Market Movement

OPEC decision undercuts oil market prices

The Apr. 24 decision by ministers of the Organization of the Petroleum Exporting Countries to raise their official quota by 900,000 b/d to 25.4 million b/d, effective June 1, effectively promising to reduce recent overproduction by 2 million b/d, triggered a general retreat in oil prices until a weaker-than-expected build in US crude inventories and expressions of concern by OPEC officials sparked an Apr. 30 price increase.

The quota increase will be divided among the 10 active OPEC members minus Iraq on a pro rata basis, giving each member a 3.7% increase, officials said. OPEC ministers indicated they would take another look at oil market conditions June 11 at a meeting in Doha, Qatar.

Skeptical analysts

Several analysts were skeptical about OPEC's decision.

"OPEC's surprise quota increase unnecessarily confused the market at a time when there is sufficient uncertainty already present, with debate over the return of Iraqi [oil production and export] volumes and concerns over economic recovery and the impact of the SARS [severe acute respiratory syndrome] virus on petroleum demand (see related item, p. 7)," said Matthew Warburton, UBS Warburg LLC, New York, in an Apr. 25 report.

"The bulk of the 'cuts' needed to balance supply [under OPEC's new quota] and demand in the very short run was provided in late March by OPEC's new shadow member—the coalition forces who 'liberated' Iraq," said Adam Sieminski, industry analyst at Deutsche Bank AG.

With world oil inventories near record lows, Warburton said, OPEC's "mistake" is not as bad as the one it "made in Jakarta in late 1997 when it endorsed overproduction ahead of the Asian [financial] crisis." However, he said, "By its actions, OPEC has partially undermined [its] substantial recovery in credibility achieved over the last 3 years."

Warburton had anticipated "an unofficial OPEC-10 [minus Iraq] production reduction of 1.5 million b/d over the next 2-3 months from current OPEC-10 production levels of 26.2 million b/d and a reaffirmation of the existing 24.5 million b/d quota. This would have had the double benefit of increasing global inventories at a rate marginally above seasonal norms, as well as preparing OPEC for the reintroduction of Iraqi volumes into world markets later this year."

J. Marshall Adkins, an analyst in the Houston office of Raymond James & Associates Inc., St. Petersburg, Fla., said: "The latest meeting among OPEC members looked a lot like a Chinese fire drill. "The US inventory situation remains extremely tight, with product inventories hovering around all-time lows. In fact, current total inventories support low-$30/bbl prices today. We expect US oil inventories to continue building as OPEC's overproduction and seasonal demand softness takes it toll," Adkins said.

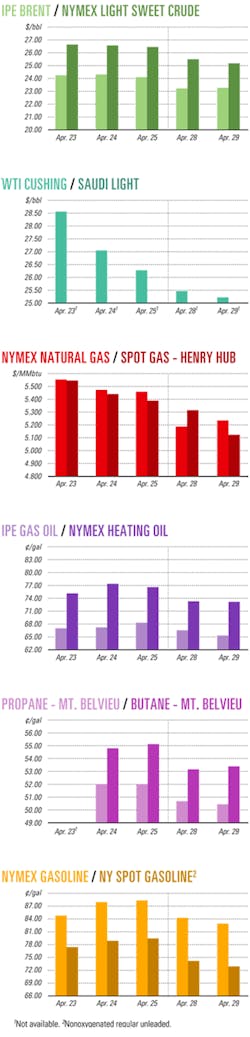

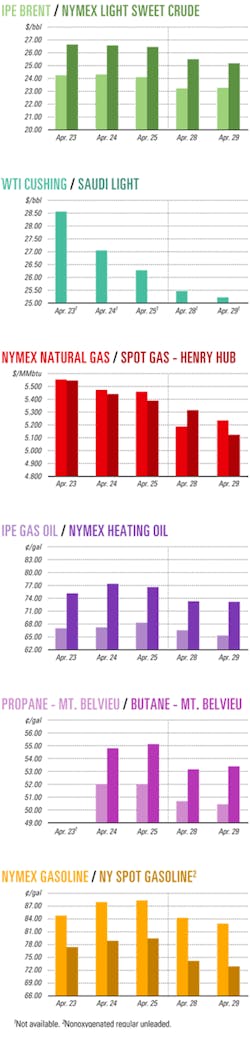

On the day of OPEC's meeting, the June contract for benchmark US light, sweet crudes dipped by 1¢ to $26.64/bbl on the New York Mercantile Exchange. The June contract for North Sea Brent oil gained 7¢ to $24.33/bbl that same day on the International Petroleum Exchange in London, while the average price for OPEC's basket of benchmark crudes plunged by $1.17 to $23.97/bbl.

By Apr. 29, the June oil contracts were down to $25.24/bbl on NYMEX and at $23.26/bbl on IPE where it touched new 5-month lows in consecutive trading sessions Apr. 28-29. The average price for the OPEC basket of benchmark crudes then stood at $23.27/bbl.

Prices firm

But on Apr. 30, the June oil contracts rebounded to $25.80/bbl on NYMEX and $23.68/bbl on IPE, ending the six-session losing streak, as US oil inventories increased by only 1.8 million bbl to 288 million bbl for the week ended Apr. 25. OPEC's offices in Vienna were closed for a holiday, so there was no report on the group's basket price.

Still, that price hike illustrates that "the widespread reaction that oil prices must now be due for a major collapse because OPEC was not cutting enough is incorrect," said Paul Horsnell, an analyst at J.P. Morgan Securities Inc., London, in a May 1 report.

"Recent arrivals of crude oil to the US reflect loadings before Iraq stopped exporting [prior to the invasion of that country by US-led coalition forces], i.e., the high-water mark for OPEC production," said Horsnell. "Further down the delivery chain, tankers in transit represent a period of loadings when OPEC production was 3 million b/d lower than the high point, and that reduction has yet to feed through into the inventory data."

In late March, when Iraq oil exports had stopped and those of Nigeria were curtailed by civil unrest, total OPEC production "may have been a little shy of 26 million b/d, and the volume may not have crept much higher since then," said Horsnell.

US industry scoreboard

null

null

null

Industry Trends

CONCERN ABOUT SARS (severe acute respiratory syndrome) is reducing Asia's petroleum product demand growth.

Jeffrey Brown, a senior associate at FACTS Inc. of Honolulu, said SARS contributed to lower jet fuel demand in Asia as well as reduced regional economic growth and petroleum product consumption.

People are altering their travel habits, work habits, and avoiding public places to evade the highly infectious respiratory ailment, Brown said in a research note late last month.

"On the whole, we expect that SARS will reduce petroleum product [regional] demand growth by 70,000-100,000 b/d over the course of this year. This implies that regional demand will grow by 367,000-397,000 b/d in 2003," he said.

The disease's virulence has alarmed health officials and panicked Asian residents.

Health officials have warned people to avoid China, Hong Kong, Singapore, and Viet Nam. Officials have closed schools and quarantined health workers to stop the spread of the virus.

Fewer people are willing to fly because of the SARS virus, which in turn has prompted airlines across Asia to cancel flights. US and European airlines owning Asia networks also have seen a substantial drop in passenger demand.

"Air traffic in the region is down by 10-15%, and it is likely that more flights will be canceled. The impact on jet fuel demand will depend on the extent to which the virus spreads and lingers, but currently demand is down by 110,000-140,000 b/d on a year ago. Over the course of 2003 it is likely to be off by at least 30,000-40,000 b/d," Brown said.

Overall, SARS is projected to reduce the region's 2003 GDP growth by as much as 1%, which translates into $79 billion vanishing from the Asian economy.

US INDEPENDENT refiners face excellent industry fundamentals, and margins are expected to remain well above normal this year due to improved demand and low inventories. Prudential Securities Inc. analyst Andrew F. Rosenfeld of New York said refining margins are likely to trend lower in the second half, but they still are forecast to remain well above normalized values.

Prudential raised its 2003 refining margin forecast to $7.25/bbl from $4.65/bbl, and forecast 2003 US refined product demand growth of 1.7%.

"We expect higher operating rates and product imports will be required to meet our forecast. However, our 2003 refined product demand growth forecast is below the current 2003 [US] Energy Information Administration forecast of 2.5% growth, as we believe that the relationship between [gross domestic product] growth and refined product demand will be lower than the implied EIA relationship," Rosenfeld said.

Refined product inventories now are at a new seasonal low in a 5-year range, he said, adding that he expects inventories to remain in the bottom quarter of the 5-year range for months.

Any major unplanned refinery outages could prompt a rapid increase in refining margins, he added. Prudential forecasts a 2004 US refining margin of $4.65/bbl, reflecting its belief that refined product inventories will begin to be rebuilt toward late 2003.

Government Developments

BOLIVIA REFUSES to lower gas export prices unless Brazil increases its imports.

At an Apr. 28 meeting, Brazilian President Luiz Inácio Lula da Silva failed to convince Bolivia's President Gonzalo Sánchez de Lozada to revise the contract under which Brazil imports a fixed quota of gas from its neighbor.

"It is very unlikely that Bolivia will distance itself from what was agreed (with Brazil) in good faith in the past. It is unlikely that we will change the take-or-pay clause of the contract," said de Lozada.

However, Brazilian Energy Minister Dilma Rousseff, who also took part in the talks, declared, "Brazil will only increase the volume of gas imported from Bolivia if the price of the fuel is reduced."

Brazil wanted to revise the take-or-pay clause in the import contract signed with Bolivia in 1996. Under that agreement, Brazil pays for a certain quota of imported Bolivian gas even if it does not need to import the fuel. Brazilian officials claim the take-or-pay provision will cost Brazil more than the present $150 million/year.

The minimum gas quota Brazil agreed to import from Bolivia is 14 million cu m/day. Under the proposal, the minimum quota would be boosted to 18 million cu m/day by 2004.

However, Brazil currently takes only 11 million cu m/day. The Brazilian economy is experiencing a severe recession, and it is unlikely that Brazil's gas consumption will increase from current levels for at least the next 2 years, said local analysts. Moreover, Lula's administration shelved an ambitious gas-fired thermoelectric project devised by former President Fernando Henrique Cardoso.

Brazilian officials said the price of imported Bolivian gas has dampened Brazil's demand for the commodity. However, Lozada rejected the possibility of reducing gas prices unless Brazil increases imports.

Bolivia's natural gas reserves are estimated at 52 tcf, second in Latin America behind Venezuela. Bolivia's economy depends heavily on its gas sales. In addition, Losada faces strong opposition from powerful left wing factions in Bolivia that oppose lowering exported gas prices.

THE US advocates international collaboration in advanced research and development for hydrogen energy technologies.

US Sec. of Energy Spencer Abraham announced an International Partnership for the Hydrogen Economy initiative during the International Energy Agency ministerial meeting in Paris last week.

"International cooperation is key to achieving hydrogen and fuel cell program goals," Abraham said. Numerous countries are accelerating the development of hydrogen energy technologies to improve their energy, economic, and environmental security, he said.

The US has committed $1.7 billion for the first 5 years of an R&D program for hydrogen, hydrogen infrastructure, fuel cells, and hybrid-vehicle technologies. The European Union has committed as much as 2 billion euros to long-term R&D of renewable and hydrogen energy technologies.

Most of IEA's Organization for Economic Cooperation and Development countries face undesirable risk to the reliability of their energy sectors and environmental quality by relying heavily upon imported petroleum, unstable energy prices, and aging electricity and natural gas infrastructures, Abraham said.

Quick Takes

A TOTALFINAELF SA-led consortium is again considering the development of Sein and Badamyar natural gas fields in the Gulf of Martaban to augment gas deliveries from adjacent Yadana field, all on Blocks M-5 and M-6 about 320 km south of Rangoon, Myanmar (OGJ Online, June 14, 2002).

Yadana has certified reserves of 5.7 tcf of gas; the initial estimate of gas reserves at Sein is 200 bcf and at Badamyar, 500 bcf.

The consortium expects to drill two wells at Sein and four at Badamyar over the next 4-5 years. The $40 million cost of developing Sein field also includes a platform and an interfield pipeline.

In addition, the consortium has moved up installation of a medium-compression platform at Yadana to this year from 2005, ramping up its maximum gas delivery to 850 MMcfd from 650 MMcfd to Myanmar and Thailand, especially for new electric power generation.

Most production is delivered via a pipeline extending 346 km offshore and 65 km onshore. Political extremists have bombed the gas line three times this year, charging Myanmar's military government with using proceeds from gas sales to purchase weapons for killing and oppressing the country's people. Extremists charge the oil companies with complicity and supporting the military government in that pursuit (OGJ Online, Apr. 28, 2003).

KERN RIVER GAS TRANSMISSION CO. placed its $1.2 billion, 2003 expansion project into service May 1 and is now accepting nominations for natural gas delivery.

The expansion, which more than doubles Kern River system capacity, consists of 717 miles of pipeline loop adjacent Kern River's existing pipeline, 163,700 hp of additional compression, and meter station modifications. Kern River already has secured long-term contracts for more than 99% of the new capacity.

The completed 1,679 mile pipeline system will enable 1.73 bcfd of gas to serve nearly 6,500 Mw of new electric power generation throughout the western US.

CORRIDOR RESOURCES INC., Halifax, NS, has begun natural gas production from the first two wells in McCully field near Sussex, NB. About 2.3 MMcfd of the gas is being processed for delivery to a Potash Corp. of Saskatchewan mill 2 km from the field.

The A-67 and P-66 wells, both in the Mississippian Albert formation, have combined reserves of 11 bcf. Corridor and Potash share a 50:50 ownership of gas production from the two wells.

Other potential farm-in partners are conducting talks that could lead to additional gas sales, more drilling, and a pipeline connection to the Maritimes & Northeast gas pipeline 45 km north of the field (OGJ, Jan. 20, 2003, p. 26).

ENCANA CORP., Calgary, will resume shallow-water exploration drilling early this month off eastern Canada.

Houston-based Rowan Cos. Inc.'s Gorilla V Super Gorilla class jack up has an initial commitment for drilling one well, with "options for additional wells," the company added (OGJ Online, Apr. 17, 2003).

A drilling contract for the rig was suspended in 2002, Rowan said.

"The resumption of this contract reaffirms our confidence in the long-term viability of the eastern Canada market for harsh-environment jack ups," said Bob Palmer, Rowan chairman and CEO.

PETROLEOS DE VENEZUELA SA (PDVSA) has resumed operation of the atmospheric distillation unit (DA-2) at its Puerto La Cruz refinery in eastern Venezuela. Currently, the refinery is processing 170,000 b/d of oil.

The DA-2 unit, used to blend crude oil shipments for delivery to Phillips Petroleum Co., now ConocoPhillips, was shut down when PDVSA declared force majeure after the Dec. 2 strike that disrupted Venezuela's oil industry operations. A new agreement is being negotiated with ConocoPhillips.

PDVSA expects this month to resume crude oil deliveries to ConocoPhillips, which is scheduled to receive a shipment of more than 1 million bbl of oil at Guaraguao maritime terminal. A fire that broke out at midnight Apr. 26 shut down one of the four hydrodesulfurization units at PDVSA's 940,000 b/d Paraguana refinery complex 350 miles from Caracas in Venezuela's western state of Falcon, Caracas media reported. No one was injured. The fire occurred in the 84,000 b/d HDS unit at the complex's Amuay refinery but was limited to the one unit, which is expected to be back in service in mid-May, PDVSA said. Meanwhile, three other HDS units at the complex will offset the loss in output, PDVSA's spokesman said.

ATLANTIC LNG CO. of Trinidad and Tobago Ltd. reported that its third LNG train at Point Fortin on the southwestern coast of the Caribbean island of Trinidad will come on stream this week, and the first Train 3 LNG shipment will go out by mid-May.

Atlantic LNG moved its schedule forward to meet the strong worldwide LNG demand.

Train 3 will have a capacity of 3.3 million tonnes/year of LNG and will process 500 MMcfd of gas. When combined with the first two trains of the Atlantic LNG project, the LNG facility's production totals 9.6 million tonnes/year, making it the fifth largest in the world, according to Atlantic LNG.

Meanwhile, Trinidad and Tobago still is locked in negotiations with Atlantic LNG shareholders—BP PLC unit Amoco Trinidad (LNG) BV, British Gas Trinidad LNG Ltd., Tractabel Trinidad LNG Ltd., NGC Trinidad & Tobago LNG Ltd., and Repsol-YPF SA unit Repsol LNG Port Spain BV—over the proposed construction of a fourth LNG train that would expand the project by 5.2 million tonnes/year. Trinidad and Tobago's Prime Minister Patrick Manning said it was likely the deal could be signed within the next month. In other LNG activities, Royal Dutch/Shell Group unit Shell Gas & Power said the Mexican authority Secretaría de Medio Ambiente y Recursos Naturales (Semarnat) granted an environmental permit Apr. 8 for Shell's proposed 7.5 million tonne/year LNG terminal in Baja California (OGJ Online, Apr. 8, 2002). The terminal, expected to begin operations in 2007, will be sited in Costa Azul, 23 km north of Ensenada on Mexico's west coast. Shell has secured initial supplies for the proposed terminal and said that studies required for other permits are under way.

DOW CHEMICAL CO. has launched a pilot gas treating plant at Freeport, Tex., to help operating companies minimize risks associated with altering gas processing plant operations.

The pilot plant mimics the performance of large-scale commercial equipment, including carbon dioxide absorbers and strippers. It can be set up to simulate individual company plant operations. The company's proposed modifications then are made at the pilot plant. Data acquisition equipment and control systems measure gas treating capacity, product quality, circulation requirements, and energy costs.

null

Measuring the effect of the changes on pilot plant operations enables companies to assess the impact of potential system changes before actual modifications are implemented in their full-scale plants.

ROMPETROL GROUP NV (TRG) expects to start construction this summer on a $31 million oil terminal 7 km off Midia, Romania. Completion is slated for 2004.

The proposed terminal, to be built as a satellite of Constanta Port that serves the nearby petrochemical and industrial area, is the first of a two-stage process whereby TRG also will develop facilities to increase refined products exports.

The port expansion will nearly triple TRG's oil import capacity to 700,000 tonnes/month from 250,000 tonnes/month and will reduce discharging and transporting costs by about 75¢/tonne.

TRG also acquired from Romania's National Agency for Mineral Resources the rights to two oil fields leases—E IV-3 Zegujani and E IV-5 Satu Mare—and currently is negotiating terms.

INTERNATIONAL OIL COMPANIES expect to spend about $100 million on exploration activities in Ireland this year, particularly in the Celtic Sea, making 2003 the busiest in 25 years for drilling off Ireland, according to industry officials.

Ramco Oil & Gas Ltd., London, will drill five wells this year in its Seven Heads gas field in the Celtic Sea and expects first gas by yearend. Seven Heads contains proved and probable reserves of 300 bcf (OGJ Online, Mar. 17, 2003).

Ramco also recently received a licensing option giving it exclusive rights until July 31, 2004, to run seismic surveys over parts of Blocks 49/11 and 49/12, its Midleton acreage, and to apply for a 6-year exploration license for that area if results are successful.

Midleton is 60 km northeast of Seven Heads. The Midleton geological target is the Greensand ('A' sand) that has produced most of the gas from Kinsale Head field 35 km to the south.

Also in the Celtic Sea, Marathon International Petroleum Ireland Ltd. will develop its fifth subsea gas well tieback. Work is under way on tiebacks from the company's Greensand development well, where first gas is expected by July, to the Kinsale Bravo platform, 7 km away (OGJ Online, Dec. 9, 2002).

Off the northwest of Ireland, Statoil Exploration (Ireland) Ltd. will drill an exploration well as part of its license commitment on the Atlantic Margin, which extends from western Ireland to northern Norway. Statoil said it considers the area to be one of its "most important" international exploration provinces. Statoil drilled the first wildcat on the Sarsfield prospect west of Ireland in 2001 (OGJ Online, May 22, 2001).

And in the Slyne basin off Ireland, Enterprise Energy Ireland Ltd., a Shell unit, is developing onshore and offshore facilities for developing Corrib gas field on Blocks 18/20 and 18/25. First gas is anticipated the second half of this year, and a plateau of 8.9 million cu m/day of gas is expected next year (OGJ Online, Aug. 16, 2001). Enterprise also will return to its Dooish deepwater prospect 125 km northwest of Donegal. Enterprise drilled the well last year in 1,478 m of water on License 2/94 on behalf of itself, AGIP Ireland BV, and OMV (Ireland) GMBH, but suspended operations when the weather deteriorated (OGJ Online, Feb. 12, 2003).

In other exploration news, ChevronTexaco Corp.'s Canadian unit Chevron Canada Resources, operator of the North Langley K-30 well in the Mackenzie Delta, reported that the well found commercial quantities of natural gas. On test and under restricted flow, the well flowed 18 MMcfd of gas from the Tertiary interval, the first Tertiary discovery from the 1999 and 2000 exploration lease sales. The well is on Exploration License 394, about 81 miles northwest of Inuvik and 7 miles from Niglintgak field, one of the anchor fields for the proposed Mackenzie Valley pipeline project. Chevron Canada jointly owns the lease with other Mackenzie Delta Partnership members, BP Canada Energy Co., and Burlington Resources Canada Ltd.

Recent appraisal drilling has confirmed the Constitution and Hornet oil fields in the deepwater Gulf of Mexico, reported Kerr-McGee Corp., which owns 100% of both fields. Constitution lies in 5,000 ft of water on Green Canyon Block 680, and Hornet, in 3,850 ft of water on Green Canyon Block 379. "The (Constitution) pay sands are high-quality oil reservoirs, with 25-30% porosity and greater than 30° gravity oil," Kerr McGee said. The initial well, drilled to 13,727 ft, encountered more than 100 ft of net oil pay in a shallow Plio-Pleistocene objective. The confirmation well, 4,000 ft northwest, was drilled to 15,213 ft and encountered 375 ft of net oil pay in PlioPleistocene sands, primarily in deeper objectives not tested in the discovery well. The well is being sidetracked downdip, 1,650 ft to the southwest, to test for additional deeper reservoirs, and another appraisal well is planned. The appraisal well in Hornet field encountered more than 275 ft of net pay in Plio-Pleistocene sands. It is being sidetracked 2,300 ft to the northwest onto Green Canyon Block 335 to define the areal extent of the reservoirs. Trinidad and Tobago plans to put seven oil and natural gas exploration blocks up for bid by May 31, a Ministry of Energy source said. Of the seven blocks, three are natural gas prone, two are oil prone, and two have a mixture of oil and gas.