Second in a series of six special reports on Future Energy Supply

Concerns over global natural gas supply are mounting.

While most apprehension over future energy supply has centered on oil, speculation has grown recently over whether future gas supplies also will suffice to meet projected demand.

Some of this concern is longer-term, as advocates of the theory of an imminent peak in world oil production also attempt to model a similar grim scenario for gas (OGJ, July 14, 2003, p. 18).

Detractors of that view hold that applying a bell-shaped curve to model a near-term peak in world gas production, as former Shell Oil Co. geophysicist M. King Hubbert did famously with US Lower 48 oil, is even less valid than it is for future oil output.

Their primary objection is that estimates of global gas resources are a great deal more amorphous than for oil. Secondly, the antidepletionists contend that gas, because it is less fungible than oil and thus more sensitive to demand and price vagaries than oil, is even less amenable to speculation about future output levels.

Yet there remain concerns about the timing of future gas availability. Securing an adequate future supply of gas is susceptible to a number of hindrances. First, the bulk of the world's gas untapped resources remain in remote locations difficult to access by the major gas markets. And the cost of transporting those resources varies widely, which makes monetization of much of the world's stranded gas much more problematic than the relatively easily quantified monetization of oil reserves.

Complicating that outlook is the fact that the overwhelming majority of postulated gas resources—when methane hydrates are included—is less amenable to technical and economic recovery than is the case for nonconventional oil vs. conventional oil resources.

In addition, gas is more susceptible to competition—including oil itself—from other energy sources than oil is. This stems from its growing preferential status as a fuel for power generation and other industrial uses and as a feedstock for petrochemicals, fertilizers, and other commodities.

Because the hurdles in developing gas use infrastructure and in meeting future gas supply needs are much greater than they are for oil, any short-term supply shortfalls will have a relatively greater impact on markets than will oil supply shortages.

Furthermore, with the rapid buildup in global gas-fired power generation capacity hinging on future gas supply availability, governments and companies must grapple with the dilemma of near-term supply shortfalls and ensuing price spikes eroding a future gas-fired power market and losing the related environmental and supply-diversification benefits.

If there is an emerging consensus on the gas supply question, it is this: The US faces a near-term shortfall in gas supply, and there is little near-term solution in sight on the supply side.

The depletionist-theory advocates point to the US as an example of validation of their view that a global gas production peak is coming soon. The current supply travails that have more than doubled US gas prices in the past year or so stem from an inherent, geology-based problem that the usual market forces won't solve, they say. And thus, the thinking goes, the US current gas supply woes may serve as a litmus test for their theory that a peak in world gas production is coming soon, followed by a steep decline, and that the resulting market dislocations could be catastrophic.

The antidepletionists dispute this notion, saying that the US gas supply problems are transient in nature.

Still, there is little disagreement that the US gas supply shortfall is already here. And the broadly accepted view is that high gas prices will hold for several more years in the US, perhaps well past the midpoint of the decade.

Gas production peak

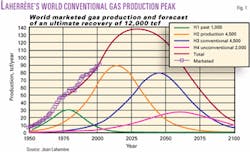

Jean Laherrère, a consulting geologist and former deputy exploration manager for Total SA who is one of the leading proponents of the peak-oil theory, puts the ultimate resource recovery (URR) at 10,000 tcf for worldwide conventional gas and at 12,000 tcf for all gas (Fig. 1). He puts the peak in global gas production at 130 tcf/year in 2030.

Richard Duncan, director of the Seattle-based Institute on Energy & Man, while noting that he uses his own "systems dynamics" approach to forecast natural gas supply vs. Hubbert's bell curve, says Hubbert correctly forecast 1970 as the year of peak US natural gas production and that this prediction "is likely to hold up to the test of time."

Where Hubbert erred, says Duncan, was in calculating the subsequent decline rate.

"Short of applying Hubbert's methodology (that would take several months if each gas-producing nation were to be modeled separately), we can quickly learn something by graphing the world production of natural gas and then doing a qualitative analysis," he said.

Duncan cited average annual production growth rates for world natural gas as 3.52% from 1970 to 1980, 3.15% from 1980 to 1990, and 1.97% from 1990 to 2000.

"Since the rate has clearly slowed, we would expect the inflection point of world cumulative natural gas production to occur in about 10 years, say in 2010.

"Now we know that the inflection point of world cumulative oil production occurred in 1979 and, further, that world oil production has not yet peaked. Hence the delay between the inflection point and the peak of world oil production must be at least 23 years...

"It then follows that if the inflection point of world cumulative natural gas production occurs in 2010, taking the assumption that the delay time between the inflection point and the peak will be 23 years, then the peak of world natural gas production would occur in 2033."

A problem arises with Hubbert predicting a production change rate (PCR) of 2%/year for US Lower 48 natural gas vs. the actual rate of 0.6%/year.

Duncan noted that Hubbert forecast a US Lower 48 peak rate of production of 14 tcf/year in 1970, whereas the actual peak rate was 22 tcf/year. Hubbert also forecast a postpeak PCR of.22%/year, whereas the actual postpeak PCR was 0.6%/year.

"While there are sufficient data on world natural gas production, cumulative production, proven reserves, and ultimate recovery to make a 'first cut' at predicting the peak year for most gas-producing nations and thus [by summation] the world peak itself...a first-cut forecast of the post peak PCR for world natural gas would, of course, be more difficult and less reliable," Duncan said.

Gas-peak detractors

William L. Fisher, director of the school of geosciences at the University of Texas at Austin, contends that application of the Hubbert curve for resource assessment or for projection of production peaks is "seriously flawed."

"It assumes that the amount of oil or gas is known, which it is not. It assumes that the peak will come midway through the production of the resource, thus the symmetry of the curve, which is not necessarily the case. It also assumes that resources are inelastic, not responding measurably to economics and technology."

Fisher also points out that most predictors of a near-term peak in gas production "ignore field reserve growth or assume it has already been accounted for in proven reserves; in so doing, they deny 50% or more of the action in reserve additions over the past 25 years. And they are careful to exclude unconventional sources, even deepwater resources."

Fisher noted that while Hubbert was correct in pinpointing the peak year for Lower 48 oil production, "this reflected mostly flush production; to the extent there is or will be symmetry to his curve, it will be a function of demand, much like [it was for] Pennsylvania anthracite."

Fisher says the Hubbert curve has not worked on natural gas in the US because demand for domestic gas and domestic gas exploration and development continue, "thus the disparity.

"The Hubbert model has no more application to global gas than it does to global oil."

Michael Lynch, president of Strategic Energy & Economic Research Inc. (SEER), Winchester, Mass., claims that Hubbert-style modeling for global gas resources won't work, for two reasons:

"Global gas resources are much less studied than oil resources, and their recoverability is much more determined by the cost of transportation to market. Thus, much of the world's gas resource is unrecorded or considered 'unrecoverable' at present, which results in a severe underestimate of resources, such that the peak calculation would be grossly in error.

"And global gas production is demand-constrained, so that creating a logistic curve of production does not provide any information about resources."

Lynch also pointed out that Hubbert's 1970 peak for US gas production proved "dramatically pessimistic" at 14 tcf/year, a level the US has typically surpassed by 25-30% in the 3 decades since then.

"Gas production did drop in the 1980s, to as low as 16 tcf, but only because higher prices led to a drop in consumption, not due to resource constraints," he said. "Since 1986, demand has risen and gas production has been in the 16-20 tcf range, approximately 140% above the level Hubbert predicted for 2000."

Cambridge Energy Research Associates acknowledges that at some point a Hubbert model could be applied to global gas resources and production, but it does not see that peak happening until "well into this century."

Robert Esser, CERA senior consultant and director, Global Oil and Gas Resources, said, "Only two areas face near-term peaks: North America and Western Europe. Strong growth in production is projected for all other areas through the first quarter of this century."

Global gas resources

Estimates of global gas URR vary wildly.

While Laherrère and other depletionists peg the URR for conventional gas at 12,000 tcf, others have a more sanguine view of the URR outlook.

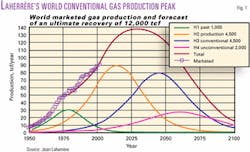

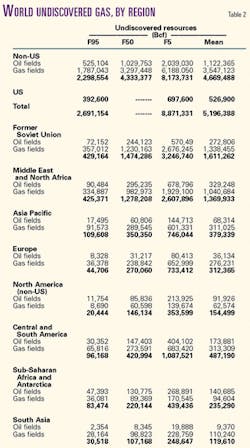

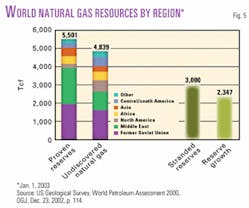

The US Geological Survey in 2000 estimated a worldwide mean of 5,501 tcf for proven reserves; 4,839 tcf for worldwide undiscovered gas, about double cumulative global consumption; another 3,000 tcf for stranded gas reserves; and 2,347 tcf for reserve growth (Fig. 2, Tables 1-2).

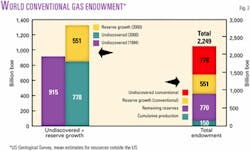

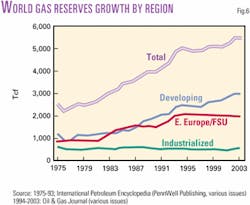

And both resources and reserves of gas have grown dramatically in the past 3 decades (Fig. 3).

Fisher's own estimate is for a global resource base of natural gas "on the order of 25,000 tcf, not counting exotics like hydrates; that volume will grow, if history tells us anything, and it does."

Taking into consideration the "exotic" sources of natural gas, the estimate of the resource base skyrockets.

According to the Gas Research Institute, the mean average of the in-place methane hydrate resource for the US alone is 320,000 tcf.

"If only 1% of this resource is producible, the reserve would be enough to meet the entire US gas demand for 100 years," GTI's Iraj Salehi reported, in the organization's in-house publication earlier this year.

The US Energy Information Administration puts the global methane hydrate resource at 61 million tcf.

Several methane hydrate research projects are under way under US Department of Energy funding, with one US attempt currently under way to test for producibility on Alaska's North Slope by a group led by Anadarko Petroleum Corp. (OGJ, Mar. 26, 2003, p. 15).

Thomas Ahlbrandt, world energy project chief with the US Geological Survey in Denver, cited a recent successful attempt in Canada at producing gas from methane hydrates.

"The Mallik [MacKenzie Delta] gas hydrate flow tests in excess of 10 MMcfd open up a big resource base that seems economically viable."

No one expects exotic gas resources to make a significant contribution to global gas supply for decades, however.

"Efforts now under way to make methane hydrates and geopressurized gas will have a significant impact, but probably not for a long time to come," Lynch said.

"Deep gas and coalbed methane (CBM) will probably be the primary unconventional source in the medium term [20-30 years].

"However, if methane hydrates become cheap, given their prevalence near a number of major consumer areas, they could do serious damage to many of today's gas exporters". (Fig. 4)

The depletionists generally scoff at the notion that nonconventional gas will do much to delay the onset of peak-gas—as they do with nonconventional oil. But as with some nonconventional oil—such as the bitumen and oil sands resources of Venezuela's Orinoco oil belt and Canada's Athabasca region—nonconventional gas resources are already making a contribution.

"...Bear in mind that a lot of gas called unconventional [low-permeability, coalbed methane, etc.] is in reality conventional," Fisher said.

The question becomes: Will nonconventional gas sources help bridge the gap once supplies of conventional gas eventually do decline?

"Will there be time to convert?" Fisher asked. "The historic progression down the resource pyramid says yes."

Regional disparities

For the time being, a bigger concern for those projecting future global gas supply is the disparity of regional concentrations of existing gas reserves vs. their most likely markets (Fig. 5).

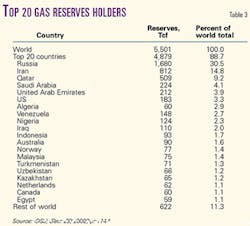

According to EIA, 71% of the world's gas reserves are in the Middle East and former Soviet Union. Russia and Iran together account for 45% of the global total (Table 3). Reserves in the rest of the world are distributed fairly evenly across the regions. And the growth in gas reserves since 1975 has occurred disproportionately in the FSU and developing countries (Fig. 6).

"Although the United States has produced more than 40% of its total estimated natural gas endowment and carries less than 10% as remaining reserves, in the rest of the world reserves have been largely unexploited," EIA said in its 2003 International Energy Outlook. "Outside the US, the world has produced less than 10% of its total estimated natural gas endowment and carries more than 30% in remaining reserves."

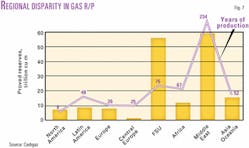

This situation yields a sharp disparity in regional gas reserves-production ratios, which by Cedigaz estimates range from 8 years in North America to 76 years in the FSU and 234 years in the Middle East (Fig. 7).

That disparity also means a growing concentration of gas reserves and trade in a region that already dominates world oil reserves and production: the Middle East.

"With a third of the world's natural gas reserves and over a third of the LNG trade, Middle East gas supply could play an important role in balancing future world gas markets," said Ibrahim El Husseini, a consultant with Booz, Allen & Hamilton's Middle East office."

"Today, most of region's LNG goes to Japan, but if US prices remain high and market expectations are for netbacks from US sales to exceed those from sales into Japan, we could see more LNG flows from the region to the US, especially with the increased liquidity in the shipping market. These could be in the short term in the form of spot sales, but could also develop into term commitments..."

He also noted that other Persian Gulf governments, notably Saudi Arabia and Iraq, are also likely to further develop their gas sources for several reasons, including diversifying their exposure away for oil toward gas: "Despite recent setbacks in negotiations [on the Saudi gas initiative] with the international consortia, the Saudis are still pursuing plans to monetize their gas reserves. In Iraq, associated gas resulting from the expected significant increase in oil production may offer very attractive economics for exports."

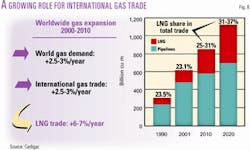

It is the regional disparity in world gas reserves, coupled with rapidly growing demand, that ensures global trade in gas will soar in the coming decades. And LNG trade will command a disproportionate share of that trade growth, at more than double the expected rate of overall international gas trade (Fig. 8).

Global gas demand

One of the legacies of the oil shocks of the 1970s was a push to diversify energy supply sources away from oil, dominated as it has been by the volatile Middle East. And no energy source has been a more resilient beneficiary of that push than gas.

Today, environmental pressures are accelerating the growth in gas demand. Beyond the local air quality concerns in many countries, there is a growing emphasis on gas to help reduce the emissions of greenhouse gases thought to contribute to a postulated catastrophic climate change. This is a mainstay of the thinking of those more moderate on the global warming issue, who contend that more-pristine (in terms of carbon emissions) energy sources such as renewables and nuclear won't be able to meet future world energy demand if global warming concerns are to be addressed without oil and coal.

Fisher says he and many of his colleagues "feel we are entering a methane economy on the way to a hydrogen economy in 50 years or so. A global methane economy for the transition will require something on the order of 25,000 tcf. Nuclear or renewables may well be the way to generate hydrogen in the full-hydrogen economy, but it will take natural gas to get us there both as a fuel and a source of hydrogen."

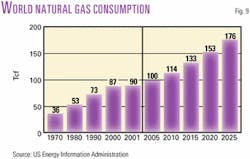

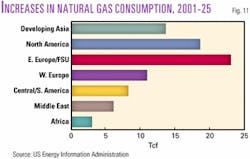

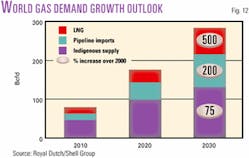

Accordingly, the outlook is for continued strong growth in gas demand and a growing share of the world's energy mix (Figs. 9-12).

No region has made stronger efforts to promote natural gas for environmental reasons than has Europe.

In a 2003 world energy outlook, the European Commission projected that natural gas will become the second largest energy source after oil in the European Union by 2030, after growth of 4.9%/year in the past decade, climbing to a 27% market share. Nuclear and renewable energies together are projected to account for less than 20% of the EU market in 2030.

The EC report estimates North American gas demand will rise 1.2%/year to 2030.

But those projections pale in comparison with growth rates in Asia and Latin America, where gas demand is expected to increase 4%/year to 2030. Developing countries' share of global gas demand is expected to jump to 40% in 2030 from 25% in 2000.

Worldwide, gas demand is expected to double by 2030, reaching 4.3 billion tonnes of oil equivalent at the end of the forecast period and averaging growth of 3%/year in 2000-10 and 2.1%/year in 2010-30.

Power generation demand is driving this growth, accounting for over 40% of the incremental increase in all world regions outside the FSU. In the EU, power generation demand for gas will account for more than 50% of the incremental growth.

Given the limited contribution expected from renewables and nuclear, and the more carbon-intensive nature of coal and oil, natural gas has been seen as the only viable alternative to allow growth in power generation while observing the Kyoto Protocol treaty to halt the growth in greenhouse gas emissions.

Consequently, any major price spikes for natural gas arising from an imminent-depletion scenario could be the death knell for initiatives such as the Kyoto Protocol.

Bridging the US gap

It is just such a surge in power generation demand for gas, coupled with the US producing sector's struggles to sustain gas production levels in recent years, that has yielded what many see as just the first phase of a supply-and-price crisis for natural gas in the US.

There are varying views as to whether the current US supply dilemma tends to validates the imminent-peak theory. But there is little disagreement that, for now, a supply shortfall is at hand. And there seems to be little in the way of a solution on the domestic production side. Many point to growth in US LNG imports and future supply expected from Alaska's and Canada's proposed natural gas pipelines. But there are doubts these two sources will deliver enough gas in time to alleviate the shortage. What will bridge the gap? And what will be result if the gap isn't bridged?

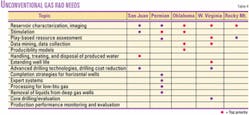

Don't count on a turnaround in US wellhead deliverability, say most observers. While growing production of CBM and other nonconventional gas—aided by prioritized research and development efforts (Table 4)—will help in the long run, these sources are not expected to do much more than help US gas production stay flat in the near term (Fig. 13).

"The gas production decline in the US is due to lack of good, large prospects," said Walter Younquist, a Eugene, Ore., consulting geologist. "We have drilled more than 1 million gas wells in the US, and we are running out of significant targets... Deep drilling will help, but I doubt we can turn the decline trend around. The high depletion rates put us on a treadmill that we are not able to stay with. Better resource access, along with infrastructure necessary to move the gas, would help a bit, but I do not think it will turn things around. At best we might keep even for a while."

CERA's Bob Ineson notes that the US has gone through a decade in which its productive capacity was essentially flat, despite burgeoning development in the San Juan basin, the Rocky Mountains, and the deepwater Gulf of Mexico. "North American capacity grew because of the development of the Western Canadian Sedimentary Basin," he said. "We do not see any supply on the horizon of the same order of magnitude as any of these regions, let alone four such regions. Given the lead times associated with development of a large new producing province, if such a new region could materially affect the market balance in this decade, odds are we would know about it today."

CERA's Esser contends that it is unlikely that US gas supply can bridge the gap between today's shortfall and the arctic gas and LNG import solutions. "Demand destruction is the only real short-term alternative," he said.

WoodMac's Matt Synder sees efficiency, conservation, and demand destruction will necessarily play a role.

"LNG will have a limited ability to assist in the near term, with the longer-term constraints being the willingness of North American offtakers to sign [contracts for] longer-term projects to get LNG supply into further development, in addition to continued development and permitting of new regasification capacity."

The demand-side response is likely to be stronger than most anticipate in the short and long term, says Ron Denhardt, SEER vice-president, natural gas services.

"We have lost 4-5 bcfd of demand this summer. If consumption grows at 1.5-2%/year, this loss is equivalent to 3-4 years of consumption growth."

Assuming 1.5%/year growth in US consumption, US gas supply would have to increase about 1 bcfd/year to meet demand, Denhardt said.

He says that if proposed expansions of existing LNG terminals occur by mid-2005 and US production increases by 500 MMcfd/year—spurred by a wellhead price of $4-4.50/MMbtu, "...there appears to be enough supply coming on to get us close to a point where new LNG terminals are completed."

CERA's Ineson sees continued pressure on industrial gas demand and continued pressure from growing electric industry gas demand, given normal weather conditions, through 2007.

"This does not by itself imply further permanent demand destruction, but rather that industrial demand will be unable to grow. In this interim period, through about 2007, we estimate that the US will be able to bridge the gap with increases in LNG imported through the existing terminals with pending expansions—as opposed to North American supply."

That puts annual average gas prices near $5/MMbtu for the period, with transitory spikes up to $10/MMbtu, he contends.

"Beyond 2007, our outlook calls for ongoing declines in the total productive capacity for the US and Canada, and that outlook does include gas from the Canadian Arctic. Gas from the North Slope cannot be available until the next decade. Hence the rest of the decade shapes up like this: Following a period [through 2007] of tightness and volatility similar to current conditions, we move into a far more critical period where investment in additional LNG terminals and contractual commitments to the related supply are necessary to balance the market... If these investments are not made, there is a real possiblity of shortages post-2007."