Special Report: US independents grappling with changing energy policy, limited access to land, capital

The role of US independent exploration and production companies continues to evolve along with the changing industry environment.

Amid tensions in the Middle East—particularly regarding President George W. Bush's proposed military campaign against Iraq—US E&P firms also must negotiate a labyrinth of domestic political issues and market volatility challenges.

As with other operating companies in the oil and gas industry, US E&P independents must struggle with holding down operating costs while they implement their business strategies despite price fluctuations and other uncertainties that influence the bottom line.

The E&P firms that will thrive are the ones that successfully adapt to meet business challenges that include:

•The opportunities and hurdles emerging from a new national energy policy, currently being hammered out by a House-Senate conference committee.

•Finding high-quality assets—particularly natural gas assets—with a high rate of return and upside potential for growth.

•Effectively raising capital and attracting investors despite the public's current distrust of the stock markets and worries about corporate ethics.

•Anticipating the impact that production quota decisions by the Organization of Petroleum Exporting Countries will have upon oil and gas prices.

US energy policy

US independents—perhaps more so than any other oil and gas industry group in the US—are keeping abreast of developments within the House-Senate conference committee as they debate the country's energy policy.

"At issue is whether or not the conferees can sort and choose between the myriad issues to come up with a final bill that is a net benefit to the US," said Independent Petroleum Association of America Chairman Diemer True.

Independent operators are paying particularly close attention to certain "hot button" issues that would directly affect US operations. These include tax reforms (contained in both the House and Senate bills), limitations on regulation of hydraulic fracturing under the Safe Drinking Water Act (Senate bill), provisions addressing access to federal onshore and offshore resources (House and Senate bills), and the placement into law of a royalty-in-kind program (House bill).

True said that if a "reasonable" conference title can be reported back to each respective body, even if Congress runs out of time, the legislation would serve "as the foundation for the next Congress."

Despite the sweeping nature of the energy bill, however, there are still some within industry who think that its components don't take enough of a long-term strategic approach in addressing US energy issues. "You can't just produce more oil and gas," said Thomas R. Kaetzer, president and CEO of Houston-based independent GulfWest Energy Inc. "You have to tell people that they need to conserve (energy), and you need to have a long-term goal for alternative, nonfossil fuels," he told OGJ.

Kaetzer added that the US needs an energy policy that does the following:

Sets long-term goals—15-30 year objectives—regarding improved fuel economy and an expanded use of renewable and other energy sources.

Sets near-term goals that are realistic and that fill the immediate and near-term energy needs. Some questions to ask are: Which energy sources will meet US demand next month and in the coming years? What pollution-reduction goals are realistic? What technologies do we need now and in the future? What price are we willing to pay for our energy?

"Most of the public does not really understand energy consumption, energy generation, fuel sources, and environmental impact," Kaetzer said. "Implementing an energy policy to meet both energy demand and environmental improvement goals will come at a cost, and when Americans get 'hit in the pocketbook' with an energy-environmental policy, they will then ask, 'What happened?' and they won't be happy. They need to be educated for this day of reckoning."

Backing the energy bill

IPAA has been advising its membership not to oppose certain bill provisions just because they aren't as attractive as others, True said: "We've had a number of people who have come to us saying, 'We don't care about this provision or that provision. We'd prefer that you opposed it.' IPAA has resisted that. With this bill, when you start pulling on one thread, we're afraid you are going to unravel it."

Ray Singleton, president and CEO of Denver-based Basic Earth Science Systems Inc., told OGJ, "We hope that the industry-supported provisions of the energy bill get passed. However, we recognize that a bill is helpful only so long as the lawmakers who are supportive of the responsible development of mineral resources are able to remain elected." He added that any gains that are achieved could easily be "undermined by an administration with a different agenda."

Whatever shape the new energy bill—if passed—takes, there is no doubt that it will have some profound effects on how independents restructure their operations in the US.

In April, Salomon Smith Barney Inc. analyst Robert Morris noted that management at Houston-based EOG Resources Inc. was "particularly upbeat" about certain provisions included in both the Senate and House versions of the energy legislation.

"Both versions include tax credit provisions for production from tight gas sands and Devonian shale formations," Morris said. "The Senate version of the bill includes tax credits for future wells, while the House version includes provisions for existing wells. In either case, EOG stated that it would likely alter its drilling and spending strategy if the tax credit provisions are included in a final bill, since the company has an abundance of tight gas sand and Devonian shale opportunities," he said.

Access to properties

A major concern for US independents is the dwindling list of drilling prospects in the country.

"The (prospect) cupboard is bare, at least on a relative basis," said James K. Wicklund in a Banc of America Securities LLC report. "When natural gas prices started to run up over 2 years ago, oil companies accelerated drilling and basically used up their top-tier prospects," he said. "It takes time to fully develop another generation of drilling prospects, and they are generally not likely to be as good, big, or easy to find as the previous batch. So prices must be higher."

However, some say that producers might suddenly see more top-tier prospects if they were to raise the conservative low prices on which they plan projects to reflect the more bullish price levels predicted by analysts.

Earlier this month, Banc of America Securities raised its 2003 price forecast for West Texas Intermediate crude by $2.50 to $23.50/bbl because current production levels of the 10 active members of the Organization of Petroleum Exporting Countries have failed to offset declines in Iraq's oil production. UBS Warburg LLC is projecting commodity prices of $23/bbl for West Texas Intermediate and $3.35/Mcf for natural gas in 2003. Moreover, Lehman Bros. Inc. hiked its fourth quarter price outlook by 40¢ to $3.90/MMbtu for gas and by $1 to $29/bbl for oil.

Yet, an executive of one independent told OGJ his company is still planning projects on commodity prices of $18/ bbl for oil and less than $3/Mcf for gas.

Meanwhile, "buyer" and "seller" markets for natural gas and oil properties "come and go, both ways," said Bob Simpson, chairman and CEO of XTO Energy Inc., Forth Worth. "With these (current gas) prices, the economics are high, but there are still opportunities to buy properties," he said. "We are just as likely to find another deal as an exploration company is to make another wildcat discovery. There's always something to buy or sell, always another deal worth consideration.

"We have more good prospects than we've ever had before, and we're drilling them," said Simpson.

XTO Energy has a portfolio of "legacy assets" rich with development opportunities. "These assets will fuel our gas production growth of 20% this year; with 10-12% targeted in 2003 and 2004. For this year, we'll see our reserves grow to over 3 tcfe, up 50% in just 3 years. Perhaps most important, our low-risk strategy has consistently delivered exceptional economic returns on capital invested, year after year," Simpson said.

More than half of Twinsburg, Ohio-based North Coast Energy Inc.'s (NCE) 299,000 net acre leasehold is undeveloped, providing the company with more than 1,000 potential drilling locations. "This represents more than 7 years of drilling locations at the company's current high rate of activity," said Omer Yonel, NCE president and CEO.

As for the acquisition of properties, Yonel said, "It's a buyer's market for good buyers." Because NCE outperforms its peers in increasing the value of properties in its niche market, he said, "We can afford to pay a premium" for good properties.

"The opportunities are there," Yonel said. "Acquisitions and divestitures are cyclical. Large companies rationalize their properties when prices go down. We're well-positioned to take advantage of that."

NCE needs to expand beyond the Appalachian basin, said Yonel. "We're looking at how to do this. We're looking at other companies that have expanded, to avoid making the same mistakes," he said.

Basic Earth's Singleton said his company has refocused its strategy and is now concentrating on drilling instead of acquisitions and also focusing on Canada instead of the US for finding additional reserves.

"The biggest reason we have abandoned acquisitions as a strategy is we've seen our success on acquisitions decline and the quality of the properties that we have been successful in acquiring decline," Singleton said. "We've seen a reduction in the results of our exploitation efforts, and that's really shifted us away from acquiring oil properties in the (US portion of the) Williston (basin)," he said.

"We are decidedly pessimistic about the acquisition market in the Williston basin for reasons quite specific to that basin," Singleton said. "First, in this high oil-price environment, the seller's expectation is particularly high. We see a lot of risk in the event that those prices decline. There are a small number of surviving Williston players who are very savvy and willing to pay for upside. That makes the acquisition environment extremely pricey and competitive."

Moreover, he said, "The property packages that we are seeing out there are much too large for Basic, as small as it is, to digest without significant debt or equity dilution. In a lot of cases, we are essentially precluded from getting into the data room just because of our small size."

After operating on federal lands in the Rockies for 20 years, Singleton said, "We have been stunned by the relative ease of obtaining permits and access in Saskatchewan. It's been refreshing to be operating in an area where the government recognizes and applauds your contributions to the local economyUThey want us there."

Access to capital

Despite current strong commodity prices, producers still have difficulty raising money from equity investors.

"Slippage in (exploration and production) share price performance has occurred despite a generally stronger trend for gas and oil prices over the last 4 weeks," said Stephen Smith of Stephen Smith Energy Associates, Natchez, Miss., in an Oct. 14 report.

Bruce E. Lazier covers about 30 E&P companies with market caps ranging up to $5 billion. A principal in and the senior petroleum investment analyst for Ispyoil LLC, Dallas, an institutional energy research and investment banking boutique, he raises investment funds for smaller E&P companies.

"Generally, you can't get people (who) want to trade these stocks. The public markets are crummy," Lazier said. "My advice to small, well-established, mature public companies is to think about going private if you have good cash flow."

The cost of doing business for small public companies is getting more expensive, Lazier said, citing escalating costs for accounting and for board of directors insurance.

Pure exploration companies are the ones struggling the most because the public equity market "has dried up" and banks only want to lend money for low-risk, proved developed projects, Lazier said.

"There generally are more exploration prospects than there is money available," Lazier said. Ironically, there are investors willing to lend money to oil and gas companies in exchange for a direct interest partnership, he said.

Typically these types of investors want an exit strategy in which they can obtain a threefold to fivefold return on their investment in 3-5 years.

GulfWest's Kaetzer agreed with Lazier that independents having enough cash flow for financial endurance face promising long-term fundamentals because US gas production is dropping significantly while gas demand is increasing.

"Regarding the capital markets, what we probably need is time and patienceUThe capital markets for independents will remain tight; private and public financial institutions have lost too much in the stock market, and this leads to cautious investing; people are apprehensive about the economy and their investments in general, and this spills over to our capital-raising markets," Kaetzer said.

OPEC's role

The decision by the 10 quota-bound members of OPEC to cut production quotas at the start of 2002 has "finally produced the desired effect of eliminating the first quarter inventory glut, despite a steady increase in OPEC cheating as the year progressed," said Smith. He predicted the Paris-based International Energy Agency will report oil stocks among Organization for Economic Cooperation and Development countries at 40 million bbl, or 1.5%, below seasonal norms at the end of the third quarter, compared with 50 million bbl above seasonal norms as of June 30.

"Historically, steady increases in OPEC cheating are viewed as evidence of eroding cartel discipline, and prices weaken in response," Smith noted. However, he said, "In addition to the potential for war-related disruptions, the market looked upon this year's cheating with a much kinder eye. The reason is that the surplus oil inventory of March 2002 has been eroding steadily for the last 6 months."

Smith observed, "The market's view appears to be that 'cheating' is not really cheating if done within limits so as to continue to tighten oil inventories."

Recent production trends among OPEC members seem to confirm the general perception of a war premium as part of current oil prices, said Tyler Dann, a Houston-based analyst with Banc of America Securities (OGJ Online, Oct. 11, 2002). "OPEC production volumes have remained relatively low in absolute terms since April," he said. "Production levels this low relative to crude oil prices are unusual but perhaps appropriate, given statements made from within the organization that there remains a $5/bbl risk premium embedded in the oil price."

However, Dann said, "Based on our analysis, the war premium is now around $1-3/bbl and is becoming increasingly justified by inventory fundamentals, particularly in the US market."

He said, "While OPEC is producing 2.8 million b/d above (its) stated quotas, the group is still producing 2.1 million b/d less than (it) did in January 2001, over which time global oil demand has only declined by roughly 300,000 b/d, or 0.4%. Over this time period, OPEC has given up approximately 11% of their market share to non-OPEC producers."

Iraqi concerns

During early October, prices weakened in US and London oil futures markets after Iraq signaled that it is willing to readmit weapons inspectors from the United Nations, thus apparently weakening the US push for immediate action against that country.

However, futures prices rose again in mid-October after the US Congress authorized President Bush to act unilaterally against Iraq, and investigations indicated a terrorist attack was responsible for an explosion on a French oil tanker off Yemen (see related item, p. 7).

"What is going on in the Middle East is sort of like an elephant moving—it's going to push everything else around a little bit," observed Nicholas C. Taylor, president of Midland, Tex.-based independent Mexco Energy Corp.

"We could see a quick spike in the oil price as events in Iraq transpire," said Dann. "We believe that the oil markets are relatively more certain about potential conflict in Iraq now than during the months (in 1990) leading up to Iraq's invasion into Kuwait and the following allied attacks in the 1991 (Persian) Gulf War. However, incremental news of immediate conflict could spike the oil price on the potential of supply shocks."

UN or US military action against Iraq could trigger a price spike, Dann said, if:

The war spreads to other regions. "Concern that Iraq could shoot a missile into Israel or that anti-US sentiment would spread to other regions and exacerbate an already touchy East-West balance in the Middle East could translate into a higher probability of risk of damage to oil infrastructure, simply due to more countries or more time being involved."

Iraq disrupts shipping through the Strait of Hormuz. "Our sources indicate that it would be difficult for Saddam (Hussein) to target this region, bearing in mind that the southern no-fly zone (in Iraq) would be off-limits as a launch site. Nonetheless, the risk remains, however unlikely, and would likely contribute to an oil price spike."

Facing ouster, Hussein blows up Iraq's oil fields, as his troops did in Kuwait. "This is anybody's guess."

However, a "restructured Iraq" under a new government has bearish implications over the long term, opening the country to outside investment and quickly increasing its oil production capacity as the UN ban on oil exports outside the organization's oil-for-aid program is removed, Dann said.

In a separate report, Smith said, "The new Iraqi leadership might demand that OPEC allow maximum Iraq production (about 2.8 million b/d) to offset the lost exports of the Saddam years and threaten to leave OPEC if this demand is not met."

According to that scenario, he said, "The OPEC-10 comply with Iraq's demand, but reduced quotas for the OPEC-10 increase the level of cheating and dissension. The war risk premium, of course, is gone. WTI slips to $23-27/bblUdue to lack of a war-risk premium, normal supply-side pressure from Russia-Caspian gains, and a general deterioration in cartel discipline."

On the other hand, Paul Horsnell, with J.P. Morgan Securities Inc. in London, claims such an outcome "seems to imply tossing the coin several times and always getting heads." (OGJ Online, Sept. 26, 2002).

"To get to a major sustainable downside-price-move scenario, a lot of things have got to go right for the US," he said. "The change in regime in Iraq would have to be swift and, if not bloodless, would need to take place with a minimum of military action and be confined to Iraq. A sustainable political solution would be needed that maintains Iraq's territorial integrity, and Iraq would have to be governable. Iraq's transition to a new regime would have to be faster and more successful than Afghanistan's."

Moreover, Horsnell said, "Arab opinion (in other Middle East countries) would have to be incensed less than necessary to change (their own) governments or change policy, and the Iranians would have to be comfortable with events." Horsnell questions if it's rational to expect any Iraqi government to take action to collapse world oil prices. "If defending oil prices is rational for democratic and pro-US governments such as Mexico and Norway," he said, "it is not clear why things would be different for an even more oil-dependent government in Baghdad."

More important, he said, Iraq won't be capable for years of significantly increasing its production above its current capacity of 2.6 million b/d.

Oil prices

"Oil price strength should continue in the near term as lower-than-normal inventories (particularly in the US), a lack of a quota increase on the part of OPEC, a forecasted seasonal demand increase from the onset of winter in the Northern Hemisphere, and Iraq war speculation prove to be bullish factors," Dann said. "These factors are all likely to continue to play a role through yearend 2002 and into the first half of 2003."

However, he said, "We remain concerned that prices will fall in the second half of 2003 as Iraqi supply is likely to resume and seasonal demand falls."

Meanwhile, Dann said, benchmark crude prices continue to defy gravity. The price for WTI "has risen by 49% since the beginning of 2002. Brent crude also has risen by 47%, not quite keeping pace with the US benchmark, allowing for a widened WTI-Brent spread (now at $1.33/bbl). We see several reasons for the strength in crude oil markets as they stand right now."

Smith observed, "There are now two factors arguing for $30/bbl oil—tight inventories and the risk of war-related disruptions. We'd bet on $30/bbl (WTI) as long as both of these conditions prevail. But over the next 6 months, odds favor both of these conditions changing." He said, "Our bet is that OECD stock shortages will have diminished and that the prospects for war-related disruptions will have diminished as well. This would argue for an easing of WTI prices to perhaps the $23-27/bbl range."

However, he added, "A winter demand increase, no matter how slight, should continue to shift the already strengthened oil market balance."

Mexco's Taylor said, "Market conditions affect Mexco the most, with the wide fluctuation in the prices for oil and gas. Price stability is important for planning purposes."

He added, "We have talked to a number of operators out here, and that is one of the things that is causing operators to defer development in exploration and development—the unpredictability of prices. The price of oil can be $10(/bbl) one day and a few months later, it's $30(/bbl), and then it's back down at $10(/bbl). But we move ahead. We have (oil) projects that we work at low prices."

On the other hand, Taylor said, "We are very excited about gas prices."

Gas prices

Salomon Smith Barney meteorologists in Chicago early this month predicted more-normal temperatures across the continental US this winter, compared with last winter's "extremely warm" conditions. As if on cue in response, an early cold front sparked an Oct. 14 jump in natural gas futures prices to $4.15/Mcf—"highs not seen since June 2001," said analysts at Enerfax Daily.

"We expect tight gas markets at some point in 2003, with timing depending largely on the severity of winter," said analyst Smith. "As a result, we believe that we will see several months of $4-plus gas in 2003, which should be enough to cause a upward move in midcycle gas price expectations."

"Gas wants to be in the $3-4/Mcf range," said XTO Energy's Simpson. "Any period where the price is below or above that band will be a brief one."

The industry's peak deliverability of natural gas has been tested "only once in the last 5 years, and it failed miserably, with prices spiking at $10/Mcf," said Simpson. "That's not healthy, and I hope it doesn't happen again."

NCE's Yonel said he doesn't expect US gas prices to fall below $3/Mcf in the near term. But prices eventually could surge to $9-10/Mcf "if we go to war with Iraq or electric (power) demand picks up," he said.

"There is going to be a point where there is more downside than upside in the pricing structure," said Pogo Producing Co. Chairman, CEO, and Pres. Paul G. Van Wagenen. "Fundamentals of natural gas appear still to be very strong, as far as we're concerned, but winter hasn't come yet."

He said, "Natural gas is driven largely by the weather; oil is driven by world politics and, as we know, that's in the state of some amount of flux right now. So it's hard to guess. But the prices are good, and at times like this, it behooves you to at least review the possibility of laying in some hedges to protect yourself. The principal reason to hedge your prices ought to be to lock in your budget and to make sure that you have a strong balance sheet."

Singleton at Basic Earth said, "At our current size, the stock market, I think, has very little impact on us. I think the principal market that shapes us more than anything is the price of oil and the shape of the forward curve if we choose to hedge, given our high percentage of oil production.

"We have hedged in the past. In some cases, we looked like we were really, really brilliant, and sometimes we looked like we were really foolish. I think the lessons learned were that certainly it is a useful technique, it is insurance, but at times, it can be extremely costly. In a lot of cases depending upon the instrument that you are using, you don't really know what the cost is until after the fact. Especially the so-called zero-cost collars," Singleton said.

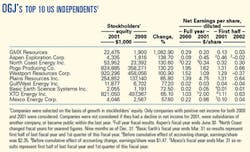

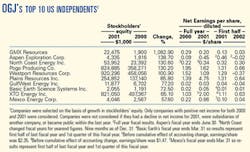

The companies profiled in the sidebar articles are the top 10 fastest-growing US independents—in terms of stockholders' equity growth—according to their ranking in the latest OGJ 200 (see table on p. 19 and OGJ, Sept. 9, 2002, p. 72).