OGJ Newsletter

Market Movement

Analyst sees storms helping refiners

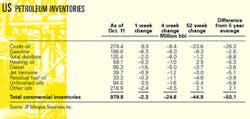

Back-to-back storms in the central Gulf of Mexico "have improved the lot of US oil refiners considerably" through a "massive transfer of tightness from crude oil into oil products," said Paul Horsnell, head of energy research for JP Morgan Chase & Co., London.

"The adjustment that the (oil production and refining) system had to make (because of the storms) was one of spreading the overall tightness more evenly between crude and products," he said. A similar change through market mechanisms would have involved cutting refiners' profits until they were forced to reduce runs. "Given the tendency of refiners to wait in the hope that others will cut first, that period could have become prolonged. Instead, the bulk of that adjustment has happened in one dramatic move," Horsnell said.

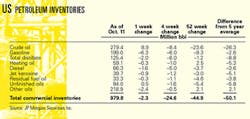

For 26 days in late September through mid-October, Tropical Storm Isidore and Hurricane Lili shut in 14.4 million bbl of oil production in the central Gulf of Mexico. But the effect of those storms eventually "should increase" US oil inventories "relatively to where they were before," Horsnell said. That, he acknowledged, "is perhaps not immediately obvious." As of Oct. 11, total US inventories of oil and petroleum products were 50.1 million bbl below the 5-year average (see table). However, Horsnell figures oil will flow into US inventories faster than refiners will ramp up storm-idled operations.

US Minerals Management Service reported gulf production had "almost returned to prestorm levels" by Oct. 18, with "only 105,000 (b/d) of oil and 670 (MMcfd) of natural gas" still shut in.

The American Petroleum Institute reported US oil inventories jumped 4.9 million bbl to 287.6 million bbl in the week ended Oct. 18. US distillate stocks increased 1.4 million bbl to 125.4 million bbl; gasoline stocks fell 2.9 million bbl to 197.2 million bbl.

"API data showed diametrically opposed inventory movements in crude and refined products for the second week running. Total crude and products increased by 3.5 million bbl but still remain 33.6 million bbl below last year's levels," said Matthew Warburton at UBS Warburg LLC, New York.

Imports hit high

Storm-delayed imports eventually will arrive, "and so factor out of the net calculations," Horsnell said in an Oct. 17 report. That same week, US oil imports rose by 1.7 million b/d to 9.9 million b/d, "the highest weekly level since April, partially reflecting clearance of the (Louisiana Offshore Oil Port) backlog," Warburton reported. "With imports likely to remain around current levels, we would expect crude inventories to continue to increase even if refinery runs recover further."

Runs at Gulf Coast refineries during the storm period "were nearly 2 million b/d lower than normal, and that may take some time to rebound fully," Horsnell said. "The fall in crude oil runs translates, due to volume gains in refining, to a larger reduction in oil product availabilities of over 27 million bbl."

The gasoline draw API reported last week "reflects the inherent lags in the product distribution system following the refinery disruptions (along the Gulf Coast) and seasonal maintenance. Refin- ery gasoline yields continue to be unseasonably high, driven by the abnormal economic signals from higher gasoline crack spreads relative to heating oil spreads," said Warburton.

Had the storms been the only factor, Horsnell said, US crude inventories as of Oct. 11 would have risen by 8 million bbl above the prestorm level, while oil product inventories would have fallen by 27 million bbl.

Instead, he said, "We had a net reduction of 6 million bbl in crude and of 18 million bbl in oil products. So far, there is an overall fall 5 million bbl greater than the hurricane effect, and beyond that the data would not have appeared to have caught up fully with either the rise in crude oil or the fall in oil products."

Industry Scoreboard

null

null

null

Industry Trends

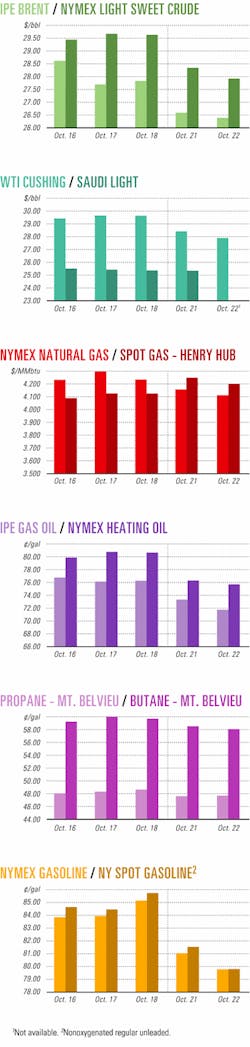

CHARTER RATES for very large crude carriers have skyrocketed within the past few months, said analysts at Poten & Partners Inc., New York.

They blame dwindling vessel availability and increased transportation activity for the escalating rates. Earnings topped $50,000/day in Oc- tober, up from $7,500/day in August when the market was much quieter. "This is only the fourth time since 1990 that rates have climbed to these levels," Poten said.

Several factors created this shift. The large crude carrier fleet is significantly smaller—by 14 vessels or about 5 million dwt—than it was in January because of heavy ULCC scrapping, analysts said (see table). At the same time, charter activity for the past 30 days has nearly doubled, Poten said. "Charterers are now fixing out 30-33 days compared with 21-24 days just a month ago to make sure they have a ship. Saudi Arabia and Iraq are cooperating by supplying crude for these shipments," Poten said. The early November dates on the Persian Gulf position lists already were thin because Gulf of Mexico storms delayed vessel lighterings and closed the Louisiana Offshore Oil Port, pushing back vessel return dates. That combined with increased activity off West Africa to make availability of suitable tonnage even thinner, Poten said.

In addition, a heightened state of uncertainty engendered by the attack on the Limburg tanker, the bombing on the island of Bali, and sniper attacks in the Washington, DC, area has fostered a sense that "it is better to cover requirements now than to wait," said Poten.

Nevertheless, the analyst said 20 newbuilds are scheduled for delivery by yearend, which should balance the fleet and allow vessels to return at full speed. This will temporarily increase supply and dissuade charterers from fixing further out in time.

US MARGINAL OIL WELLS are declining both in number of wells and production volume.

The Interstate Oil and Gas Compact Commission (IOGCC) said that the number of marginal wells was down by 8,170 to 403,459 in 2001 compared with 2000. Production, meanwhile, declined to 316.1 million bbl in 2001, down 9.8 million bbl from the previous year.

"As demand for oil and natural gas continues to rise, and reliance on imported oil continues to be a troubling reality, production from marginal wells must be encouraged," said Gov. Mike Huckabee of Arkansas, IOGCC chairman. The plight of marginal oil wells is a serious one, IOGCC members contend. Although production from each well averaged only 2.15 b/d in 2001, collectively, they make up 29% of US oil production.

Meanwhile, marginal natural gas wells showed an increase in production for the sixth consecutive year, IOGCC reported. Production reached 1.35 tcf in 2001 from 234,507 marginal gas wells.

Government Developments

PERU RATIFIED a 30% cut in royalties to help spur exploration activity and boost Peru's average 97,000 b/d oil production.

President Alejandro Toledo authorized state oil company Petroleos del Peru SA (Perupetro) to allow the cut. Royalties may not fall below 13.8% because legislation requires that Perupetro transfer 12.5% to the hydrocarbon-producing regions.

Perupetro's board approved the royalty reduction last year, but the measure stalled in the economy and finance ministry, despite 10 requests from companies waiting to modify their contracts for the new regulation.

Perupetro signed one exploration contract this year and is awaiting final approval for a second contract.

In another move to spur exploration, Perupetro has proposed royalties of 5% during a 6-year period for companies investing in new blocks in the future, but that measure has yet to be approved by two ministries and President Toledo.

Perupetro Pres. Antonio Cueto said the 5% royalty would apply to new investors and to companies already working in Peru that invest in exploring new areas.

Cueto wants to encourage new exploration because the last major discovery in Peru was in the mid-1980s with the finding of Camisea natural gas fields (OGJ Online, July 11, 2002).

A CANADIAN national renewable fuels strategy is being promoted by the Canadian Renewable Fuels Association.

CRFA called on the Canadian federal government to introduce a National Renewable Fuels Strategy. CRFA estimates the strategy would cost $400 million (Can.) over 7 years.

Bliss Baker, CRFA president, said, "This strategy is expected to create new markets for over 100 million bushels of Canadian grain and generate over $1.5 billion in direct investment in Canada. It will also help us lower greenhouse gas (GHG) emissions—helping us reach our Kyoto Protocol targets."

Lagging the US in ethanol production, Canada has built one ethanol plant in 10 years and has no ethanol mandate, Baker said. The US has legislation pending before Congress to mandate the use of ethanol in gasoline from coast to coast.

The CRFA called for a three-pronged program that would include:

A national renewable fuels standard mandating specific levels of ethanol and biodiesel content in gasoline. This mandate could be phased in over time while the Canadian ethanol industry builds capacity.

Producer incentives matching US levels of support to encourage greater production of ethanol and biodiesel in Canada.

Research and development support for expanded technology applications. This would allow for continued research into newer, more efficient applications of ethanol technology, such as cellulose ethanol technology.

The proposed program would eliminate over 30 million tons of GHG emissions during the Kyoto commitment period from 2008 to 2012.

Quick Takes

ENI SPA subsidiary Agip KCO (formerly Offshore Kazakhstan International Operating Co.), operator of a North Caspian Sea production-sharing agreement off Kazakhstan, reported that hydrocarbons have been found with the Kalamkas well in the Kazakhstan sector of the Caspian Sea. The North Caspian PSA covers 5,600 sq km.

The Kalamkas exploration area is near giant Kashagan field, also Agip KCO-operated, which was declared a commercial discovery June 30 with estimated reserves of 7-9 billion bbl of oil (OGJ Online, June 28, 2002).

The Kalamkas-1 well was spudded Aug. 4 and drilled to 2,360 m TD. On test, the well yielded an initial flow rate of 2,300 b/d of oil through a 32/64-in. choke. Following test completion, the well will be abandoned.

Other members of the North Caspian Sea PSA consortium are BG Group PLC, ENI, ExxonMobil Corp., Royal Dutch/Shell Group, and TotalFinaElf SA, each with 16.67% interest; and ConocoPhillips and Tokyo's Inpex Corp., each with 8.33% interest.

Thai authorities have granted five new production licenses in Thailand to existing concessionaire groups: Thai Shell Exploration & Production Co. Ltd. (South Pratu Tao prospect, part of the onshore Block S1), Pacific Tiger Energy Inc. (Wichian Buri License II field, onshore on Block SW1A), Harrods Natural Resources Inc. (Jasmine field, on Block B5/27 in the Gulf of Thailand), and PTT Exploration & Production PCL (Pikun field, on Block B13/38 and Tong Rang field on Block 15, both in the gulf). The awards follow seven other onshore and offshore blocks Thailand's Ministry of Industry awarded earlier this month after a 2-year delay (OGJ Online, Oct. 2, 2002). The latest approval, covering a total production area of 168 sq km offshore and onshore, will add 100 MMcfd of natural gas, 15,000 b/d of crude oil, and 1,000 b/d of condensate to Thailand's petroleum output. Thailand's hydrocarbon production, mostly natural gas, increased 5.8% in the first 7 months of this year to 463,000 boe/d.

THE US National Transportation Safety Board ruled earlier this month that the rupture of an Olympic Pipe Line Co. gasoline pipeline in Washington in 1999 probably resulted from inadequate inspection procedures and poor oversight of valve testing, among other factors.

Nearly 237,000 gal of gasoline from the break spilled into a creek near a Bellingham, Wash., park June 10, 1999, igniting about 11/2 hr later and killing three people. Property damage amounted to at least $45 million, Olympia told NTSB.

NTSB made two safety recommendations, calling for better training for pipeline personnel and for pipeline operators to develop new standards to test relief valves.

Williams Oil Gathering LLC has awarded a contract to Horizon Offshore Inc. subsidiary Horizon Offshore Contractors Inc. to install 49.96 miles of 20-in. oil pipeline in the Gulf of Mexico for the Mountaineer shallow-water pipeline system, which is part of Williams's Devils Tower project. Horizon will employ its Lone Star Horizon pipelay barge and Pecos Horizon lay-bury barge for this line, which will be installed in water 8,270 ft deep. Installation is expected to commence during the fourth quarter, with completion scheduled for first quarter 2003.

PETROLEOS MEXICANOS SA awarded contracts to Pride International Inc., Houston, for two additional Gulf of Mexico jack up to drill in the Bay of Campeche. Pemex is contracting the Pride Nebraska and Pride Alaska for 2,123 days, at a total contract value exceeding $79 million. Drilling operations are expected to commence in mid-November.

Pemex also is finalizing agreements with subsidiaries of Noble Corp., Sugar Land, Tex., for the use of four 300 ft independent-leg, cantilevered, jack ups in the Bay of Campeche.

The Noble Gene Rosser commenced a 917-day contract on Sept. 29, and the Noble Sam Noble is expected to begin a 1,082-day contract by the end of October. Tropical Storm Isidore and Hurricane Lili delayed previously anticipated commencement dates for the use of the Noble Johnnie Hoffman for 981 days and the Noble John Sandifer for 960 days. Both contracts were to have been initiated by Oct. 30, but the date for the Noble John Sandifer will be delayed as a result of damages it sustained by the storms (OGJ Online, Oct. 22, 2002). Pemex and Noble are discussing the possible effects of such a delay.

With the commencement of these contracts, Noble will have five 300 ft, independent-leg, cantilever jack ups operating for Pemex in the Bay of Campeche.

Meanwhile, the Noble Leo Segerius, a dynamically positioned drillship, which is under a 3-year contract to Petroleo Brasiliero SA in Brazil, will not recommence operations under its contract until this week, rather than Oct. 1, as previously projected, said Noble.

The delay was precipitated by strikes of Brazilian customs personnel that hindered the importation of key components. The unit, which will be outfitted with Noble's aluminum alloy riser, has been undergoing refurbishment-upgrade and is now undergoing commissioning and acceptance testing for Petrobras.

LYONDELL CHEMICAL CO., Houston, completed the lab-scale testing of a one-step, direct oxidation, propylene oxide (PO) technology and is ready to pilot the process on a larger scale.

The company plans to build an integrated pilot plant at its technology center in Newtown Square, Pa., as a final demonstration of the technology before commercialization, said Ed Dineen, Lyondell senior vice-president, chemicals and polymers.

The new technology will produce PO without requiring an auxiliary feedstock facility, such as a hydrogen peroxide plant, Dineen said, and it produces PO without a coproduct such as styrene or tertiary butyl alcohol. Consequently, such a plant would require less capital investment than plants using other technologies, and investment decisions would not be influenced by market conditions for coproducts, he said.

"We continue to work with Sumitomo Chemical Co. Ltd., our partner in the Nihon Oxirane Co. Ltd. joint venture, on a pioneering PO-cumene plant in Japan that is scheduled to be operational in 2003," said Peter Gaines, Lyondell's global vice-president, oxygenated chemicals. "This technology, developed by Sumitomo as part of an ongoing technology cooperation with Lyondell, is particularly suited to the Japanese market, where there is currently an oversupply of styrene," Gaines said.

Lyondell also is building a new PO-styrene monomer plant in Rotterdam, scheduled for start-up in 2003. It will be jointly owned by Lyondell and Bayer AG.

Taiwan's state-run Chinese Petroleum Corp. (CPC) has confirmed that it is reviving a plan to build Taiwan's eighth naphtha cracking plant. CPC Pres. Pan Wen-yen said that the plan would be finalized within 3 months. The plan calls for a facility that will be considerably larger in terms of both area and production capacity than Taiwan's sixth naphtha cracking plant, built and operated by the Formosa Plastics Group at Mailiao. Projected capacity will be 450,000 b/d of naphtha with an output of 2.6 million tonnes/year of ethylene, 1.63 million tonnes/year of propylene, and 420,000 tonnes/year of butadiene. CPC earlier had shelved the plan for the new naphtha cracker because of financial uncertainties, the inability to decide on a location for the project, and opposition by environmentalists.

The original plan called for developing the project with the cooperation of nearly a dozen partners, and the company hopes to attract partners willing to share the cost this time as well. Potential partners being named are Grand Pacific Petrochemical Corp., Taiwan Styrene Monomer Corp., Taiwan Polypropylene Co., the Far Eastern Group, and China Petrochemical Development Corp. Pan said, however, that CPC is determined to carry the plan through this time and will go ahead with the project whether or not the potential partners come on board. In addition, Chang Hung-chiang, vice-president of CPC's petrochemical business department, said that the company has the financial capability to complete the project even if potential partners fail to sign on. CPC projects that an investment of $7.2 billion will be required for the first stage of the planned cracker. The plan has received the backing of Taiwan's Ministry of Economic Affairs with Economics Minister Lin I-fu saying that the ministry will actively work to encourage other companies to join the project. He added that the ministry supports Nanchou in Pingtung County as the site for building the cracker.

ENCANA CORP., Calgary, and joint venture partner MGV Energy Inc., the Calgary-based subsidiary of Quicksilver Re- sources Inc., Fort Worth, have begun development drilling in the previously announced coalbed methane project on the Palliser Block in southern Alberta (OGJ Online, Feb. 28, 2002). The action is based on test results from 100 exploration and pilot wells drilled to date.

"Based on the (testing) resultsUwe are moving to the first CBM commercial development in Canadian history," said Mike Gatens, chairman and CEO of MGV Energy. "This projectUis a major step for CBM production in Alberta," he added.

With three rigs drilling, the JV anticipates completing about 50 new wells by yearend, and the remainder of the initial 250-well Palliser development program will be completed in 2003, with follow-up programs also planned for next year.

Most existing wells on the Palliser block are shut in awaiting connection to sales lines, Quicksilver said.

The JV has 14 wells already producing gas into sales lines on an extended test basis, and it expects to book CBM reserves this year. Wells should produce 30-250 Mcfd of methane each, the company said.

The JV anticipates proved reserves of 1-2 bcf/section. The 1 million acre Palliser Block has 300 sections, which represent about half of the JV's total acreage.

Statoil ASA has awarded a contract valued at almost 300 million kroner to Dragados Offshore SA, Madrid, to build the riser balcony and flare boom for Kristin field's floating production platform. The completed structures are due to be shipped in March 2004 from the Dragados yard in Cadiz to Aker Stord, north of Stavanger, for hook-up with the rest of the topsides, said Nina Udnes Tronstad, Statoil operations vice-president for Kristin. The Kristin floater, scheduled to become operational Oct. 1, 2005, is being designed to produce 126,000 b/d of condensate and slightly more than 18 million cu m/day of rich gas from 12 subsea wells. Kristin field will deliver 35 billion cu m of gas until 2016. Its output of condensate and natural gas liquids is estimated at 220 million bbl and 8.5 million tonnes, respectively.

Total investment in the Kristin development is estimated at 17 billion kroner.

Calder platform installed in East Irish Sea

Burlington Resources (Irish Sea) Ltd. has successfully installed its Calder field platform in the East Irish Sea off Barrow, Furness, England. First-phase hook-up is expected to be completed by early November. The unmanned platform has production facilities to accommodate at least six wells, and the Ensco 85 jack up is slated to begin drilling three wells early next year. First gas is anticipated in late 2003, with production to peak at 145 MMscfd. Total Calder field reserves are estimated at 294 bcf of gas.

Burlington next year will install a 24-in. gas export pipeline and 3-in. methanol line linking the platform to the new £60 million Rivers joint venture gas processing terminal under construction in Barrow. Production from the nearby Crossans and Darwen reservoirs also will be delivered there, via subsea wells tied back to the Calder platform. Centrica PLC will operate the terminal on behalf of Burlington.

Rivers JV is a partnership of Allseas UK Ltd., which will procure and install the pipelines, and Genesis Oil & Gas Consultants Ltd., which is responsible for all detailed design, procurement, fabrication, installation, and hook-up of the Calder platform and power cable. Photo of the platform under tow courtesy of Burlington Resources.