OGJ Newsletter

Market Movement

null

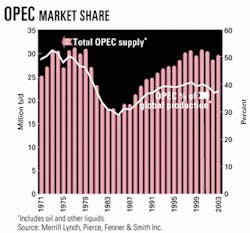

Merrill Lynch: OPEC accomplishes mission

Even as ministers of the Organization of Petroleum Exporting Countries prepare for their Sept. 19 meeting in Osaka, analysts at Merrill Lynch, Pierce, Fenner & Smith Inc. have already declared OPEC's "mission accomplished," in sustaining world oil prices through "the worst global demand in 20 years."

"OPEC has safely navigated through the storm," said five Merrill Lynch analysts in a report issued Sept. 6. "OPEC's output cuts in 2001 and 2002 significantly mitigated the impact of negative demand shocks caused by a slowing economy and the (Sept. 11, 2001, terrorist) attacks."

In fact, OPEC did such a good job that Merrill Lynch early this month increased its 2002 forecast spot price for US benchmark West Texas Intermediate crude to $25/bbl from $24/bbl previously, "as oil prices have rallied above our prior forecast in response to rapidly declining inventories." Merrill Lynch's 2003 oil price forecast is still stuck at $24/bbl, which the analysts described as "conservative, despite the fact that it remains several dollars higher than consensus expectations."

More important, they said, OPEC's strategy of cutting production to compensate for a weak economy is about to pay off for its members by permitting them to expand market share without a price war (see chart).

"While reduced output volumes in 2001 and 2002 did temporarily reduce OPEC's market share, OPEC's share is set to expand in 2003," said Merrill Lynch analysts.

"Increasing global demand and declining inventories will require OPEC to increase production by the end of 2002 to avoid a significant decline in inventories."

Without an increase in OPEC production, financial models used by Merrill Lynch indicate US oil inventories will plummet to 6.3% below normal by yearend and that oil prices could spike to more than $30/bbl early next year.

"While many pundits point to a 'war premium' as the reason for robust oil prices, we believe that improving supply-demand and inventory fundamentals are the much more important driver of higher oil prices," Merrill Lynch analysts reported.

Bear tales

Market bears have advanced "several stories" to support forecasts of falling oil prices "including 'tankers at sea,' 'China inventories,' 'higher Russian volumes,' 'declining OPEC market share,' 'Nigeria and Algeria pulling out of OPEC,' and the like. The bear call of the day currently focuses on the notion that, post-Saddam Hussein, Iraq will rapidly flood oil markets. The reality is that a meaningful increase in Iraqi export capacity would require 3-4 years to put in place," the Merrill Lynch analysts said.

"Many bearish calls relating to oil prices and energy shares center around the notion that ultimately OPEC will be forced to 'crash' prices to increase market share relative to non-OPEC producers. These arguments generally focus on OPEC's short-term reduction in market share as the organization reduced output to compensate for slowing demand," they said. "OPEC's outlook, however, is over the longer term, and longer term, the secular slowing in the rate of non-OPEC supply growth leaves OPEC in the strongest position since the 1970s."

Since 1992, OPEC generally has commanded a 39-40% share of the world oil market. "While OPEC's market share did briefly decline to 38% in the first half of 2002," said the analysts, "the need for 700,000-1 million b/d of incremental OPEC oil during late 2002 will allow OPEC to regain market share and achieve the mid-$20s oil price required to meet (its members') domestic budgetary requirements."

Saudi Arabia requires an oil price equivalent to $25/bbl for spot WTI to satisfy its domestic spending requirements, the analysts said.

"While the oil demand shock immediately following the Sept. 11, 2001, (terrorist) attacks prompted the Saudis to originally budget a draconian 21% reduction in government expenditures, higher-than-budgeted oil prices have allowed the Saudis to exceed the original spending budget," they said.

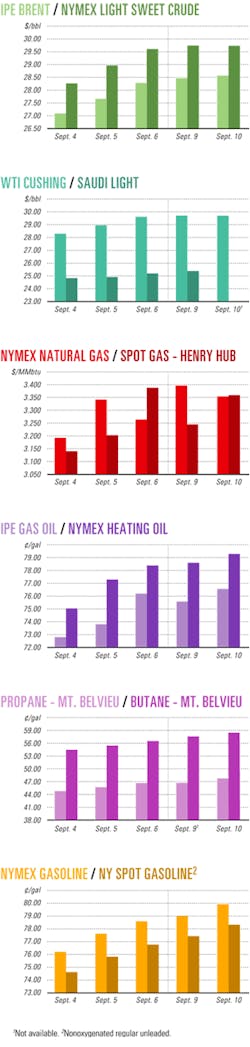

Industry Scoreboard

null

null

null

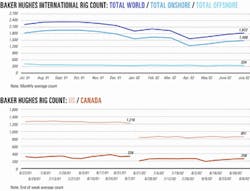

Industry Trends

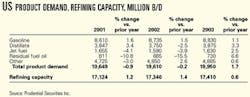

US REFINING MARGINS are expected to remain under pressure for the near term, but heating oil inventory levels offer a glimmer of potential improvement. "We expect heating oil inventories to become a more important factor influencing refining margins in the coming months as the industry has exited the prime gasoline season and is now entering the winter heating season," said Andrew Rosenfeld of Prudential Securities Inc.

Heating oil inventories are 8% above levels for the same time last year but have not grown as expected for months because of lower refinery operating rates and because several refiners have used heating oil as gasoline feedstock, Rosenfeld said.

Total US refined product inventories are 4% higher than levels for the same period last year even though refining operating rates have been at or below 5-year lows most of the year, he said.

Refining margins are expected to expand, assuming the winter is colder than normal. Prudential maintains its 2002 US refining margin forecast of $4.15/bbl, compared with its normalized estimate of $4.65/bbl. In 2003, Prudential expects refining margins to rebound to its normalized estimate of $4.65/bbl. The refined products demand contraction experienced through July prompted Prudential to cut its 2002 refined products demand growth rate forecast to -0.2% from 0.5% (see table).

If this forecast proves correct, 2002 would be the second consecutive year of negative US refined product demand growth-which has not happened since the 1990-91 recession.

IN SINGAPORE, refining margins are expected to remain under bullish pressure because South Korea's fuel oil production is dropping and Russian fuel oil exports are expected to drop. Large run cuts and lighter crude slates are combining to dramatically reduce South Korean fuel oil production this year. At the same time, Russia announced a 100% tax hike on fuel oil exports beginning this month.

Boston-based Energy Security Analysis Inc., in the latest issue of its Pacific Basin Stockwatch, reported that these factors combined should keep Singapore's fuel oil margins strong. "(South) Korean fuel oil production is averaging 150,000 b/d less through the first 7 months of 2002," said Rick Mueller, ESAI oil analyst. "Even though domestic demand is down this year, the greater fall in production has dramatically slashed (South) Korean exports."

Meanwhile, the Russian government wants to build domestic stocks in order to prevent a repeat of last winter's shortages. ESAI believes falling Russian exports in the third quarter should keep fuel oil prices strong.

Government Developments

US HOUSE AND SENATE lawmakers resumed negotiations last week on sweeping energy reform legislation.

Conference Chairman Billy Tauzin (R-La.), chairman of the House Energy and Commerce Committee, disagrees with growing pessimism that consensus can't be reached before the congressional calendar ends for the year.

Votes are anticipated soon on relatively noncontroversial items, such as pipeline safety legislation and energy efficiency. During this latest energy bill markup, members will be allowed to comment on the other, more prominent pieces in the bill, such as industry access to the Arctic National Wildlife Refuge coastal plain, clean fuel guidelines, and energy tax proposals.

Oil and gas trade associations are working to keep the legislation a top priority in the minds of lawmakers and the public. For example, the Independent Petroleum Association of America stressed that, irrespective of ANWR, there is a plethora of items of interest to their members.

Tax reform is a key item on the immediate agenda, IPAA said. Other examples include reduced royalties for marginal production when prices are low, a permanent royalty in-kind program, resolving regulation of hydraulic fracturing under the Safe Drinking Water Act, limited royalty incentives for water depths of 400 m and greater, and a study on the impact of incentives for offshore and onshore production.

IPAA Chairman Diemer True acknowledged that some important issues-such as land access-will always be the target of litigation. Nevertheless, he argued that Congress and the White House should pursue policies encouraging more domestic production.

True said he anticipates that a 2003 update of the 1999 National Petroleum Council study on natural gas supply and demand would further highlight the need for energy legislation designed to encourage domestic supply.

True predicted that researchers may find even more untapped potential in public lands that are now severely restricted or off-limits to industry. The 1999 report was prepared in response to a request from the secretary of energy to provide advice on the potential contribution of natural gas in meeting the US's future economic, energy, and environmental goals. The primary focus of the study was to test supply and delivery systems against significantly increased demand.

Pending pipeline safety legislation is expected to be resolved sooner rather than later. Both the House and Senate passed legislation reauthorizing pipeline safety rules. Pipeline companies prefer the House version, which is separate, stand-alone legislation and is not in the House energy bill (OGJ Online, July 25, 2002). In the Senate version, companies support the adoption of a modified provision regarding community right-to-know, which industry says has been adjusted to shield security-sensitive information from public release.

Pipeline companies also called on lawmakers to support a new Alaska gas pipeline that would transport North Slope gas to the Lower 48.

Quick Takes

DUKE ENERGY INTERNATIONAL (DEI) unit Duke Energy Corp., Charlotte, NC, has started up its $246 million Tasmanian natural gas pipeline, Australia's longest subsea pipeline project. The newly completed pipeline links Tasmania to the Australian mainland gas network via a connection to the DEI Eastern gas pipeline at Longford. The pipeline project includes 455 miles of subsea and onshore pipeline and the conversion of the 120 Mw Bell Bay power station on Tasmania to natural gas-fired operations (OGJ, June 3, 2002, p. 9).

Duke Energy said that the pipeline "delivers on a promiseellipseto bring a new, competitive, and reliable energy supply to Tasmania to fuel industrial growth and spur long-term employment opportunities in the state."

Separately, Duke also announced the start of construction of the VicHub project, a DEI initiative that will enable gas to flow freely between Victoria, New South Wales, and Tasmania through construction of a link between the Eastern gas pipeline, Tasmanian gas pipeline, and the GasNet pipeline system.

In other pipeline advances, TransCanada PipeLines Ltd. (TCPL), Calgary, has ordered 500 tons of X-100 (Grade 690) steel line pipe-touted as the world's first commercial production of the light-weight, high-tensile-strength pipe-which it plans to install on a 1 km section of its 63.5 km Westpass expansion, south of Calgary. The pipeline carries natural gas to British Columbia and the western US along the west leg of TCPL's Alberta system. NKK Corp., which began development of the X-100 steel pipe manufacturing technology in 1987, will supply TCPL with the single-jointed, 48-in. pipe with 14.3 mm wall thickness. It will be delivered in mid-September, and construction is scheduled to begin shortly thereafter. "We are committed to operating a safe system, so we are testing to see (the pipe's) constructability," TCPL said.

The company said it wants to determine the safety factors and ease or difficulty of operations involved in constructing a pipeline using the new pipe. "We just want to see how it is in handling, welding, (and) moving," said a company representative. Development of high-strength, low-alloy pipe such as X-100 is part of a group of technological innovations that the industry hopes will lower project and operating costs while improving efficiency and safety. Although the TCPL installation will be the first commercial application of X-100 line pipe, tests have been conducted, including a 3-year trial of the high-grade pipe-from four manufacturers-carried out during 1996-99 by BP Exploration Operating Co. Ltd., BG Technology, and Shell Global Solutions. A report of those findings was published in 1999 (OGJ, Mar. 15, 1999, p. 54).

ANR Pipeline Co., a unit of El Paso Corp., Houston, has applied to the US Federal Energy Regulatory Commission for approval to construct its proposed $42 million Westleg natural gas pipeline in the Midwest.

The 26 mile, 30-in. pipeline would parallel ANR's existing Madison lateral to provide as much as 220 MMcfd of additional natural gas service to northern Illinois and southeastern Wisconsin. The new line would replace two smaller pipelines along the Beloit lateral. ANR said it has obtained most of the permanent easements and has forged an agreement to supply as much as 60 MMcfd to Wisconsin Power & Light for the utility's planned 600 Mw Riverside plant. Pending FERC approval, the Westleg project is expected to reach completion by November 2004.

A JOINT VENTURE of Enterprise Products Partners LP and Marathon Oil Co. let a lump-sum, turnkey contract to Technip-Coflexip for the engineering, procurement, construction, and start up of a 350 MMscfd cryogenic gas processing train at the Neptune gas processing plant near Morgan City, La.

The plant-owned by Enterprise 66% and Marathon 34%-currently has a capacity of 300 MMscfd. It provides midstream services to natural gas producers operating on the Continental Shelf and in the Gulf of Mexico deepwater.

The expansion is slated for completion in September 2003.

VAALCO ENERGY INC. said production is now under way in Etame field off Gabon following completion of the third development well in August. The ET-1VA well, vertically drilled, flowed 4,130 b/d through a 48/64-in. choke. Previously, ET-3H and 4H wells were drilled horizontally about 1,300 ft through the reservoir and tested 7,600 b/d and 9,800 b/d of oil, respectively.

Etame is estimated to hold more than 150 million bbl OOIP, 30 million bbl of which is recoverable (OGJ Online, June 25, 2002).

Vaalco said it anticipates production of about 15,000 bo/d this month.

Oil from Etame is being produced using the Petroleo Nautipa floating production, storage, and offloading vessel, which is anchored in 250 ft of water. Vaalco leased the 1.1 million bbl storage capacity FPSO for 2 years, with options for 3 more years of service. Vaalco also said it has successfully secured $6.2 million in additional financing to help pay for its share of the development project and other planned exploration activities on the Etame block.

In other production news, Norsk Hydro ASA has installed the first downhole multiple fiber-optic sensors combined with surface-controlled downhole flow-control components, according to Weatherford International Ltd., supplier of the intelligent-well technology. The sensors, in Well E-11C in Oseberg East field in the Norwegian North Sea, include pressure and temperature gauges and a distributed temperature sensing line, which provide production management data and enable strategic reservoir management during the field's life.

EXXONMOBIL CORP. subsidiary Mobil Producing Nigeria Unlimited (MPN) has begun development of the $1.2 billion Yoho project off Nigeria, planning an early production system (EPS) to produce first oil almost 2 years ahead of full field start-up.

MPN will temporarily utilize the Falcon FPSO to begin production of about 90,000 b/d of oil late this year.

"The commencement of Yoho construction activities, including the first deployment of an EPS in West Africa, represents an important milestone for ExxonMobil in Nigeria," ExxonMobil said. "The ability to advance productionellipseby over 2 years not only improves the project's economics but also meets the (Nigerian) government's objective of increasing production capacity."

Yoho field, on Nigerian National Petroleum Corp. (NNPC)-MPN joint venture acreage on shallow-water Oil Mining Lease 104, has reserves of 400 million bbl of oil. Yoho facilities will develop discoveries in both Yoho and Awawa reservoirs in waters 200-300 ft deep.

MPN has awarded construction and fabrication contracts valued at more than $400 million for Yoho offshore facilities that will also include additional wellhead platforms, a central production platform, a living quarters platform, and a floating storage and offloading vessel to replace the FPSO. Local contractors will be used for significant aspects of the development such as fabrication of jackets, bridges, and pipe coatings for the main offshore facilities, ExxonMobil said.

Full field start-up in 2004 targets peak oil production of 150,000 b/d. Produced gas will be reinjected.

The Nigerian government holds 60% interest in the Yoho JV, through NNPC, and operator MPN holds the remaining 40%.

In other development news, TotalFinaElf SA, which recently became operator of Tempa Rossa oil field in the Basilicata region of southern Italy, said development of the field would begin next year, with first production expected in 2006. The project incorporates the now-unified Gorgoglione and Tempa d'Emma concessions. Five exploration wells and a sidetrack well were drilled in the field in the 1990s and tested, yielding 20° gravity, 6% sulfur crude oil. Production will be piped via the Val d'Agri-Taranto pipeline to Agip Petroli's refinery in Taranto on Italy's coast for treatment and then exported. Proved reserves are estimated at 420 million boe, with associated gas accounting for about 7% of the total. Tempa Rossa is expected to reach a production plateau of 50,000 b/d of oil, TotalFinaElf said. The company recently purchased former operator ENI SPA's 25% interest in the field, giving TotalFinaElf a 50% ownership interest as well as operatorship of the field. Other partners are Enterprise Oil Italiana 25% and Mobil Oil Italiana 25%.

PHILLIPS PETROLEUM CO. (now ConocoPhillips) has awarded a contract to Aliso Viejo, Calif.-based Fluor Corp. to perform engineering, procurement, and construction upgrade services on the company's 89,000 b/d refinery at Ferndale, Wash.

The upgrade-which is being performed to comply with the US Environmental Protection Agency's new regulations initiating the production of cleaner gasoline-will involve the installation of a new cat gasoline desulfurizer unit utilizing Phillip's S Zorb sulfur removal technology. The contract also includes the revamp of an existing gasoline splitter unit.

Engineering work for the project began in June; construction is slated to begin in October and is due to be completed by fourth quarter 2003.

BP TRINIDAD & TOBAGO (BPTT) has announced the discovery of 1 tcf of gas in Iron Horse field off the east coast of Trinidad.

"This confirms our long-held view that this country possesses a world-class gas basin," BPTT Chairman Robert Riley said.

Iron Horse was discovered in mid-July, 24 miles off Trinidad's east coast close to the Amherstia, Cassia, and Red Mango fields. The Chiles Coronado jack up (renamed the Ensco 76) drilled the discovery well in 230 ft of water. It was spudded on June 12, drilled vertically to 13,471 ft TD, and completed early last month.

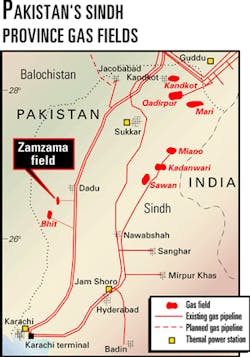

In other exploration activities, Pakistan granted an exploration license to a JV for Manchar Block 2667.5 in the country's Dadu district of Sindh Province. The JV consists of ENI SPA-through its wholly owned subsidiary Lasmo Oil Pakistan Ltd.-55% (operator); Pakistan Oilfields Ltd., a subsidiary of Attock Oil Co., 22.5%; and local company Mari Gas Co. Ltd. 22.5%. The block is about 200 km north of Karachi near Bhit gas field and covers a 2,435 sq km area. It falls in Prospectivity Zone III and lies in the same sedimentary ba- sin as that of adjacent Zamzama gas field (see map), which has 1.7 tcf proved and probable gas reserves (OGJ Online, June 24, 2002). Under the JV agreement the partners will invest at least $6.7 million with an additional contingent in- vestment of $5.55 million based on the outcome of results in the first 2 years. Lasmo also has working interests in Zamzama, Miano, and Sawan gas fields; Kadanwari gas field, which has been supplying gas to the national market since 1995; and Bhit field, which is expected to commence production shortly.

ONGC Videsh Ltd. (OVL), the wholly owned subsidiary of the Indian government-owned Oil & Natural Gas Corp. (ONGC), has signed a farmout agreement with Turkish Petroleum Overseas Corp. to acquire a 49% equity stake in two inland oil and gas exploration blocks in Libya. One block, in Libya's prolific Sirte basin, measures about 2,100 sq km; the second block, in the Ghadames basin, is spread over an area of 6,600 sq km. "We expect to complete the seismic survey of both exploration blocks shortly, and have scheduled the drilling of the first exploratory well in 2003," said OVL's Managing Director Atul Chandra. "We are awaiting formal approval from the Libyan government."