Middle East terrorism rattles markets

The May 12 explosion of terrorist bombs that killed 34 people, including 8 US citizens and 9 suicide bombers, in Saudi Arabia also rattled energy markets worldwide as traders worried that more attacks, targeting Middle East oil production and export facilities, might disrupt global oil supplies.

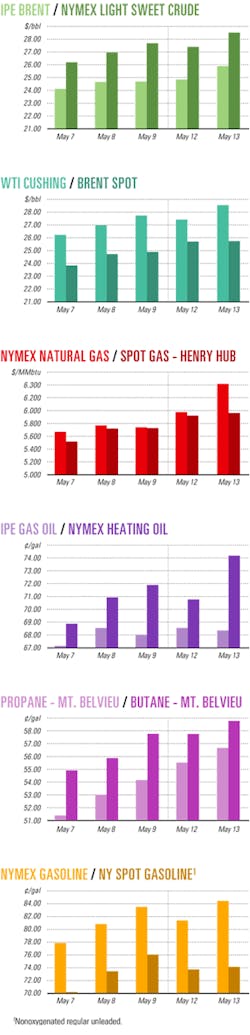

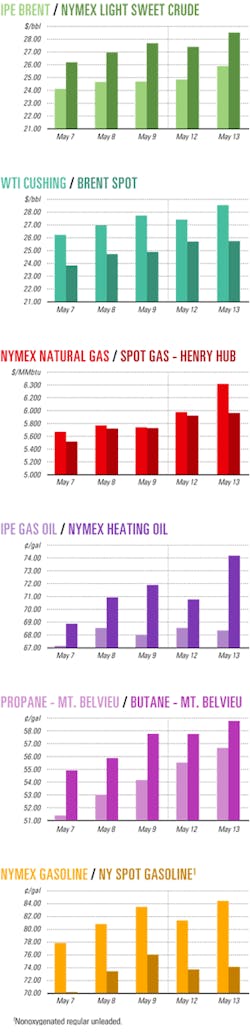

Saudi authorities reported a 19-member Al-Qaeda team coordinated the attacks that also wounded nearly 200 people. As a result, near-month oil futures prices jumped by more than $1/bbl in New York and London markets the next day. By midweek, the June contract for benchmark US light, sweet crudes closed at $29.17/bbl on the New York Mercantile Exchange, while North Sea Brent oil settled at $26.75/bbl on the International Petroleum Exchange.

"The bomb attacks in Saudi Arabia have unsettled traders," said Paul Horsnell, an analyst with J.P. Morgan Securities Inc., London. "Any belief that some might have had that the end of the war in Iraq would remove all urgent geopolitical concerns from the market has been shattered. This is a decade in which politics and oil are inextricably linked."

Inventories decline

Prior to the terrorist bombings in Saudi Arabia, energy futures prices were already rallying in reaction to a significant decline in US oil inventories during the week ended May 2. The US Energy Information Administration last week reported US oil stocks fell by 2.7 million bbl to 284.5 million bbl during the week ended May 9.

"For the second week running, total [US] commercial inventories [of crude and petroleum products] have fallen slightly in absolute terms [down 500,000 bbl to 904.7 million bbl total]," Horsnell reported May 14. "That means that they have fallen heavily relative to the 5-year average. That deficit now stands at 97.6 million bbl, 5.6 million bbl more than last week and 12.4 million bbl more than 2 weeks ago. Put another way, relative to the normal pattern, total US inventories have been falling away at 900,000 b/d over a 2-week period." Moreover, he said, "The oil product deficit increased for the sixth successive week and now stands at 57.5 million bbl"

US imports of both crude and gasoline "have been extremely high recently," Horsnell noted. However, he claimed neither trend can be maintained as prewar shipments of Iraqi crude work their way through the system. "The flow of information from Iraq continues to put back the putative timetables for the ramping up of output and to suggest that (the Organization of Petroleum Exporting Countries) is likely to face far less pressure at its June meeting than many had perhaps expected," he said.

API numbers

Unlike EIA, the American Petroleum Institute last week reported a slight increase in US oil stocks, up 927,000 bbl to 287.1 million bbl total in the week ended May 9, with distillate stocks up by 2.1 million bbl to 99.7 million bbl. However, with the start of the US peak summer driving season imminent, API reported US gasoline stocks declined by 750,000 bbl to 207.5 million bbl.

DOE said US gasoline stocks increased by 800,000 bbl to 208.6 million bbl in the same period, with distillates up 2.6 million bbl to 99.9 million bbl.

Meanwhile, API said in an earlier report that total imports of oil and petroleum products into the US during April increased by more than 6% from year-ago levels for the second consecutive month. US imports totaled nearly 12.3 million b/d in April, the highest amount in nearly 2 years.

More than 1.1 million b/d of gasoline and blending products were imported during April. It was the largest volume of product ever imported, up 32% from the same period last year, and accounted for the largest share ever, 13%, of the US gasoline market, API said. At the same time, the amount of gasoline refined in the US in April dipped by 3.3% to 8.3 million b/d.

One reason for increased US imports of gasoline is the oversupply of gasoline in Europe, said API officials. Because of increased popularity of diesel engines in European vehicles, they said, there is currently an excess supply of bargain-priced gasoline in that market.

US imports of crude also increased by 5.6% in April to the largest monthly amount in nearly 2 years, API reported.

Natural gas prices firm

US prices for natural gas again moved above $6/Mcf last week, to $6.31/Mcf on NYMEX May 15.

As a result, Horsnell said, "There are some signs that demand destruction in natural gas is beginning to make an impact on oil demand."

In particular, he said, petrochemical plants are switching from more-expensive natural gas to less-expensive LPG and naphtha.

Industry Scoreboard

null

null

null

Industry Trends

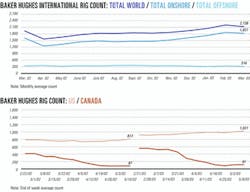

OIL FIELD SERVICE COMPANY fundamentals are strengthening, say analysts.

The Philadelphia Oil Service Index (OSX) outperformed virtually all the major indices, commodity prices, and other energy sectors for the week ended May 9, said James K. Wicklund, a Banc of America LLC Houston analyst.

Meanwhile, the mood was optimistic among oil service representatives and their investors attending the Offshore Technology Conference, said both Wicklund and J. Marshall Adkins, a Houston-based analyst with Raymond James & Associates Inc.

OTC reported that 50,655 participants attended the May 5-8 event, compared with 49,620 last year. The 2003 OTC attendance was the highest since 1985, which drew 56,438 participants.

"While well shy of the peak levels we saw during the early 1980s, it was well above the approximately 37,000 annual attendees we have averaged over the prior 15 years," said Adkins. "We believe this is evidence of the view from most in the oil patch that activity levels are likely to recover steadily over the next several quarters."

The OSX closed near 92 on May 9 and was 94.75 by midafternoon on May 14. Oil service stocks, as measured by the index, have added 10% since late April.

"There has been significant outperformance by a number of stocks," particularly for the land drillers, Wicklund said. He expects land drillers to outperform all other oil service sectors through the cycle, which is expected to last through 2004.

"In the near term, we could see some outperformance from the offshore drillers as they catch (up) from their dismal performance during the first quarter," Wicklund said.

So far, most of the drilling increase has been for shallow gas wells, Wicklund said, adding that is normal at the beginning of the cycle. "Sustained, deeper, higher-margin drilling should be expected," he noted.

THE WORLDWIDE LNG TRADE will see an oversupply of vessels for 2005-06, but a shortage is expected during 2008, according to one forecast.

Ocean Shipping Consultants Ltd., Chertsey, UK, made that projection in its newly released report "LNG to 2015: Prospects for Trade & Shipping."

Global LNG trade expansion slowed in 2001-02, but annual trade is expected to accelerate through 2015, Ocean Shipping said.

At least 65 new LNG vessels are expected to start trading worldwide within 5 years, and Ocean Shipping analysts expect an oversupply of tonnage for 2005-06.

"In absolute terms, the annual trade is expected to increase from the level of just under 146 billion cu m in 2002 to over 175 billion cu m in 2005, 256 billion cu m in 2010, and 317 billion cu m in 2015," the analysts' report said.

A total of 4.6 million cu m of new vessel tonnage—in addition to the 8.9 million cu m already on order—would need to be ordered and delivered in the second half of this decade to match the anticipated trade volumes and patterns, Ocean Shipping concluded. That forecast means another 33 new vessels would need to be ordered and delivered yet this decade.

Government Developments

BRAZIL AND VENEZULA are planning oil and natural gas partnerships.

Venezuela's President Hugo Chávez visited Brazil's President Luiz Inácio Lula da Silva in Recife, the capital of Brazil's northeastern state of Pernambuco, late last month to outline oil and gas alliances between state-owned oil firms Petroleo Brasileiro SA (Petrobras) and Petroleos de Venezuela SA (PDVSA).

The commercial alliance ratified a mutual cooperation agreement between the two countries regarding heavy crude oil refining, exploration, and production in Venezuela, and joint activities in the petrochemicals and natural gas sectors.

For years, Brazil was little more than a customer for Venezuelan oil, but after the meeting, the presidents said they have "interests in common in the oil sector" and they "intend to expand cooperation."

Chávez said, "We want to refine oil in or as close to Venezuela as possible in the Caribbean, in the Andes, or here in Brazil."

Petrobras announced its intention to build a 150,000 b/d refinery in Northeast Brazil. The refinery, expected to cost $2 billion and to come on stream in 2007, could be built by Petrobras alone or possibly in partnership with PDVSA, officials said.

Rogerio Manso, Petrobras supply director, said the refinery would be the first in Brazil to have the capacity to process heavy crude oil, which currently is exported. Petrobras owns 11 of Brazil's 13 refineries. All were built when Brazil imported most of its crude from the Middle East. Most of the oil produced in Brazil is heavy.

LATIN AMERICAN governments continue pushing the oil and gas industry for greater local content investment.

Venezuela announced that PDVSA has more than $8 billion with which to buy locally produced goods and services. Previously, those goods and services were acquired abroad.

Venezuela Energy and Mines Minister Rafael Ramirez said PDVSA will try to distribute its operational purchasing needs among indigenous suppliers in order to strengthen the nation's industrial sector.

His comments came during an interview last month with state news agency Venpres, before he departed on a visit to Brazil, OPEC News Agency reported.

Previously, Brazil announced its own plans to demand more local content in its pipeline construction, for semisubmersible platform construction, and for an upcoming fifth licensing round for exploration and production (OGJ, Apr. 14, 2003, p. 7).

NEW YORK state officials should postpone a scheduled ban on methyl tertiary butyl ether in gasoline that is set to start next year, said the National Petrochemical & Refineries Association.

Charles Drevna, NPRA director of technical advocacy, testified May 13 before New York state's Environmental Conservation Committee.

"NPRA fears that imposition of a unilateral ban of MTBE by the state of New York on Jan.1, 2004, will produce the opposite of the desired and necessary goals," Drevna said.

If enacted, New York's MTBE ban will leave no other option than using ethanol to meet the 2% reformulated gasoline requirement of the Federal Clean Air Act, he said (OGJ, Jan. 20, 2003, p. 30).

Quick Takes

BRAZIL'S LARGEST NATURAL GAS DISCOVERY to date has been confirmed by Petroleo Brasileiro SA (Petrobras), Brazil's state-run oil company, on Block BS-400 in the Santos basin on the Brazilian continental shelf.

The 1-SPS-35 well indicated reserves of about 70 billion cu m of natural gas, or roughly 440 million boe, which increases by about 30% the company's previously recorded 231 billion cu m of proven gas reserves

The well's location off Sao Paulo state is doubly important because of its proximity to the nation's largest consuming market in the states of southeastern Brazil.

Petrobras completed the constrained flow test Apr. 28 for well 1-SPS-35, which lies in 485 m of water 137 km off Sao Paulo state.

The well, drilled to 4,956 m TD from the seabed, recorded 100 m of pay that in flow tests produced roughly 700,000 cu m/day of gas and 600 b/d of condensate, indicating a gas production potential of more than 3 million cu m/day in the well.

In other exploration news, Canadian Natural Resources Ltd. (CNR), Calgary, has discovered oil on the Acajou South prospect 24 km off Ivory Coast. The Acajou-1x well on License CI-26 was drilled in 3,050 ft of water 9 km southeast of Espoir field facilities. The well reached a total depth of 8,027 ft and encountered a gross oil column of over 250 ft. Oil from a 45 ft interval of sands at the top of the oil column flowed on test at a rate of 3,500 b/d of 33° oil, similar to that found in Espoir (OGJ Online, Sept. 3, 2002). "The well also encountered a significant sand section below the oil-water contact, which holds potential in the northern part of the structure," said Brian O'Cathain, managing director of Tullow Oil International Ltd., which reported the discovery. CNR holds a 66% interest in Acajou, with Tullow holding 24% and Ivory Coast government-affiliated Petroci Exploration Production SA 10%. Elsewhere on license CI-26, O'Cathain said the partners expect to produce 25,000 b/d from Espoir field by the end of this quarter. Espoir has estimated reserves of 93 million bbl of oil and 180 bcf of natural gas. Well EP-4 has been completed, and the perforation of the upper reservoir in wells EP-1, 2, and 3 is under way. Espoir production facilities currently comprise an unmanned wellhead platform with oil and gas processed on a floating production, storage, and offloading (FPSO) vessel. CNR is developing East Espoir first and will follow with West Espoir development within 2 years. ChevronTexaco Corp. reported that two Tahiti appraisal wells, one of which encountered more than 1,000 ft of net pay, confirmed hydrocarbon reservoirs found last year in the Tahiti discovery well in the deepwater Gulf of Mexico 190 miles southwest of New Orleans. The vertical wells, each with a sidetrack, were drilled simultaneously 0n Green Canyon Blocks 596 and 640 in more than 4,000 ft of water and confirmed initial estimates of 400-500 million bbl of reserves (OGJ Online, Apr. 3, 2002).

Appraisal drilling is continuing, and a production test of the discovery well is planned for first quarter 2004.

ROYAL DUTCH/SHELL GROUP plans within the next 2 years to reduce to 350 the number of its retail stations in France from the 950 it currently operates.

Shell said it would focus on highway service stations with high-volume sales and added-value services to clients.

Last month, Shell bolstered its highway network with the acquisition of seven such service stations from Total SA (formerly TotalFinaElfSA).

EXXONMOBIL CORP. unit Esso Exploration Angola (Block 15) Ltd. awarded Saipem unit Saibos Construções Maritimas Lda. an engineering, procurement, construction, and installation contract for risers and flowline facilities to be installed in 1,100 m of water in Kizomba B field on deepwater Block 15 off Angola. Saibos CML will install an FPSO mooring system and subsea manifolds and umbilicals beginning the third quarter of this year and completing in third quarter 2005, Saipem said.

TotalFinaElf E&P Angola SA (now Total E&P Angola SA) let a contract to a joint venture of Saipem, Technip-Coflexip, and Stolt Offshore SA, along with South Korean engineering firms Samsung Heavy Industries Ltd. and Daewoo Shipbuilding & Marine Engineering Co. Ltd. (DSME) for engineering, procurement, fabrication, and integration of an FPSO vessel topsides for development of Dalia field on Angola's deepwater Block 17. The project involves integration of the 22,000-ton topsides onto the hull, which will be supplied by Samsung under a separate contract, Technip-Coflexip reported. The Saipem JV will engineer, procure, and commission the project, while Samsung and DSME will carry out fabrication and integration. Dalia is slated for first oil in mid-2006. In other development news, Statoil ASA expects to install by late June four subsea production templates that form part of its 17 billion kroner Kristin field development in the Norwegian Sea. Production well drilling is slated to commence July 1. Statoil said it plans to start gas and condensate flowing at Kristin in summer 2005 through 12 subsea-completed wells tied back to a floating platform. It estimates total lean gas deliveries will be 35 billion cu m during 2005-16. By yearend 2005, Statoil expects to operate 270 subsea wells following the start-up of Kristin and other current developments, it said.

ANADARKO PETROLEUM CORP. has installed and commissioned the reconfigured Al Morjan platform in Al Rayyan oil field on Block 12 off Qatar. The platform, which can process up to 45,000 b/d of oil, will enable Anadarko to significantly increase production from the field, which it operates with a 92.5% interest in an exploration-production sharing agreement with Qatar. Preussag Energie holds 7.5% interest.

The field also has a permanently moored storage and offloading vessel with a storage capacity of 1.3 million bbl of oil.

Anadarko plans to drill additional exploration and development wells on the block later this year, pending Qatar Petroleum Co. approval. Anadarko is exploring on two other blocks off Qatar, Block 13 with a 92.5% interest and Block 11 with 49%.

Bad weather and technical problems have delayed Petrobras's second production well, Coral D4, which is in its final stages of completion in Coral field in the Santos basin off Brazil. When this well is in production, the rig will be moved back to the Coral D3 well that was put on production Feb. 3 but was shut down temporarily for safety reasons Mar. 13. Afterwards, Petrobras said, it will complete Coral D7, the third and final production well. Petrobras is operator of Coral field, and Coplex Petroleo do Brasil Ltda., subsidiary of Vancouver-based Naftex Energy Corp., has a 27.5% interest. ExxonMobil Corp.'s Nigeria unit Mobil Producing Nigeria Unlimited and the Nigerian National Petroleum Corp. declared force majeure the first week of May on exports of Oso field condensate and natural gas liquids following a fire in early May at the Oso platform 25 miles off southeastern Nigeria. The shut-in reportedly affects 95,000 b/d of condensate and 45,000 b/d of NGL. The companies gave no indication as to how long production would be disrupted.

MEXICO'S ENERGY REGULATORY COMMISSION (CRE) awarded a natural gas storage permit to Marathon Oil Corp. unit Gas Natural Baja California SRL de CV for the construction and operation of an LNG storage facility near Tijuana, Baja California, Mexico.

The permit gives Marathon and partners Grupo GGS SA de CV and Golar LNG Ltd. the necessary federal approval to offload and regasify LNG at the proposed Tijuana Regional Energy Center complex, which will include an LNG offloading terminal, a 750 MMcfd regasification plant, a 1,200 Mw power generation plant, a 20 million gpd water desalination plant, wastewater treatment facilities, and related gas pipeline infrastructure (OGJ Online, Mar. 1, 2002).

Following receipt of additional regulatory reviews and permits, the consortium will begin construction on the center late this year, with start-up expected in 2006.

The start-up May 8 of the $4.36 billion Petronas (Petroliam Nasional Bhd.) LNG complex in Bintulu, Sarawak, May 8, marked the site's third LNG plant. A consortium led by the US-based Halliburton Co.'s KBR and Japanese-based JCG Corp. constructed the new facility—Malaysia LNG Tiga Sdn. (MLNG Tiga)—and revamped existing Malaysia LNG Sdn. Bhd. (MLNG) facilities. The MLNG Tiga project included design, procurement, construction, and commissioning of two 3.4 million tonne/ year (m/y) LNG trains and offsite facilities added to the existing six-train facilities of MLNG and Malaysia Dua Sdn. Bhd. (MLNG Dua). The first train came on stream in March, while the second is scheduled to begin commercial operations by October, when MLNG Tiga will make the Bintulu LNG complex the world's single largest LNG production facility, with a combined capacity of about 23 m/y (OGJ Online, May 02, 2001).

MALAYSIA recently signed LNG supply agreements worth $20 billion with Japanese firms Tokyo Electric Power Co. Inc. and Tokyo Gas Co. Ltd. Up to 5.6 m/y of LNG will be supplied by LNG tankers owned by Malaysia International Shipping Corp. Bhd. (MISC), a subsidiary of Petronas. Tankers owned by Tokyo Electric and Tokyo Gas will transport the balance of up to 1.8 m/y of LNG.

MISC expects four LNG tankers under construction in Japan to be delivered between September and April 2005. They will bring MISC's LNG carrier fleet to 19.

Under another contract, MISC also will begin this month delivering as much as 2 m/y of LNG to South Korea's Korea Gas Corp. (Kogas), after MLNG Tiga signed a 7-year, $3.2 billion supply deal with Kogas. The LNG will be shipped from MLNG Tiga to Kogas terminals at Incheon, Pyeong Taek, and Tong Young in South Korea. The agreement marks the fifth supply contract concluded by MLNG Tiga to date, with about 6 m/y of LNG committed to buyers from South Korea, Japan, and Taiwan.

VALERO ENERGY CORP., San Antonio, said it would temporarily shut down its Ardmore, Okla., refinery May 13 to repair a steam generation leak in the sulfur recovery unit of the refinery's only sulfur train.

"An estimated outage of 5-6 days is anticipated," resulting in a loss of about 40,000 b/d of gasoline, said a company spokesperson.

Total is investing 20 million euros in a new gasoline desulfurization unit at its Flanders refinery near Dunkirk to meet the 50 ppm sulfur European Union specifications for 2005, and be ready for the next 10 ppm stage later on. The diesel oil unit will benefit from the same treatment during a shutdown in 2004. BP France will spend about 13 million euros to reduce by two thirds the volatile organic components (VOCs) emitted by the ethylene oxide unit at its Lavéra site on the French Riviera. Work is expected to reach completion by yearend or in early 2004. In 2004, air gases group Messer Grisheim will double its recovery capacity to 120,000 tonnes/year from the ethylene oxide unit as well as the hydrocracker. Messer Grisheim recovers 60,000 tonnes/year of carbon dioxide from the BP ethylene oxide unit on the Lavéra site. The consequent CO2 reduction will be part of BP France's commitment to the French government to reduce its greenhouse gases in the framework of an industry engagement to avoid a CO2 tax.

CORRECTION

Al Kaplan was incorrectly identified as being with Arup Energy (OGJ, May 12, 2003, p. 24). He actually is director of LNG for Foster Wheeler Ltd., who collaborated with Arup Energy on a paper presented at the Offshore Technology Conference.