Heavy hydrocarbons playing key role in peak-oil debate, future energy supply

Third in a series of six special reports on Future Energy Supply

Increasing production of unconventional oil could be crucial for meeting future global oil demand.

In the near to middle term, almost all of that unconventional oil supply will come in the form of extra-heavy crude and bitumen.

Just as some experts predict a near-term precipitous decline in conventional oil production, others point to burgeoning supplies of upgraded and synthetic crude derived from the world's vast tar sands, oil sands, bitumen resources. Some see those as the linchpin in bridging the gap between peak of global conventional oil production and more-exotic nonconventional energy sources.

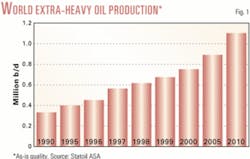

Those who favor the view that peak-oil is imminent generally dismiss the contribution to world oil supply to be made by heavy oil and bitumen as inadequate within their projected timeframes for global oil production peaking. But unlike many other nonconventional energy sources, heavy hydrocarbons are already making a robust, economically viable contribution to the world's oil supply today (Fig. 1).

And the outlook is for that contribution to rise significantly in the decades to come. This outlook hinges on continuing improvements in reducing the cost of heavy hydrocarbon production through technology advances and efficiency improvements. In fact, the consensus is that production of heavy hydrocarbons has reached a point where it can be sustained through a range of oil prices once thought unsurvivable.

That bodes well for the world's future volumes and diversity of oil supply. But it also presents challenges for producers and refiners that must exert ever-greater efforts to squeeze value from a increasingly poor-quality production stream. Even as producers step up efforts to enhance the value of heavy hydrocarbons upstream of the refinery, today's refiners must adapt—in terms of logistics as well as process operations—to an expanding slate of new synthetic crude oils (SCOs).

This report will focus mainly on the most commercially advanced heavy hydrocarbons, relegating oil shale to the margins where industry has left it since the US shale oil industry boom of the early 1980s fizzled under slumping oil prices and the evaporation of government support. While there is a minuscule volume of shale oil being produced, nothing else on the heavy hydrocarbons scene approaches the vast scale or immediate commercial potential of operations in Canada's Athabasca oil sands and Venezuela's Orinoco oil belt. However, an enormous oil shale and tar sands resource in the US may get another look as sources of low-cost oil in the world begin to approach a peak.

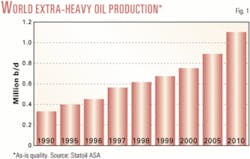

Currently, the world's endowment of heavy hydrocarbons—including oil sands or tar sands, bitumen, extra-heavy oil, and oil shale—outstrips known and projected resources of conventional oil (Table 1). The devotees of the Hubbert's peak theory of imminent oil peak and precipitous decline (OGJ, July 14, 2003, p. 18) contend a permanent oil price shock awaits on the horizon. That then would argue for a concerted effort by government and industry to further commercialize and expand oil supply from these resources beginning now.

But given the uncertainty of oil markets and prices, heavy hydrocarbon producers are doing well to keep ramping up output and reducing cost of this increasingly important component of the world's oil supply.

And those efforts may be compromised by environmental concerns ranging from local pollution worries to the impact of the Kyoto Protocol on global warming. Such concerns are certain to be ratcheted up by those who campaign for a switch to alternate energy sources amid rising oil prices.

It adds up to an often overlooked corner of the world oil sector gaining in prominence and in debate as a key component of future energy supply.

World potential

Some estimates put the total global heavy hydrocarbon resource in place at more than 6 trillion bbl.

According to the International Energy Agency, worldwide oil shale resources exceed 3.5 trillion bbl; however, potential oil shale reserves are put at a mere 160 billion bbl. Despite the massive oil shale resources in the US, former Soviet Union, China, Brazil, and Canada, tiny Estonia is the world's largest producer of shale oil at about 3,000 b/d.

Bitumen alone has been pegged at a worldwide resource in place of more than 3 trillion bbl. Canada's bitumen resource in place has been estimated at 1.7-2.5 trillion bbl, mainly in Alberta. Of that total, Canada's potential oil sands reserves are 315 billion bbl under expected technology and economic conditions, according to the Alberta Energy and Utilities Board (EUB). The agency put Alberta's "established" remaining reserves of in situ and mineable bitumen at 174 billion bbl in 2002, down slightly from 2001 due to production. Up to that point, only 2% of Alberta's initial established bitumen reserves had been produced.

When Oil & Gas Journal last year accepted EUB's estimate of established oil sands reserves, it vaulted Canada up the ranks of the world's largest oil reserve holders to No. 2. And that provoked a storm of controversy.

In a recent commentary written for the Calgary Herald daily newspaper, EUB Chairman Neil McCrank took note of the change in OGJ's numbers.

Writing that, until recently, the agency's responsibility for calculating the province's energy resources "was not very controversial," McCrank noted that while "industry experts took note, few others noticed."

"Last year, things changed," he wrote. "The Oil & Gas Journal, which is a highly regarded international petroleum news magazine, began including Alberta's oil sands reserves for the very first timeUSubsequent to the Journal article, other periodicals began to consider the oil sands."

McCrank also noted some of the skepticism voiced about Alberta's oil sands reserves numbers, adding that he welcomes "a thorough examination of the methods the EUB uses to calculate our estimates of Alberta's crude bitumen reserves."

He contended that the crude bitumen reserves EUB reported are "accurate, independent estimates based upon detailed technical and geological analysis of data obtained from thousands of wells drilled in the oil sands."

While noting that his agency is currently working to update Alberta's crude bitumen reserves estimates, "Uat this time, the EUB does not expect any significant change in our reserves estimates upon completion of the review.

"The EUB takes its responsibilities to provide accurate oil sands reserves estimates very seriously," McCrank wrote. "And we stand behind our numbers."

According to the IEA, Venezuela's bitumen and extra-heavy crude oil resource in the Orinoco oil belt totals 1.2 trillion bbl. It estimates ultimate potential reserves there at 270 billion bbl.

The US Geological Survey acknowledged the vastness of heavy hydrocarbon resources even though the agency didn't include them in its 2000 assessment of the world's hydrocarbon resources.

"There are significant volumes of heavy oil and tar sands in the world, Venezuela, the Siberian basins, the Middle East (Zagros), etc.," Thomas Ahlbrandt, world energy project chief with the US Geological Survey in Denver, told OGJ. "In our USGS assessment it would have been good to have included heavy oil and tar sands, but we didn't have an appropriate and endorsed methodology for such unconventional resources.

"We actually conducted an assessment of a prototype methodology for the Orinoco heavy oil belt; we got big numbers, but you won't see them reported anywhere (in the assessment)."

In a paper presented at a 1998 heavy oil and tar sands conference in Beijing, Douglas Lanier of Chevron Petroleum Technology (now part of ChevronTexaco Corp.), put the heavy hydrocarbon resource in perspective: "Conventional oil and gas each has a remaining reserve of 800 billion to 1 trillion boe. Considering a resource base of about 6.3 trillion bbl of oil in place and a recovery factor of about 15%, heavy oil is an equivalent resource, approximately one third of the world total oil and gas reserves."

"It is clear that huge volumes of nonconventional oil exist around the world," Wood Mackenzie Ltd. analysts Derek Butter and Martin Purvis told OGJ. "and Wood Mackenzie estimates the remaining commercial reserves (including only reserves that are under development or where firm development plans exist) in Canada's oil sands alone to be 26 billion bbl as of Jan. 1, 2003. Estimates for the in-place bitumen in Canada's oil sands has been placed as high as 2 trillion bbl.

"To put these figures into perspective, production in 2003 is expected to be approximately 500,000 b/d, which gives an R/P ratio of almost 150 years for existing and planned operations. At 2 trillion bbl the R/P ratio becomes almost irrelevant."

An even bigger gap between resource base and production outlook exists for oil shale. In responses to OGJ queries, both sides of the peak-oil debate gave scant attention to this resource—the result, no doubt, of its "white elephant" reputation stemming from the rapid boom-and-bust, government-subsidized projects in the US West of 2 decades ago.

But William F. Lawson, director of the US Department of Energy's National Petroleum Technology Office in Tulsa, isn't ready to write off oil shale just yet.

"Three fourths of the world oil shale reserves are in the US," he noted. "To restart an oil shale industry in the US will take a decade and could build substantially after that.

"With an estimated 2 trillion bbl of oil technically recoverable from US oil shales, it is only a matter of time before it is exploited. However, if it is to help make up the gap between supply and demand, we need to start now."

With nonconventional heavy hydrocarbons production representing only about 1% of global oil production, it's clear that the exploitation of heavy hydrocarbons is only beginning to scratch the surface of its potential.

But development of these massive resources is highly sensitive to oil prices. Even with the dramatic improvements in cost reduction and recovery efficiencies, the lower quality and relatively higher costs associated with producing heavy oil will keep it hostage to the vagaries of oil price movements. And it is the nature of bitumen, extra-heavy oil, and oil shale projects that they feature a long-term development path and a long payout. So the central question becomes: How will the oil industry be able to commercially exploit this huge and increasingly important nonconventional oil resource in the near to medium term while withstanding the inevitable volatility of oil prices in the interim?

Peak-oil concerns

It is the economic viability and thus timing of growth in nonconventional heavy oil production that peak-oil advocates point to when pressing their case that this increment of supply won't solve what they see as a dramatic shortfall of oil supply in the near to middle term.

Kjell Aleklett, president of the Association for the Study of Peak Oil & Gas (ASPO), points out that "the next 10 years will see production in the North Sea alone drop (by) 3 million b/d. It seems most unlikely that production from tar sands, which is essentially a slow mining process, could begin to compensate for this loss.

"At the (May 2003) ASPO workshop in Paris, (Institute Français du Petròle) Pres. Olivier AppertUshowedUthat by year 2010 we will need as much as 60 million (b/d) of new production to meet projected demand. But by all means tar sands will be important to make the downhill slope less steep."

Pierre-René Bauquis, special advisor to the Total SA chairman and an associate professor at IFP School, factored in the role of nonconventional oil (as well as all other hydrocarbon liquids, including NGLs), into his prediction that global oil production will peak at 100 million b/d—"not 120-130 million b/d, as said by IEA"—around 2020 and decline thereafter to 25 million b/d in 2100.

"In such a view, ultraheavy oil, as part of nonconventional (hydrocarbon supply), can only smooth the peak into a bumpy plateau (2015-30), but certainly not compensate for the decline of conventional oils," he told OGJ. "The order of magnitude of future production profiles both from Athabasca and Orinoco is not sufficient for such compensation."

So heavy oils will not 'fill the gap' but slow the decline."

A.M. Samsam Bakhtiari, a senior expert with National Iranian Oil Co. and another prominent proponent of peak-oil theory, expressed his belief that Canadian oil sands and Venezuelan heavy oils will not change the overall conventional oil depletion picture.

"Certainly they will both come to the fore when the going gets real tough on the conventional oil side and prices begin to gyrate wildly, but they will only be stopgap production schemes," he told OGJ. "These exotic projects are and will always remain expensive, problematic, and extremely messy affairs—further complicated by Canada's ratification of (the) Kyoto (Protocol on climate change) and natural gas prices (remaining) high in North America."

Another prominent peak-oil theory defender, who declined to be identified for publication, expressed skepticism about the resources in question.

"If you extrapolate Total's figures for Orinoco to the whole area, taking into account that the geological setting is potentially the best—large channel bars—on Total's contract area, you find that Orinoco, if it were entirely developed, could at maximum produce 60 billion bbl over the next 30 years. In other words the real contribution of Orinoco in 2010-20 could be, say 3 million b/d.

"The same is true for Athabasca. Official Canadian forecasts put the additional supply of this area (as compared to today) to less than 2 million b/d in 2010-20. All that makes a lot but will not save the world if non-Middle East oil starts to decline by, say 1 million b/d each annum.

"I am convinced that oil will continue to be produced for a long time because the 'tank' of oil is large. The problem is how to increase the 'tap' when non-Middle East oil will start to decline, say around 2010. I have no answer and suspect that there is none except to squeeze our belts and start to produce synthetic liquid fuels."

Mariano Gurfinkel, assistant director for energy technology development, integration, and deployment at the Center for Energy and Technology of the Americas at Florida International University, disputes that notion.

Using the US as analogy for his argument, Gurfinkel notes that more than half of the US oil endowment of 650 billion bbl has been discovered but is not economically viable at current prices.

"In late 1998 and early 1999, prices dropped to levels that made many tertiary recovery processes uneconomical in the short term, so output was reduced from such fields. Once prices recovered, many of these projects were put on line again.

"Now let's assume that new discoveries were fewer and farther apart (which some argue will not be the case), and that demand kept up. Given that there is elasticity of demand to prices, demand would be reduced as prices increase (at least long-run demand); additionally, rising prices will provide a margin for the production from marginal fields.

"All this to say is that there will not be a sharp decline in production after the peak. Most likely once a peak is reached—a peak not determined by geology (as put forth by the Hubbert modelers) but rather by the market—production will decline very slowly as higher-cost fields come online.

"Eventually, prices will increase sufficiently that other means of energy will become viable, and fuel-switching will take place to keep the marginal costs and prices nearly constant. If at this point, a new, lower-cost alternative is developed, it will substitute for oil as the primary source of energy, and then and only then will there be a sharp decline in production.

"Now let's bring heavy oil and tar sands into the picture. Heavy oil and tar sands constitute the equivalent of new fields in the previous argument, and as we know there is much of it around the world. Just in Canada and Venezuela there is more than 2 trillion bbl in place."

Projects update

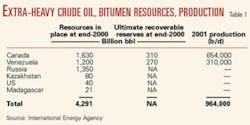

Production of nonconventional heavy hydrocarbons has been and will continue to be dominated by megaprojects in Canada's Athabasca and Venezuela's Orinoco regions (Fig. 2).

In Canada, huge capital outlays have been earmarked for expansions of oil sands projects.

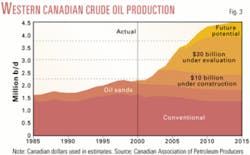

EUB estimates that $23 billion (Can.) has been invested in oil sands expansion since 1996, $7 billion worth of projects is under construction, and a further $30 billion of oil sands investment has been announced for the next 10 years (Fig. 3).

EUB predicts that bitumen production from oil sands mining operations will increase to 248,000 cu m/day by 2012 from 84,000 cu m/day in 2002. It forecasts that bitumen production from in situ operations will jump to 123,000 cu m/day by 2012 from 47,600 cu m/day in 2002.

Oil sands output today accounts for 26% of Canadian crude oil production, a level expected to climb to 50% by 2005, according to Syncrude Ltd. Combined SCO and nonupgraded bitumen production accounted for 48% of total Alberta hydrocarbon liquids output in 2002, vs. 43% in 2001, according to EUB. The agency forecasts that share will soar to 77% of a projected 2.7 million b/d of Alberta liquids production in 2012.

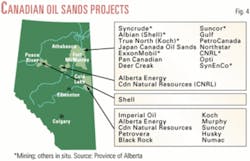

Canadian bitumen and related SCO production (Fig. 4) is dominated by the massive oil sands mining and upgrading projects dominated by Calgary companies Syncrude and Suncor Ltd. The two megaprojects produced 37,100 cu m/day and 32,700 cu m/day of SCO, respectively, in 2002.

Syncrude in 2001 approved spending $4 billion (Can.) for the third stage of its four-stage, $8 billion Syncrude 21 expansion program. With start-up slated by late 2004, the third stage would increase production of Syncrude Sweet Blend SCO by more than 100,000 b/d. That will boost Syncrude's SCO output to more than 360,000 b/d by 2005.

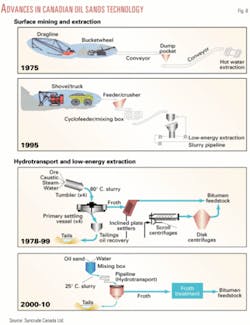

The expansion reflects the advances in oil sands mining technology that includes transporting oil sand by pipeline as a slurry and a low-energy extraction process that cuts by 40% the energy required to produce a barrel of bitumen. A further expansion is slated under Stage 4, due online by 2009.

Suncor in 1967 opened the world's first commercial-scale oil sands processing facility. Since that time, it has producted nearly 1 billion bbl of oil and claims enough reserves to sustain production for th next 50 years.

Suncor recently completed construction on Project Millennium, a $3.4 billion expansion of its existing operations. In 2001, the company received regulatory approval for its Firebag in situ oil sands project. Its latest proposed expansion, Voyageur, is expected to increase Suncor's oil sands production to 500,000-550,000 b/d in 2010-12.

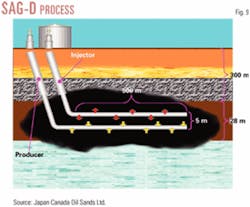

Technology advances such as the SAG-D process (steam-assisted gravity drainage), Vapex (vapor extraction incorporating a solvent such as naphtha), and new cyclic steaming techniques are marking significant progress in opening the bulk of Canada's postulated 300 billion bbl of recoverable oil sands resource (80%) that is too deep to be mined.

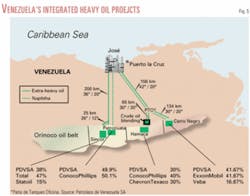

In Venezuela, four integrated extra-heavy oil projects are garnering the lion's share of attention for heavy hydrocarbons development outside Canada (Fig. 5).

They include:

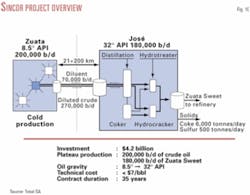

- The Sincor and Hamaca projects, which entail maximum upgrading of extra-heavy crude oil in Venezuela to a 26º API gravity crude, with minimal residuals, that is exported.

- The Petrozuata and Cerro Negro projects, which involve partial upgrading in Venezuela of the extra-heavy crude to a 14-22º API gravity crude that is then exported to US refineries.

The Hamaca project, which began producing in 2001, is expected to join the other three fully online when its upgrader at José starts up at yearend.

Together the four projects will seek to exploit 11 billion bbl of 8-9º API gravity oil reserves at a combined total cost of $13.27 billion under "strategic association" joint ventures with state-owned Petroleos de Venezuela SA. Production is expected to rise to 600,000 b/d in 2006 from 450,000 b/d today and 240,000 b/d in 2001. The JV contracts are for 35 years.

In addition, PDVSA has incorporated a fifth Orinoco integrated heavy oil project in its current (2003-08) 5-year business plan, although plans have not yet coalesced for it.

PDVSA is tackling Venezuela's heavy oil resource in another way. Through its subsidiary Bitumenes Orinoco SA, it has developed a product called Orimulsion—an emulsion of bitumen with water and a surfactant—that is being marketed as a fuel for power generation in competition with residual fuel oil and coal. Orimulsion production started during the 1980s and rose to 110,000 b/d in 2001. It is sold under long-term supply contracts to utilities in Canada, Denmark, Japan, and Italy. Negotiations also are under way with electric utilities in China, Lithuania, Canada, and the US. The latest such contract was signed in April with South Korean utility Korea Southern to supply 300,000 tonnes/year of Orimulsion to 2006, with an option to increase volumes thereafter.

One noteworthy new heavy hydrocarbons project entails an effort to establish a commercial oil shale industry in Australia.

A group led by Southern Pacific Petroleum Ltd. is attempting to tap an oil shale resource pegged at a potential 20 billion bbl. It has started up a semicommercial demonstration plant at Stuart, Australia, that is producing high-quality, low-sulfur naphtha and a fuel oil blendingstock. Plans call for ultimately producing as much as 150,000 b/d of high-quality SCO by 2012.

This is not to discount the more-conventional heavy oil operations, which account for a significant portion of US oil production.

Edward J. Hanzlik, of Texaco E&P Technology (now part of ChevronTexaco Corp.) in his 1998 Beijing conference presentation, estimated the US heavy oil resource at 100 billion bbl of OOIP. Of that total, California accounted for 73% and Alaska 19%. He pegged US heavy oil output at 700,000 b/d in 1997, down from a peak of 829,000 b/d in 1986 but up from 632,000 b/d in 1993.

And California's heavy oil giants are still going strong, with steamflood and cyclic steam operations still accounting for over 70% of the state's oil production. Here, too, operators continue to press the technology envelope to capture more of this huge resource. Ivanhoe Energy, Bakersfield, Calif., last month signed a contract with Ensyn Petroleum International, Boston, to test the latter's Rapid Thermal Processing technology to upgrade heavy oil to a lighter crude in the field. Until now, the technology has been used commercially only in continuous wood and biomass processing projects. A 250 b/d demonstration plant is under construction that is designed to upgrade heavy crude produced from Ivanhoe's leases in Midway-Sunset field in California.

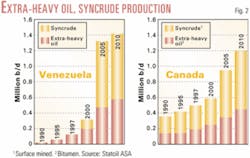

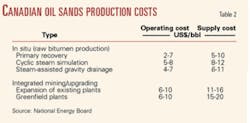

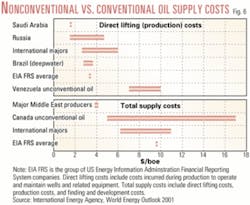

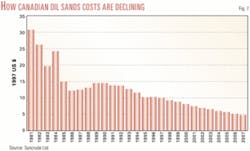

Meanwhile, new efficiencies have brought down the costs of recovering Canada's and Venezuela's heavy hydrocarbons to within striking range of conventional oil production (Figs. 6-7, Table 2).

IEA last year noted that Canadian oil sands operating costs fell to $10/bbl from $22/bbl from the early 1980s to the late 1990s through continuous process improvements and major innovations in truck-and-shovel mining and hydrotransport techniques (Fig. 8)

And bitumen recovery rates have jumped to 25% from 10% at the outset, according to Imperial Oil Ltd.'s C.F. Ruigrok, vice-president, oil sands development and research.

According to a variety of sources, expectations are that further improvements in technology and operations could reduce Canadian oil sands operating costs, in constant dollars, to $7/bbl by 2004 and $6/bbl by 2015 from $8-9/bbl today. IEA estimated Orinoco extra-heavy oil operating costs at $8/bbl, with lifting costs only $3/bbl.

Heavy oil hurdles

The improvements in efficiencies, cost reductions, and technology advances notwithstanding, the continued expansion of heavy hydrocarbons recovery projects faces significant hurdles.

Environmental concerns are among the chief concerns. Canadian oil sands operators must deal with local concerns about the disposal of huge volumes of tailings into giant sludge ponds. Permitting hurdles involving potential risks to domestic water supply are getting bigger.

But a larger threat to Canadian oil sands operators looms in the form of Canada's ratification of the Kyoto Treaty on global warming. While those operators are making strenuous efforts to reduce their emissions of greenhouse gases, particularly carbon dioxide, the Kyoto threat remains. IFP estimated oil sands CO2 emissions levels four to six times greater than those of conventional oil production.

Some estimates have put the cost of Kyoto compliance at $1-7 (Can.)/bbl, but the federal government contends the costs will be lower than that.

Venezuela's integrated heavy oil project operators also have undertaken voluntary efforts to rein in CO2 emissions.

Canadian oil sands operators also must contend with a competing resource. A still-unresolved controversy in Alberta is the dispute over expansion of natural gas development in oil sands areas. Some oil sands operators have sought to curtail associated gas drilling in their project areas for fears that gas cap pressure depletion could hinder bitumen recovery, particularly for SAG-D projects. The EUB responded by ordering that certain gas wells in the Wabiskaw-McMurray area be shut in in a selected area, allowing production outside the area to proceed. The agency continues to hold hearings on the matter.

Ironically, there are concerns that there won't be enough gas available to burn for these energy-intensive projects. Similar supply concerns exist for future diluent supply for Canada's oil sands operations.

There are also infrastructure and market constraints to Canadian oil sands expansion.

Some analysts point to the need for additional pipeline capacity and electric power capacity in the coming decade to serve Canadian oil sands operations.

Purvin & Gertz Inc., Houston, late last year expressed concern over the capability of US and Canadian markets to absorb the surge in heavy crudes and SCO reaching the market in the coming decade.

Undertaking a multiclient study, the consultants noted that much of the new production will be headed for the US Northern Tier states, a market already awash with 750,000 b/d of heavy crudes and 200,000 b/d of SCO from Canada.

"Increased runs will require further crude substitution in the near term to absorb the unique characteristics and expected volumes of synthetic crude, condensate-bitumen blend (DilBit), and a new synthetic-bitumen blend (SynBit)," Purvin & Gertz said. "New coking capacity is urgently needed to absorb the additional heavy supplies. Before 2010, refineries will need to expand catalytic crackers and add hydrocrackers to handle all of the synthetic crude."

Purvin & Gertz suggested that integration of oil sands projects and refineries "may be the best way to expand markets and mitigate price discounts."

*Debate continues

Such hurdles tend to reinvigorate the peak-oil theory defenders, who contend that constraints on heavy hydrocarbon production will keep it from being one of the keys to sufficiently "bridge the gap" between the decline of conventional oil production and the onset of more-exotic energy solutions.

"Future SAG-D projects are all based on the utilization of natural gas to produce the necessary steam to be injected (Fig. 9)," Bauquis told OGJ. "If you calculate the amount of gas needed to produce from Athabasca the quantities your magazine has included in its new vision of Canada's reserves, you apparently need two or three times the totality of Canada's known gas reserves to produce those heavy oil reserves. Is this a reasonable assumption? Is Canada going to import LNG or buy the Alaska gas reserves to transform its nonmineable heavy oil resources into reserves?

"The only possible explanation I could imagine is a large-scale use of dedicated nuclear reactors just to produce the steam. If this was the assumption, you should tell everybody, because this is probably decades ahead of history, and this contradicts the very concept of 'reserves'U."

Bauquis also contends that Canadian oil sands operating cost reductions are close to their feasible limit.

As for the four Orinoco megaprojects, he notes that reported costs of less than $10/bbl are reliable "as long as we limit the production to 'creaming' the best reservoirs and do not attempt to recover more than 10% of the oil in place. Here also, the hurdles will appear when the industry will try to boost the recovery factors to 20%, 30%, or 40%.

"Nothing is impossible if you have plenty of cheap energy to stimulate production."

Lawson, who contends that technology advances will both reduce production costs and make possible production of assets not possible today, noted that "the Venezuelans will need to carefully manage those assets to incease production significantly. Geologic conditions may play a bigger role in cost reduction than any other factor."

For conventional heavy oil reservoirs, Lawson says that managing production to maintain adequate reservoir energy is critical and that better reservoir monitoring technologies are important.

He sees "carbon management" as a critical item for Canadian oil sands.

For US oil shales, Lawson says, new technical approaches to avoid mining and environmental issues of the 1970s are required.

"US oil shale production costs are much less-defined, but some substantial production could be made at today's oil prices. There is a lot of room to reduce the cost of synthetic oil from oil shale with technology advances. Additionally, large scale oil shale developments are likely to achieve much greater cost reductions because the capital investments required are large on any scale."

Lawson sees in situ kerogen conversion technology and preservation of groundwater integrity as the most critical technology challenges for US oil shales

"The market will drive companies to find acceptable solutions. Public policy can play an important role in accelerating oil shale development. I am confident that the necessary technology advances will be made, but public acceptance could delay development until a supply crisis arises.

Citing upstream production costs for the Venezuela integrated megaprojects of $1-2/bbl, Gurfinkel claims that "there is not much room for improvement there other than keeping those costs near those levels in the long run, avoiding the natural increases due to depletion and water breakthrough.

"However, this is not the whole picture, since to bridge the gap to existing markets, upgrading facilities are required (Fig. 10). These facilities add between $2/bbl and $4/bbl to the total long-run cost. I still believe that, at $6-8/bbl, production from the (Orinoco) Faja is viable for many years to come.

"Now, radical changes might come about through in situ upgrading, which could combine the two stages of production of synthetic crude into one, lower-cost process. Sensor and actuator technologies will make insitu combustion a viable technology in the not so distant future."

In the end, it may be geopolitical concerns that drive the big push on heavy hydrocarbon development in the decades to come more than anything else, according to USGS's Ahlbrandt.

"Heavy oils, tar sands, and other unconventionals will clearly play an increasing role for several reasons," he said. "First, there is less geologic risk to their development, and the thereby economic risk is reduced. Unconventional oils also fall outside of (Organization of Petroleum Exporting Countries) quotas, and thus there is considerable incentive to get them on stream. The inclusion of the 174 billion bbl (of Canadian oil sands reserves) by Oil & Gas Journal in December 2002U demonstrates this changing landscape.

"Absolutely, heavy oils and tar sands will play a huge role, because they contribute mightily to geographic scenario options, i.e., oil supplies outside of the main producing areas where there are political risks."