%, Unocal Corp. 8.9%, Statoil ASA 8.71%, Turkish Oil Corp. 6.53%, ENI SPA 5%, TotalFinaElf SA 5%, Japan's Itochu Corp. 3.4%, ConocoPhillips 2.5%, Japan's Inpex Corp. 2.5%, and Amerada Hess Corp. 2.36%.

THE YEMENI GOVERNMENT has signed a deal with Calgary-based Nexen Inc. for monitoring systems, boats, and training for coast guards to help thwart future terrorist attacks on oil tankers using the Al Dhaba oil export terminal.

Al Dhaba was the site of the Oct. 6, 2003, terrorist attack on the Limburg supertanker, which killed one crewman, injured 12 others, and spilled more than 8,000 tonnes of crude oil into Yemeni waters (OGJ Online, Oct. 11, 2002).

The terminal, also run by Nexen, is on the Gulf of Aden near Al Mukalla, 500 miles southeast of Sanaa, the Yemeni capital.

Matterhorn hull fabrication complete

A completed hull, fabricated at the Singapore yard of Keppel Fels Ltd. for TotalFinaElf E&P USA's Matterhorn SeaStar tension leg platform, is prepared for loading onto a heavy lift transportation vessel for delivery to Pascagoula, Miss., where it will remain for 2 months awaiting installation in Matterhorn field on Mississippi Canyon Block 243 in the Gulf of Mexico.

The piles and topsides are being fabricated at Gulf Marine Fabricators and the tendons by Kiewit Offshore Services. Prime contractor Atlantia Offshore Ltd. is responsible for engineering, procurement, construction, and offshore installation.

Fabrication of the Matterhorn began Jan. 28, 2002, and was completed Dec. 31. Photo courtesy of Atlantia.