Market Movement

EIA: Summer gasoline prices likely lower than last year

US gasoline pump prices for spring and summer 2002 are expected to average $1.46/gal, about 8¢ lower than last year's average of $1.54/gal, according to new US Energy Information Admin- istration projections. "In general, motor gasoline market conditions in the United States are less tight at the beginning of the driving season this year than they were in 2001," EIA officials said.

Motor fuel demand traditionally rises after the Memorial Day federal holiday at the end of May.

However, EIA cautioned that sharply higher crude oil prices over the past few months and tightening oil markets worldwide have moved gasoline prices up rapidly this spring from winter lows.

"US crude oil and gasoline inventories are now above last year's levels but are expected to decline to less ample levels through the summer and into the fall. US motor gasoline inventories were 8.8 % (17 million bbl) above year-ago levels at the end of March," EIA said.

Gasoline prices most likely will remain below the 2001 average for the driving season, but there is a slight possibility it could be higher than last summer's levels, especially if refining problems develop or the crude oil market gets tighter, EIA said.

Even with a larger inventory cushion this year, the summer average for nominal pump prices is expected to be the third highest on record, after 2001 and 2000. Adjusting for inflation, the all-time record summer gasoline price was recorded in 1980, when it was $2.65/gal in 2001 dollars.

Oil price outlook

Looking at oil markets, EIA said average crude oil prices moved up rapidly in March to $24.50/bbl from the average February level of $20.75/bbl for West Texas Intermediate. The average WTI price for 2002 is now projected at about $25.00/bbl, EIA said.

"Continued strong compliance by the Organization of Petroleum Exporting Countries producers [with] current quotas and continued economic recovery in 2002 are important factors in our forecast for oil prices this year. Questions about the extent of the non-OPEC production response, worldwide economic strength, and other factors result in uncertainty concerning potential oil prices over the next 7 quarters."

Gas, power outlook

US dry natural gas production is projected to fall by about 4.7% in 2002 compared with the 2001 level. Natural gas storage levels were projected to end the heating season [Mar. 31] at 1.569 tcf, more than double the 742 bcf seen at the same time last year, EIA said. "Despite rising demand stemming from lower relative natural gas prices, particularly in the industrial and electricity generating sectors, there is a strong possibility of spot gas prices slipping to about $2.40/Mcf by midsummer from the current range of over $3.00/Mcf," EIA said.

Depending on weather and overall market conditions, natural gas prices are expected to be $2-3/Mcf for most of the year, with higher ranges likely entering the next heating season, EIA predicted.

This summer, total electricity demand is expected to be nearly level with last summer's demand due to both weather and economic factors.

"Total annual electricity demand growth is estimated to have beenellipse-0.7% in 2001 but is expected to begin to revive slightly in 2002 and to grow by 3.2% in 2003," EIA said. Midwinter heating demand and a solid recovery in the industrial sector are expected to yield higher growth in 2003," EIA said.

Industry Scoreboard

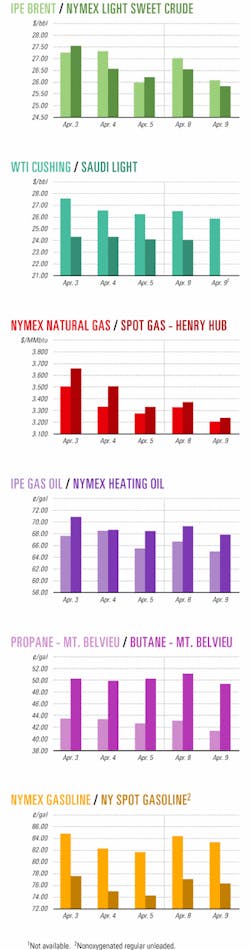

null

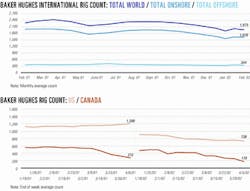

null

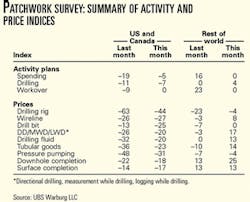

null

Industry Trends

Oil and gas companies generally expect to increase their upstream capital spending plans over the next few months, particularly for projects outside the US and Canada. Also, pricing expectations for oil field products and services are expected to decrease in the US and Canada, while they will likely increase in the rest of the world.

These are some of the findings of UBS Warburg LLC's second monthly PatchWork Survey. UBS released its first survey last month (OGJ, Mar. 25, 2002, p. 7). The responses underpin an index pegged to a weighted average ranging from 100 to -100. The size of a positive value indicates the relative sentiment for an increase in that price or activity, and the converse is true for the negative values.

The survey revealed that 32% of those responding on planned activity in the US and Canada said they expect to decrease spending, with 26% expecting to increase spending. For operations outside the US and Canada, 24% said they would increase spending, while the same percentage said they would decrease spending.

"The recent surge in commodity prices should further encourage oil companies to loosen their purse strings and to start spending again," UBS said. "If commodity prices manage to stay near their current lofty levels, which are far above the levels built into any respondents' spending budget, we expect the risk of further declines in expectations to be minimal," UBS added.

Expectations for product and service pricing in the US and Canada-although remaining "solidly negative"-have improved over last month, according to respondents. "Perhaps operators are starting to believe that they are getting closer to squeezing as much as they can from oil service companies and that the bottom is near," UBS suggested.

Meanwhile, "Internationally, respondents expected prices for oil field services to increase marginally in the next 2 months, reversing the negative expectation that they had last month," UBS said.

Government Developments

A bolstered federal budget for oil and natural gas research and development projects for the US Department of Energy's Office of Fossil Energy would be a "wise investment," in US energy security, said Arkansas Gov. Mike Huckabee. Huckabee, who is the new chairman of the Interstate Oil & Gas Compact Commission (IOGCC), made the statements in testimony presented to the US House Subcommittee on Interior and Related Agencies Appropriations. Currently, cuts in federal spending in R&D for the oil and gas industry have "created a critical situation," Huckabee said.

The subcommittee, which is chaired by Rep. Joe Skeen (R-NM), will determine the fiscal year 2003 budget.

"While there are differences in opinion about effective energy policy, there is little argument against the importance of research and development in our country's energy future," Huckabee said. "In fact, many experts believe R&D is the most important factor in maximizing the availability and utilization of petroleum resources."

In a recent IOGCC-commissioned study, a decline was noted in R&D spending by the oil and gas industry, while dependence on foreign oil has been on the rise. "The bulk of domestic oil and natural gas exploration and production is now done by independent companies that lack the resources and infrastructure for significant R&D," the report said.

Domestic oil and gas supplies, Huckabee stated, are the US's "best hedge against disruptions and increasing import dependency." F

US government and industry officials said support in Congress is waning for various lease swapping proposals now being considered as the Senate deliberates a comprehensive energy bill this spring.

Senators from Louisiana and California wanted to see legislation that would close a decades-old, billion-dollar dispute between industry and California over offshore oil leases (OGJ Online, Feb. 18, 2002). Their proposal directed the Secretary of the Interior to provide oil companies holding California leases with a swap of equivalent value in the Gulf of Mexico within 30 days of the bill's passage.

A similar plan was considered by Florida and Texas lawmakers, industry sources said.

But Department of the Interior officials predicted Apr. 5 that it was unlikely any amendment would formally be offered as part of the Senate energy bill.

US Sens. Barbara Boxer and Dianne Feinstein (D-Calif.) and John Breaux and Mary Landrieu (D-La.) said in February their proposal would cancel the 40 remaining nonproducing offshore oil and gas leases in California and create an environmental preserve to permanently protect these areas. The plan did not impact the 43 federal tracts now producing oil and gas. The bill also banned future drilling, but existing federal and state laws already prevent companies from doing so.

Industry trade groups had avoided commenting publicly on the proposal, but several oil companies privately lobbied against the swap arrangements because they feared the companies that did not hold leases in Florida or California would be left with an unfair competitive disadvantage.

Quick Takes

CHEVRONTEXACO CORP. reported what it is calling a "significant" oil discovery with its Tahiti prospect on Green Canyon Block 640, 190 miles southwest of New Orleans in the Gulf of Mexico.

The well, Tahiti No. 1, was drilled to 28,411 ft MD in 4,017 ft of water. The well was drilled with Transocean Sedco Forex Inc.'s Discoverer Deep Seas ultradeepwater drillship.

"Results from the exploratory well indicate the presence of high-quality reservoir sand with total net pay of more than 400 ft," said Tahiti partner Enterprise Oil PLC.

Operator ChevronTexaco holds a 58% working interest in the Tahiti prospect. Other Tahiti partnership interests are held by PanCanadian Energy Corp. 25% and Enterprise 17%.

Separately, Enterprise reported that partner and operator Royal Dutch/Shell Group has temporarily suspended the drilling of the Deep Mensa well on Mississippi Canyon Block 687 in the Gulf of Mexico.

The well has been temporarily abandoned at 27,278 ft due to technical reasons. "The main objectives of the well were not reached, and the operator and partners will now examine data from the well to determine whether to reenter the well at a later date," Enterprise said.

In other exploration news, Mallon Resources Corp., Denver, and Smart Exploration Inc., Tulsa, have agreed to form a joint venture to explore and develop the Fruitland formation coal seams under Mallon's East Blanco prospect in New Mexico's San Juan basin. The companies signed a letter of intent calling for a finalized exploration agreement by May 1. That agreement will require Smart Exploration to drill a pilot project of six horizontal test wells on Mallon's acreage in order to earn a 50% interest in the venture. Mallon will commit 58,000 acres to the project (OGJ, July 16, 2001, p. 44). Mallon Chairman George O. Mallon Jr. said, "We have long held a substantial coal acreage position and a good database of information, but we have been without the expertise to properly explore the coal ourselves." Smart Pres. Berry J. Mullennix said, "Having recently sold our coalbed methane project in the Arkoma basin, we have been looking for another CBM opportunity. Mallon's coal appears to be ideally suited to our proprietary horizontal drilling and completion techniques."

Repsol-YPF SA said it has presented to the Fuerteventura local authorities plans for oil and gas exploration in the Atlantic Ocean off the Canary Islands. Early last year, Repsol-YPF was seeking government permission to explore for oil on nine blocks comprising 6,160 sq km in the waters surrounding the islands (OGJ, Mar. 12, 2001, p. 39). In January, Repsol-YPF received the required government permits to explore an area 32-80 km off the Canary Islands coast, just west of Lanzarote and Fuerteventura islands. "Activity in this area is classified as 'high-risk exploration,' meaning that there is no proof of the existence of hydrocarbons," Repsol-YPF said, although surveys carried out during 1978-83 by former Spanish state-owned firms Eniepsa and Hispanoil "gave grounds for positive expectations." Repsol-YPF said it is currently acquiring and processing 3,000 sq km of 3D seismic and will continue doing so through 2003, aiming to start drilling wells in 2004. Repsol-YPF also plans to initiate an environmental impact assessment of the area.

Kerr-McGee Corp. and Ocean Energy Inc. announced a deepwater natural gas discovery at their Merganser prospect on Atwater Valley Block 37 in the Gulf of Mexico. Kerr-McGee operates the block, in which each company holds a 50% interest. The discovery well, 1 OCS 21826 No. 1, was drilled to 21,268 ft in 7,900 ft of water and found 150 ft of gas pay. Gross estimated reserve potential is 200-400 bcfe. Ocean and Kerr-McGee expect to drill an appraisal well later this year to further evaluate the field. Merganser was drilled under the deepwater exploratory drilling joint venture between Kerr-McGee and Ocean that calls for the two companies to jointly explore and develop oil and gas prospects on more than 1 million undeveloped acres in the deepwater gulf.

Olympic Peru Inc. plans to begin its first commercial sales of nonassociated gas by mid-April.

That is when it expects to have its final technical certificate from Osinerg, Peru's organization for the supervision of the energy industry.

Perupetro SA, the state oil company, earlier certified that Olympic completed constructing, filling, and testing its Paita natural gas pipeline. That project included construction of a 6-in. gas line running about 50 km northwest from Olympic's natural gas fields to the gathering station system and Paita port.

Olympic Peru operates Block 13 in Peru's Sechura Desert, which the company began exploring and developing in 1996.

The Austral Group fisheries complex is to be the first customer for an initial 3 MMscfd of Olympic Peru's gas. The complex plans to convert its boilers to gas from residual fuel to reduce costs.

Olympic said it has two other contracts in the offing and is negotiating with other fisheries groups at Tierra Colorada, adjacent Paita. It would require installation of an additional 2 km of pipeline, along with connections to the plants, to serve that market.

At the start of this year, officials in the hydrocarbons bureau of Peru's energy and mines ministry certified Olympic's proven reserves at 194.90 bscf of dry gas, the company reported.

Among other production events, Anadarko Petroleum Corp. has started a fourth oil production train at Hassi Berkine central processing facility (CPF) in Algeria. Startup of the 75,000 b/d train-which ties in production from five satellite fields on Block 404-will eventually increase output from the four-train CPF to 285,000 b/d of oil, Anadarko said. Partners in the Hassi Berkine South project are Algerian state oil firm Sonatrach, ENI SPA unit Lasmo Oil (Algeria) Ltd., and Maersk Olie Algeriet AS, a unit of Denmark's Maersk Olie & Gas AS, each holding 25% interest. Production through the fourth train from Block 404 marks the completion of the development plan at the Hassi Berkine CPF, Anadarko noted. Production from the first train began in May 1998. Production from the second and third trains were started, respectively, in August and December 2001 (OGJ, Jan. 21, 2002, p. 9).

CONSTRUCTION of the Thai-Malay natural gas pipeline will likely be delayed yet again.

The fate of the pipeline, which would transport gas from the offshore Thai-Malay Joint Development Area (JDA), is in the hands of the Thai government that was elected earlier this year. The government has set in motion a request for another environmental assessment of the project.

Late last year, Thai authorities had approved construction of the project-which would involve laying a 336 km gas pipeline between the Gulf of Thailand and Malaysia and the construction of a related onshore gas processing plant-but the project continued to face opposition in the southern Thai province of Songkhla (OGJ Online, Jan. 5, 2001). Construction of the two 425 MMcfd gas processing units was slated to begin in Songkhla earlier this year, and the entire project was scheduled to be completed and operational by midyear.

The project will be operated by Trans Thai-Malaysia Ltd., a 50:50 joint venture of Petroleum Authority of Thailand and Petronas. The main section of line, which will carry gas from the JDA to the separation plant, will have capacity for more than 1 bcfd.

Elsewhere on the pipeline front, Black Hills Energy Inc., a unit of Black Hills Corp., Rapid City, SD, has acquired Equilon Pipeline Co. LLC's outstanding interests in Millennium Pipeline Co. LP and Millennium Terminal Co. LP, both based in Houston. Black Hills originally held a one-third interest in the pipeline. The purchase will give Black Hills 100% ownership in the Millennium companies, it said. The value of the deal was not disclosed. Millennium Pipeline owns and operates a 200 mile, 12-in., 65,000 b/d crude oil system that extends from Beaumont, Tex., to Longview, Tex. Millennium Terminal has 1.1 million bbl of oil storage in Beaumont. "The Millennium system is presently operating near capacity through shipper agreements," Black Hills said.

PAKISTAN is seeking to help Iran develop its compressed natural gas motor fuel industry.

As one of the world's largest CNG motor fuel users, Pakistan is in a position to provide technical expertise and cooperation to develop and promote the CNG industry in Iran, a government official said.

Pakistan Natural Resources Sec. M. Abdullah Yusuf made the comment recently to a six-member Iranian delegation led by Chief Advisor to the Minister for Oil Fereidoun Saghafiyan.

CNG stations are economically viable in Pakistan, which is why the CNG industry is being promoted at an accelerated pace, Yusuf said. Pakistan currently has 200 CNG refueling stations, and that figure is expected to double in 2 years, he added.

The Hydrocarbon Development Institute of Pakistan (HDIP) introduced the CNG industry to Pakistan in 1982. After HDIP demonstrated pilot stations at Karachi and Islamabad, the government formulated Pakistan CNG rules in 1992 and commercialized CNG as an alternative motor fuel.

The government has declared all the equipment for CNG stations and vehicle concessions exempt from import duty and sales tax for 5 years, Yusuf said, adding that Pakistan has prioritized replacing diesel with CNG to cut costs for imported diesel.

Pakistan has 24.9 tcf in natural gas reserves, and given current consumption-production levels, those reserves are expected to last for about 31 years. Gas discoveries in the country date to the 1950s, when state-owned Oil & Gas Development Corp. (OGDC), with the help of some international partners, discovered natural gas in Sui field. This is Pakistan's largest field, with a current production of 650 MMscfd (OGJ, Jan. 28, 2002, p. 24.)

DEVELOPMENT of White Rose oil field is progressing.

Husky Oil Operations Ltd., operator of White Rose oil field, and its partner Petro-Canada announced plans to proceed with the White Rose development off the east coast of Canada and have awarded a $400 million engineering, procurement, and construction contract for all topsides facilities to Aker Maritime Kiewit Contractors (AMKC).

Peter Kiewit & Sons Co. owns 51% of AMKC, while Aker Kvaerner owns 49%. AMKC will work on the contract from a joint venture base in Newfoundland, AMKC said.

The White Rose development plan is focused on installing a floating production, storage, and offloading vessel with a capacity to handle production of 100,000 b/d. Plans call for 19-21 wells to recover up to 250 million bbl of oil over a 10-15 year period. Peak production of 92,000 b/d is expected to be sustained for 4 years, Husky said. White Rose is 350 km east of Newfoundland in 115-130 m of water (OGJ, Jan. 21, 2002, p. 54). Production startup is expected by the end of 2005, with total development costs estimated at $2.35 billion (Can.). Full field operating costs are expected to be $2 billion. During the peak production years, operating costs are expected to average $3.30/bbl.

Excavation of the subsea glory holes is scheduled to begin in the field in third quarter 2002, and development drilling is expected to begin in first half 2003.

"With Hibernia and, more recently, Terra Nova now both in production, White Rose will be the third offshore east coast project for the province," said John Lau, Husky president and CEO. "White Rose will be an important contributor to the growing oil and gas industry in Canada and Newfoundland and Labrador."White Rose development owners are Husky Energy through its unit Husky Oil 72.5% and Petro-Canada 27.5%.

New mooring systems headed for Gulf of Mexico

New mooring systems are to be deployed in BP PLC's Horn spar and Royal Dutch/Shell Group's Nakika deepwater developments in the Gulf of Mexico. Allison Cos.-to provide marshaling services for handling the mooring systems-designed and built specialized equipment to handle the heavy reels and mooring chains. Shown at top is Allison's Grua Grande derrick lifting mooring chain and wire rope units that weigh up to 150 tons. At bottom is Allison's self-propelled modular transporter that will move the mooring systems into secured storage at Allison's Fourchon, La., yard prior to deployment. Photo courtesy of Allison.