OGJ Newsletter

Market Movement

Energy prices bounce as market knee-jerks

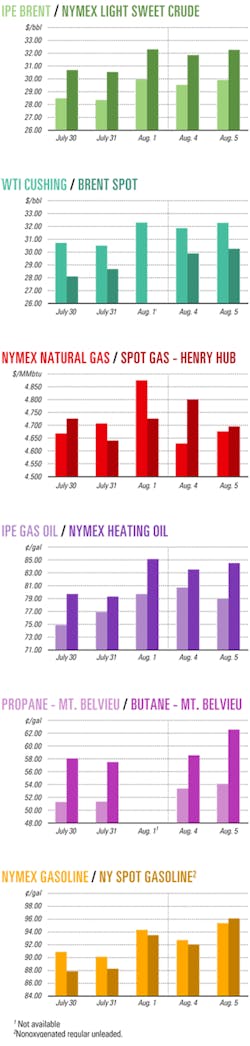

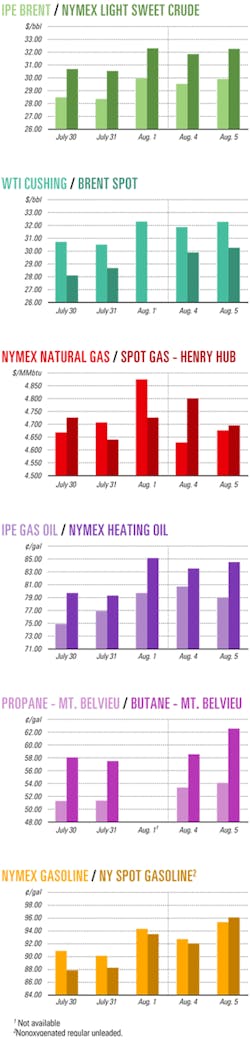

August energy futures prices have bounced up and down as traders knee-jerked to conflicting market stimuli.

The September contract for benchmark US light, sweet crudes soared to an 8-week high Aug. 1, jumping by $1.77 to $32.31/bbl on the New York Mercantile Exchange.

It was the highest closing price for a near-month crude contract in a daily trading session since June 11, when reports of falling US oil inventories and warnings by US Federal Reserve Chairman Alan Greenspan of higher natural gas prices combined to lift oil prices to $32.36/bbl, officials said. It also was the largest 1-day price jump since Sept. 14, 2001, the first NYMEX internet-based trading session after the Sept. 11, 2001, attacks on the US by the Al-Qaeda terrorist group.

The Aug. 1 spike was triggered by a report of apparent sabotage to a gasoline pipeline in northern Iraq, speculation of a pending refinery outage in Venezuela, and a potential tropical storm in the Atlantic Ocean. With no basic change in market fundamentals, there was no way to sustain that sudden run-up of energy prices.

So energy futures prices fell in the next session—down to $31.84/bbl for the September crude contract on NYMEX—as traders took their profits from the previous run-up. Although world inventories of oil and petroleum products remained at historically low levels, analysts said, the market's perception had turned more bearish.

However, energy futures prices rebounded the next day, after a suicidal terrorist bombing of a hotel in Jakarta killed at least 14 people, injured 150, and inflicted extensive damage.

Jemaah Islamiyah—a militant Islamic group active in several Southeast Asian countries that is seeking to establish a Muslim fundamentalist state in the region—is suspected in the latest terrorist bombing. A member of that group currently is on trial in Indonesia and last week was sentenced to death in connection with the bombing of a Bali nightclub in October 2002. Jemaah Islamiyah has been linked to Al-Qaeda.

Signs of improvement in the US economy also had a bullish effect on the market, analysts said Aug. 5, as the September oil contract climbed to $32.22/bbl on NYMEX.

But the market's cautious optimism about economic recovery was buried by the US Energy Information Administration's Aug. 6 report that commercial US oil inventories increased by 2.9 million bbl to 280.2 million bbl during the week ended Aug. 1. As a result, the September crude contract dropped to $31.70/bbl on NYMEX.

Futures prices for unleaded gasoline and heating oil for September delivery also declined Aug. 6, even though US gasoline stocks dropped by 2.7 million bbl to 201.8 million bbl as of Aug. 1, below the normal range for this time of year. US distillate inventories increased by 1.7 million bbl during the same period, remaining within the normal range for the period.

No fears from OPEC

About the only thing that the futures market hasn't reacted to this month is the July 31 decision by ministers of the Organization of Petroleum Exporting Countries to maintain their existing oil production quota at 25.4 million b/d. It was "perhaps the most widely anticipated OPEC meeting outcome in years," and the "oil market response has been predictably muted," said industry analysts at Merrill Lynch & Co. Inc., New York.

Even before that special OPEC meeting, analysts reported world energy markets had already factored into current prices the general expectation that OPEC members wouldn't change production. At their meeting in Vienna, OPEC officials reported that world oil markets remained "stable and well supplied" and that prices were "within agreed levels."

The next day, the average price for OPEC's basket of seven benchmark crudes jumped to $28.52/bbl, popping above the group's targeted price range of $22-28/bbl for the first time since early this year when world oil supplies were constrained by a general strike in Venezuela (OGJ Online, Mar. 19, 2003). As of Aug. 6, it averaged $28.88/bbl.

OPEC's price band mechanism calls for members to adjust production quotas up or down by 500,000 b/d for each $1/bbl that its average basket price remains above or below the target price band for 20 consecutive trading days. But OPEC went far beyond that time limit before taking action when its basket price averaged nearly $32/bbl in the early months of this year. The basket price since has remained in the upper levels of OPEC's targeted range.

Even if the OPEC basket price remains above the targeted level long enough to trigger the adjustment mechanism, ministers are unlikely to take action before their next scheduled meeting on Sept. 24.

Industry Scoreboard

null

null

null

null

Industry Trends

US GASOLINE demand growth for the first half of 2003 was at its weakest since the 1990-91 recession, the American Petroleum Institute recently reported.

Demand growth was equally grim for jet fuel. The US experienced an "unprecedented" double-digit, 2-year decline in jet fuel demand during January-June, API said in its latest Monthly Statistical Report.

Higher retail and crude oil prices, a sluggish US economy, and less travel due to inclement weather all contributed to the decline, API said. Total product demand slipped 0.2% in the second quarter compared with the same period last year.

Additionally, total petroleum imports of crude oil and products as of June 30 accounted for 63.5% of the US market—a new high.

Deliveries of gasoline from refineries, terminals, and pipelines to wholesalers, retailers, and end users fell a marginal 0.3% in the year's first half compared with a 2.8% increase for the same period last year, API said.

Distillate fuel oil demand for winter heating needs increased 11% during the first quarter compared with a year ago. The second quarter fuel oil demand increase was 4.4%, which API said stemmed from the return of warmer weather.

Demand for jet fuel in the second quarter fell more than 6% to the lowest quarterly level since the end of 2001. That year's figures reflected how the Sept. 11, 2001, terrorist attacks on the US severely hampered air travel. A 2003 slump in international flights was attributed to the war on Iraq, the outbreak of Severe Acute Respiratory Syndrome, and the poor economy.

Total oil inventories were 281 million bbl as of June 30, 11.6% lower than a year ago and 35 million bbl below the average June level for the previous 5 years. Total domestic oil stocks were 948.9 million bbl, an 8.7% decline from a year ago.

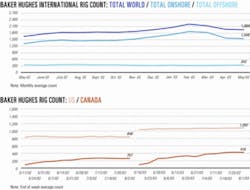

US OIL PRODUCTION continued its decade-long decline with a 1.4% drop in the first half compared with the first half of 2002, API said.

The output of 5.8 million b/d of oil was the lowest in 50 years (excluding weather stoppages) and 40% lower than its peak in 1970 of 9.6 million b/d. In Alaska, the production decline was 2.3% compared with first half 2002 and, at 1 million b/d, only half of its 1988 peak, said API.

The most recent drilling data showed a 19% increase in second quarter natural gas well completions compared with the same period a year ago. Oil well completions increased 28%.

Higher world oil prices during the first quarter prompted oil imports to fall to their lowest quarterly level in 3 years. Yet, oil imports to the US surged to 9.8 million b/d during the second quarter. Combined with higher product imports, such as gasoline, the 12.5 million b/d of total oil imports set a quarterly record, API said.

Total petroleum imports of oil and products through June 30 accounted for 63.5% of the US market, a new high, API said.

Government Developments

THE INTERNATIONAL ENERGY AGENCY appointed Noé van Hulst director of the IEA's long-term cooperation and policy analysis office, effective Sept. 1.

Van Hulst succeeds Olivier Appert, who was named chairman and CEO of the Institut Français du Pétrole earlier this year (OGJ Online, Apr. 16, 2003).

Formerly, van Hulst worked as director-general for competition and energy at the Ministry of Economic Affairs in the Netherlands. He oversaw the liberalization of the Dutch electricity and natural gas markets, privatization of energy companies, and promotion of energy efficiency and renewable fuels, and policies related to energy supply security.

In his IEA role, he will oversee policy analysis relating to coal, gas, and electricity, including nuclear and renewable fuels. He also will monitor key policy issues raised by regulatory reform and market liberalization in the energy sector.

US MARITIME SECURITY rules should be clear and consistent, the National Petrochemical & Refiners Association said.

NPRA representatives testified late last month at a US Coast Guard hearing in Washington, DC, on a temporary interim rule implementing the Maritime Transportation Security Act of 2002. The association urged the USCG to be more specific on some of its definitions.

One example NPRA noted was that facilities adjacent to US waters must develop Facility Security Assessments (FSA) and Facility Security Plans (FSP) to implement a range of security measures.

NPRA estimates that this rule covers more than half of US refineries and petrochemical plants. These facilities will have to submit FSAs and FSPs to USCG by Dec. 31 (OGJ Online, July 3, 2003).

The regulations involve an estimated 10,000 vessels, 5,000 port facilities, and 40 Outer Continental Shelf facilities in the Gulf of Mexico. Initial compliance costs for OCS facilities are expected to total $37 million, with compliance estimated at $5 million/year, USCG said.

Industry representatives, whether they are refiners or producers, generally support the rule, which is expected to be finalized Oct. 25.

But refiners said confusion currently exists over which government agency holds jurisdiction over certain security-related rules.

"The last thing a company striving to enhance security needs is more confusion as a result of overlapping jurisdictions," said Bob Slaughter, NPRA president. "A significant majority of NPRA members would prefer to see a firm demarcation limiting USCG authority to the dock."

SAUDI ARABIA has a stable financial outlook based on the kingdom's position as the world's largest oil exporter and holder of the world's largest proven oil reserves, according to a recent research report released by New York-based Moody's Investors Service.

In its report, entitled "Saudi Arabia Credit Research," Moody's upgraded Saudi Arabia's ratings in June as geopolitical risk stemming from the war on Iraq diminished.

Adel Satel, a Moody's vice-president and senior credit officer, said, "The kingdom's dominant oil market position confers strategic importance and security guarantees from the US and other industrialized nations."

Saudi Arabia's stable outlook reflects a balance between the kingdom's fiscal vulnerability to oil price swings and its ability to withstand those shocks, the report said.

Quick Takes

A CHEVRONTEXACO CORP. unit has signed a memorandum of understanding with the joint venture partners in Gorgon natural gas field off Western Australia, which could lead to Gorgon supplying enough gas to provide at least 2 million tonnes/year of LNG over 20 years, starting in 2008, to an LNG terminal planned for construction in Baja California.

Gorgon field has proven reserves of 12.9 tcf of gas with total gas resources in the greater Gorgon area exceeding 40 tcf, said ChevronTexaco. TheGorgonJVparticipantsincludeoperator ChevronTexaco (four-seventh interest), Royal Dutch/Shell Group (two-seventh interest), and ExxonMobil Corp. (one-seventh interest).

ChevronTexaco currently is seeking approvals from local Mexican authorities to permit the construction and operation of an LNG terminal and regasification facility in Baja California that would be capable of receiving Gorgon LNG. Although a specific site for its LNG terminal has not been revealed, ChevronTexaco said it is aiming to "secure a site by the fourth quarter of this year."

In a separate, competing project, Shell Gas & Power, a unit of Shell, is proposing to build a 7.5 million tonne/year LNG import terminal at Costa Azul, 23 km north of Ensenada on Mexico's West Coast (OGJ Online, Apr. 8, 2002). Shell said it expects to begin LNG operations in 2007. "Terminal permitting activities with the Mexican authorities are well-advanced," Shell said, adding that it plans to market the LNG in Northwest Mexico and southern California. In other LNG news, Nigeria LNG Ltd. has signed GE Power Systems, Atlanta, to a 28-year contractual service agreement to provide maintenance and other services at the company's NGL plant on Bonny Island, in Rivers state, Nigeria. GE will provide parts, repairs, and services for all the planned and unplanned outage work for 22 gas turbines and 18 compressors at the site. The agreement also includes Trains 3, which is entering commercial operation; Trains 4 and 5, which are under construction; and Train 6, which is planned. Once completed, total capacity will be more than 23 million tonnes/year of LNG. Nigeria LNG is a joint venture of Nigerian National Petroleum Corp., Shell Gas BV, TotalFinaElf LNG Nigeria Ltd., and Agip International NA.

SHOWA SHELL SEIKYU KK, in a consortium with Iwatani International Corp. and the Tokyo metropolitan government, opened Japan's first liquid hydrogen filling station June 12 in Tokyo.

The Japanese government is promoting hydrogen use and is planning to construct other H2 filling stations in the Tokyo area as well, reported Wiesbaden, Germany-based Linde AG, whose liquid hydrogen technology as well as a 400 bar (5,700 psi) cryocompressor system of gaseous hydrogen (CGH2) was used for the station, which will support a test fleet of hydrogen-powered vehicles.

Linde said it can provide CGH2 vehicle fueling technology as high as 700 bar (10,000 psi).

SAIPEM SPA'S SCARABEO 5 drilling rig spudded the first natural gas-condensate production well, 6406/2-S-3H, in Kristin field in the Norwegian Sea Aug. 3. Scarabeo has been chartered for 36 months, operator Statoil ASA said.

Two rigs will drill 12 wells in the field, with the West Alpha rig due to arrive later this year.

Production is due to start Oct. 1, 2005. Production capacity is expected to be 126,000 b/d of condensate and 18 million cu m/day of gas.

Kristin,inthesouthwesternpartof Haltenbanken, is being developed with a floating production platform. The reservoir's 910 bar pressure and 170° C. temperature required personnel to take a Kristin-specific high-pressure, high-temperature course, Statoil said.

The 200 tonne templates, fabricated by Aker Kværner Egersund, have been installed, and manifolds will be installed next spring. Meanwhile, temporary covers are in place.

Statoil awarded three pipe-coating contracts totaling 100 million kroner to Bredero Shaw Norge in July to coat the flowlines, which will tie the subsea installations back to the floating platform, and the oil and gas export pipelines that will link the floater with Statoil's Åsgard field and its trunkline.

Statoil also has awarded a 550 million kroner contract to Technip Offshore Norge for flowline and umbilical installations as part of Snøhvit natural gas field development in the Barents Sea. Water is 300-340 m deep. Technip will lay and connect flowlines on Blocks 7120/6, 7121/4, and 7121/5 in Snøhvit field in 2004 and will lay infield umbilicals in 2005 along with umbilical and chemical lines to Snøhvit from Melkøya outside Hammerfest in northern Norway, where an LNG export terminal is being built. The contract includes an option to lay a carbon dioxide pipeline from the Melkøya gas liquefaction plant back to the field for seabed injection. Statoil plans to award another contract this fall for the main gas pipeline from Snøhvit to Melkøya.

CHINESE PETROLEUM CORP. (CPC) is abandoning a plan to build Taiwan's eighth naphtha cracker at an industrial salt plant site in Putai. The plan to build the cracker has been under development since 1995 (OGJ Online, Oct. 22, 2002). In February 1999, CPC signed a letter of intent with the Chiayi County government to build the cracker.

Since then, the project has come under fire from conservationist groups both in Taiwan and abroad and from Chiayi County's aquaculture industry.

In addition, a CPC official said, an evaluation has determined that building a required deepwater port at the site would not be economically viable, making it impossible to move ahead with the project.

The company previously had ruled out other potential sites.

APACHE CORP., Houston, and PetroChina Co. Ltd. said they have begun production from three wells on the shallow-water Zhao Dong block in Bohai Bay, China. Oil is flowing at 6,000 b/d, and Apache said production is expected to reach its 22,000 b/d peak by first quarter next year.

The Zhao Dong infrastructure includes two 6,000 ton platforms, the largest ever fabricated in China.

Initial drilling included 17 wells—drilled primarily to the Guantao formation—which have identified several new reservoirs. When the companies finish completion operations on Guantao, they will resume drilling to develop additional Guantao and Minghuazhen reservoirs.

In other production activities, ExxonMobil Corp.'s Mobil Equatorial Guinea Inc. (MEGI) unit has initiated production from the southern expansion area (SEA) of Zafiro field on Block B off Equatorial Guinea. The $900 million SEA expansion project, which uses subsea well infrastructure and a 2 million bbl floating production, storage, and offloading (FPSO) vessel, is expected to add about 110,000 b/d of oil to current Zafiro production, increasing total field production to 300,000 b/d of oil. The FPSO ultimately is expected to recover more than 150 million bbl of oil (OGJ Online, May 15, 2002). Zafiro field is 40 miles northwest of Malabo in 1,400-2,800 ft of water. Block B participants are operator MEGI 71.25 %, Devon Energy Corp. 23.75%, and Equatorial Guinea 5%.

THE UK Department of Trade and Industry, in the 21st UK licensing round, has awarded BG Group North Sea Blocks 20/11 and 20/12—to the south-southeast of BG's Buzzard oil field— Blocks 13/22c, and part of Block 13/27, west of BG's Blake oil field and Atlantic and Cromarty gas fields.

BG will operate 20/12 with 62.5% equity interest; its partner Intrepid Energy North Sea Ltd. holds 37.5%.

Calgary-based EnCana Corp. 30% will operate the exploration phase on Block 20/11, with BG 31.25% operator of the development phase. Other partners are Intrepid 18.75%, Austria's OMV AG 17.5%, and Edinburgh Oil & Gas 2.5%. Total work commitments on these two blocks include a 3D seismic survey and a well on Block 20/11 to test an Upper Jurassic prospect in 2004.

BG, with 50% interest, also will operate Blocks 13/22c and 13/27 with partners Intrepid 30% and Paladin Resources PLC, London 20%. Work commitments on both blocks include seismic reprocessing and one contingent well.

In other exploration news, CNOOC Ltd. said it has confirmed its Panyu 30-1 and Panyu 34-1 discoveries made last year in the eastern South China Sea and has delineated the scope for natural gas recovery. The discoveries (OGJ Online, Sept. 24, 2002) have 1.5 tcf of OGIP. 34-1-1 is about 30 km southwest of 30-1. These discoveries are the first confirmed major gas finds in the Pearl River Mouth, CNOOC said. The preliminary development plan calls for an integrated design to add production from smaller reserves in the area. CNOOC said it is targeting "the fast-growing Guangdong market," adding that it expects to invest about $500 million in initial capital expenditure. CNOOC Ltd., a 70.6% held subsidiary of China National Offshore Oil Corp., holds 100% interest in both fields. Statoil's wildcat on the Gråspett prospect 175 km off northern Norway in the Norwegian Sea is a dry hole. The area is 3 km northeast of Statoil's Norne field (see map, OGJ, Apr. 29, 2002, p. 8). Spudded on Production License 128, covering Blocks 6608/10 and 6608/11, the well was drilled in 374 m of water to 2,750 m TD subsea and terminated in Jurassic rocks. No hydrocarbons were found in the relevant sandstones.

Turkmenistan's state-run company Turkmenneft awarded a 3- year contract to Houston-based Parker Drilling Co. and Çalyk Enerji AS, Ankara, Turkey, for two land drilling rigs in Turkmenistan, with an option for a 2 year extension.

Drilling is expected to begin in September, following the mobilization of Rig 230 from Kazakhstan to Korpedje field in western Turkmenistan. The current schedule calls for the second Parker rig to begin work before yearend.

The state company plans to drill 38 wells and place 46 wells on production at Korpedje, Gunorta (South) Gamyshlyja, Akpatlavuk, and Goturdepe fields (OGJ, Mar. 10, 2003, p. 8).

Motor Oil Hellas Corinth Refineries SA, one of Greece's largest refining companies, has let a 7.45 million euro contract to Florence-based GE Oil & Gas to supply equipment and services for its refinery expansion project in Corinth, Greece.

The equipment will include two 6,000 kw, 4HG/3 reciprocating compressors to be supplied by Apr. 30, 2004, and other equipment. The compressors will support hydrogen-treating service, increasing the refinery's light products output, GE said.

GE also will provide a BCL 509/A centrifugal compressor by May 30, 2004, other equipment, installation and start-up supervision, and training at the site for both the compressor and turbine.

Both compressors is expected to be installed and operating by early 2005.

Indonesian President Megawati Sukarnoputri and Singapore Prime Minister Goh Chok Tong Aug. 4 formally initiated the start of activities leading to the construction of a 470 km natural gas pipeline from Indonesia to Singapore, reported OPEC News Agency.

The proposed $420 million pipeline represents the first stage of the $6 billion, 10,000 km Trans-ASEAN Gas Pipeline linking 7 of the 10 Association of Southeast Asian Nations (ASEAN)—Indonesia, Singapore, Malaysia, the Philippines, Myanmar, Viet Nam, and Thailand (OGJ Online, Jan. 9, 2002).

The pipeline, from Grissik in the southern Sumatra region of Indonesia to Singapore, will enable Indonesia to export an initial 350 MMscfd of natural gas to Singapore, generating $9 billion for Indonesia over a 20-year contract period, OPECNA said. The line will have a total capacity of 600 MMscfd of gas, which ultimately could generate $700 million/year of foreign exchange earnings for Indonesia.

Purnomo Yusgiantoro, Indonesian minister of energy and mineral resources, said more pipelines would be built in the coming years as part of the Indonesian Integrated Gas Transmission Pipeline system, which would include a 584 km Grissik-to-West Java line, designed to supply 600 MMscfd to West Java by 2006.

After running aground in heavy seas July 24, following Typhoon Imbudo's pass through southern Taiwan July 23, the 30,000-dwt Al Farabi tanker was successfully refloated 5 days later just outside the entrance to Kaohsiung Port in Kaoshiung Harbor, Taiwan.

The tanker's 27-man crew was reported to be safe.

The tanker was carrying 1,177.5 tonnes of fuel oil—as well as 22,152 tonnes of methanol, 4,693 tonnes of glycol, and 4,046 tonnes of glycerol—but Taiwan's Environmental Protection Administration said the accident resulted in no chemical spill or pollution. Prior to refloating, some 8,060 tonnes of methanol and 2,000 tonnes of glycol were transferred to other vessels.

The tanker was registered in Saudi Arabia.