OGJ Newsletter

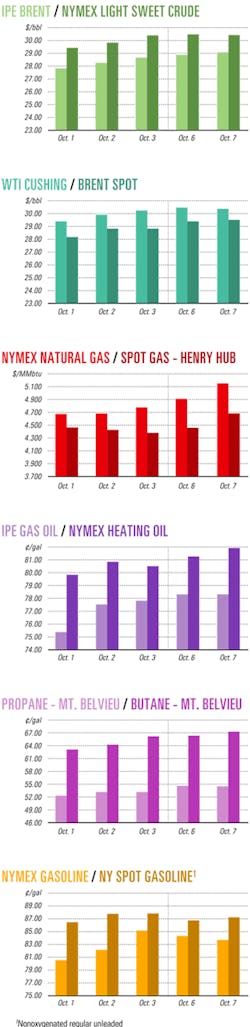

Market Movement

Oil market dodges Nigerian strike

For now, oil markets have dodged the bullet of a Nigerian supply outage.

Oil futures prices slipped in early trade Oct. 9 on the International Petroleum Exchange in London, after oil workers in Nigeria called off a general strike slated to begin that day. Fears that a strike would disrupt world oil supplies pushed Oct. 8 futures prices for light, sweet crudes on the Tokyo Commodity Exchange above $30/bbl to the highest level in 6 months.

The proposed 2-week strike to protest increased retail fuel prices in that country was cancelled after retail marketers agreed during last-minute negotiations to revert to previous lower prices. Officials from the state-run Nigerian National Petroleum Corp. met Oct. 8 with major retail marketers and union leaders in the capital Abuja in an attempt to avert the strike.

Nigerian union representatives earlier said the problems go beyond price increases. Union members are especially concerned about potential plans to privatize the downstream oil sector (OGJ Online, Oct. 6, 2003).

Lukman quits post

Meanwhile, Rilwanu Lukman, former secretary general of the Organization of Petroleum Exporting Countries, confirmed Oct. 8 that he has resigned as special advisor to Nigerian President Olusegun Obasanjo on petroleum and energy issues.

"It is true. I have resigned. There is a time to be in, and there is a time to go. And this is the time to go," Lukman told OPEC News Agency. OPECNA reported Lukman gave no additional details about his decision. There was no indication whether his resignation is related to Nigeria's labor problems.

Formerly Nigeria's minister of petroleum resources, Lukman served as OPEC's secretary general in 1995-2000 and was the group's conference president for eight consecutive terms. He has served as special advisor to Nigeria's president since 1999.

US oil stocks increase

Traders on the New York Mercantile Exchange early last week took a wait-and-see attitude toward the threatened strike. However, oil futures prices in New York and London declined Oct. 8 on government and industry reports of large increases in commercial US oil inventories during the week ended Oct. 3. The NYMEX November crude contract lost 60¢ to $29.81/bbl, while IPE Brent oil for the same month fell 30¢ to $28.73/bbl.

The US Energy Information Administration reported US crude inventories jumped by 5.4 million bbl to 286.2 million bbl during the week ended Oct. 3, while the American Petroleum Institute put the gain at 8.2 million bbl to 290.2 million bbl.

EIA said US distillate inventories increased by 200,000 bbl to 131.5 million bbl during the same period, while gasoline stocks fell by 1.2 million bbl to 198 million bbl. API said US distillates were up by 537,000 bbl to 127.1 million bbl and that US gasoline inventories plunged by 3.4 million bbl to 196.8 million bbl.

Gas futures price jumps

The price for the NYMEX front-month natural gas contract jumped by 5% to a 6-week high Oct. 7, as EIA's warning of possible price spikes this winter had traders scrambling to buy new supplies to offset existing, lower-priced sales obligations.

Traders who previously had sold gas futures contracts in expectation of a later decline in price faced losses in a rising market and were forced to cover their short positions. "The funds have been heavily short, and a lot of them got caught," said analysts at Enerfax Daily.

The NYMEX November gas contract closed at $5.14/Mcf Oct. 7, up 23.6¢ for the day after trading at $4.88-5.21/Mcf. It inched up another 0.8¢/Mcf the following day, despite some profit-taking early in that session.

"When locals [utilities] couldn't take the market down, they took it right back up," explained Enerfax analysts. "The market has rallied 47¢, or 10%, in the last five sessions as forecasters call for cool weather and rising heating demand in the Northeast and Midwest next week. However, a lagging cash market, still nearly 30¢[/Mcf] below the NYMEX [front-month price], and rising [US gas] storage levels will likely limit the upside."

Venezuela claims higher exports

Venezuela says it is stepping up exports of crude and products.

Venezuela claimed a record in its oil refining operations by processing more than 1.1 million bbl of oil in August at Petroleos de Venezuela SA's refinery on the island of Curacao.

Officials said that represented a 4.6% increase vs. throughput levels prior to the general strike that crippled Venezuela's oil operations earlier this year.

PDVSA claimed it increased its combined exports of crude and petroleum products to 2.36 million b/d in August from 2.27 million b/d in July.

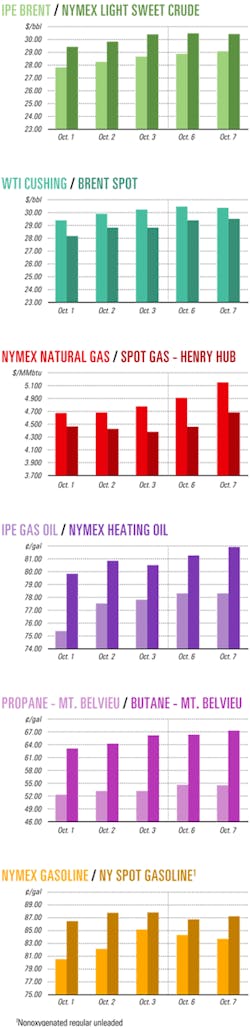

Industry Scoreboard

null

null

null

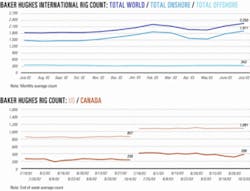

Industry Trends

WESTERN CANADA'S operating costs in oil and natural gas fields continue to rise, meaning that reducing operating costs is the quickest value lever for producers, said Ziff Energy Group, Calgary.

In its 2003 study of 176 oil and gas fields in western Canada, Ziff reported that average oil operating costs increased to $6.85(Can.)/boe in 2002 from $6.50/boe in 2001. For gas, the average cost increased to 70¢/Mcfe in 2002 from 69¢/Mcfe in 2001.

With increasing levels of drilling activity, the cost of many services also increased, raising the cost of well servicing by 14% for gas and 25% for oil (see chart).

Repairs and maintenance rose 33% for gas wells. Other operating costs—including field overhead, contract services, trucking, and third-party processing—rose by 8% for gas but were flat for oil.

CEO Paul Ziff said, "Over the last 3 years, we have recommended to all our clients in Canada and the US to commence programs that manage their energy use more efficiently. Those who did were prepared, while many others continue to be stressed by the full impact of high costs. While some energy costs moderated in 2002, we expect continued volatility over the next several years."

UPSTREAM SPENDING declined more than 20% in the US and nearly 10% in Canada since 2000, while double-digit increases were reported in Africa and the Middle East, reported Norwalk, Conn.-based consulting firm John S. Herold Inc.

Herold and Harrison Lovegrove Co. Ltd., London, reviewed more than 200 companies for the annual Global Upstream Performance Review.

The high cost of replacing oil and natural gas reserves in the US and Canada contributed to the plunge in upstream capital investment in those countries in 2002.

"Capital is increasingly being directed to regions that have more significant growth opportunities and higher profit margins, even if these regions also have higher perceived economic or political risks," said Arthur L. Smith, chairman and CEO of John S. Herold.

Proved acquisition spending in the US and Canada last year dropped 50% from the $36.4 billion spent in 2000.

"Meanwhile, grassroots exploration activity has soared in frontier areas, most notably in Africa and the Middle East, where spending jumped 68% since 2000 to $8.4 billion. In Europe, upstream capital expenditures rose 45% since 2002, the report said.

The Asia-Pacific region, which the report defines as including Russia, also has experienced a trend of increasing investment.

Government Developments

ALASKA STATE officials report less opposition from the Northwest Territories regarding a proposed Alaska natural gas pipeline from the North Slope to the Lower 48.

Alaska Gov. Frank Murkowski recently met with Northwest Territories Premier Stephen Kakfwi and Yukon Territory Premier Dennis Fentie.

The meetings happened in Calgary where Murkowski addressed the Far North Oil & Gas Forum. He talked about both the pipeline and also the proposed opening of the Arctic National Wildlife Refuge coastal plain to oil and gas exploration.

Murkowski said he was "heartened" because Premier Kakfwi indicated that he had moderated his opposition to the Alaska Highway route.

"Now that it is clear that the southern route is not competing with the construction of the Mackenzie Delta pipelineUKakfwi has indicated the southern route is no longer an issue," Murkowski said.

Draft language in the US energy bill supports the construction of an Alaskan natural gas export pipeline (OGJ Online, Sept. 17, 2003). Murkowski expects that the US Congress will approve that provision.

Regarding ANWR, Murkowski emphasized that its potential reserves could help reduce US dependence on imported oil while helping to create more jobs within the oil and gas industry.

"With enhanced-recovery technology, ANWR could provide an additional 30-50 years of reliable supply," he said.

Last month, Murkowski met with Alberta Premier Ralph Klein to discuss support for Alaska's proposed gas line. Murkowski and Klein also discussed the Alberta-Alaska bilateral commission, which was established to address various border initiatives, including energy issues. Separately, Murkowski has said he is encouraged that the Canadaian government plans to open a consulate in Anchorage this fall.

THE SMUGGLING of gasoline and diesel fuel is robbing Pakistan's government of revenues.

Illegal deliveries of Iranian gasoline and diesel into Pakistan are diminishing the profits of retail marketers there and severely decreasing government revenue from taxes on these products.

Oil Companies Advisory Committee (OCAC) officials are urging Pakistan to take preventative action, including involving the governments of Iran and Afghanistan to stop the smuggling.

Pakistan also should fine and imprison people convicted of smuggling, OCAC suggested.

OCAC said an estimated 265,000 tonnes/year of gasoline enters Balochistan and North West Frontier provinces along with 347,000 tonnes/year of diesel.

Records indicate that Pakistan's national exchequer has lost revenues of 6.2-7 billion rupees in duties and taxes in the last 2 years on sales of gasoline and diesel due to smuggling.

Quick Takes

BRITISH AND NORWEGIAN AUTHORITIES have reached agreement on the main facets of a treaty that will pave the way for laying the two-part, 1,200 km Britpipe subsea natural gas pipeline from deepwater Ormen Lange field in the Norwegian Sea to the UK.

Natural gas from the field will be transported via a 140 km pipeline to Nyhamna on the Norwegian coast for processing, then piped south to Statoil ASA-operated Sleipner fields in the North Sea and on to Easington in northeastern England.

The agreements will be incorporated into a treaty within the coming year by Norway's Ministry of Petroleum and Energy and the UK Department of Trade and Industry, enabling Norway to supply 20 billion cu m/year of gas to the UK over 20 years via Britpipe. Ormen Lange will increase Norwegian gas exports by 25%, making Norway the world's next largest gas exporter after Russia (OGJ Online, Mar. 19, 2003).

Statoil will plan and construct the pipeline in cooperation with field operator and transport system developer Norsk Hydro AS.

Ormen Lange gas field licensees and ConocoPhillips plan to invest almost 20 billion kroner in the trunkline, Statoil said.

Partner AS Norske Shell will be production operator when the field comes on stream in 2007. Other field shareholders are Statoil, Petoro AS, Esso Norge AS, and BP PLC.

Statoil said the pipeline installation and operation plan is due in November, and the trunkline could be ready in autumn 2006.

Statoil and the state's direct financial interest will own almost half of the total capacity on Britpipe, which will be operated by Norway's state-owned company Gassco AS.

In other pipeline activities, Enbridge Energy Partners LP plans to construct a 630 mile crude oil pipeline from its existing terminal at Superior, Wis., south to the Wood River hub in southern Illinois. The $550-650 million line will form part of the partnership's Lakehead Pipeline System, increasing its capacity to accommodate growing production from Alberta oil sands. Expected to be in service in 2007, the line will be either 24 in. or 30 in. and will have an initial capacity of 250,000 b/d of oil, Enbridge said. It will interconnect with the Spearhead pipeline project being developed by Enbridge Inc., permitting shippers access to market hubs at Chicago, Wood River, and Cushing, Okla.

MALAYSIA LNG SDN. BHD. has awarded a contract valued at more than $127.6 million to GE Oil & Gas, Florence, Italy, to provide maintenance services for the gas turbines and other equipment at the LNG complex at Bintulu, Sarawak, Malaysia.

The service agreement covers a period of 88 months and includes all GE-supplied gas turbines and related equipment comprising the power generation units and liquefaction trains for the LNG complex, which contains three plants.

In other LNG news, Trunkline LNG Co., a unit of Southern Union Co., has awarded an $80 million lump-sum, turnkey contract to Chicago Bridge & Iron Co. NV, The Woodlands, Tex., to expand its LNG terminal at Lake Charles, La. The contracted work will increase the facility's send-out capacity to 1.2 bscfd of gas from 630 MMscfd. The terminal will remain operational during the expansion, which is slated for completion by yearend 2005. The contract includes the engineering, procurement, construction, and commissioning of a 140,000 cu m LNG storage tank, modified send-out pumps and vaporizers, and related civil, mechanical, and electrical works. Gaz de France has signed a service contract with India's Petronet LNG to train Indian technicians to operate the Dahej LNG terminal in Gujarat state in northeastern India and to provide technical assistance for operation and maintenance of the plant's equipment over a 20-month period. GDF, which holds a 10% stake in Petronet LNG, has been involved in the Dahej project, which involves construction of a 5 million tonne/year LNG regasification terminal. LNG will be supplied by RasGas Co. Ltd., which is building a new liquefaction train in Qatar and two LNG carriers. First deliveries to the Dahej terminal are expected in early 2004. The regasified LNG will supply Gujarat and India's northwestern states through a 1,750 km pipeline extending to New Delhi. Total cost of the LNG chain is estimated at $2 billion. Peru LNG SRL, led by Dallas-based Hunt Oil Co. and South Korea's SK Corp., agreed to sell 400 MMcfd of Camisea gas—equivalent to 2.7 million tonnes/year of LNG—to Belgium's Tractebel Electricity & Gas International beginning in late 2007 or early 2008.

Peru LNG has called for bids for construction of a $1 billion liquefaction plant with an initial capacity of 4.4 million tonnes/year of LNG—600 MMcfd of natural gas—at Pampa Melchorita near Cañete, 169 km south of Lima. It later will spend another $800 million for additional wells, pipelines, and other facilities. Tractebel will ship the LNG from the plant and regasify it in Mexico.

STATOIL is seeking production licenses in the North Sea and the Halten-Nordland area of the Norwegian Sea under Norway's first exploration program covering license awards in the Norwegian Continental Shelf areas near those already known to have reserves.

The "2003 TFO scheme," which replaces the former North Sea rounds, covers a total of 143 full and partial blocks in mature areas close to existing infrastructure.

Norway is encouraging exploration and development in mature areas while infrastructure is still in place and production operating costs are relatively low. After the large fields cease production and the infrastructure is removed, it may not be commercially viable to develop smaller discoveries.

In other exploration news, Pakistan has granted a petroleum exploration license to Pakistan Petroleum Ltd. (PPL) for Block No. 2966-1 (Nushki) covering an area of 1,781 sq km in prospectivity Zone-I in the Chaghai, Mastang, Kalat, and Kharan districts of Balochistan province in western Pakistan. PPL will invest more than $350,000 for geological and geophysical studies and gravity and magnetic surveys of 750 km. Based on results of the first year's firm work program, the company will opt for a second seismic acquisition of 50 km, investing $756,250 in the second year, and will conduct a $3 million program in the third year.

ARGENTINA'S Pluspetrol SA has agreed to sell 10% of its shares in the Camisea natural gas fields license to Algeria's state-owned Sonatrach and another 10% interest in the related gas transport consortium in which Sonatrach already holds 11%.

Camisea's natural gas production, scheduled to begin Aug. 9, 2004, will be piped to Lima and the port of Callao.

In other development activities, Brazil's state-owned oil firm Petroleo Brasileiro SA (Petrobras) has awarded 2H Offshore Engineering, a UWG Group company, a contract for riser engineering services for Petrobras's P51 semisubmersible production platform to be installed in 1,255 m of water in Campos basin off Brazil. The scope covers the detail design of an 18-in., free-standing hybrid riser for oil export, 2H said. The contract covers detailed analysis, hardware design and specification, installation engineering, and technical support through the manufacturing and installation phases.

URANIUM POWER CORP. reached agreement with Western Petrochemicals Corp., both of Calgary, to secure 60% interest in the 700,000 acre Pasquia Hills, Sask., oil shale joint venture. Western has spent $2 million (Can.) drilling 45 holes to evaluate the deposit's core area.

Consultants advised that the 100,000-acre core area contains an original resource in place of 4.3 billion bbl of oil. Uranium Power said the joint venture's initial focus is to complete a development program to achieve start-up production at a cost of $3.5 million.

The preliminary mine plan indicates that the shale ore is 70 ft below the surface and 100 ft thick.

The formation of interest is the Cretaceous Second Whitespecks, which is nearly flat-lying and of consistent grade. Pasquia Hills is 210 miles northeast of Regina near Hudson Bay, Sask.

TALISMAN MALAYSIA LTD., a unit of Calgary-based Talisman Energy Inc., has begun oil production Phases 2 and 3 on Block PM-3 in the overlapping Commercial Arrangement Area (CAA) off Malaysia and Viet Nam.

The project involves oil and gas production from six fields within a 1,350 sq km area in the zone between Malaysia and Viet Nam: West Bunga Kekwa, East Bunga Kekwa-Cai Nuoc, East Bunga Raya, West Bunga Raya, NW Bunga Raya, and Bunga Seroja fields.

One third of the planned 60-well drilling program is complete, and development drilling will continue throughout 2004, operator Talisman said.

null

Talisman has installed facilities with a production capacity of 60,000 b/d of oil and 270 MMcfd of gas.

Partners are Talisman Malaysia (PM3) Ltd., Petronas Carigali Sdn. Bhd., and Petrovietnam Investment & Development Co.

Petrovietnam confirmed that it would build 330 km of 18-in. gas pipeline from Block PM-3 CAA to Ca Mau in southern Viet Nam. Engineering design and procurement is under way, and first deliveries of gas to Viet Nam are slated for 2005-06.

The Bunga Orkid-Bunga Pakma gas field complex on the north end of Block PM-3, which CAA has targeted for development in 2007.

In other production news, BG Group PLC and partners Oil & Natural Gas Corp. Ltd. and Reliance Industries Ltd. have received approval from India to begin a $138 million project to enhance the production of Panna-Mukta and Tapti fields off western India. The key fields contribute 7% to India's total oil and gas production. The partners will conduct infill drilling on as many as 18 wells in Panna-Mukta fields and 4 well recompletions in Tapti field. Drilling will begin in first quarter 2004. BG acquired a 30% interest in the fields in 2002. The partners, which agreed this spring to form an integrated joint operating framework, said they plan to invest $700 million over the next few years to develop the fields (OGJ Online, Mar. 3, 2003).

NEW ZEALAND REFINING CO. LTD. (NZRC) has awarded a $90 million engineering, procurement, and construction (EPC) contract to Houston-based Foster Wheeler Ltd. for the second stage of NZRC's Future Fuels clean-fuels project at New Zealand's sole refinery.

The contract covers the full EPC and involves modifying the refinery at Whangarei, North Island, to produce low-sulfur diesel fuel and low-benzene, low-sulfur, and low-aromatics gasoline. The project includes adding and integrating new hydrodesulfurization, benzene removal, and hydrogen separation units.

Specifications require the reduction of sulfur in diesel fuel to 50 ppm or less and the reduction of benzene to 1 vol %. Gasoline also is required to have sulfur and aromatics content reduced by Jan. 1, 2006.

Work began on the site in September, and the new facilities are to start up in August 2005.

This production platform is handling first oil and gas from a six-field development in the overlap area off Malaysia and Viet Nam. Photo courtesy of Talisman Energy Inc.

CORRECTION

The average catalytic cracking capacity per US refinery is 55,120 b/cd, not 1,010 b/cd, and the median is 48,420 b/cd, not 1,000 b/cd, as incorrectly reported (OGJ, Oct. 6, 2003, p. 52).