Catalyst developments driven by clean fuels strategies

Clean fuels strategies are at the top of crude oil refiners' lists of challenges this year, and catalyst suppliers have responded with solutions.

"Refining catalyst development activities over the last few years have been driven by refiners' needs to meet regulatory requirements without capital infusion," said Joseph Gelo, catalyst marketing director for UOP LLC, Des Plaines, Ill. "These regulations require new generations of high-performance hydrotreating catalysts to meet stringent sulfur specifications and catalysts that increase octane from existing reformers and isomerization units."

As refinery utilization has increased, the industry has demanded longer-life catalysts that extend turnaround time of key process units. New generation reforming catalysts are achieving significantly longer cycles than older generation catalysts for high-severity operations.

Likewise, advanced jet fuel and distillate hydrocracking catalysts have doubled life cycles and have provided large yield benefits as refinery product slates shift towards diesel and jet fuels.

Research and development efforts continue to focus on catalysts that allow refiners to meet more stringent regulations. These include hydrocracking catalysts that provide higher yield and improved hydrogen management, solid catalyst alkylation, and breakthrough catalysts for sulfur reduction.

"We are also focusing on hydrocarbon conversion technologies and have developed a catalyst for conversion of methanol to olefins which can economically utilize stranded natural gas," said Gelo.

Sustainable development

According to.Gelo, capabilities that facilitate rapid product development and commercialization are needed to keep up with changing requirements.

Based on today's requirements, companies are designing newer generation catalysts to provide improved stability that will allow refiners to operate for extended periods between replacement or regeneration.

"It's common to see a 50-100% increase in the useful life of a currently available catalyst when compared to previous generations. These improvements effectively expand refinery capacity by increasing utilization," he said.

In addition, catalyst suppliers have responded to refiners' needs to meet market and regulatory requirements without significant capital expenditures by providing catalyst replacement alternatives.

A longer useful catalyst life is consistent with the principles of sustainable development embraced by the industry. Sustainable development fundamentally focuses on the effective use of resources in a manner that preserves them for future generations.

For catalyst suppliers, this is more than "cradle to grave." It also embraces waste minimization, efficient energy use in catalyst manufacturing processes, and the development of catalysts that allow refiners to minimize emissions and energy use in their processes.

On the engineering side, a capability that refiners should be aware of is "remote performance management" (RPM). This allows refiners to achieve and sustain the optimal performance of their catalytic processing systems.

RPM is based on rigorous models for data reconciliation, reactor kinetics, equipment constraints, and process simulation. The system provides process-unit monitoring and optimization via a web browser and provides for continuous evaluation of the trade-off between day-to-day market opportunities and long-term catalyst life and performance.

Catalyst survey report

The following article describes the more important developments that have occurred since the last catalyst survey report (OGJ, Oct. 8, 2001, p. 56).

The complete list of tried and true catalysts, along with new formulations, appear in the Refining Catalyst Compilation-2003, found exclusively at Oil & Gas Journal Online.

Click here to view Catalyst Compilation in PDF.

According to the report, fluid catalytic cracking (FCC) units, the refiner's workhorse, are major beneficiaries of recent R&D efforts. In addition to FCC catalysts, a new slate of FCC-unit additives has been formulated to efficiently increase low-sulfur-gasoline production.

Table 1 lists the 25 refining catalyst suppliers surveyed. Most suppliers have extensive portfolios of hydrocracking and hydrotreating catalysts.

Click here to view Refinning Catalyst Suppliers in PDF.

The field of supplier offerings ranges from full product portfolios to targeted specialization such as Amber Chemical Co.'s selection of CO combustion promoters and the Ondeo Nalco Co., Naperville, Ill., nickel and vanadium passivation additives.

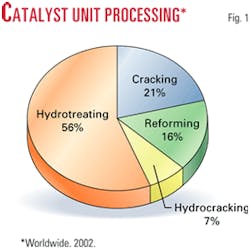

Fig. 1 shows the four major catalytic cracking units' share of refining processes. Since 1997, catalytic hydrocracking processing capacity has increased by 20% on a worldwide basis. Catalytic hydrotreating and FCC capacities have each increased by 7%, and catalytic reforming capacity has increased by a mere 1%. The total number of refineries has grown to 722 by the end of 2002 from 702 in 1997.

The average catalytic cracking capacity in US refineries is 55,120 b/cd and the median is 48,420 b/cd. The average reforming capacity in US refineries is 26,378 b/cd and the median is 20,000 b/cd.

The average hydrocracking processing capacity in US refineries is 30,723 b/cd, and the median is 28,500 b/cd. The average hydrotreating processing capacity in US refineries is 30,089 b/cd, and the median is 23,500 b/cd.

The average isomerization processing capacity in US refineries is 9,337 b/cd, and the median is 7,000 b/cd.

Mergers, acquisitions

Catalyst manufacturing and supply companies have experienced many mergers, acquisitions, capacity increases, and shutdowns.

In 2000, Chevron Research & Technology Co., a division of Chevron Products Co., and Lummus Catalyst Co. Ltd., a subsidiary of ABB Lummus Global Inc., formed Chevron Lummus Global LLC (CLG). CLG now has the exclusive right to supply hydrocracking, mild-hydrocracking, lube dewaxing, and hydrofinishing catalysts formerly supplied by Chevron Research & Technology Co.

Additionally, CLG's STARS catalysts are CLG products produced by Akzo Nobel, incorporating Akzo's STARS technology.

In July 2001, US Filter, Schaumburg, Ill., sold Gas Technology Products (GTP) to Merichem Chemicals & Refinery Services LLC, Houston. GTP will operate as a wholly owned subsidiary of Merichem based in Houston and will direct GTP's research facility, Plainfield, Ill.

On Sept. 4, 2003, a consortium of private equity firms comprised of the Blackstone Group, Apollo Management LP, and Goldman Sachs Capital Partners announced an agreement to acquire Ondeo Nalco, Naperville, Ill., from Suez SA in a transaction valued at $4.2 billion. Following the transaction, which is expected to close in fourth quarter 2003, Ondeo Nalco will operate as an independent company.

Advanced Refining Technologies LLC (ART), Columbia, Md., a joint venture of Chevron Products Co. and Grace Davison, acquired an exclusive license and assumed marketing and sales responsibilities for the hydroprocessing catalyst technologies of Japan Energy Corp. (JEC) and its subsidiary, Orient Catalyst Co. Ltd., Tokyo. ART's Japanese subsidiary ART KK will produce catalysts at Orient's facility in Hitachi and support further catalyst research at JEC's research center in Toda.

Borealis and W. R. Grace & Co. reached an agreement in 2002 whereby Grace would acquire Borealis catalyst production units in Stenungsund, Sweden, and manufacturing equipment for catalysts and carriers in Porvoo, Finland.

The agreement enables Grace to produce, market, and sell certain Borealis catalysts on a global basis and enhances Grace's existing polyolefin catalyst business.

New technology

BP PLC, London, patented a stabilized, dual-bed xylene isomerization catalyst system that produces less benzene by-product. The 3-catalyst system reduces rapid catalyst fouling and increases economic benefits of dual-bed processing, according to the company.

Fortum Oil & Gas, ABB Lummus Global, and Akzo Nobel have jointly developed a new solid acid catalyst process for isobutane alkylation called AlkyClean. A demonstration plant is under construction in Provoo, Finland.

Additionally, Fortum Oil & Gas recently announced the successful start up of a Prime G+ unit at its Naantali, Finland, refinery. The 5,700-b/d unit uses Axens technology and catalyst and has commercially proven its desulfurization of cracked naphtha down to 16 ppm sulfur, said the company.

Engelhard Corp., Iselin, NJ, supplied its specially designed sorbent technology to support ConocoPhillip's Ferndale, Wash., large-scale gasoline sulfur removal unit—S Zorb. The company says the process can remove up to 99% of sulfur in gasoline. The new unit is to be running at a capacity of 20,000 b/d by yearend 2003.

Capacity expansion

Davison Catalysts, Colombia, Md., a business unit of W.R. Grace & Co., announced the completion of a multimillion dollar expansion to the FCC catalyst manufacturing facility at its Lake Charles, La., complex. The new facility went onstream in May and will produce Davison's premium cracking catalysts, including Aurora-XLC and the resid catalyst, Impact.

null

Also, Davison announced a licensing agreement with ExxonMobil Research & Engineering Co. to manufacture and market ExxonMobil's AdVanta FCC catalyst. Originally the catalyst was only available to ExxonMobil refineries.

Capacity reduction

As part of a company-wide program to consolidate facilities and reduce costs, Criterion Catalysts & Technologies LP, Houston, a subsidiary of CRI International Inc., mothballed its Michigan City, Ind., hydroprocessing catalyst manufacturing plant in March 2002. Depending on product mix, the closure represents about 7-10 million lb/year of catalyst manufacturing capacity.

Criterion is the largest supplier of hydroprocessing catalysts based on a 28-30% market share. The plant will continue to produce alumina, while finished catalysts will be produced from its other locations in North American and Europe.

Noble metals

Another aspect of catalyst management is the use of essential noble metals in catalysts. According to P. M. Chaudhuri, Petro-Canada, Ont., the use of precious metals in the refining industry will increase as environmental regulations become more stringent. Based on a particular refiner's economics, noble metals are either purchased or leased.

Platinum, palladium, and rhenium are used in reforming, isomerization, hydroprocessing catalysts, and in FCC additives.

Chemical and petroleum catalysts account for 13% of worldwide platinum demand. About 80% of the world's supply of platinum is concentrated in South African mines.

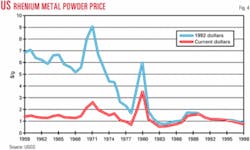

Since the beginning of 2002, the price of platinum has steadily increased (Fig. 2), the price of palladium has decreased (Fig. 3), and rhenium has been steady at around $1/Troy oz (Fig. 4).

Metals recovery is a critical element of refining catalyst management. Spent catalyst sampling, assaying, and turnaround should be closely monitored. Companies such as Gemini, Gulf Chem, Umicore Precious Metals, and Sabin Metal Corp. specialize in noble metals recovery.

Other trends

On May 5-6, 2003, the Catalyst Group presented its 7th annual worldwide catalyst industry conference and exhibition. Although this year's theme was "Gas-To-Liquids: The Rubber Meets the Road," other major topics were also discussed.

Selected presentation topics included FCC additives, resid and heavy oil upgrading, and methodologies to handle gasoline and diesel sulfur specifications.

M. Vaarkamp of Engelhard Corp., Houston, presented a way of using FCC additives as an economical and flexible method to reduce NOx and SOx emissions. The presentation covered the chemistry and technology of developing the materials, results of commercial applications, and the effectiveness of the materials in emissions reduction.

EniTechnologies SPA, San Donato, Italy, submitted information on upgrading petroleum residues, heavy oils, and tar sands bitumen. The ENI slurry technology results, in some cases, in a syncrude with >20° API gravity with >99% metals removal, >80% sulfur removal, and >40% nitrogen removal. Heavy oil fields in Canada, Russia, and Venezuela are likely targets for the technology. Case studies included Urals, Arabian Heavy, Zuata, Maya, and Athabasca crudes.

ENI stated that the technology's economic analysis had an internal rate of return after-tax improvement of more than 20%/year with a payback time of less than 4 years.

EnSys Energy's presentation covered the impending impact of product quality regulations on refiners and the growing importance of noncrude supplies such as NGL, GTL, and synthetic crude. According to Ensys, the global crude slate in 2015 will consist of 34% sweet crude, 54% light to medium crude, and 12% heavy oil.

EnSys stated that the supply of noncrudes will rise faster than the typical crude supply. OECD regions will require ultra-low sulfur gasoline and diesel, and non-OECD regions will gradually progress to low sulfur and ultra-low sulfur fuels with some tightening of residual fuel sulfurs.

Ensys projected a global investment for refining capacity additions of $128 billion by 2015 with Asia-Pacific taking the lion's share at $47 billion. The total is broken down into $7.3 billion to be spent on revamps, $1.7 billion for debottlenecking, and $188.8 billion for major new units. OECD regions will invest for fuel spec compliance, whereas non-OECD regional spending will be mainly targeted toward growth.

Major upgrades will focus on coking, hydrocracking, and hydrodesulfurization, and also include alkylation and iso-octane technologies. Ensys stated that GTL markets will be contingent on capital costs, natural gas prices, emissions costs, new technology, and timing.

Consultant Geoffrey Dolbear presented an overview of the issues and challenges facing refiners regarding zero-sulfur fuels technology. According to Dolbear, sulfur will disappear from fuels this decade, as justified by exhaust emission health effects, and the fact that fuel and vehicle regulations will be linked meet this goal.

He pointed out that, for ultra-low sulfur diesel, the industry faces a major problem removing the last 1-200 ppm of sulfur. He showed that improved reactor design and dense-bed catalyst packing should improve catalyst utilization and life cycle.

Some costs, such as increased hydrogen demand and H2S scrubber and sulfur plant load, must be considered, along with the probable product yield loss. Dolbear suggested that there will be a diesel shortfall in 2006 but that higher prices will allow trials of newer technologies.

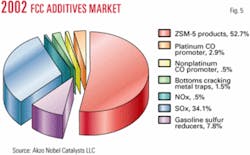

Adrian Humphries with Akzo Nobel presented data on the current market for FCC additives (Fig. 5). According to Humphries, there is an increasing demand for additives due to refiners' wishes to take advantage of niche markets for C3=, mandated reduction in sulfur in transportation fuels, and environmental legislation for reduction in SOx and NOx from FCC units.

Akzo's findings show that more than half of US refiners have signed consent decrees with the EPA to reduce FCC emissions over the next few years and that Texas has already mandated a 90% reduction in NOx.

"Many older refineries are losing their historical exemptions as the new regulations are enacted," said Humphries. He also advised refiners to use additives that can function in more than one application and that supplement primary catalytic cracking.