The Middle East, despite many political events, will continue to demand more refined products and produce these products with more-stringent specifications. Armed conflict, continued violence, and a transition in Iraqi leadership have combined to make events in the Middle East more unpredictable than normal.

Total oil product demand in the Middle East will increase around 124,000 b/d/year until 2010. The demand pattern has shifted slightly away from fuel oil and jet fuel in favor of gasoline. Iranian gasoline demand, in particular, has grown rapidly.

Certain refining projects, such as the quality-related expansions in Iraq, will be delayed.

Iraqi refining capacity will not increase in the next couple of years; however, throughput is recovering at existing refineries.

In other Middle East countries, investments and expansions continue.

Condensate prices have been so high that many splitters have temporarily shut down or are running at low rates. Condensate output and processing should grow, however, in the next few years.

Fuel oil destruction capacity will also increase due to the cracking projects that will start up in the next 5 years. Every major refining country in the Middle East is planning to add cracking capacity.

Many planned expansions and upgrades are designed to produce higher-quality transport fuels that conform to US and European Union standards, which are spreading to other markets. Domestic fuel quality is also improving and countries are maintaining goals for continued improvement. The region will also become a producer of zero-sulfur synthetic diesel when the first commercial-scale gas-to-liquid (GTL) plants start up.

Middle East product exports will steadily increase in 2001-05. Although LPG and naphtha demand will grow, LPG export volumes will still rise. Naphtha exports will be more volatile, remaining above 2000 levels but with considerable variability from year to year. The region will shift from net importer of gasoline to a net exporter by 2005.

Fuel oil net exports will decline during 2003-08. This is in line with stagnating demand in many export markets and is a function of increased cracking and condensate throughput.

Within the Middle East, the largest export growth will occur in middle distillates; 2005 exports will exceed 1.3 million b/d.

The quality of certain exports may be good—on par with European, US, and Asian specifications—and may include synthetic diesel.

With Asian net imports languishing in recent years, exporters have looked to diversify outlets. Attention paid to product quality indicates that many refiners view product quality as the key to market entry, particularly in the large markets of many OECD countries.

Iraq effects

Events in the Persian Gulf are always hard to predict, and the situation is even more complex due to the armed conflict in Iraq and the move to a new government. Developments in the Middle East energy sector have shifted somewhat. In many respects the changes have had little or nothing to do with Iraq.

In Iraq itself, the oil sector is rebuilding, and the Basra refinery is already back on stream at 50% capacity. Iraq still faces many challenges, with difficulties getting the necessary equipment and spare parts stemming from long-term neglect and vandalism.

Iraqi leadership is now in a transition; the length of this process is unknown. Although the physical damage to the oil sector is less severe than feared, it will still take a steady program with billions of dollars of investment to rebuild and modernize the Iraqi industry.

We are adopting a more conservative view of Iraqi refinery expansions and refined product output. The regional picture, however, does not change drastically: growth will occur for demand, refinery throughput capacity (with the exception of Iraq in 2003), and exports, and fuel quality will continue to improve.

Demand

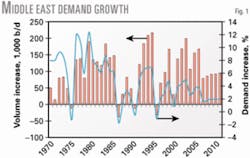

Our regional demand forecast is now slightly lower for fuel oil and middle distillates but higher in gasoline, so that 2005 total demand will be only modestly below last year's forecast (Fig. 1). Jet fuel demand will continue to contract due to sharp reductions in travel.

The long-term picture is one of significant demand growth. Fig. 1 shows that the average increase in Middle East oil demand was 90,000 b/d/year during 1971-80, declining somewhat to 83,000 b/d/year for 1981-90. The 1990s brought a significant increase in demand; incremental demand increases were nearly 120,000 b/d/year for 1991-2000.

Demand should increase 124,000 b/d/year for 2001-10. These increases would be larger if Persian Gulf countries were not making aggressive moves into natural gas development and utilization.

Demand growth indicates massive changes and progress in the region. Many gulf countries are experiencing extremely rapid population growth, with in-migration fomented by local economic activity and wealth.

Expatriate populations constitute a substantial percentage of the workforce, particularly in the private sector.

The region's most populous country, Iran, has a young population and a growing workforce.

Iran's population of around 66.6 million is larger than the UK's at around 59.8 million. It is also younger; an estimated 32% of the population is 14 and younger, compared with around 19% in the UK.

Iran is the main driver behind the increase in Middle East gasoline demand. Iranian gasoline demand will grow at 9%/year between 2000 and 2005—the fastest rate in the region.

Iran's gasoline imports have skyrocketed; imports will continue to grow in the next few years. During 2006-08, Iran will complete various refinery projects that will help reduce gasoline import dependency.

Iran may possibly build a large condensate refinery at the Port of Assaluyeh to help boost gasoline output. Iran will nonetheless remain a net gasoline importer in the near term.

This forecast assumes that many industrial projects will be completed; the level and pattern of demand can change quickly. For example, an accelerated schedule of natural gas development could quickly supplant the use of liquid fuels in the power sector or in certain petrochemical and industrial applications.

Similarly, changing the schedule or design of a modern petrochemical facility can create a large swing in demand; existing plants often have a great deal of flexibility in terms of feedstock choice, depending on price and availability.

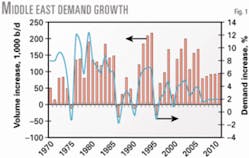

Fig. 2 shows that, with our base assumptions for feed, naphtha's share of the demand barrel rises to 5% by 2010 from 0% in 1980; LPG's share rises to 17% in 2010 from 3% in 1980. These volumes could rise or fall depending on natural gas availability.

Our forecast assumes a major increase in natural gas utilization and the inauguration of the region's first GTL plants.

The Middle East is set to become a significant producer of zero-sulfur synthetic diesel and has firm plans to reduce sulfur levels in conventional diesels as well.

Refining, fuel quality

In the refining sector, some projects will be delayed, such as the quality-related expansions in Iraq. Iraq will not have any capacity changes in the next couple of years, although throughput should recover at existing refineries.

In other countries, however, investments and expansions continue to advance especially for:

- Condensate splitters that boost light and middle distillate output without needing costly fuel oil destruction capacity

- Product quality.

Condensate prices have been so high that many splitters have temporarily shut down or are running at low utilization rates, particularly in Dubai and Fujairah, UAE. The Fujairah refinery may even be mothballed entirely.

Additional splitter projects are still planned, awaiting an expansion in supply, and condensate output will rise. Increased condensates from gas processing has several impacts:

- A shift in demand patterns via gas substitution.

- An increase in condensate runs relative to crude runs within the region.

- Potential condensate exports, sometimes from non-traditional sources.

Iran's South Pars gas field development plans, for example, call for 12 phases of development that will produce pipeline gas for domestic and export markets, condensate up to 480,000 b/d, and LNG by 2007.

In the Middle East, condensate runs will exceed 600,000 b/d by 2005. Fuel oil destruction capability will also increase because cracking projects will come on stream in the next 5 years.

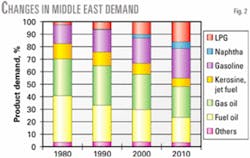

Fig. 3 shows that every refining country in the region is planning to add cracking capacity between 2003 and 2008, with major expansions in Iran and Saudi Arabia.

Many expansions and upgrades in the planning stages are geared toward producing higher quality transport fuels intended to meet US and EU standards, which are spreading to other markets.

Domestic fuel quality is also improving and goals remain for continued improvement. A number of projects will hasten the phaseout of leaded gasolines and reduce diesel sulfur levels.

Kuwait has rebuilt damaged refinery units and is adding even more middle distillate hydrotreating capacity at Mina Abdullah. Iran has announced an aggressive specification-tightening campaign; the goal is 50-ppm sulfur diesel throughout the country. It will, however, take Iran some time to achieve this level—the budget for the necessary enhancements has yet to be approved.

Bahrain is adding a distillate hydrotreater and a hydrocracker that will cut diesel sulfur levels. Saudi Arabia is making quality-related investments at Yanbu, Rabigh, and Riyadh, including a large hydrocracker that will improve middle distillate output and quality.

With shifting demand and overcapacity in Asia, Middle East refiners are concluding that improved fuel quality is desirable for their local markets and is the key to flexibility in penetrating export markets.

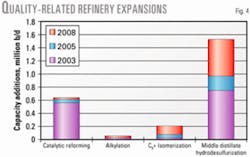

Fig. 4 summarizes some of the quality-related expansion plans in the Middle East. Countries are focusing on middle distillate quality. By 2008, middle distillate hydrodesulfurization capacity will surpass 1.5 million b/d, more than double its current level of around 750,000 b/d.

Gasoline-related projects include catalytic reforming, isomerization, and alkylation. As Fig. 4 shows, these expansions are moderate compared to middle distillates. Gasoline demand is growing rapidly and most regional markets are moving to unleaded gasolines; therefore, additions to gasoline production are geared more toward domestic markets than export markets.

There is currently little emphasis on producing EU and US reformulated gasolines for export, but a serious focus on middle distillates.

Product trade

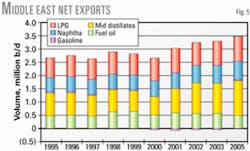

Overall Middle East product exports 2001-05 should steadily increase (Fig. 5).

Although LPG and naphtha demand will grow, LPG export volumes should still rise. Naphtha exports will be more volatile, remaining above their 2000 levels but with considerable variability.

The region will shift from a net importer of gasoline to a net exporter by 2005.

This is due to higher crude and condensate runs and the expansion of catalytic cracking and isomerization capacities. The exports will be about 24,000 b/d, compared to recent net imports of around 34,000 b/d.

Rapid demand growth and the rescheduling of some gasoline-related projects have reduced potential gasoline export volumes; Iranian demand has grown so rapidly that it will absorb much of the region's exports. Recently, Iraq has imported gasoline and LPG, some from neighboring Kuwait, to ease shortages.

Within the region, most export growth will occur in middle distillates; 2005 exports will exceed 1.3 million b/d. The quality of certain exports may be on par with European, US, and Asian specifications. Fuel oil net exports will decline during 2003-08, in line with stagnating demand in many export markets.

Outlook

The Middle East remains a major focal point in the global oil market, not only in terms of crude oil export, but also in overall economic growth, oil demand growth, refinery and petrochemical facility construction, and product exports.

Because only some of the region's refineries are sophisticated, average fuel quality still tends to lag behind specifications in OECD countries. This is a serious drawback for the region's refiners in two ways:

- Local economies are modernizing, which creates domestic demand for higher-quality fuels.

- Export refiners must keep pace with specification changes to remain competitive in a wide variety of foreign markets.

There are many efforts underway, therefore, to improve fuel quality for domestic and export markets. The GTL projects will also produce quantities of zero-sulfur diesel.

Despite domestic demand growth, Middle Eastern product exports will increase; exporters are exploring growth in various markets.

Even though a large portion of Middle Eastern product exports are headed to Asian markets, exporters also must look to larger markets in the US and Europe.

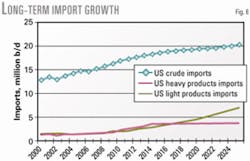

To place Middle Eastern exports in the US context, Fig. 6 shows the US Department of Energy's Energy Information Administration forecast for long-term US crude, heavy product, and light product imports.

By yearend 2010, US product imports will increase to 4.2 million b/d, including 1.9 million b/d of light products—nearly equal to the entire volume of transport fuels available for export from Middle East refineries.

Because Asian net imports have languished in recent years, exporters want to diversify outlets. The fact that they are paying attention to product quality indicates that many refiners view product quality as the key to market entry.

The author

Nancy Yamaguchi is president of Trans-Energy Research Associates Inc., Seattle, and a director of FACTS Inc., Honolulu. She previously worked for the East-West Center, Honolulu, and the California Energy Commission, Sacramento. Yamaguchi holds a BA (1981) from the University of California and an MA (1985) and PhD (1988) from the University of Hawaii. She is a member of the International Association for Energy Economics.