OGJ Newsletter

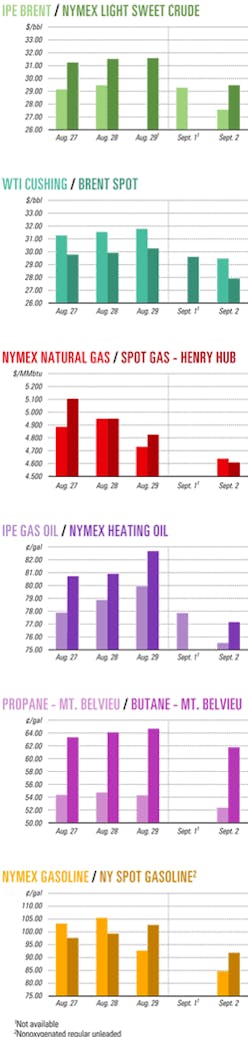

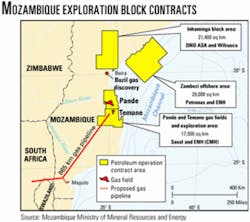

Market Movement

Labor Day belabors gasoline futures prices

The period prior to and immediately following the US Labor Day holiday was a volatile one for US gasoline futures prices.

The volatility began Aug. 25 when the September contract reached a 51/2-month high of $1.12/gal on the New York Mercantile Exchange and culminated with the new near-month October position that plunged Sept. 2 by 8.08¢ to 84.74¢/gal Sept. 2 in the largest single-session price drop in 2 years. That 9-day period began with US gasoline in tight supply after the Aug. 14 electric power failure in the Northeast US and parts of Canada temporarily disrupted operations at four US and five Canadian refineries. Almost 4 million bbl of production—including 2 million bbl of gasoline and 800,000 bbl of distillate—were lost as a result (OGJ Online, Aug. 20, 2003).

In the week ended Aug. 22, US gasoline inventories fell by 5.7 million bbl to 191.2 million bbl, the lowest level since Nov. 17, 2000, the US Energy Information Administration reported (OGJ Online, Aug. 27, 2003). US gasoline stocks grew by only 700,000 bbl in the week ended Aug. 29, despite an increase of 244,000 b/d in crude input into US refineries and a jump in total gasoline imports to nearly 1.2 million b/d during that period, "the second highest weekly average ever" for gasoline imports, EIA said. US gasoline demand over the 4 weeks ended Aug. 29 averaged a record 9.4 million b/d. However, traders were convinced that the resulting price surge was not sustainable and predicted prices would fall sharply after the Sept. 1 holiday, which marked the end of the US summer driving season. Gasoline for September delivery dropped a total of 8.56¢/gal during the Aug. 26-27 trading sessions, as NYMEX again raised margins—the de-posits required for trading at the ex- change—and as speculative funds took profits from the previous rally. The Aug. 26 margin increase was the second for the September gasoline contract following an Aug. 21 price spike, making it too expensive for small speculators to hold until its Aug. 29 expiration, analysts said.

Refinery problems

However, gasoline futures prices rebounded somewhat Aug. 28, with reports of problems with a 65,000 b/d fluid catalytic cracker at ChevronTexaco Corp.'s 225,000 b/d Richmond, Calif., refinery. Traders also reacted to rumors of a fire at Valero Energy Corp.'s 210,000 b/d Texas City, Tex., refinery, but company officials quickly denied those reports, noting there was a fire-and-safety drill that same day at Valero's 140,000 b/d refinery at Corpus Christi, Tex. The expiring September gasoline contract jumped by 4.16¢ to $1.093/gal in the abbreviated Aug. 29 session on NYMEX, ending the week within a few cents of where it started.

The rebound in price for the September gasoline contract signaled the market's realization that US gasoline supplies were stretched thin ahead of the expected surge in demand during the 3-day holiday weekend Aug. 30-Sept. 1. Indeed, near record-high average pump prices for gasoline across the nation apparently didn't discourage US motorists who took to the roads in large numbers during that period.

When trading resumed Sept. 2, however, gasoline futures prices plummeted in a post-Labor Day selloff, pulling down other energy commodities in the process. Yet despite that fall, gasoline futures prices were still at the highest level for the start of September since 2000, analysts said.

Traders in the energy futures market since have shifted their attention to the fuel oil market, where inventories are at a more comfortable level than gasoline. However, EIA earlier reported that US distillate stocks, including fuel oil, are near the bottom of the normal range for this time of year. US refiners are still struggling to build fuel inventories during a period of tight supply.

Demand wanes

"With demand easing for both natural gas and crude oil in the seasonal 'shoulder' period leading up to winter, we don't foresee much upside for either commodity near term," said Robert S. Morris, analyst with Banc of America Securities LLC, New York, in a Sept. 2 report.

"Of course, this could change if there were an unexpected terrorist or geopolitical event or a hurricane through the Gulf of Mexico," he acknowledged. "September is the peak of hurricane season, which always holds the potential to revive natural gas price momentum if Gulf of Mexico production appears that it could be interrupted."

Meanwhile, Saudi Arabia and Russia on Sept. 2 signed a 5-year oil and gas cooperation agreement that could lead to Saudi investment of as much as $25 billion in Russia's energy sector. Various press agencies quoted officials as saying that the accord calls for the two large oil-producing countries to cooperate in monitoring world oil prices and coordinating oil supplies.

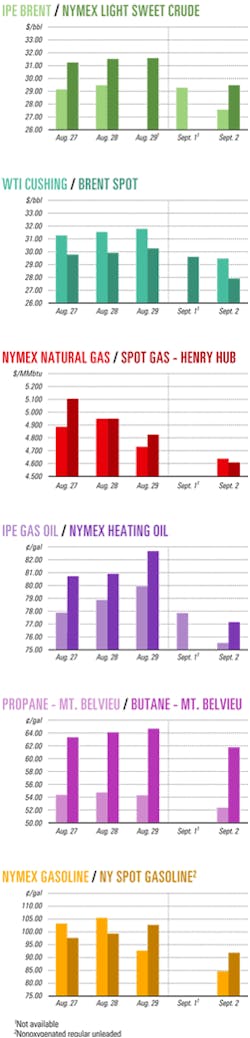

Industry Scoreboard

null

null

null

Industry Trends

THE INSTALLATION of 51,000 km of offshore pipeline worldwide is forecast during the next 5 years, representing a 42% increase compared with the previous 5 years, said UK analysts Douglas-Westwood Ltd. and Infield Systems Ltd.

The installations—which include flowlines, risers, export systems, and trunk lines—are estimated to require a global capital expenditure of $54.4 billion, said Dominic Harbinson of Douglas-Westwood.

Two regions, Western Europe and North America, look set to dominate the market, accounting for more than 40% of the activity forecast for the period, said the report, entitled World Offshore Pipelines & Umbilicals Report 2003-07.

The report defines North America as the US, Canada, and Greenland, while Mexico is included in Latin America.

Capital expenditures off Western Europe are forecast at $10.8 billion. Capital expenditures off North America could top $11.5 billion, driven almost entirely by activity in the Gulf of Mexico, the report said (see chart).

"Activity off Africa and Asia also is expected to grow strongly, requiring regional spends of $9.7 billion and $8.3 billion, respectively," Harbinson said.

The report also forecast 10,600 km of umbilical installations through 2007, representing a 22% increase compared with 8,700 km installed during 1998-2002.

Global capital expenditure in the umbilical sector during 2003-07 is forecast at $2.6 billion, up 53% from the $1.7 billion estimated expenditures during 1998-2002. Western Europe is expected to retain its umbilical market lead with an anticipated spend of more than $863 million, followed by North America with almost $700 million.

Meanwhile, 2,100 km of flexible pipe is forecast for installation worldwide during 2003-07, with Latin America accounting for 56% of the global total.

THE ARGENTINE economic crisis has negatively affected the country's upstream oil and natural gas sector, said consultants with Wood Mackenzie Ltd., Edinburgh.

The oil sector has a new 20% tax on crude exports. Argentina's natural gas wellhead prices have dipped to record lows, prompting operators to drastically scale back projects.

Based upon dollar-peso exchange rates, Argentine wellhead gas prices in 2002 averaged the equivalent of 40¢/MMbtu compared with $1.20/MMbtu in 2001, Woodmac said.

Government Developments

JAPAN IS NEGOTIATING with Iran for the development of the latter's giant Azadegan oil field, apparently brushing aside US concerns about nuclear proliferation issues in the Middle Eastern country. Japanese Minister of Trade and Industry Takeo Hiranuma told reporters in Tokyo on Aug. 25 that, "We have reached substantial compromises on some points," adding that, "We still need to tie up loose ends."

Hirnuma's statement followed more-strident remarks by Japanese Agency Director-Gen. Shigeru Ishiba insisting that Tokyo should ignore US opposition and reach an agreement with Tehran.

"Although I am not the supervising minister [for energy issues]UI do not think abandoning [negotiations with Iran] because of America's opposition would promote Japan's national interest," Ishiba said during a talk show on the private Asahi network. He insisted that Japan should "hold out" against US objections.

US President George W. Bush's administration has introduced an obstacle to Tokyo's plans by accusing Tehran of using its atomic energy program as a cover for the development of an illicit nuclear weapons program, a charge that the Iranians deny. Japan's earlier hesitation over the development of Azadegan field enabled other countries—including China, Russia, and India—to open talks with Iran, much to the chagrin of Japanese government and business leaders intent on diversifying the country's sources of energy imports.

Many Japanese also see Azadegan field, reputed to have 26 billion bbl of oil reserves, as a way of making up for the loss of Japan's concession rights in Khafji oil field in the Kuwait-Saudi Arabia Neutral Zone.

June crude oil imports into Japan rose 23.9% from the same time a year ago. Its reliance on Middle Eastern crude oil was estimated at 85.1% in June, government statistics show.

BRAZIL IS CONSIDERING a review of its petroleum tax policies.

"We are evaluating the possibility of reviewing royalties and the fiscal burden for heavy oil discoveries in deep waters," said Maria das Graças Silva Foster, executive secretary for oil and gas of the Mines and Energy Ministry. A change in tax policies could apply to companies that won concessions during the initial Round Zero of oil exploration and production concessions in 1998. Shell Brazil SA and Total SA have requested taxation changes. Both companies made discoveries on concessions acquired during Round Zero, but neither participated in a recent fifth round.

"Today, royalties are 10%, whether the oil is heavy or light, and [are] independent of the depth at which the oil was discovered or the size of the field," said Sebastião de Rego Barros, executive-director of the National Petroleum Agency, which organizes the rounds. Special Participation, the name for a series of taxes under the current regime, is progressive, increasing with the amount of oil output, and it can reach 40% of the net revenues in a highly productive field.

International companies have alerted Brazilian authorities about their concerns regarding the tax code's affect. Many companies have said that they are shifting their efforts toward the Gulf of Mexico and off West Africa.

Quick Takes

DOMINION COVE POINT LNG TERMINAL has received its first commercial cargo of LNG in 23 years.

BP PLC subsidiary BP Energy delivered 130,000 cu m of LNG from Trinidad and Tobago's Atlantic LNG project to Dominion Resources Inc.'s dock in southern Maryland Aug. 22. The cargo will be regasified into 2.9 bcf of natural gas.

Dominion Cove Point is the largest US LNG import facility, with a sendout capacity of 1 bcfd of natural gas. Dominion invested $180 million to reactivate the facility since purchasing it in September 2002, and has started construction on a new 2.5 bcf storage tank, scheduled for service in January 2005.

Dominion Cove Point will process LNG for BP, Royal Dutch/Shell Group, and Statoil ASA, each of which holds a one-third access right to processing facilities and storage as well as capacity on Dominion's 87 mile pipeline linked to markets and storage fields.

Meanwhile, Statoil received its first LNG cargo at the Cove Point terminal Sept. 2. The delivery, acquired as a spot purchase from Spain's Repsol-YPF SA, will be regasified into 2.8 bcf of natural gas. Originally, El Paso Global LNG had agreed to buy 2.4 billion cu m/year of LNG to be delivered from Snøhvit field in the Barents Sea during 2006-23, but the Cove Point LNG LP group has assumed that purchase contract, and Statoil signed a separate agreement with El Paso Merchant Energy last year giving Statoil the right to one third of Cove Point's import capacity over 20 years (OGJ, June 30, 2003, p. 64).

The group will receive an additional spot cargo later this month from another supplier, and negotiations are under way for long-term LNG deliveries until Snøhvit comes on stream in 2006.

In other LNG news, Marathon Oil Corp. subsidiary GNBC Ventas SRL de CV (GNBC), on behalf of its Tijuana Regional Energy Center partners—Grupo GGS SA de CV and Bermuda-based Golar LNG Ltd.—has signed a memorandum of understanding with Pertamina and PT Exspan Tomori Sulawesi to receive as much as 6 million tonnes/year of LNG for 20 years from a new LNG plant to be constructed on Sulawesi Island, Indonesia. LNG would be delivered to the partners' proposed Tijuana Regional Energy Center terminal being developed in Baja California, Mexico (OGJ Online, May 12, 2003). GNBC and its affiliates plan to begin construction in 2004 and start up the terminal in 2007.

SYNTROLEUM CORP., Tulsa, owner of a proprietary air-blown, gas-to-liquids process for converting stranded gas reserves to liquid fuels, plans to commercialize a small, barge-mounted GTL plant to develop offshore natural gas reserves of 1-3 tcf and to process associated rich gas that might otherwise be flared or reinjected.

The plant will be placed on a 200 ft by 400 ft barge weighing 35,000 tons. It is designed to produce 20,000 b/d of total liquid products, including 12,000 b/d of GTL products, of which 8,000 b/d is zero-sulfur diesel fuel. The balance is a mix of natural gas liquids.

The GTL barge will focus on gas reserves in shallow water or on onshore gas reserves near coastlines. Syntroleum said it has identified more than 40 uncontracted gas fields as having initial development potential. It intends to build and deploy a fleet of the barges during the next 10 years, and is actively seeking industry participants to build and operate the first GTL barge.

PAKISTAN has lodged a formal complaint with the International Maritime Organization claiming damages from Assimina Maritime Ltd., the owner of the Malta-based MV Tasman Spirit tanker, after a massive oil spill from its broken hull polluted a large coastal belt near the port of Karachi (OGJ Online, Aug. 14, 2003).

The complaint calls for an initial payment of $200,000, but the authorities plan to submit a final claim after a full loss assessment.

The tanker began breaking up and split in two near Karachi 2 weeks after running aground July 27.

The ship has leaked 12,000 tonnes of crude.

The authorities have salvaged about 6,000 tonnes, one sixth of the oil still in the tanker, and efforts were continuing at presstime to contain the spill.

UNOCAL CORP. subsidiary Unocal Makassar Ltd. has begun production of 17,000 b/d of oil and 18 MMcfd of gas from the first five wells in Phase 1 of its deepwater West Seno project off East Kalimantan—the first deepwater oil and gas project off Indonesia.

The field is in 975 m of water in the Makassar Strait between Kalimantan and Sulawesi, 190 km northeast of Balikpapan.

Phase 1 production is expected to reach 35,000-40,000 b/d by yearend, with additional production expected in 2004. The company plans ultimately to have 48-52 wells in the field (OGJ Online, Sept. 25, 2001).

Unocal is developing West Seno with two tension leg platforms and a floating production unit. This is the first application of a tender-assisted drilling rig in deep water, Unocal said.

Phase 2 will include a second TLP and up to 24 additional development wells in the field's southern section. Production is expected to peak at 60,000 b/d of oil and 150 MMcfd of gas by yearend 2005.

Unocal Makassar ultimately expects to recover 210-320 million boe from West Seno.

Petroleum Oil & Gas Corp. of South Africa and Dallas-based Pioneer Natural Resources South Africa (Pty.) Ltd., operators of Sable field off South Africa, have begun production, utilizing the Bluewater Group's Glas Dowr floating production, storage, and offloading vessel. The field is expected to produce 30,000-40,000 b/d of oil from six wells (OGJ, Feb. 24, 2003, p. 44). Sable field, which has reserves of 25 million bbl of oil, is in the Bredasdorp basin 150 km southwest of Mossel Bay. Bluewater expects to operate the FPSO, shuttle tanker, and subsea equipment during Sable field's productive life. Zakum Development Co. (Zadco), an Abu Dhabi National Oil Co. affiliate that operates Zakum oil field off the UAE in the Persian Gulf, has awarded Honeywell Industry Solutions, Morris Township, NJ, a $17 million order to modernize the SCADA and instrument control systems at the Zirku and Satah oil and gas treating plants on Zirku Island, Abu Dhabi. The Zirku Island facilities include crude oil treatment with hot and cold separation, gas treatment, propane compressor system, storage tanks, loading, and metering units. Satah plant facilities include crude receiving, separation, metering, and gas sweetening units. The contract includes the engineering and supply of a proprietary Honeywell integrated control and safety system and advanced applications at the plants, as well as installation, testing and commissioning, and support services. Completion is slated for April 2005.

PETROCHINA CO. LTD. started construction Aug. 28 of its 718.9 km Zhongxian-Wuhan natural gas pipeline in China. The 711-mm mainline, which will have a capacity of 3 billion cu m/year, will transport Sichuan basin gas to Wuhan from Zhongxian, with three spurs: a 210 km Jingzhou-Xiangfan branch; a 340.5 km Qianjiang-Xiangtan link; and a 77.9 km Wuhan-Huangshi spur, making the total system length 1,347.3 km.

The mainline and the Xiangfan and Huangshi branches are slated to be in operation by Dec. 30, 2004.

The Xiangtan branch will start operation July 1, 2005. PetroChina has signed gas supply contracts with 27 users in Hubei and Hunan provinces.

PetroChina said Sichuan basin total gas resource in place exceeds 7 trillion cu m, with 680 billion cu m of proven reserves.

In other pipeline news, the steering committee of the Asian Development Bank-backed Turkmenistan-Afghanistan-Pakistan (TAP) natural gas pipeline project is scheduled to meet Sept. 26-27 to prequalify companies for bidding on the pipeline and to finalize purchase and sales agreements.

At the meeting, ADB also is expected to release results from its study of the amount of reserves in Daulatabad gas field that Turkmenistan could dedicate to the proposed system.

Turkmenistan earlier had dedicated 45 tcf of proven reserves for TAP but since has committed some of that to Russia.

The change has created doubts among TAP stakeholders.

During the June meeting in Ashkabad, Pakistan asked ADB not to prequalify companies unless certification of dedicated reserves was provided.

The planned 1,700 km TAP system would extend from Daulatabad field to Gwadar, Pakistan, via Afghanistan, transporting 1.5-2 bcfd of gas. More than 40 companies have expressed interest in the $3 billion project.

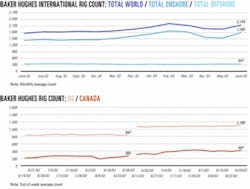

SASOL PETROLEUM INTERNATIONAL (PTY.) LTD., Johannesburg—under a production sharing agreement with Mozambique's Ministry of Mineral Resources and Energy—is undertaking an aggressive 2003 drilling campaign in the area of Temane and Pande natural gas fields in Mozambique (see map).

Five of the eight development and exploration wells drilled to date are in partnership with Cia. Moçambicana de Hidrocarbonetos, an affiliate of Empresa Nacional de Hidrocarbonetos de Moçambique (OGJ, July 2, 2001, p. 70).

Sasol might drill as many as 19 wells. Drilling will target TDs at 1,300-1,900 m, with all wells targeting Upper Cretaceous sedimentary rocks in the Lower Grudja formation. (OGJ, July 2, 2001, p. 70).

In other exploration news, Calvalley Petroleum Inc., Calgary, reported significant initial results from the Al Roidhat-1 exploration well on Block 9, which it operates in Yemen. The well was drilled and cased to 1,159 m TD, and it intersected oil-bearing, highly porous and permeable Qishn sands at 1,025 m. Three oil-bearing Qishn sand layers were encountered, the first containing 11 m of net oil column, the second layer 20 m, and the third layer 6 m. Al-Roidhat field extends over an 8 sq km area. Schlumberger Ltd. will carry out testing during the next 30 days. The drilling rig moved Aug. 25 to a separate structure 8 km northeast of Al Roidhat-1 to spud a second well. Murphy Oil Corp. reported an oil discovery with the Kikeh Kecil No. 1 well, drilled on Block K off Sabah, Malaysia. Drilled in 4,460 ft of water, the well is 2.5 miles north of Kikeh field on a separate structural feature. Immediate plans call for the discovery well's rig to move to Kikeh field to conduct a flow test on a previously drilled well. It will return to the Kikeh Kecil well later this year to appraise the discovery, Murphy said. Carigali Sdn. Bhd. holds 20% of Block K. Separately, Murphy reported two recent unsuccessful wells: Dengkis on Block H, off Sabah, and Stonemaker, on Mississippi Canyon Block 493 in the deepwater Gulf of Mexico.

India's Oil & Natural Gas Corp. (ONGC) plans to expend $61-65 million to drill four exploratory wells on its block off Bengal, India, by yearend 2004. ONGC will float a tender offer by yearend, officials said, and unlike an earlier, unsuccessful tender, this tender allows rigs to be used to drill at all four well locations. Rig chartering companies can work on better economies of scale under the revised four-rig tender, and a shorter rig deployment period will result in a more cost-competitive process, ONGC said. Companies bidding for the revised tender may bring in more than one rig to take up exploratory well drilling simultaneously or to complete wells within a stipulated time. ONGC currently is interpreting existing 2D and 3D seismic data to identify the four drilling locations. Separately, ONGC has begun exploratory work on the Bengal onshore block near Contai in Midnapore district.