Market Movement

US imports of Canadian gas falling

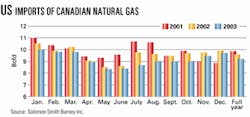

Imports of Canadian natural gas into US markets are expected to fall 3% this year from 2001 levels and drop another 4% in 2003, said Robert Morris with Salomon Smith Barney Inc., New York.

That's primarily because production from the significant Ladyfern gas field in northeastern British Columbia is declining quicker than previously expected, he said. "In fact, Ladyfern production is currently estimated to be just under 500 MMcfd, vs. 650 MMcfd in early June, and volumes are currently expected to exit the year at roughly 450 MMcfd," Morris reported. "EnCana (Corp., Calgary) and Canadian Natural (Resources Ltd.), whose wells are the furthest downdip on the structure, have already experienced a nearly 40% decline in Ladyfern production from its peak.

"Thus, we now believe that Ladyfern production could exit next year as low as 100-150 MMcfd, with volumes expected to be down more than 50%, on average, in 2003 relative to this year."

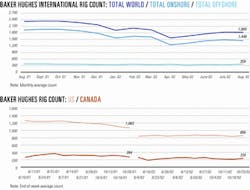

Meanwhile, Morris said, drilling activity in the Western Canada Sedimentary Basin continues to lag, with the Canadian natural gas rig count 30% below 2001 levels on average. Baker Hughes Inc. reported 235 rotary rigs working in Canada during the week ended Oct. 25, up 29 from the previous week but down from 284 during the same period a year ago.

As a result, said Morris, western Canadian production, excluding Ladyfern, is down roughly 3% year-to-date compared with 2001. "We now expect (US) Canadian imports to decline roughly 3% in 2002, compared with last year, and an additional 4% in 2003," he said (see graph).

Moreover, Morris said, recent reports by 15 of the 40 largest publicly traded producers indicate a third quarter sequential drop of 1.7% in US natural gas production, down 5.3% from year-ago levels.

"Given our longer-term outlook that North American natural gas supply (and) demand fundamentals will remain tight," said Morris, "interest has been revived in alternative sources to augment natural gas supply, such as liquefied natural gas, and 'stranded' natural gas reserves in the Arctic and offshore Nova Scotia."

OPEC dilemma

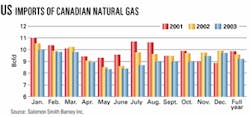

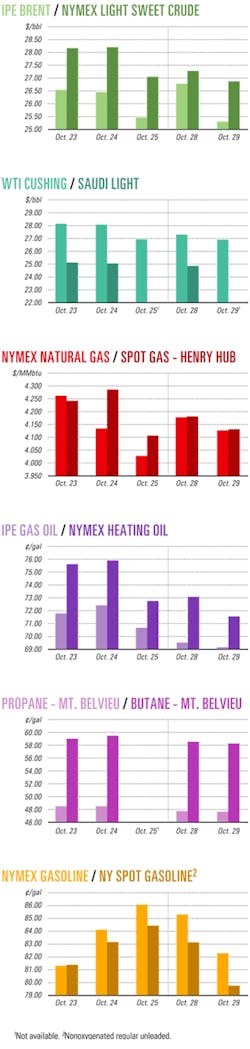

Members of the Organization of Petroleum Exporting Countries are in a "Catch-22" dichotomy between oil market fundamentals and conflicting expectations among futures market traders who may bid market prices up or down for the wrong reasons, said Paul Horsnell, head of energy research for JP Morgan Chase & Co., London.

Either OPEC members "produce what is warranted for market balances," and thereby risk market perceptions of overrunning their quotas, so "that prices could fall below (the group's) target band." Or else they "change production strategy to maintain credibility, and the market will remain overly tight for months," Horsnell said last week.

Speculators in oil futures markets recently have been closing out long positions on the assumption that the current tightness in world oil markets is temporary and soon will be offset by what they perceive as "cheating" among those OPEC members who are exceeding their production quotas.

"However, even using early October estimates that show further gains in (still low levels of) Iraqi production," Horsnell said, "OPEC is not yet producing enough to even hold inventories constant in (the fourth quarter), let alone make up the deficit, even before you add in the time lags between production and arrival of oil at refineries."

He said, "If the market is waiting for the (OPEC) cavalry to bring things back to normal, it had better dig in for a long wait."

Horsnell noted, "US heating oil inventories are now lower than they were at the start of August." And gasoline stocks are "only a little better," he said. "Crude inventories have remained stubbornly low after storms that should have increased them by so dramatically reducing refinery runs. Hence, we suspect that the 5-month old downwards trend must still be very much intact."

Industry Scoreboard

null

null

null

Industry Trends

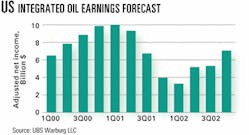

US INTEGRATED OIL COMPANIES' third quarter adjusted net income will decline 20% vs. third quarter 2001 figures, reflecting weaker refining margins and limited exploration and production volume growth, an analyst forecast.

"Individually, we expect (third quarter) company earnings to fall 11-46% (year-on-year), with the larger declines for those companies more leveraged to refining margins," UBS Warburg LLC analyst Matthew Warburton in New York said in a research note.

On a more positive note, he anticipates a rebound in earnings momentum for the integrated sector, saying he expects the third quarter to be the last quarter of negative YOY earnings momentum.

"We currently expect aggregate adjusted net income for the US oil majors to increase by 79% (YOY) in (fourth quarter 2002), marking the first quarter with positive (YOY) momentum since (second quarter 2001)," Warburton said. The first quarter of 2002 experienced the most pronounced downturn across all industry segments.

"Given our oil and natural gas price forecasts, normalized (refining and marketing) margins, and a further improvement in chemical fundamentals, we forecast earnings to rise 22% (YOY) in 2003 and fall 7% in 2004," he said.

West Texas Intermediate oil prices in the third quarter were the highest since the second quarter of 2001. "Nonetheless, we expected adjusted E&P earnings to decline 1% vs. (third quarter 2001) to $5.1 billion…," Warburton said.

He forecast that R&M earnings for the third quarter will decline 67% YOY to $700 million.

US NATURAL GAS pipeline companies are apt to find utilities and major integrated oil companies reemerge as their primary customers, Fitch Inc. analysts forecast.

This is because pipeline companies find themselves facing liquidity issues and regulatory uncertainties in the wake of the Enron Corp. scandal and resulting credit downgrades of merchant energy companies as a group. "In the past, Fitch has expressed some concern regarding a shift in the profile of a typical pipeline capacity holder to lower-rated energy marketers and traders and independent power producers," analysts Hugh Welton and Ralph Pellecchia wrote in a recent report.

"However, in today's new environment, many energy merchants are expected to relinquish this capacity as part of overall efforts to downscale energy marketing and trading activities and preserve liquidity," the analysts said.

They identified three trends likely to influence the credit quality of gas pipeline companies in the near to intermediate term:

The negative overhang of parent company credit problems and liquidity issues.

Increasing regulatory risk and oversight.

Evolving counterparty credit risk.

Meanwhile, natural gas end-user dynamics are unlikely to change, they said.

Government Developments

BRITISH COLUMBIA is cutting taxes, slashing regulations, and putting out the welcome mat for the energy industry.

Premier Gordon Campbell told a Ziff Energy Group conference in Calgary Oct. 28 that the province plans to unveil a comprehensive energy policy in November. He said the policy will encourage exploitation and exploration.

Campbell said his government hopes to generate $24 billion (Can.) in new energy investment in the next 5-6 years.

British Columbian energy development will focus on its conventional natural gas potential and on an estimated 90 tcf of coalbed methane. Campbell said the costs of CBM development will be recognized in a new royalty package under development.

He declined to put any date on when prospective areas off the British Columbia coast would be opened for exploration but said the government is working on scientific, environmental, and social concerns and developing a cooperative approach with Ottawa on the area, which is now under moratoriums against drilling.

"We can create an energy industry second to none in the Northwest, with British Columbia, Alberta, the Northwest Territories, and Alaska," he said, adding British Columbia can help fulfill US energy needs.

"Would you (the US) rather depend on Saudi Arabia or on Canadian energy? We can supply the US with secure energy."

Campbell was critical of Ottawa's position on the Kyoto Protocol on Climate Change and its plans to ratify the pact by yearend. The premier said Kyoto creates uncertainty about energy development.

"We have yet to hear federal targets on Kyoto and how they are to be met. We have yet to hear how Ottawa plans to mitigate economic damage. It will cost 11,000 jobs in (British Columbia)," he said.

US PRODUCERS are urging the White House and the US Environmental Protection Agency to revise stormwater drilling rules. Specifically, producers want the administration to retool an EPA proposal that would require oil and natural gas drillers to follow the existing stormwater regulations for general construction companies.

State and regional independent oil associations say 1987 amendments to the Clean Water Act gave oil and gas producers an exemption to stormwater runoff rules. Even if EPA believes it is still within its authority to remove that exemption, regulators should consider a blanket waiver for industry, the groups claim.

Stormwater runoff from oil and gas drilling sites has minimal to no impact on surface waters compared with commercial construction activities, producers said. Industry officials say EPA is considering waivers for certain situations in which a new water permit may be redundant or unnecessary.

Meanwhile, producer groups are threatening litigation, saying the current waiver proposal is too narrow.

Quick Takes

HURRICANE HYDROCARBONS LTD., Calgary, and Kazakh- stan state oil firm KazMunaiGas are undertaking a joint venture feasibility study for a 700 km "KAK" oil pipeline in Kazakhstan to extend from Kumkol to Aralsk in Phase I, and then from Aralsk to Kenkiyak.

KazMunaiGas will be operator, with minority interest holder Hurricane lending support and committing to ship available export volumes from its South Turgai basin oil fields to Atyrau under ship-or-pay contracts in order to facilitate project financing.

Hurricane said design, financing, and construction of the line could take 2-3 years.

An agreement between the two firms also confirms KazMunaiGas support for the construction of a 100,000 b/d pipeline that would connect Hurricane's Kumkol field to Aryskum and its Qyzylkiya, Aryskum, and Maybulak oil fields to a new rail terminal at Dzhusaly.

Peru has authorized Camisea downstream consortium Transportadora de Gas del Peru (TGP) to extend for another 18 months negotiations for rights-of-way on pipeline routes for the Camisea project. The original build, own, operate, and transfer (BOOT) concession called for ROWs to be established by Dec. 9, 2001. The date has been extended twice due to detours around archeological ruins or for geologic, environmental, or other reasons (OGJ Online, Apr. 1, 2002). An official said negotiations would not delay work on the project, which is already under way. The natural gas line will extend 697 km over the Andes Mountains to the southern coast and then north to Lima. The liquids pipeline will extend 575 km to the NGL fractionation plant on the southern coast. Camisea's BOOT concession commits it to complete the project by August 2004. TGP said that the pipelines are being built in different phases, and it expects these to be ready in first quarter 2004. Identifying land rights along the pipeline routes is expected to take as long as a year.

THE FEASIBILITY STUDY for the Camisea LNG export project led by Hunt Oil Co., Dallas, should be completed by yearend, according to Carlos del Solar, Hunt's general manager in Peru.

Engineering and design studies are due in early November, to be followed by a marketing and environmental impact analysis by yearend.

Hunt expects a decision on the LNG export project within first quarter 2003.

France's TotalFinaElf SA and Algeria's Sonatrach reportedly have expressed an interest in joining an LNG export concession and in taking shares in the Camisea project. Sonatrach already holds a 10% interest in the upstream project.

Pluspetrol SA is looking for a buyer for its share in TGP in the Camisea downstream concession and could possibly also sell part of its share in the upstream concession, said Alberto Moons, Pluspetrol's international business vice-president. He maintains, however, that Pluspetrol will continue to be the upstream operator.

Pluspetrol and Hunt Oil each own 36% in the concession for the development and production of Camisea natural gas and condensate and 19.2% in the transport concession (OGJ Online, Oct. 8, 2002).

CARRIZO OIL & GAS INC., Houston, has successfully completed and tested its Hankamer No. 1 exploratory well, drilled to 12,500 ft TD in the company's Liberty Project area in Liberty County, Tex.

On test, the well, which reached TD Oct. 4, flowed 10.49 MMcfd of natural gas and 772 b/d of oil at 7,166 psi flowing tubing pressure from 40 ft of net pay in the Cook Mountain interval.

Well operator Carrizo holds 40% working interest in Hankamer No. 1. Well partners are Palace Exploration Co., New York, and Choice Exploration Inc., Arlington, Tex.

Carrizo expects to begin sales from the well by late December, it said. Also, the company expects to spud another well in Liberty County later this year.

Unocal Corp. expects to complete by yearend the second appraisal well at its Trident ultradeepwater discovery in the Gulf of Mexico 185 miles southeast of Corpus Christi, Tex. The new well is on Alaminos Canyon Block 947, about 2 miles southwest of the original Block 903 discovery well (OGJ Online, July 24, 2001). The discovery well is in 9,687 ft of water. The Trident prospect area covers seven blocks in Alaminos Canyon. Unocal is operator and has a 59.5% working interest in the prospect. x‡ Pakistan has issued an oil exploration license for Block 2568-11 (Nawabshah) to a joint venture of Tullow Oil PLC subsidiaries Tullow Pakistan (Developments) Ltd. (operator with 45% ownership interest) and Tullow Pakistan (Operations) Pte. Ltd. 25% and Austria-based OMV AG unit OMV (Pakistan) Exploration GMBH 30%. The block, which lies in Prospectivity Zone III, covers an area of 2,335 sq km in Sindh Province. The JV is obligated to carry out geological and geophysical studies, a 300 line km seismic survey, and the drilling of one exploration well during Phase I of the initial 3-year term, with a minimum expenditure obligation of more than $6.2 million.

STATOIL ASA has exercised options in a contract with Aker Kværner for modification work in connection with the tie-back of Alpha North satellite field to Sleipner West field's A and T platforms in the Norwegian North Sea. Total value of the options is slightly more than 200 million kroner.

The work involves connecting all 18 km pipeline between Alpha North and Sleipner T and the control systems between the satellite and Sleipner A.

Alpha North is due to deliver condensate and gas Oct. 1, 2004, via the pipeline to gas treatment facilities on Sleipner T platform, where carbon dioxide will be removed and pumped into the Utsira aquifer. Condensate will be piped through an existing line to the Kårstø treatment complex north of Stavanger, while lean gas will enter the distribution network for gas from the Sleipner area.

Alpha North has reserves of 13 billion cu m of gas and 32 million bbl of condensate.

ExxonMobil Corp. unit Esso Exploration & Production Nigeria Ltd. has awarded a turnkey contract to Bouygues Offshore for the construction of a floating production, storage, and offloading vessel for use in the unit's deepwater Erha oil and gas field off Nigeria. The vessel will operate in 1,200 m of water on Block 209, about 100 miles southeast of Lagos (OGJ, Feb. 28, 2000, p. 55). The contract covers engineering, procurement, construction, towing, and commissioning of the FPSO, Bouygues said. The FPSO will have a hull 285 m long, 63 m wide, and 32 m high and will contain 24,000 tons of production modules and living quarters. It will have a storage capacity of 2.2 million bbl of oil and an initial production capacity of 165,000 b/d of oil. Hyundai Heavy Industries will supply the hull, and Bouygues Offshore subsidiary NISSCO will fabricate the 2,000 ton production modules. Esso's schedule calls for the FPSO to arrive at Erha field in mid-2005 and production to begin by yearend 2005. Erha field may contain 1 billion bbl of reserves. Nigerian National Petroleum Corp. is the concessionaire of the production-sharing contract for this block's lease.

BP Exploration Co. (Colombia) Ltd. has awarded a 5-year contract to Colombia-based Equipo to design, build, operate, and maintain an early production processing facility on Recetor Block in Colombia's Casanare region. Equipo is owned principally by Wood Group Engineering (Colombia) Ltd., a unit of UK-based John Wood Group PLC. The plant will be designed to handle 30,000 b/d of oil and 80 MMscfd of natural gas, and will generate its own power. Equipo will perform the administration, operation, and maintenance of the plant. Oil from Recetor will be supplied to BP's Cupiagua field central production, and gas from the early production facility will be reinjected. The Recetor reservoir is an extension of Cupiagua field in neighboring Santiago de las Atalayas license. BP operates and holds a 63.33% interest in Recetor.

PARS PETROCHEMICAL CO., a wholly owned subsidiary of the National Petrochemical Co. of Iran (NPC), has awarded France's Technip-Coflexip and Tehran-based Iranian engineering firm Nargan a contract for the design and construction of a 300,000 tonne/year low-density polyethylene unit for the ninth olefins complex at Asaluyeh.

The contract is valued at 100 million euros to Technip-Coflexip, the company said. The French engineering firm and Nargan, in which it holds a 20% stake, will oversee basic and detailed engineering for the unit as well as procurement of equipment and materials. The construction, commissioning, and start-up of the unit is expected to be completed in 34 months, the companies said.

The unit, which will use Stamicarbon technology, will be fed by ethylene produced by a 1 million tonne/year ethane cracker also designed and constructed by the Technip-Coflexip-Nargan partnership (OGJ Online, Dec. 17, 2001).

ENCANA CORP.'s western Canada natural gas storage capacity is expected to rise 40% to more than 135 bcf with the development in southeastern Alberta of a new 40 bcf gas storage facility.

The Countess storage facility, designed for peak injections of 950 MMcfd and peak withdrawals of 1.25 bcfd, will use two depleted underground gas reservoirs 85 km east of Calgary. The first 10 bcf of new storage capacity is scheduled to be available in second quarter 2003, and the additional 30 bcf, in April 2005.

The facility will be operated commercially as part of the AECO Hub, which comprises 85 bcf of gas storage capacity at Suffield, in Southeast Alberta, and 10 bcf of gas storage at Hythe, in Northwest Alberta. Once Countess is complete, EnCana will own and operate about 180 bcf of gas storage capacity across North America, with facilities in Alberta, California, and Oklahoma.

Construction is currently under way to double the capacity of EnCana's Wild Goose storage facility in northern California to 29 bcf of storage. With the two expansion projects complete by 2005, total peak withdrawal capacity of EnCana's North American storage network is expected to grow to 4 bcfd.

PAKISTAN NATIONAL SHIPPING CORP. (PNSC) has signed a 10-year contract of affreightment with Pakistan's three oil refineries—Pak-Arab Refinery Co. Ltd. (Parco), National Refinery Ltd. (NRL), and Pakistan Refinery Ltd. (PRL)—for the transportation of crude oil from three international ports.

Under the contract's terms, PNSC would purchase two oil tankers within 90 days to transport the oil. Currently, PNSC charters vessels to transport the oil.

The agreement ensures PNSC a total shipment of 7.35 million tonnes/year of crude oil; of that amount, PNSC would ship 4.1 million tonnes/year for NRL, 2.75 million tonnes/year for Parco, and 0.5 million tonnes/year for PRL.

Nippon Oil Corp. places Tateyama VLCC in service

Japan's Nippon Oil Corp. is now operating the new 300,000 dwt Tateyama very large crude carrier in regular service. The vessel, operating under the Panama flag, was delivered earlier this year to owner Aquamarine Shipholding Maritime SA, a Panamanian subsidiary of NYK Line (OGJ, June 3, 2002, p. 65). The oil tanker, built at NKK Corp.'s Tsu Works, is the first vessel NKK developed in the Malaccamax class. It is 333 m long, 60 m wide, and 29.6 m deep, with a 20.84 m draft, the maximum permissible dimension to sail through the Strait of Malacca. A DU Sulzer 7RTA84T engine powers Tateyama, enabling a service speed of 16.20 knots and making it one of the fastest tankers in this class.

Correction

Aframax tankers are 80,000-120,000 dwt, not 80,000-200,000 dwt, as reported incorrectly (OGJ, Oct. 21, 2002, p. 8).