FBR: Worldwide E&D spending to increase by 4.8% in 2003

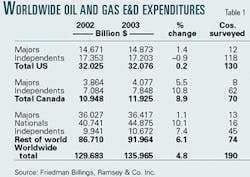

Oil and natural gas companies plan to increase worldwide exploration and development spending by 4.8% to $136 billion in 2003 compared with 2002, although potential exists for spending to increase considerably more in the second half, a recent poll said.

During 2002, the surveyed oil and gas companies increased E&D spending by 3.6% compared with 2001. Last year's spending growth was dampened by sharp declines in spending on projects in the US and Canada.

During November and December, the Arlington, Va.-based Friedman, Billings, Ramsey & Co. Inc. surveyed 190 companies about planned E&D spending. Poll results were released after trading ended Jan. 8.

"Although conservatism is warranted when dealing with the commodity markets, we believe that current high cash-flow generation will induce operators to begin increasing budgets above current estimates. We also believe that these increases will occur primarily in the second halfUand that they could amount to $5 billion to $8 billion of additional E&D spending, representing a 4-6% increase over current 2003 spending estimates," Robert J. MacKenzie, senior analyst and vice-president of the FBR Energy Group, said in a report on the survey.

Outlook

Survey companies said that Canada will dominate the spending growth with an 8.9% increase to $11.9 billion in 2003 from $10.9 billion during 2002. Spending on US E&D is expected to be flat with 2002 levels, rising 0.2% (Table 1).

The report showed that majors plan to increase US spending by 1.4% during 2003, compared with an anticipated 0.9% decline in US spending by independents.

"We attribute this result to the higher debt levels at many small and mid-size E&P companies, combined with increased spending by the majors just to keep production levels flat. We expect independents and majors alike to continue shifting capital from US projects to Canadian and (rest of the world) markets, a trend that has developed over the last several years in response to the declining quality of new US projects," MacKenzie said.

Companies, particularly national oil companies and a growing base of independents, plan to boost E&D spending outside the US and Canada by 6.1% during 2003, the report said.

Of the survey companies, 5% will dominate E&D spending, FBR said, noting that 10 firms control 50% of forecasted 2003 E&D expenditures. The top 10 companies included ExxonMobil Corp., Royal Dutch/Shell Group, BP PLC, and some national oil companies (NOCs).

Of the remaining 185 companies surveyed, 45 firms control 90% of 2003 E&D spending. These included Amerada Hess Corp., Repsol-YPF SA, other NOCs, and some large independents such as EnCana Corp. and Anadarko Petroleum Corp.

The survey showed companies plan to spend 67% of their capital budgets outside Canada and the US. They expect to spend 24% in the US and 9% in Canada. Regarding capital spending by company category, 41% of the spending is expected to come from majors, 33% from NOCs, and 26% from independents.

When asked how they would allocate capital in 2003, 80% of survey participants said they plan no change in spending patterns. Meanwhile, 15% said they would spend more on natural gas. NOCs and multinational companies dominated the 5% of companies that indicated plans to spend more money on oil.

"Historically, it is worth noting that recent E&D spending patterns have focused high levels of capital on natural gas, a trend that we can expect to continue," MacKenzie said.

Risk-averse

"Based on survey responses, we expect more exploitation of low-risk, near-field reserves (particularly in the Gulf of Mexico) and continued focus on US natural gas development projects," MacKenzie said.

Survey participants based their responses upon 2003 average oil and natural gas price assumptions of $21.40/bbl for West Texas Intermediate crude and $3.26/Mcf for natural gas at the Henry Hub; both prices are well below current commodity prices.

"Fluctuating commodity prices and the perception of future prices pose the greatest risk to 2003 E&D budgets. Military and political activity in the Middle East, North Korea, and Latin America will undoubtedly influence commodity prices," MacKenzie said.

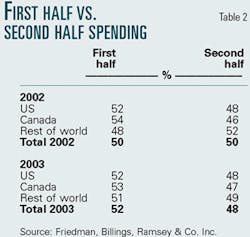

"However, the fundamental effects of a recovering economy and declining US gas production offer some protection against a precipitous drop in commodity prices. In any event, we expect a high tolerance for moderate commodity price declines," he said (Table 2).

The companies surveyed told FBR that prices would have to drop to $19.06/bbl for WTI and $2.41/Mcf at the Henry Hub before they would decrease their budgets.

MacKenzie said this indicates "very inelastic behavior across a wide range of oil and gas prices. These figures are well below the current 12-month strip, and we do not expect budget cuts due to commodity price declines."

Free cash flow

Survey participants said they would use 61% of their free cash flow on additional E&D spending; 25% would be used to pay down debt, and 10% would be used for acquisitions.

Alternative uses of cash included stock repurchases, dividends, and spending for other business activities.

"Large and midcap independents were the most responsive when it came to additional E&D activity. These companies are facing continued production declines, increasing natural gas prices, and they are generally on firm financial ground. Although focused on spending within cash flow, we believe that they are very likely to increase spending at the first sign of excess cash flow," MacKenzie said.

Spending patterns by budget size

NOCs are increasing budgets, while independents are allocating capital away from the US. The survey differentiated spending patterns according to a company's budget size (Table 3).

The majors and NOCs possess budgets of greater than $2 billion each, while the independents dominate the smaller budget categories of less than $1 billion each. A mixture of majors, NOCs, and independents fell into the $1-2 billion category.

"US spending should increase at the largest and smallest budgets, while the midsize budgets are decreasing," MacKenzie said. "We believe that the majors are instituting slight US spending increases to exploit near-field deepwater opportunities, to continue development of long-term projects, and to maintain current production levels."

The smallest independents are expected to increase US natural gas spending to capitalize on continued strength in US gas prices, he said.

"Meanwhile, the mid- and large-cap independents should continue to divert capital to Canadian and overseas projects that offer superior growth and rates of return. For example, companies that have budgets of $1 billion to $2 billion plan to decrease US spending by 8.7% while increasing Canadian and (non-US) spending 13-14%," he said.