Market Movement

Venezuelan crisis persists

The general strike that has slashed Venezuela's oil production to less than 500,000 b/d was well into its 7th week at presstime last week, with no solution yet in sight.

Alí Rodríguez Araque, who stepped down as secretary general of the Organization of Petroleum Exporting Countries last year to become president of Petroleos de Venezuela SA (PDVSA), said the embattled Venezuelan government has taken over the national oil company from striking workers, is increasing production, and should return to normal production levels by the end of February. But analysts said his claims sound like someone whistling past a graveyard.

Striking PDVSA employees maintain it would take 4 months to return the firm to full operation, even if experienced workers retain their jobs.

Rodríguez earlier acknowledged it would take "a tremendous effort during several years" for Venezuela's economy to recover from the general strike aimed at ousting President Hugo Chávez (OGJ Online, Dec. 20, 2002). He said, "A long time will pass before the company recovers, not only from the economic damage, but also from the damage inflicted on Venezuela's oil industry in the international market."

Role change

Ironically, Rodríguez was named to head PDVSA in what was then seen as a conciliatory gesture by Chávez to PDVSA employees. Previous attempts to pack PDVSA with political cronies triggered a strike that briefly removed Chávez from office early last year. Last week, Rodríguez was trying to run the company with military and unskilled workers after Chávez fired 2,000 PDVSA employees.

Paul Horsnell, head of energy research for London-based JP Morgan Chase & Co., reported Jan. 15, "There is no apparent strong momentum towards a resolution except through a process of attrition."

The amount of oil stripped out of world markets since the start of the strike on Dec. 2 was "likely to pass 100 million bbl by (Jan. 18)," said Horsnell. "The longer the stoppage goes on, the more we are concerned over the scale of the permanent damage to Venezuelan productive capacity, and the higher the probability that our current assumption of a 500,000 b/d loss is an underestimate."

With crude inventories already tight and military conflict threatening in Iraq, the oil market "remains just a shade away" from price spikes, Horsnell said. US crude inventories for the week ended Jan. 10 were "down to the second-lowest level since 1976. The margin of spare inventory above minimum operating requirements is now about 4 hr worth of crude runs through refineries," he added.

Despite sharp drops in shipments of Venezuelan crude to refiners, total US oil imports actually increased earlier. Horsnell said that was "probably due to the 'slow steamers'Utankers that were loaded in November and early December and ordered to arrive after Dec. 31 in order to reduce tax liabilities arising from year-on-year gains in the value of inventories held at yearend." Most of those "slow steamers" probably have arrived by now, resulting in a likely fall in US oil imports in coming weeks, he said.

"Only a combination of OPEC and luck has stopped prices reaching $35(/bbl) so far," Horsnell said, "and we are concerned that the luck will run out soon."

He warned, "The US system has almost run out of spare oil, suggesting that refinery run cuts due to lack of crude are going to become a more generalized phenomenon." But it's unlikely, he said, that "some crumbs might be thrown to refiners, in either a targeted or generalized manner" through the release of crude from the US Strategic Petroleum Reserve. US officials are reluctant to draw down those emergency reserves prior to the start of likely military action against Saddam Hussein.

OPEC's help limited

Meanwhile, last week's decision by OPEC ministers to raise the group's production quota by 1.5 million b/d to 24.5 million b/d, effective Feb. 1, returns its output almost to where it was late last year.

That was when members were overproducing by 2.5 million b/d their previous quota of 21.7 million b/d. The production gap narrows if one backs out the increase of 173,000 b/d to 2.8 million b/d that was authorized for Venezuela. It's currently producing <500,000 b/d vs. nearly 3 million b/d in November.

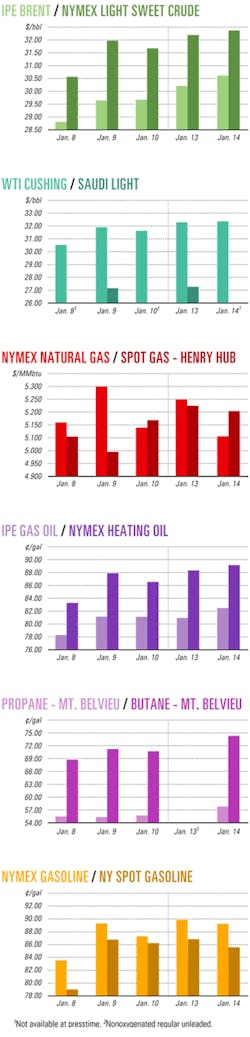

Industry Scoreboard

null

null

null

Industry Trends

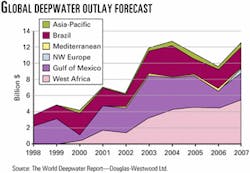

ROBUST GROWTH is expected in the deepwater sector within 5 years.

Energy analyst Douglas-Westwood Ltd. and offshore data specialist Infield Systems Ltd. report that 148 deepwater fields are expected to come on stream during 2003-07—more than twice the number developed during the previous 5 years.

Almost 70% of the future deepwater development prospects will be developed through stand-alone floating production facilities or as subsea tiebacks to production facilities, said the analysts in recently released "The World Deepwater Report 2003-2007."

Records show 66 deepwater fields off 6 countries were brought into production during 1998-2002. By 2007, an additional 13 countries are expected to achieve production from fields in water depths greater than 500 m.

The reserve base targeted by these prospects worldwide amounts to 32.8 billion boe, more than triple the 10.6 billion boe targeted by the 66 deepwater projects brought on stream during the previous 5-year period.

"We have not attempted to reflect the fact that ongoing exploration and appraisal activity will almost certainly reveal new prospects for development during the 2003-07 period by 'inventing' development prospects. We believe, therefore, that activity in the deepwater sector may actually exceed the levels presented in our forecasts," said John Westwood, Douglas-Westwood director.

For 2003-07, analysts forecast worldwide capital expenditures of $57.9 billion on deepwater developments compared with an estimated $25.6 billion for 1998-2002 (see chart). In the last 5 years, the Gulf of Mexico and Brazil dominated deepwater development, accounting for 83% of the money spent worldwide.

A series of multibillion-dollar development projects are progressing off West Africa, which will propel it to the forefront of the deepwater arena, the report said. Meanwhile, activity levels are expected to remain strong off Brazil and in the Gulf of Mexico.

Drilling expenditures and floating production platforms will dominate the US forecast deepwater outlay of $18.3 billion, with 22 platforms forecast for installation during 2003-07.

"It should be noted that, due to the highly dynamic nature of the regional market, we believe there is potentially significant upside to our forecasts (for the Gulf of Mexico)," the report said.

The 64 deepwater platforms forecast for installation during 2003-07 account for 36% of total expenditures, or $20.9 billion. Drilling and completion of more than 1,000 development wells—both surface and subsurface—account for 35%, or $20.2 billion.

Pipelines and control lines represent $11.4 billion, or 20%, of the market, the report said.

Government Developments

A CLEAN AIR GROUP has charged that US House Republican leaders, working with the US Environmental Protection Agency, are seeking legislation that could allow some states to avoid using reformulated gasoline (RFG) to meet federal clean air standards.

The Clean Air Trust (CAT) released a leaked Jan. 6 e-mail from a Texas state official to eight members of the House of Representatives' Texas delegation urging them to attend an EPA briefing on the agency's ozone attainment extension policy. The e-mail was from Duane Taylor with the Texas Office of State-Federal Relations in Washington.

CAT Executive Director Frank O'Donnell said it was "a secret attack on the Clean Air Act through the arcane congressional budget process. We fear that the conspirators intend to try putting this amendment on an omnibus congressional budget billUwithout hearings, debate, or public notice," said O'Donnell.

CAT said the "conspirators" include political appointees from the George W. Bush administration's EPA, Texas state government officials, and key Capitol Hill staffers "who are seeking to reverse several court decisions."

In the e-mail, Taylor told congressional staff "a legislative fix will be necessary to ensure that the BPA (Beaumont-Port Arthur) and DFW (Dallas-Fort Worth) areas retain their extension, and it would be extremely difficult for these areas to reach attainment without the extension."

Under recent court decisions, dozens of areas are expected to face growing pressure to consider RFG as an air quality strategy in light of stricter ozone standards (OGJ, Nov. 25, 2002, p. 25).

In the late 1990s, EPA extended the deadline for several ozone nonattainment areas classified as moderate or serious. But the policy was challenged successfully in court, and some areas now face EPA penalties unless they implement additional measures to reduce air pollution. This could mean the introduction of RFG, enhanced inspection and maintenance programs, or other measures to control pollutants.

Congressional sources confirmed EPA's Capitol Hill briefing on the attainment date-extension policy. But Hill sources said it is "too premature" to speculate what lawmakers might consider. Texas natural resources representatives in Austin said that a legislative proposal was being studied.

BRITISH COLUMBIA has joined the Interstate Oil and Gas Compact Commission (IOGCC) as the organization's seventh non-US affiliate.

Through IOGCC International, affiliates have access to the organization's information and the opportunity to participate on committees.

British Columbia 's coal seam natural gas potential is estimated at 89 tcf. In addition, it is estimated to have as much as 42 tcf of offshore gas potential. The province also is expected to become active in the North American Coastal Alliance, a group formed in 1998 by several IOGCC representatives to identify areas of concern to coastal states.

Quick Takes

STATOIL ASA has awarded an engineering, procurement, construction, and installation contract to Technip-Coflexip's Nor- wegian affiliate Technip Offshore Norge AS and issued letters of intent totaling 560 million kroner for pipelay and marine operations connected with the development of its 12-well Kristin field complex in the Norwegian Sea:

Technip-Coflexip was awarded a 60 million euro EPCI contract for infield flowlines, umbilicals, and subsea structures. Project management and engineering will be performed in Oslo, and fabrication of the flowline will take place at Technip Offshore Norge's welding base in Orkanger, Norway.

Technip-Coflexip unit Coflexip Stena Offshore Ltd. (CSO) will install six 10-in. production flowlines totaling 39 km, which will tie four subsea templates back to the Kristin floating production platform, and it will lay 23 km 12-in.oil export line to Statoil's Åsgard C storage vessel. CSO's contract also includes the positioning of manifolds, 16 km of umbilicals and service lines, and 26 km of fiber-optic cables and subsea pipeline tie-ins to the templates.

Allseas Marine Contractors SA was selected to install 30 km of dual gas export pipeline between the field's floating platform and the Åsgard transport gas trunkline. Work on the line will be carried out in spring 2004.

Saipem SPA was awarded a contract to install the four templates next spring.

The work will be carried out largely in spring and summer 2004, with the remainder of the tie-ins to the platform due in 2005 when this installation is scheduled to arrive on site.

Total investment in the Kristin development is estimated at 17 billion kroner ($1.9 billion). Statoil's partners in Kristin are Petoro (formerly state holdings group SDFI), Norsk Hydro AS, ExxonMobil Corp., Agip SPA, and TotalFinaElf SA.

Kristin field, scheduled to become operational Oct. 1, 2005, will deliver 35 billion cu m of gas until 2016 from 12 subsea wells. Its output of condensate and natural gas liquids is estimated at 220 million bbl and 8.5 million tonnes, respectively (OGJ Online, Oct. 15, 2002).

Development of the Sakhalin-1 project in the Russian Far East is moving forward. South Korea's Hyundai Heavy Industries (HHI), which holds the main contract for drilling package fabrication, has awarded a subcontract to Houston-based KCA Deutag Drilling Inc., a division of Abbot Group PLC, for the detailed design of drilling facilities. The design project will be undertaken in Houston, followed by construction support and commissioning at Ulsan shipyard in South Korea.

Sakhalin-1, which consists of three offshore oil and gas fields in the Sea of Okhotsk off Sakhalin Island, is being developed in phases, with first production from Chayvo field scheduled to commence at yearend 2005.

A consortium of US, Russian, Japanese, and Indian companies is developing the project, which is operated by Exxon Neftegas Ltd., an ExxonMobil Corp. affiliate.

A modified concrete and steel structure—formerly used by ExxonMobil predecessor Exxon Corp. and other operators off Alaska's North Slope—will be installed 7 miles off Sakhalin Island in 45 ft of water. It will support existing living quarters, minimum production facilities, and a new drilling package designed for world class, extended-reach wells. Production will be moved by pipeline for further processing at a new onshore processing plant.

SAUDI ARABIAN BASIC INDUSTRIES CORP. (SABIC) subsidiary, United Petrochemical Co., has arranged financing for its proposed petrochemical plant at Jubail Industrial City and plans to start production in the second half of 2004.

SABIC signed a 4.33 billion riyal ($1.154 billion) loan Jan. 8 with a consortium of international and local banks to finance construction of the plant, with Riyadh Bank serving as lead manager for the loan and Gulf International Bank as independent financial adviser. The Saudi Public Investment Fund will provide an additional 1.5 billion riyals ($400 million).

The United plant will have an annual production capacity of 1 million tonnes of ethylene, 575,000 tonnes of ethylene glycol, and 150,000 tonnes of linear alpha olefins.

Another facility, an 800,000 tonne/year polyethylene plant in which United has a 50% interest, is currently under construction in Jubail at the site of SABIC's affiliate Petrokemya (Arabian Petrochemical Co.).

FIRST PRODUCTION of 75,000 b/d of oil has started from Ourhoud oil field—Algeria's second largest—OPEC News Agency reported state oil firm Sonatrach as saying earlier this month. The field, in northeastern Algeria, is in the Ghadames basin, 250 km east-southeast of Hassi Messaoud, Algeria's largest oil field.

OPECNA said the field was brought into production 1 month ahead of schedule. At the end of February, Sonatrach expects the field's production to reach its peak of 230,000 b/d of oil, OPECNA said.

Sonatrach holds a 51% interest in Ourhoud field. Other partners include Spain's Cepsa and US-based Anadarko Petroleum Corp. and Burlington Resources Inc.

The country's production capacity now is expected to exceed 1.3 million b/d compared with 1.1 million b/d before Ourhoud production, OPECNA said.

Iran's offshore Balal oil field has come on stream, following a $310 million development program led by TotalFinaElf. The 390 million bbl oil field began production from two completed wells at a rate of 20,000 b/d, with output expected to increase to 40,000 b/d by March 2004 when eight remaining wells come online. Balal field lies 100 km south of Lavan Island in the Persian Gulf. A pipeline is planned to transport Balal's output to Lavan Island for export. Balal oil field is being developed under a 3-year buy-back contract signed with Iran in 1999. Stakeholders are TotalFinaElf (operator) 46.75%, Italy's ENI SPA 38.25%, and Canada's Bow Valley Energy Ltd. 15%.

In other production news, Noble Energy Inc. started crude oil production Jan. 13 from Cheng Dao Xi field in Bohai Bay off China. The oil flowed from three wells at a combined rate of 6,000 b/d. The production platform was designed to produce 10,000 b/d of oil, and production is expected to reach this capacity next month. The field is on the south side of Bohai Bay in 25 ft of water (see map, OGJ, Dec. 17, 2001, p. 59). A 5 mile pipeline transports the oil to existing onshore processing and pipeline infrastructure in Shengli oil field. Noble Energy, through its subsidiary Energy Development Corp. (China) Inc., has a 57% interest in Cheng Dax Xi field. China Petrochemical Corp. (Sinopec) is Noble Energy's partner with 43% interest.

APACHE CORP., Houston, made a discovery on its Ras El Hekma concession 18 miles northeast of the company's prolific Khalda concession. The Emerald-1X well, Apache's 11th discovery in Egypt, was drilled to 12,440 ft TD. It flowed 16.9 MMcfd of natural gas and 4,285 b/d of condensate through a 1-in. choke with 1,311 psi flowing wellhead pressure. Apache holds a 100% contractor interest in the field

The discovery logged a total of 218 ft of net pay in multiple Alem El Bueib (AEB) reservoirs. There was 184 ft of net pay in the AEB 5A, 5B, and 6 reservoirs with no observed water contact.

Emerald-1X tested a 1,200 acre structure and perforated 34 net ft of pay in the AEB 6 sand in two intervals at 11,848-11,892 ft. At depths of 10,010-11,644 ft, Emerald-1X logged 88 ft of gas-condensate pay in the AEB 5B sand and 19 ft of oil pay in the AEB 3E sand.

The discovery improves understanding of the Tarek-Ras El Hekma fault trend, said Rodney J. Eichler, Apache's regional vice-president and general manager in Egypt. "We have just found AEB sands 180-200 ft updip of any previous penetrations, and we have flow rates from the AEB 6 that are the highest ever recorded from that Ras El Hekma reservoir," he said.

Apache said it plans to test the development and delineation potential with a second well, Emerald-2X. Gas and condensate from the discovery will go to a gas processing plant in Tarek field 8.5 km away.

Oman, in cooperation with Norway's Petroleum Geo-Services ASA, opened the 2003 licensing round for Gulf of Oman Blocks 18A, 18B, and 41 on Jan. 15 and will close tenders July 15. The blocks cover 7,920 sq km for 18A, 13,520 sq km for 18B, and 23,800 sq km for 41. The three blocks were selected for a license offer based on interpretation of the new 2D seismic data acquired last year by PGS Geophysical AS, comprising 5,839 line km along with 2,738 line km of reprocessed data, both available from water depths of 50-3,000 m. PGS said all seismic data would be made available in two data packages. Closures are of the order of tens to hundreds of square kilometers, and reservoirs are potentially stacked in growth-fault, rollover anticlines and collapsed-crest listric fault blocks, PGS said. Diapir flanks and flower structures provide additional structural closures, while stratigraphic pinchouts are evident in seismic sections. Detailed information regarding the Gulf of Oman 2003 licensing round and the PGS Oman survey can be found in the data library on the PGS website.

JORDAN has selected 47 local trucking companies to deliver 5.5 million tonnes of Iraqi oil during 2003 at a cost of $56 million, pending construction of a new oil pipeline.

The proposed $365 million, 750 km pipeline, which will link Jordan's Zarqa oil refinery with Iraq's Al-Haditha oil wells, is expected to replace the use of trucks for oil transport by 2004. Under a recently signed accord, Iraq will supply Jordan with 4 million tonnes of crude oil and 1 million tonnes of oil products (OGJ Online, Nov. 25, 2002).

Jordan's section of the pipeline, from Zarqa to the Iraqi border, is to be completed by yearend, following the award in January of the tender for a 30 year "build, own, operate, and transfer" contract. Jordan receives all of its oil from Iraq, half of it free of charge and half purchased at $4-5/bbl less than the world market price.

MARATHON OIL CO. has selected Houston-based KBR (Kellogg Brown & Root) and Techint SA de CV of Argentina as engineering, procurement, and construction (EPC) contractors for the Baja California Regional Energy Center project in western Mexico.

As previously announced (OGJ Online, Mar. 1, 2002), the Baja California Regional Energy Center is an integrated complex to be sited near Tijuana, Mexico. It is expected to contain an LNG offloading terminal and regasification plant, a 1,200 Mw power generation plant, a 20 million gpd water desalination plant, wastewater treatment facilities, and natural gas pipeline infrastructure. The complex will be designed to regasify as much as 750 MMcfd of LNG to meet local needs and for export to southern California.

Marathon's partners include Bermuda-based Golar LNG Ltd., which will operate the LNG vessels, and the Mexican company Grupo GGS SA de CV LNG will be supplied from the Asia-Pacific region and other sources worldwide, with Indonesia's Pertamina expected to be a key supplier.

KBR will provide initial engineering for the offloading terminal, regasification plant, desalination plant, and natural gas pipeline infrastructure. A joint venture of KBR and Techint then will follow with detailed engineering, procurement, construction, commissioning, and testing activities.

Currently, the consortium is proceeding with Mexico's required regulatory reviews and permits. Assuming approval and the development of a successful commercial structure and financing plan, construction could begin in 2003 with start-up operations in 2006.

CORRECTIONS

Petrogal Exploration was erroneously denoted as being from Spain (OGJ, Jan. 6, 2003, Newsletter, p. 8). It is actually an arm of Petroleos de Portugal, the national oil company of Portugal.

OGJ excluded Paramount Petroleum Corp.'s refinery at Long Beach, Calif., from the annual worldwide refining survey after characterizing it as an asphalt plant (OGJ, Dec. 23, 2002, p. 68). However, the facility also produces finished transportation fuels and will be included in future survey reports. Since the 2001 worldwide refining survey (OGJ, Dec. 24, 2001, p. 115), Paramount Petroleum has increased capacities of specific process units as follows: 52,000 b/cd crude unit, 30,000 b/cd vacuum distillation unit, and 16,500 b/cd asphalt unit. The California capacities are increased to 1,945,020 b/cd crude unit, 1,132,209 b/cd vacuum distillation unit, and 46,600 b/cd asphalt unit. The US total capacities are increased to 16,675,301 b/cd crude unit, 7,377,704 b/cd vacuum distillation unit, and 488,080 b/cd asphalt unit. The worldwide totals are increased to 81,929,646 b/cd crude unit, 26,707,254 b/cd vacuum distillation unit, and 1,727,551 b/cd asphalt unit.