US onshore industry bustles with high prices, decline legacy

Alan Petzet

Chief Editor-Exploration and Economics

Relatively high gas and oil prices are exerting more punch into US onshore exploration and development.

A slow early-year start in the face of optimistic capital spending plans has given way to the biggest rig count jump in 15 years in the first quarter, a traditional time of drilling decline (OGJ, May 5, 2003, p. 63).

From 862 rigs active during the last week of 2002, the count approached 1,000 units at this writing in early May after reaching only 912 by Feb. 28. Onshore units dominated the gains in recent weeks, and intent to drill filings are also up.

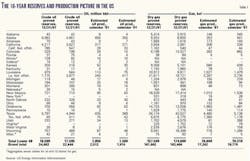

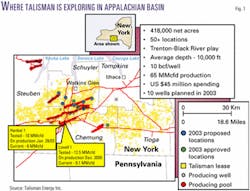

The press of activity is occurring under a shadow that has seen oil and gas production and reserves decline markedly in most states the past 10 years (Table 1). US oil production in 2002 posted its first hike since 1991, the American Petroleum Institute reported.

What follows is a sampling of onshore E&D activity in most producing states. For reasons of brevity, numerous operators active in many plays could not be mentioned.

Alaska

BP Exploration Alaska Inc. expects to announce successful bidders Oct. 1 after it offered more than 400,000 acres of North Slope leases to 15 companies, including independents, that BP said are in a position to explore the lands.

While it wants to draw more operators to the area, BP will continue to invest about $500 million/year itself on the slope for at least the next several years.

Anadarko Petroleum Corp., spending more than $60 million on Alaska E&D this year, drilled more wells and was improving water handling and oil train bottlenecks to boost Alpine field production capacity to 110,000 b/d in 2004 from 103,000 b/d at yearend 2002. It also looks toward development of a growing number of Alpine satellites.

At Cook Inlet, Forest Oil Corp. was near startup of the Kustatan onshore production facilities to serve its giant Redoubt Shoal field (OGJ Online, Dec. 17, 2002). The field started up in December 2002, and its ultimate reserves could reach 220 million bbl. Ultimate recovery of similar size may exist in nearby prospects, of which Corsair appears the largest.

Evergreen Resources Inc., Denver, plans to drill a third coalbed methane pilot project north of Anchorage in the Cook Inlet basin. It hopes to start producing Alaska's first CBM by yearend 2003.

California

Onshore and state offshore oil production fell slightly on the year to 660,000 b/d and 45,000 b/d, respectively, in 2002, state figures showed. Federal offshore production fell 7% to 85,000 b/d.

Gas production fell 2.3% to 1 bcfd as Elk Hills oil field remained the state's largest gas producing field at just under 400 MMcfd, 97% associated gas. Rio Vista gas-condensate field at 76 MMcfd was the largest gas producing field in the Sacramento basin.

All operators collectively drilled 5 million ft of hole in 2,040 wells, 25% fewer wells than in 2001.

Utah-Nevada-Arizona

CBM has grown to make up 35% of Utah's 4.5 tcf of year 2000 proved gas reserves and 28% of 2001 gas production, said the Utah Geological Survey.

Early estimates that CBM wells would last 20 years and recover 1-4 bcf now appear conservative, UGS said.

In Nevada, Tri-Valley Oil & Gas Co., Bakersfield, Calif., has acquired more than 17,500 acres in Railroad Valley and is generating initial prospects for drilling.

The Arizona Geological Survey said 20 oil and 8 gas wells produce about 200 b/d of oil and 1 MMcfd of gas from several small fields in northeasternmost Arizona (Apache County).

Montana-Dakotas

Burlington Resources Inc., Houston, said implementation of the world's largest horizontal waterfloods tripled net recoverable oil in Cedar Hills field in North Dakota and East Lookout Butte field in Montana along the Cedar Creek anticline to 100 million bbl. The floods have begun to respond.

K2 Energy Corp., Calgary, was to start an exploration program for shallow Bow Island gas on 100,000 acres on the Blackfeet Indian Reservation, pending federal approval.

null

K2 laid a 6-mile, 4-in. steel pipeline to deliver gas from 8 existing Bow Island wells on the 3,000-acre Palmer Unit on the reservation to Northwestern Energy.

Continental Resources Inc., Enid, Okla., averaged 1,034 boed from Red River B at Buffalo Unit and five other high-pressure air injection units in northwestern South Dakota during 2002. Remaining reserve life is 4-13 years. The company was to begin air injection in one more unit in mid-2003.

null

Continental made a modest Lodgepole reef oil discovery in Valley County, Mont., in late 2002, 200 miles northwest of the nearest Lodgepole production in Stark County, ND.

Wyoming

Some operators awaited the early May start-up of an expansion of the Kern River pipeline from Opal, Wyo., to Utah, Nevada, and California.

Doubling of capacity to 1.73 bcfd could narrow the gas price differential at which Opal prices have held well below prices at the Henry Hub in Louisiana.

In the Green River basin, Ultra Petroleum Corp., Houston, plans to expand its tight Cretaceous Lance and Mesaverde reserves in the Pinedale anticline and Jonah fields by 25% to 875 bcf this year after a 58% increase in 2002. Ultra plans to boost its production 38% to 24 bcfe after a 43% hike last year.

"A $3.4 million Lance well generates a 44% rate of return at $2.50 wellhead gas price and pays out in 2.3 years and produces for an additional 36 plus years," Ultra said. Incremental economics of deepening to the Mesaverde appear equally as compelling, it added.

Burlington Resources drilled what it called the last development well on the Madden Deep Unit in the Wind River basin. Partner Pogo Producing Co. said the 9-4 well cut 240 ft of pay.

Ultradeep drilling established 2.8 tcf of sour gas in the Madison formation. The 70,000-acre field averaged 79 MMcfed of sales last year from multiple zones at 5,000-25,000 ft.

null

Anadarko averaged 93 MMcfd of gas and 9,500 b/d of condensate from tight Almond and Lewis formations in the Wamsutter area in the first quarter, up slightly from the fourth quarter. It recompleted the Laney Rim 35-3 exploration well, commingling newly perforated Lewis with Almond and identifying Fox Hill, behind pipe, as a new pay zone.

Results exceeded expectations at its Copper Ridge pilot on the East Rock Springs uplift, where 9 Anadarko wells averaged 850 Mcfd and 1,900 b/d of water from Almond coals.

Continental Resources is trying to maximize recovery of sour oil and gas from Worland field, Washakie County, in the Big Horn basin. The company began injecting water into 5 Phosphoria dolomite wells in late 2002. It is also evaluating infill drilling opportunities based on neural network analysis.

Colorado

The state's total gas production, including CBM, averaged 2.3 bcfd in 2002, with 34 counties producing gas. CBM production averaged 1.1 bcfd from 8 counties.

Evergreen Resources plans to drill and complete 160 CBM wells in the Raton basin during 2003. It had 876 net wells producing as of Mar. 31. Yearend proved reserves were 1.24 tcf.

The company's rate represents two-thirds of the gas production in the Raton basin, which extends into New Mexico. Net gas sales have increased for 32 consecutive quarters to 117 MMcfd in first quarter 2003.

The state in late April approved a plan by Williams Cos. Inc., Tulsa, to drill more than 550 wells on 10-acre spacing to tight sands in the Piceance basin. Recovery is expected to be 80% of gas in place on 10 acres versus 40-45% on 20 acres, Williams found.

New Mexico

Decades of work remain to exploit formations in the mature San Juan basin, said Burlington Resources, which controls more than 848,000 acres there.

During 2003, the company plans to drill 150 wells, work over 450 others, and participate in 150 nonoperated well projects.

Burlington Resource' 2002 net San Juan production averaged 569 MMcfd of gas, 28,200 b/d of natural gas liquids, and 1,300 b/d of crude oil. The gas included 217 MMcfd of CBM from more than 1,500 wells in the Fruitland, which is in decline.

Texas

Gulf Coast. Santos USA Corp. plans to expand to 25% of the Santos Group in the next 5 to 10 years by way of exploration, acquisition, and optimization. Texas is its main initial focus.

Two exploratory wells drilled in late 2002 went online in February and March at 22 MMcfd and 2.8 MMcfd. Three wells are on the 2003 drilling schedule, including a Woodbine prospect in East Texas.

Carrizo Oil & Gas Inc., Houston, was starting a Cook Mountain well in Liberty County after its Hankamer 1 went online in early April making 525 b/d of oil and 7 MMcfd from the same formation.

ExxonMobil Corp., whose net production averages 700,000 b/d of oil and more than 2.2 bcfd of gas in the US, consolidated its east (New Orleans) and west US production organizations in Houston.

South. Houston Exploration Co. said that at 126 MMcfed it became the third largest producer in Webb and Zapata counties, where production by all operators represents 10% of Texas gas output.

Southwest. Saxet Energy Ltd., Houston, and The Exploration Co., San Antonio, built production from Comanche Halsell (6500) field in Maverick County to 3,250 b/d of oil and 3,150 b/d of water in late April.

TXCO is in early stages of developing Texas' first CBM play in Cretaceous Olmos coals in Sacatosa field.

North. Burlington Resources, relatively new to the Barnett shale play, plans to drill 100-150 wells in 2003, compared with 40 in 2002, for a $29 million capital investment.

That will build on a $141 million acquisition of 21,000 acres with more than 800 potential drillsites. The deal made Burlington Resources the play's second largest participant after Devon Energy Corp. Burlington Resources' production is to grow to 40 MMcfed this year from 7 MMcfed in 2002.

Cimarex Energy Co., Denver, is targeting mud mounds in the Mississippian Chappel formation in Hardeman and Wilbarger counties.

Cimarex plans to drill 24 horizontal and 2 vertical wells this year. For completed well costs of $800,000-$1.2 million, the probes aim at reserves of 150,000-500,000 boe at about 8,000 ft TVD.

East. Anadarko has discovered nearly 3 tcf of gas in the Bossier trend of East Texas and North Louisiana. The company expects 20% production volume growth this year.

Production from its Bossier fields averaged 245 MMcfd in the first quarter of 2003 versus 256 MMcfd in the 2002 fourth quarter.

Anadarko operates 19 rigs and has cut drilling/completion costs by as much as 40% in some localities compared with the cost of the original discovery well.

Southwestern Energy Co., Houston, is accelerating infill drilling in Overton field in Smith County, where production increased to 27 MMcfd at yearend 2002 from 2 MMcfd in March 2001.

Apache Corp. was testing a discovery with 65 ft of pay in Cotton Valley lime in Upshur County, where it has a block covering more than 7,000 acres.

An Anadarko well in northern Giddings field had four laterals in the Austin Chalk A and B, Buda, and Georgetown zones. The company also carried out water refrac jobs on 30 wells.

Anadarko spudded a well on the Dollarsville prospect projected to Cretaceous Woodbine at 21,500 ft.

West. EOG Resources Inc., on a farmout from Abraxas Petroleum Corp., San Antonio, drilled 5 horizontal wells to the Montoya, the last of which came on line in December 2002. Two wells are planned in 2003. Abraxas also plans a horizontal Montoya well in Oates Southwest field.

Oklahoma

Chesapeake Energy Corp., Oklahoma City, refocused entirely on the Midcontinent, bolstered by acquisition of properties from Oneok Inc., El Paso Corp., and Vintage Petroleum Inc. Chesapeake has grown to the 18th largest US gas producer and the third most active US driller.

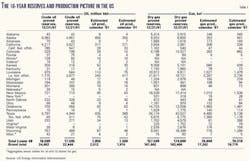

Chesapeake was drilling the country's deepest land wells on average in recent months (Table 2), with 14 of its 33 operated rigs targeting formations deeper than 15,000 ft.

Burlington Resources controls more than 250,000 net acres in the Anadarko basin and spent $5 million there in 2002, when its production averaged 91 MMcfd of gas and 1,400 b/d of NGLs.

The last Oklahoma field to be discovered with recovery of more than 10 million bbl of oil was Wheatland field west of Oklahoma City in 1981, wrote Dan T. Boyd in Oklahoma Geology Notes.

Kansas

Eastern Kansas CBM operations are small but growing and thought of as a partial replacement for declining production from supergiant Hugoton gas field (OGJ, Dec. 23, 2002, p. 36).

One operator, Berry Petroleum Co., Bakersfield, Calif., in January budgeted $1.3 million, including facilities for a second CBM pilot in Kansas. It had not yet committed any development capital for potential follow-up development of CBM pilots in Kansas and Illinois. Berry held 192,000 acres in Kansas and 52,000 acres in Illinois.

Anadarko leased 90,000 net acres in the Forest City basin CBM play in Lyon and Wabaunsee counties and planned to drill 5 wells shortly to test for gas content, coal thickness, and permeability.

Arkansas

Downspacing will boost the rig count in the eastern Arkoma basin and northern Ouachita Overthrust trend.

The state commission approved increased density in Pennsylvanian Middle Atoka in Gragg, Booneville, Chismville, Waveland, and other gas fields. Two to four additional wells are authorized on around 100 sq miles held by production in the fields.

XTO Energy Inc., Fort Worth, became the top gas producer in Arkansas with more than 500,000 acres of leasehold. The company has added 500 MMcf of reserves in the basin by stimulating or opening bypassed pays in 90 wells. Reserves averaged 400 Mcfd at 30¢/Mcfe.

Louisiana

BP is developing gas-condensate from more formations in Judge Digby field in Pointe Coupee Parish northwest of Baton Rouge on the Tuscaloosa Trend. The field has been producing for 20 years.

A partner, St. Mary Land & Exploration Co., Denver, has 10-20% working interest that stems from its acquisition of King Ranch Oil & Gas Co. in 1999. The main producing formations are at 19,500-22,500 ft and had 14,300-16,400 psi initial pressures at 350-400° F. bottomhole temperatures and 1-2 md of permeability (OGJ, May 7, 2001, p. 43).

The 2003 plan calls for drilling 2 wells, sidetracking two others, and recompleting several more. One new well, projected to 23,200 ft, was among the 10 deepest onshore wells drilling in the US as of Apr. 4, 2003 (Table 2).

Meridian Resource Corp., Houston, planned $35-40 million in 2003 capital spending on seismic and drilling, mostly for the Biloxi Marshlands project in St. Bernard Parish. The first well flowed 10 MMcfd of gas from Cristellaria I sand.

The Woods Oil & Gas IPCO-1 in Caldwell Parish was the state's first well to establish gas production from the Russell coal bed of Paleocene-Eocene Wilcox age. Results remain confidential.

Mississippi-Alabama

Black Warrior basin newcomer Continental Resources expects to drill 5 wells this year, and their outcome will determine its commitment there.

The company acquired 25,000 net acres from April 2000 to yearend 2002. It drilled four producers out of 12 wells in 2002. It called that an acceptable success rate but said production and reserves did not meet expectations. The basin's typical well has 750 MMcf of reserves, Continental said.

Remington Oil & Gas Corp., Dallas, was to spud a well in late May on the east side of the Tatum salt dome in Lamar County, Miss., where it completed a 3D seismic survey. The company's 1 Singer discovery well found oil and-or gas in Cretaceous James Lime and Upper Hosston sands on the dome's west flank.

Florida

Calumet Florida Inc., a unit of Plains Resources Inc., Houston, operates most of the former Exxon Co. USA fields in the South Florida Sunniland Trend and has had some success with horizontal drilling. It produced 2,800 b/d in fourth quarter 2002 from 16 million bbl of reserves.

Peninsular Oil Corp., Bonita Springs, Fla., produces 175 b/d of oil from Cretaceous Sunniland B and C zones in Corkscrew field, Collier and Lee counties. It is looking for a partner to drill a 600 ft leg in the C zone, core, and if warranted extend the leg to 1,000-1,500 ft. Horizontal C wells in other fields have IPd at 1,000-3,400 b/d, Peninsular said.

In the panhandle, Zinke & Trumbo Inc., Tulsa, is to drill a 17,000 ft wildcat to Smackover in nonproducing Okaloosa County, 30 miles east of Blackjack Creek oil field.

Tennessee-Kentucky

Miller Petroleum Inc., Huntsville, Tenn., a public company that mainly produces gas and oil from the Mississippian Big Lime formation along the Cumberland saddle, has begun to evaluate CBM potential.

Miller also has begun to participate in Eastern Overthrust activity. The company identified 12 large structures similar to Swan Creek field and is exploring for more.

West Virginia

Operators have filed records for 222 CBM wells, many of which are in McDowell, Wyoming, and Raleigh counties. The state also has issued CBM well permits in Monongalia, Marion, Wetzel, and Marshall counties along the Pennsylvania line.

Upper Pennsylvanian Monongahela Group coals produce in northern West Virginia, while Lower Pennsylvanian New River and Pocahontas coals produce in southern West Virginia. One well in Wyoming County has 5 laterals.

Ohio

The state's 498 wells in 2002 were the lowest number drilled since at least 1888, the Division of Mineral Resources Management reported. The decline from 2001 was 28%.

The division said 264 wells targeted Silurian Clinton sandstone, 86 Cambrian Rose Run, 46 Cambrian Trempealeau dolomite, and 45 Ohio shale.

Operators used cable tools on 7 wells to 771-3,269 ft in 3 counties.

Pennsylvania

Operators have staked deep gas tests in northern Pennsylvania.

The roster included Dominion Exploration & Production Inc., Richmond, Va., drilling in Bradford County; Triana Energy Inc., Charleston, W.Va., in Tioga County; and possible activity implied by leasing in Cameron and Potter counties.

New York

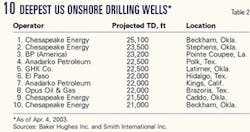

Talisman Energy Inc., Calgary, launched a major exploration campaign in the Ordovician Trenton-Black River in western New York through its Fortuna Energy Inc. subsidiary, formed through several acquisitions.

Talisman planned $45 million in capital spending this year, drilling 10 wells averaging 10,000 ft on a leasehold growing from 418,000 net acres in the Finger Lakes region (Fig. 1).

Michigan/Illinois

Continental Resources had 3 development and 10 exploratory drilling locations scheduled for drilling in 2003 on properties acquired with Farrar Oil Co. in July 2001. It will employ 3D seismic data on three exploratory projects.

The properties averaged 1,244 b/d of oil and 189 Mcfd of gas in 2002 from 880 gross wells, and 70% of net production comes from 31 waterfloods. Continental plans to implement three new floods this year.