Canada's huge gas potential challenged by cost, price, pipeline transport issues

Canada remains a long-term storehouse to help meet North American natural gas demand.

There remain enormous untapped resources of conventional and nonconventional gas in Canada.

But challenges ahead include rising depletion rates and increasing finding and development costs for smaller pools and more-remote reserves.

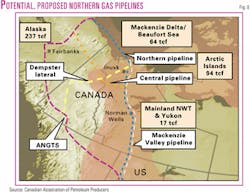

The other principal issue facing Canada's gas sector involves transportation infrastructure—in terms of both current capacity bottlenecks and economics of future frontier pipe- lines.

Gas potential

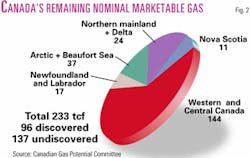

The most recent detailed survey of the country's gas potential, by the Canadian Gas Potential Committee (CGPC), indicates that Canada has substantial remaining gas potential: an estimated 233 tcf of nominal marketable conventional resources at the end of 1998 (Fig. 1). However, the committee warned that some of that gas may never be tapped because it is marketable in name only.

A CGPC spokesman said that, updating from 1998 data for gas produced, the potential for Canada to the end of 2002 would be about 24 tcf less.

The committee is an independent body of industry professionals that makes in-depth assessments of gas potential.

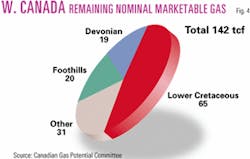

The report, released in late 2001, is based on a research program and analysis of data to the end of 1998. It says the Western Canada Sedimentary Basin (WCSB) will continue to be the mainstay of Canada's gas supply, with supplemental volumes from the Arctic and offshore frontiers. The study says the WCSB had 54 tcf of gas reserves, plus 88 tcf of undiscovered nominal marketable gas, representing 61% of remaining marketable gas in Canada (Fig. 2).

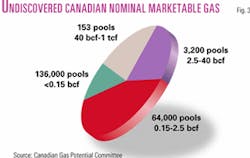

The committee said that finding and development costs will rise in the WCSB as gas is found in smaller accumulations, requiring more drilling (Figs. 3 and 7). It estimated up to 200,000 exploration wells, twice the number drilled to date in the basin, may be needed to tap undiscovered gas potential. It said that near-frontier areas—Offshore Nova Scotia, the Mackenzie Corridor, and Mackenzie Delta—hold 35 tcf of discovered and undiscovered nominal gas, about 15% of Canada's total marketable gas.

CGPC also noted there is long-term potential for unconventional sources such as coalbed methane (CBM) and gas hydrates, but work on these is still in the initial stages. It reckons that commercial CBM production could be as much as a decade away for potential reserves located in Alberta and British Columbia. Several companies are now running CBM pilot projects in Alberta. Studies also are under way in the Mackenzie Delta on hydrates—gas accumulations trapped underground as an ice-like solid composed of gas and water.

The National Energy Board estimates ultimate gas potential at 175 tcf in the arctic regions, 50 tcf in British Columbia, 270 tcf in Alberta, 9 tcf in Sas- katchewan, 63 tcf on the Grand Banks and the Scotian Shelf, and 15 tcf on the deepwater Scotian Slopes. It also estimated 89 tcf of gas in other frontier areas. Some of these reserves have already been produced in the WCSB. The NEB estimates there is 555 tcf of gas remaining as an established resource in Canada.

Short-term outlook

Industry experts and analysts agree the short-term outlook this winter for drilling is strong, depending on what happens with the weather and storage levels.

A cold snap in early January in the US Northeast increased gas prices to about $5.25 (US)/MMbtu and reduced storage levels. Spot prices at the major AECO-C storage hub in southern Alberta were $5.95/gigajoule, up 87% from the same time last year.

Reduced drilling in 2002, which sliced production levels last year and is contributing to a tighter supply-demand balance this winter, is seen as a catalyst for a forecast increase in drill- ing activity this season. The Canadian Energy Research Institute estimates Canadian production fell 2% in 2002.

Accelerating depletion

Deliverability is seen as a problem in the face of rising depletion rates. NEB has forecast a short-term decline in deliverability from the WCSB of 700 MMcfd, to 15.9 bcfd at the end of 2004 from 16.6 bcfd at the end of 2001. It was estimated to be 16.3 bcfd at yearend 2002.

The NEB forecast is based on decreasing initial production levels and rising decline rates, a trend that began in 1996. Lower gas prices in 2001 and part of 2002 also were a factor, as drillers focused on low-cost shallow gas areas, reducing average initial productivity.

The NEB analysis indicated that data from wells connected in 2001 showed that initial productivity from new wells had stabilized at 2000 rates and that decline rates also appeared to be stabilizing. New drilling is required to offset a natural 20%/year decline in production from existing wells and for any increases in production to meet demand growth.

Alberta potential

The Alberta Energy and Utilities Board (AEUB) estimates Alberta's marketable ultimate potential gas reserves at 200 tcf, based on a 1992 study that is being updated for 2003. It said 106 tcf has been produced to date, and it expects another 52 tcf will be discovered. The figures do not include CBM potential.

AEUB member Jim Dilay said that Alberta has a large remaining reserve base, but higher levels of drilling activity will be needed and movement to deeper-pay areas will be necessary just to maintain current production levels. He said that stable natural gas prices will be needed to encourage exploratory drilling, and land access will become an issue as the western basin matures.

Dilay said Alberta is capable of making a significant long-term contribution to meeting its own gas needs as well as satisfying the demand of other areas for gas.

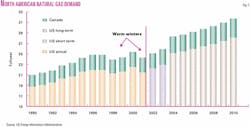

Increasing demand for Canada's natural gas in the medium to long term is forecast as US demand ramps up.

Natural gas demand in North America is expected to increase 30% over the next decade as a result of economic growth and the proliferation of gas-fired power projects (Fig. 5).

Canada produced 17.4 bcfd in 2001, with exports of 10.6 bcfd to the US, representing 17% of US gas supplies. Annual production was 6.4 tcf.

Drilling outlook

Greg Stringham, vice-president of the Canadian Association of Petroleum Producers (CAPP), says drilling got off to a slow start this year but is now above the levels at the same time last year.

He says a record 11,000 gas wells were drilled in 2001, an estimated 9,000 wells were drilled in 2002, and next season CAPP is estimating gas drilling will be back up to about 10,200 wells (Fig. 6).

Stringham says the price signals are now strong for gas, and this will result in a good reaction in drilling going forward. He says the only constraint would be warmer weather and the need for cold weather for deep drilling projects.

"Looking at the US, drilling activity is relatively flat, but their productivity is down and so the demand pull for gas, assuming a normal winter, is going to be quite strong," Stringham said.

The CAPP executive says that shallow gas drilling is strong in Alberta and Saskatchewan; he also cites high depletion rates for wells in the Ladyfern area of northeastern British Columbia but notes several new projects there. The southern Yukon and the Northwest Territories are also potential hot spots for drilling.

Stringham says a few wells and some seismic activity are expected in the Mackenzie Delta, and several high-cost drilling projects are planned for Offshore Atlantic Canada.

"It will be a key year to see the results of the wells in these new areas. I suspect we will see some movement forward on the Mackenzie gas pipeline process this year, but it is still 5-6 years away. Alaskan gas is likely not (to go on stream) before 2010," Stringham said.

Stringham says the critical factors in long-term growth of the natural gas industry in Canada include cost-effective development and implementation of new technology, market-based government policies, and efficient regulatory processes.

The Canadian Association of Oilwell Drilling Contractors (CAODC) has forecast a 24% increase in drilling activity in 2003 over 2002, measured on expected rig utilization. It forecasts 17,532 oil and gas well completions, up 22% from an estimated 14,323 wells in 2002. The forecast calls for a 70:30 split in favor of gas wells and is based on an assumption of $25 (US)/bbl oil and $4.40 (Can.)/Mcf gas at the AECO Alberta storage hub.

Uncertainties

CAODC bases its activity forecast on relatively strong commodity prices and on market-based costs of production.

The association qualifies its forecast with a caution. It says Ottawa's ratification of the Kyoto Protocol on Climate Change in December has introduced a good deal of uncertainty into the business planning process, and the investment impact could result in reduced activity and lost jobs in the drilling sector.

The Petroleum Services Association of Canada (PSAC) says higher estimated capital spending by companies in 2003 will translate into an almost 10% increase in activity to 16,500 oil and gas wells. The increases will be 10% in Alberta, 27% in British Columbia, and 3% in Saskatchewan. PSAC is forecasting 10,276 gas wells, 4,510 oil wells, 1,517 dry holes, and 197 service wells in 2003.

PSAC Pres. Roger Soucy says a significant increase in activity in the Foothills area as well as in northeastern British Columbia is contributing factors in the forecast of increased drilling. He said the trend is towards deeper wells targeting gas.

Carol Crowfoot, president and chief economist with GLJ Energy Publications Inc., formerly Brent Friedenberg Associates Ltd., says gas production in the longer term will require higher prices than seen in the past (see table).

Crowfoot says the industry entered the withdrawal season with very healthy storage levels that are now being drawn down rapidly due to colder weather. She says there also are some short-term deliverability issues right now, which is why storage withdrawals are at a high rate.

"That said, without an extended cold snap in major market areas, I don't anticipate prices to go through the roof for any extended period of time," Crowfoot said.

The energy economist says that, in the medium term, the gas industry's focus once again will turn to the deliverability situation in North America. Because of the struggle on the supply side, Crowfoot says, there is a prospect of strong prices, particularly if there is an early and cold winter.

Looking at the longer term, up to 5 years out, Crowfoot says it is not possible to discuss natural gas without considering crude oil and other competing fuels.

"I believe the equivalency (of natural gas to crude oil) previously averaging 10:1 bbl on a boe basis is now about 6:1. That means natural gas prices can be at a ratio that's higher than in the past, because there is going to be intense competition between gas to gas and competing fuels such as residual fuel oil and even distillates and higher-priced fuel oil," she said.

"We believe fundamentally there will be a tighter supply situation for gas."

Crowfoot says there is no question that areas such as the East Coast offshore will grow. But, she says, there will also be a requirement for higher gas prices than seen in the past because of rising finding and development costs.

Gas storage growth

EnCana Corp., Calgary, says it is making significant capital expenditures to expand its North American storage capacity in anticipation of medium and long-term growth in gas demand.

The company, with production of about 2.8 bcfd, is North America's largest independent gas producer and the largest independent gas storage owner and operator in North America.

EnCana is expanding its storage capacity in both Alberta and California. The company is spending about $130 million (Can.) to develop its new Countess storage facility in southern Alberta, which will have a capacity of as much as 40 bcf. The first 10 bcf of capacity is scheduled for second quarter 2003, and 40 bcf will be available in April 2005.The company now has two storage facilities in Alberta as part of its AECO hub, with 95 bcf of storage.

Construction also is under way to double capacity at EnCana's Wild Goose storage facility in northern California to 29 bcf. The company has not disclosed the cost of that expansion for competitive reasons. Once both expansions are complete, EnCana will have North American withdrawal capacity of 4 bcfd.

Bill Oliver, president of Encana's midstream and marketing division, says the anticipated need for storage is growing with expanding gas demand.

Oliver says the new Countess facility will be used not only to help manage sales and optimize the value of EnCana's produced gas but will also expand the Canadian capacity available to other producers and marketers for managing gas supplies and sales.

Pipeline expansion

TransCanada PipeLines Ltd., Calgary, says it does not plan any significant system expansion in the next 5 years, because there is adequate capacity to serve markets in the TransCanada and Alliance Pipeline systems.

Al Jamal, TransCanada manager of supply, says there is now a flat or declining supply situation.

"Overall, we are in a supply situation that probably won't warrant any expansion over the next 5 years. There could be some expansion in our western system to the Pacific Northwest at some point, but it won't be big," Jamal says.

The TransCanada executive says the prospect of natural gas from the Arctic and the Mackenzie Delta remains speculative at this point, but it would not require major expansion of system capacity. He noted there is enough capacity to handle gas from the Mackenzie Delta, and there is a good chance WCSB supply will be in decline when arctic gas flows, likely around the end of the decade.

Nonconventional gas

A continued decline in WCSB production is expected to strengthen industry interest in unconventional resources and for development of reserves in Canada's frontier regions.

Steve Wuori, group vice-president, planning and development for Enbridge Inc., Calgary, says the "angle of the treadmill" has increased for producers in the WCSB, and the basin is showing strain with an initial decline rate nearly three times what it was in 1990.

"In this decade, there will be a very strong pull to move arctic gas in Alaska and in Canada's Mackenzie Delta to market as economic activity rebounds. There will be a need for gas that is not LNG, that is sourced domestically for the US from Alaska and from Canada, a friendly supplier. This points to Alaska and the delta as being critical sources," Wuori said.

Wuori says the biggest impediment in moving Alaskan gas to market now is the absence of an appropriate legislative structure and a clear policy framework coming out of Washington, DC.

The Enbridge executive says a smaller Canadian pipeline project to move gas south from the Mackenzie Delta probably has a lead among competing projects in terms of timing at the moment (Fig. 8). He notes that a producer group headed by Imperial Oil Ltd. has completed an agreement with an aboriginal pipeline group and is well advanced in feasibility studies. There is 5.8 tcf of proven gas reserves on the Mackenzie Delta, compared with 35 tcf on Alaska's North Slope.

"A lot of things are moving into place that would suggest (the group) intends to file a pipeline application in 2003. It would be post-2007 before any gas moved on a Mackenzie Delta line," Wuori said.

Other frontiers

On the East Coast and off Nova Scotia and Newfoundland, Wuori says, additional development will require a favorable price environment at $3.75-4.25 (US)/MMbtu.

He says there also is a need for new drilling success, because nothing recently has created a great deal of new excitement. The region is well-placed to serve the growing New England gas market, says Wuori, noting that there is no question that the East Coast is a very important area for development and that it feeds into the continental gas market. The Sable Island region is currently producing more than 500 MMcfd of gas.

Wuori says there have been encouraging signs from British Columbia's government that action is under way to remove moratoria against drilling off the West Coast. The Geological Survey of Canada postulates there are undiscovered potential resources of 25.8 tcf of natural gas and 9.8 billion bbl of crude oil in several offshore basins.

Wuori says the challenge for drilling off Western Canada will come when a specific project is proposed. He says a first-case project will reveal what impediments it may face, such as environmental challenges and issues with First Nations groups. Most industry sources see the West Coast as a long-term prospect.