OG Newsletter

Market Movement

IEA reports growth of OECD oil stocks

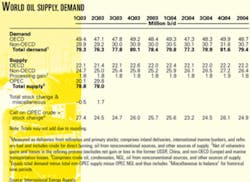

Industry oil stocks in countries of the Organization for Economic Cooperation and Development grew 1 million b/d in July, according to the latest report from the International Energy Agency. As these stocks moved to 79.5 million bbl below 2002 levels, forward demand cover was little changed at 53 days, 2 days below last year's level. OECD crude inventories rose despite a fall in such North American supplies, but distillate fuel stocks across the OECD continued to build seasonally during July.

OECD industry crude stocks rose 240,000 b/d in July, recovering from a second quarter decline of 120,000 b/d. Recent figures show that US crude stocks are trending sideways around 280 million bbl, as North American crude stocks finished the month 27 million bbl lower than a year earlier despite a second month of reduced US crude runs.

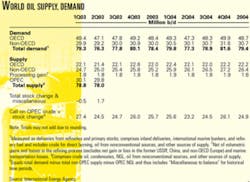

Low US Midcontinent stocks kept the prompt New York Mercantile Exchange crude futures contract at a premium, and the Paris-based agency wondered if this situation is cause for concern.

Minimum operating levels

IEA reported that a number of factors have contributed to the lower inventory holdings in North America over the past decade. While the market has placed a premium on prompt delivery prices for crude and severely restricted builds in inventories, the long-term downward trend is not solely dependent on financial disincentives, the supply management policies of the Organization of Petroleum Exporting Coun- tries, or the recent build in government stocks. In ad- vance of the war in Iraq, industry operated with re-cord-low crude inventory levels last winter. As some argued in favor of a release of strategic stocks during this period, IEA said that industry appeared comfortable with its stock position. Rather, a number of structural factors have contributed to lower inventory holdings. These factors include new information technologies that enhance logistic and scheduling abilities, refining and tank farm consolidations that diminish storage requirements, and advances in metering and tank construction that reduce the level of available stocks.

These developments, IEA noted, have been reinforced by the divestiture of downstream assets by integrated companies, lower credit and carrying positions of independent refiners, and the ability of Wall Street to pressure industry segments based on such indicators as return on capital employed.

"We may need to rethink what were previously considered to be minimum operating levels if industry is comfortable with lower stocks," IEA said. When lower industry stocks contribute to higher average oil prices and increased market volatility, someone benefits and someone else pays, the agency said. Additionally, a cycle develops in which low stocks promote a higher price for prompt delivery of oil, or backwardation, distorting market behavior. The agency said that while industry cannot build inventories if producers withhold crude, low stocks contribute to backwardation, and elevated backwardation contributes to even lower stocks.

IEA warned that in a period of heightened import dependency and geopolitical uncertainty, reduced inventory levels expose the global economy to greater risks associated with factors such as weather and even small supply disruptions.

"Lower effective spare capacity, currently estimated at slightly above 1 million b/d, exacerbates this situation. These developments constitute a challenge, even if some market participants are directionally more comfortable with and benefit from a more fragile balance," IEA said.

Industry Scoreboard

null

null

null

Industry Trends

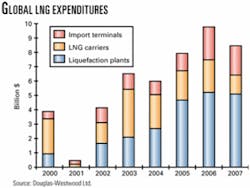

Capital expenditures for global LNG projects during 2003-07 are expected to nearly double the $20 billion spent during the previous 5 years, said UK analysts Douglas-Westwood Ltd.

"We expect over $39 billion to be spent over the period to 2007, over half of which ($20.5 billion) will be spent on constructing a total of 18 new liquefaction trains. LNG carriers are expected to attract the next largest share of the forecast spend, and we anticipate that the fleet will expand to over 200 vessels by 2007, at a cost of some $11 billion," said Douglas-Westwood analyst Steven Robinson.

Nearly $7.5 billion is expected to be spent on developing import terminal capacity, with 21 new import terminals forecast, along with the expansion of two existing terminals, said the World LNG & GTL Report, released at the Offshore Europe exhibition in Aberdeen.

In terms of liquefaction capacity, the report anticipates new facilities will offer a total of 78 million tonnes/year of additional output capacity on stream during 2003-07.

Regionally, most new production capacity will be in Africa, followed by Asia and the Middle East.

"Overall, we anticipate that Asia will be the leading region in terms of total expenditure, attracting a capex of nearly $17 billion over the 5-year period. This represents 40% of the total spend, with activity in this region driven mainly by a large number of orders for LNG carriers, the majority of which have been placed with [South] Korean shipyards," Robinson said.

The report is based on analysis of data contained in the LNG & GTL Projects Database, a service soon to be launched by Douglas-Westwood and the UK-based OTM Consulting.

New import terminals are likely to face challenges in some regions. Local opposition to new LNG facilities could strengthen, based upon terrorism concerns, the report said, adding that this is particularly a problem in North America and Western Europe.

Government Developments

The United Nations has lifted sanctions against Libya, but US diplomats made clear that US-based multinational oil companies remain bound by existing unilateral sanctions that ban new investment.

Both the US and France abstained from the Sept. 12 UN Security Council's 13-0 vote, which formally ended 13 years of international sanctions.

"US sanctions on Libya are imposed for their own reasons, and there are a variety of different laws that apply and restrictions that apply, whether for terrorism or other laws," a US Department of State spokesman said on the eve of the vote. "In order for the United States to lift our sanctions on Libya, we would want to be satisfied on all the fundamental points that we have raised that these laws apply."

For example, the US government says it still has concerns over "residual" Libyan support for terrorism, even though it says that it recognizes that the Libyans have done a lot to distance themselves from such activity in recent years. US policymakers also worry about whether Libya has an active weapons of mass destruction program as well as Tripoli's relationships with its African neighbors.

The UN vote occurred in response to Libya agreeing to accept responsibility for the 1988 Pan Am 103 bombing over Lockerbie, Scotland.

As part of the settlement, the Libyan government will pay the families of the 270 victims up to $10 million each, depending on how fast the US and the UN lift commercial sanctions (OGJ, Mar. 17, 2003, p. 33).

The US has implemented legal and political restraints by both past and present administrations and Congresses.

In August 2001, US President George W. Bush signed an updated law called the Iran-Libya Sanctions Act that was designed to penalize foreign companies that invest $20 million or more in either country.

But the measure also includes a nonbinding provision that Congress consider rescinding the law before it officially sunsets in August 2006, pending the outcome of a White House sanctions report, which is due to Congress before March 2004.

A NEW US NATURAL GAS storage technology consortium will include industry, academics, and government officials and is scheduled through 2007.

Pennsylvania State University will establish and operate the $3 million consortium under an agreement between the school and the US Department of Energy's National Energy Technology Laboratory Strategic Center for Natural Gas.

DOE said an 18-month first phase will involve formation of the consortium structure. Members will be solicited, and an executive panel of industry experts will be established. The industry-driven consortium also will award the first round of research projects.

Federal and state officials anticipate that growing natural gas demand will put new strains on the nation's gas delivery and storage systems in coming years.

Research supported by the consortium will include—but not be limited to—technologies to limit and remediate the progressive damage caused by the repeated injection and withdrawal of gas in existing and future facilities, as well as innovative reservoir development and management techniques that can maximize performance, DOE said.

Quick Takes

MARATHON OIL CO. and Unocal Corp. have begun natural gas production from the Ninilchik discovery in Cook Inlet on the Kenai Peninsula 35 miles south of Kenai, Alas.

The unit is producing 15 MMcfd of gas, which is being transported through the newly commissioned 32 mile, 12-in. Kenai Kachemak pipeline (KKPL) from Ninilchik to an existing natural gas pipeline to the Kenai Peninsula, Anchorage, and other markets in south-central Alaska.

By yearend, Ninilchik is expected to be producing 40 MMcfd of gas. Marathon estimates the structure contains 90 bcf of gas reserves.

Marathon holds a 60% working interest in the Ninilchik unit, and Unocal 40%. Construction on KKPL began in January. Marathon holds a 60% interest in Kenai Kachemak Pipeline LLC, the company formed to build and operate KKPL, and Unocal subsidiary GUT LLC holds 40%.

In other production news, Abu Dhabi Co. for Onshore Oil Operations (ADCO), an Abu Dhabi National Oil Co. subsidiary, awarded Italy's Snamprogetti SPA a $320 million engineering, procurement, and construction contract for facilities to enhance production at Bu Hasa oil field 200 km southwest of Abu Dhabi, OPEC News Agency reported. The project, aimed at offsetting an increasing gas-oil ratio in the field's production, is expected to start soon and to be completed by yearend 2006. The project includes construction of new processing and treating facilities rated at 730,000 b/d and replacement of an existing 50,000 b/d two-phase gas separator with four new three-phase separators. ADCO also will install 250 MMscfd gas reinjection facilities and 120,000 b/d water injection facilities. Abu Dhabi is enhancing or sustaining production capacity in existing fields and developing new fields in a program aimed at increasing its oil production capacity to 3 million b/d from the current 2.65 million b/d by 2006-07. Talisman Energy Inc., Calgary, reported high natural gas production rates in two core areas in western Canada this year. Talisman drilled 25 wells in the Bigstone-Wild River area, which is producing 85 MMcfd of gas. Talisman is operating four rigs and plans to drill 12 more wells prior to yearend. Expansion of the Wild River plant in 2002 and connection to Talisman's Central Foothills gas gathering system resulted in an additional 33 MMcfd of gas for the Talisman-operated Edson gas plant. The company plans additional expansions in the fourth quarter. In the Whitecourt area, Talisman drilled 13 operated wells since this time last year, with an 85% success rate, and currently is producing more than 50 MMcfd of gas. It expects to spend $41 million in the area this year. Talisman plans to continue its active drilling program in the area in 2004.

BP PLC reported an oil discovery on Block 16/28 in the central North Sea near Andrew field, 230 km northeast of Aberdeen. The Farragon discovery is estimated to contain 30 million bbl of oil.

The Ocean Nomad semisubmersible drilling rig, owned by Diamond Offshore Drilling Inc., Houston, drilled the 16/28-17 discovery well under the supervision of ENI UK Ltd., which, along with partner EnCana (UK) Ltd., financed the well under a farmin arrangement with operator BP. ENI became drilling operator in exchange for a participating interest in Block 16/28. BP holds 50% interest in the block, ENI 30%, and EnCana 20%.

The partners now are evaluating the discovery and its potential for development. Farragon production would most likely be tied in to Andrew field, which has been producing since mid-1996 (OGJ, July 8, 1996, p. 22). Andrew feeds oil into the Forties pipeline system and gas into the Central Area Transportation System.

In other exploration news, Brazil's state-owned Petróleo Brasileiro SA (Petrobras) plans to resume oil exploration activities in Cuba, said José Eduardo Dutra, the company's president. Dutra said Petrobras and the Cuban state oil company Cubapetroleo SA had signed a letter of intent for the exchange of technological information. Analysts said this is the first step towards Petrobras's accepting Cuba's invitation to explore for oil off Cuba in the deepwater Gulf of Mexico (OGJ Online, July 28, 2003). Cuba now is tendering other areas for oil exploration in the gulf. About 5 years ago, Petrobras invested $15 million prospecting for oil in shallow waters off the Cuban resort of Caio Coco, but no oil was found.

THE MEDUSA TRUSS SPAR platform, built for Murphy Oil Corp., operator of deepwater Medusa field in the Gulf of Mexico, has been completed and installed, reported contractor J. Ray McDermott SA. Medusa field is capable of producing 40,000 b/d of oil and 110 MMcfd of natural gas.

McDermott's SparTec subsidiary provided overall project management, including design engineering, procurement, fabrication, installation, and commissioning of the offshore production facility, which was installed in 2,223 ft of water on Mississippi Canyon Block 582 about 100 miles south of New Orleans. McDermott used its Derrick Barge 50 and Shearleg crane for the installation. Unocal said its Unocal Thailand Ltd. subsidiary is seeking approval from the government of Thailand to begin Phase II of its Thailand oil development that would double current gross oil production from Yala and Plamuk fields in the Gulf of Thailand. Unocal currently produces more than 20,000 b/d of oil from Platong, Surat, Yala, and Plamuk fields. Phase II will increase production to 40,000 b/d of oil following completion of wells and other facilities—including an 850,000 bbl capacity floating storage and offloading vessel to replace the current 630,000 bbl capacity Sibeia tanker (OGJ Online, Aug. 15, 2003). New facilities will be installed by mid-2005. "Since we started oil production in late 2001, estimated oil resources in place have increased significantly," said Randy Howard, Unocal Thailand president. The company said the resource potential now approaches 100 million bbl of oil, more than twice original estimates. Unocal Thailand is operator, with 71.25% working interest, in Yala, Plamuk, and Surat fields. Its partners are Mitsui Oil Exploration Co. Ltd. 23.75%, and PTT Exploration & Production Public Co. Ltd. 5%. Unocal Thailand also operates Platong and Kaphong fields, holding 70% working interest, while Mitsui holds 30%.

AFTER 14 MONTHS of construction, Imperial Oil Resources Ltd. officially opened the low-sulfur gasoline production unit at its Dartmouth refinery in Nova Scotia Sept. 4, reducing sulfur in its gasoline content by more than 90%.

The refinery processes 88,000 b/d of crude oil and produces 30,000 b/d of gasoline, mainly to supply the Maritime Provinces and eastern Quebec.

ExxonMobil Corp.'s Scanfining technology is reducing sulfur while preserving molecules needed to maintain octane levels, Imperial said.

Completion of the $80 million Dartmouth refit is part of a $575 million investment Imperial Oil is making to produce low-sulfur gasoline across Canada. Imperial Oil said all its operations will be producing fuel averaging less than 30 ppm sulfur by November, more than a year ahead of the Jan. 1, 2005, deadline set by Environment Canada.

SALVAGE WORKERS Sept. 17 were conducting an underwater survey of damage to the Rig 14J jack up, owned and operated by Parker Drilling Co., Houston, that partially collapsed Sept. 11 in 35 ft of water about 5 miles off the Chandeleur Islands along the Mississippi-Louisiana coast.

Parker officials said the rig was about to begin drilling operations in Chandeleur Sound Block 27 when "a malfunction" apparently caused one side of the rig to become partially submerged, causing its drilling equipment to slide overboard (OGJ Online, Sept. 12, 2003). The cause of that mishap and the extent of damage to the rig were still under investigation at presstime last week, officials said.

Most of the 41 people aboard the rig at the time of the mishap went into the water, according to US Coast Guard reports. All were rescued, and 12 people were taken to area hospitals for evaluation. One was hospitalized for observation.

Pollution control specialists were immediately dispatched to the rig site following the accident, but Parker officials said Sept. 17 that there was no indication of any pollution problems.

USCG initially reported a sheen—apparently spilled diesel fuel—about 200 yd wide and 4 miles long at the site of the accident. Parker officials said the sheen drifted to sea and posed no threat to land. The rig had 10,500 gal of fuel on board.

The rig is a Baker Bigfoot model built in 1979 in Singapore. Parker officials declined to confirm that the rig was working for Manti Operating Co., Port Barre, La. However, industry records list Parker USA Drilling Co., the company's US arm, as the contractor and Manti as the operator in the Chandeluer area.

In a separate incident, USCG temporarily closed a portion of the Intercoastal Waterway after a crane fell into the water from a construction barge that came loose from its moorings at Gulf Marine Fabricators' yard in high winds Sept. 12 at Ingleside, Tex. USCG and other vessels picked up 31 people who jumped from the barge in that mishap.

In other drilling news, Noble Corp., Sugarland, Tex., reported that it has acquired the Trident 18 jack up from a Schlumberger Ltd. subsidiary for $47 million. The purchase price includes $32.9 million plus an option fee of $14.1 million that Noble paid in December 2002. The unit, a Marathon LeTourneau 116-C independent-leg cantilever rig, was renamed the Noble Charlie Yester. It currently is in UAE territorial waters being prepared to mobilize to India for a long-term contract with India's Oil & Natural Gas Corp.

OMANI AUTHORITIES say a 45 km pipeline to supply natural gas to the Dolphin Energy Ltd. (DEL) project in the UAE will be completed by November, with gas volumes to begin flowing soon thereafter. Oman Gas Co. (OGC) will operate the pipeline.

"Gas supply will start by mid-December this year, and the [supply] contract between Oman and Dolphin is for 31/2 years," said Sulaiman al Balushi, acting executive director of OGC.

The $18.6 million spur will supply gas from the Fahud-Sohar pipeline at Mahdha in northern Oman to Al Ain, on the border with the UAE. There, the Omani pipeline will interconnect with the 182 km, 24-in. Dolphin pipeline that is currently under construction.

Oman will supply DEL with 4.8 million cu m/day of gas, which will be used as feedstock for a 656 Mw power plant and a 100 gal/day desalination plant currently under construction by Union Water & Electricity Co. in Fujairah (OGJ Online, Apr. 14, 2003).

By 2006, when Dolphin's new pipeline system from Qatar is in operation, Omani gas will be replaced by supplies from Qatar that will flow directly to Fujairah via the new Dolphin link and existing land lines to Al Ain.

With the onset of Qatari supplies, the flow of the Mahdha-Al Ain spur can be reversed, enabling Oman to receive natural gas from the Dolphin project, either for its own use or for onward transmission to other areas, such as Pakistan or India.

Abu Dhabi owns 51% of DEL through Dolphin Investment Co.; Total owns 24.5% and Occidental Petroleum Corp. 24.5%.

CNOOC LTD. has signed a letter of agreement with the joint venture partners in the Gorgon natural gas field development and LNG project off Western Australia to begin discussions about "a potential upstream investment" in the project by CNOOC.

In addition, CNOOC Ltd. has agreed to explore marketing opportunities for natural gas from Gorgon delivered as LNG into China. This agreement builds on the August 2001 memorandum of understanding inked between CNOOC Ltd. and Chevron Australia Pty. Ltd. to explore the feasibility of acquiring equity interests in the Gorgon area and developing the LNG import market in China (OGJ Online, Aug. 13, 2001).

"LNG will play an increasingly important role in meeting China's growing energy demand, said Wei Liucheng, chairman and CEO of CNOOC Ltd. "CNOOC has already developed a competitive advantage in China's LNG and natural gas markets."

Gorgon participants are ChevronTexaco, operator with four-sevenths interest, Royal Dutch/Shell Group two-sevenths, and ExxonMobil Corp. one-seventh. The Gorgon development has estimated proved reserves of 11 tcf of gas.