Market Movement

US natural gas prices likely to improve

Like the beginning of 2000, a record warm winter has clouded the market's view of the underlying natural gas supply and demand fundamentals, said analyst J. Marshall Adkins of Raymond James & Associates Inc.

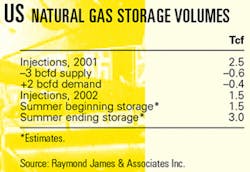

"It has only been recently with the emergence of more 'normal' weather over the past 4 weeks that the market has been able to see the true year-over-year changes in US natural gas supply and demand," Adkins said, citing a significant reduction in the gas storage overhang (see table).

For months, the RJA natural gas supply-demand model has shown that winter-ending storage above 1.5 tcf could potentially lead to "gas-on-gas" competition in late summer.

"By gas-on-gas competition, we mean that gas storage facilities could completely fill up by late summer and there would be no place to put produced gas in the early fall," Adkins said, adding this would force gas prices down until producers begin to shut in production.

"It now appears that this risk of a price collapse late in the summer has been significantly reduced as a large amount of storage overhang has been eaten away over the past several weeks," Adkins said.

Consequently, winter-ending underground storage is likely to end up below 1.5 tcf. A beginning summer storage level of 1.5 tcf, combined with year-over-year changes in natural gas supply and demand assumptions, should leave the US with "nearly full, but not over full" storage by the end of this summer, he said.

"We believe that the US will see summer gas injections that are 40% lower this summer than last summer. Like the summer of 2000, it is this positive trend change that is likely to drive gas prices up through the summer," Adkins said.

Although rising gas prices will negatively impact gas demand, Adkins said the negative demand might be less than many analysts anticipate.

"Offsetting the impact of lower gas prices will be the positive influence of lower electricity prices, a recovering economy, and higher oil prices," he said.

Adkins expects higher gas prices will be sustainable and will probably rise higher through the summer, similar to what happened in 2000.

"This shift in supply-demand should become even more evident as we move into the early part of the injection season in April-May. Look for summer gas injections to be down 30-50% from last year's numbers. This should be the bullish driver of summer natural gas prices," he said.

Nuclear outages also driving natural gas prices

Natural gas prices have gotten a boost from concerns about safety at some US nuclear plants and from drought conditions on the US East Coast, said analysts with RBC Dain Rauscher Inc., a subsidiary of RBC Capital Markets.

The Davis-Besse nuclear plant in Oak Harbor, Ohio, will be off line longer than originally expected because of corrosion caused by leaking boric acid in the reactor vessel head, said FirstEnergy Nuclear Operating Co., a subsidiary of FirstEnergy Corp., Akron, Ohio.

The plant was undergoing a refueling and maintenance outage and had been scheduled to return to service by Mar. 31. Discovery of the corrosion problems caused the outage schedule to be extended by 60-90 days. The exact length of the outage has not yet been determined, FirstEnergy said.

RBC Dain Rauscher estimated incremental natural gas demand caused by the loss of Davis-Besse plant is 250 MMcfd. Meanwhile, 69 nuclear plants out of 109 US nuclear plants could have similar problems.

"The gas markets clearly are focused on the uncertainty created by the Nuclear Regulatory Commission's demand that all 69 plants with the same design have been required to answer a 12-page bulletin of questions regarding corrosion inspections within the next 15 days," RBC Dain Rauscher said in a Mar. 22 research note. "If the 10 plants now down for maintenance remain off line due to this issue, we could see an incremental 4-6 bcfd of [gas storage] withdrawals during the summer."

Meanwhile, the market's bullishness for gas also stems from a drought on the US East Coast, RBC Dain Rauscher said, adding that the loss of hydropower probably will result in increased demand for gas of roughly 0.5 bcfd vs. a year ago. This also could further impact coal and nuclear power generation, because some of those facilities rely on fresh water for cooling.

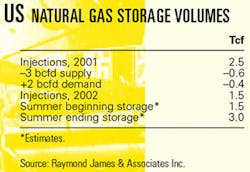

Industry Scoreboard

null

null

null

Industry Trends

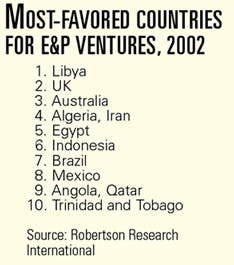

THE MIDDLE EAST and Libya rank as the region and country most favored by international oil companies for new exploration and production investment in 2002, according to a recent survey by UK consultants Robertson Research International (see table). The results mark the third successive year that Libya has been the most preferred country.

"Despite the slow pace of new contract negotiation and award, and despite the continuance of US sanctions, Libya's hydrocarbon potential appears to be a great attraction," Robertson said.

Nor did restricted opportunities in Saudi Arabia or sanctions in Iran and Iraq that make current investment difficult in those countries deter operators from favoring the Middle East region.

The UK bounced back to second after 3 years of falling in the rankings, and Mexico, Qatar, and Trinidad and Tobago entered the top 10 for the first time in the survey's 15-year history.

"Despite concerns about the proposed 'Multiple Service Contract' formula announced by [Petroleos Mexicanos], the prospect of upstream involvement in the Mexican petroleum business for the first time in over 50 years is obviously exciting many companies," Robertson postulated.

Of the survey participants, 57% said they would increase total worldwide E&P spending in 2002, "although there is an atmosphere of caution and uncertainty," Robertson said.

The survey also revealed that an average annual oil price of $19.60/bbl was used for 2002 budgeting purposes, and 87% of the responding companies expect merger and acquisition activity to continue throughout the year.

Robertson's International New Venture Survey polls oil companies involved in E&P ventures outside North America on their interest in new ventures in 146 countries. Country rankings are then analyzed to determine factors influencing movements up or down in the annual rankings.

THE RECENT UPTICK in US exploration and production company stocks will prove short-lived, contends an analyst with Houston investment banker Simmons & Co. International.

In a recent research report, Charles Eades, vice-president, Simmons E&P equity research, said that the likelihood of a slump in natural gas prices in the coming months means that the recent E&P stock gains are not sustainable.

The group of 10 large E&P independents that the company tracks is currently discounting a normalized natural gas price of $2.90/Mcf, Eades estimated.

"In our view, a cheaper entry point into the [E&P company] sector will present itself over the next 6 months," he said.

Eades expects that gas prices are likely to break below $2/Mcf during the third quarter before rebounding later in the year and into 2003, adding, "We believe there is 27% near-term downside risk in the [E&P company] sector [stocks].

"Thus the current risk-reward ratio for the E&P group is not compelling."

He cited as factors for the price softness a continuing gas storage overhang in the first half and only a modest decline in gas well deliverability this year. These factors underpin a price projection of $2.25/Mcf for the full year, $2/Mcf in the third quarter, and $2.50/Mcf in the fourth quarter.

Government Developments

THE US COURT OF APPEALS for the District of Columbia Circuit on Mar. 26 upheld ambient air quality standards for ozone (smog) and fine particulate matter (soot) finalized by the Environmental Protection Agency in 1997.

Both the oil and auto industries opposed the more stringent new standards, which they said were not cost-effective and are expected to bring additional controls in many areas.

But environmental groups and the Bush administration said the court's decision was fair.

"We are gratified that after more than 4 years of litigation, the court has affirmed these standards, implementation of which will improve the lives of millions of Americans who suffer asthma, bronchitis, and other respiratory illnesses," said Tom Sansonetti, assistant attorney general of the Department of Justice's Environment and Natural Resources division.

The court rejected the industries' argument that EPA acted arbitrarily in setting the national ambient air quality standards. In a unanimous decision the three-judge panel found that EPA "engaged in reasoned decision-making" in establishing levels that protect public health and the environment.

What further legal action industry interests may take is not yet known. Trade groups may look to Congress to pass new laws that offer more flexibility than the Clean Air Act, but further court challenges to the existing rule might be even more difficult.

The three-judge panel that rendered the decision initially set the standards aside on constitutional grounds. But last year, the US Supreme Court unanimously rejected the lower court ruling and upheld the validity of the standards.

The Supreme Court also unanimously rejected an industry argument that EPA should have based the standards on a cost-benefit analysis rather than on the impact of pollution on public health, according to Frank O'Donnell, executive director of Clean Air Trust.

The Supreme Court then returned the case to the appeals court for any further action.

The appeals court accepted a new industry motion to revisit the standards on the grounds that they were arbitrary and capricious. But the appeals court ultimately rejected that legal argument in its latest decision.

O'Donnell noted that EPA still must clear up several issues related to the ozone standard before it can begin enforcing it, but there is now no legal impediment to moving forward.

"The court has upheld the bedrock of the Clean Air Act. It is time for EPA to devote its energies to enforcing the law," said O'Donnell.

Quick Takes

EXXONMOBIL CORP. recently revealed development plans for Bintang natural gas field, which lies 137 miles off Terengganu, Malaysia, in the South China Sea. ExxonMobil said development would cost a total $150 million.

ExxonMobil unit ExxonMobil Exploration & Production Malaysia Inc. and project partner Petronas Carigali Sdn. Bhd. will develop 1 tcf of natural gas from the field. Peak production from the field is expected to reach 355 MMcfd.

Natural gas production from Bintang field will be transported via pipeline to Kertih and the Peninsular Malaysian gas pipeline grid to be used in the domestic market there. A majority of the gas will be used for power generation. Currently in Malaysia, more than 70% of electric power is natural gas-fired, ExxonMobil added.

ExxonMobil plans to install two remotely operated platforms, Bintang A and B, which are slated for installation in the third quarter. These platforms, which will be designed and built in Malaysia, will have the capacity for 10 wells. Gas from the field will be transported via a 7 mile, 18-in. newly built pipeline to Lawit A platform for processing, then to shore.

Drilling is expected to start in the fourth quarter, with gas production start-up following shortly afterward, ExxonMobil said.

UNOCAL CORP. subsidiary Unocal Ganal Ltd. reported hefty natural gas and condensate flow rates from an appraisal well in the deepwater Gendalo-Gandang gas field complex off Indonesia, demonstrating greater hydrocarbon potential for the complex.

On test, the Gendalo-3 well flowed 30 MMcfd of gas and 2,200 b/d of condensate from a single interval at 11,559-11,638 ft true vertical depth subsea (TVDS). The drill stem test had flowing tubing pressure of 4,114 psi through a 40/64-in. choke.

The well has an estimated potential production rate of 90 MMcfd of gas and 6,000 b/d of condensate, Unocal said.

The Gendalo-3 well encountered 102 ft of net pay. The well was drilled in 5,082 ft of water to 13,070 ft TVDS. The well is 2.8 miles east of the Gendalo-1 discovery well in the central portion of Gendalo-Gandang field complex.

Another appraisal well, Gandang-2, was drilled in the northern portion of the complex. This well encountered 185 ft of net gas pay. The well was drilled to 12,000 ft TVDS in 5,613 ft of water.

Unocal estimates the gross resource potential for the Gendalo-Gandang complex is at least 2-2.5 tcf of gas, plus an associated 50-150 million bbl of condensate.

An already hot play area has proven even hotter following a Mar. 25 announcement by Amerada Hess Corp. of an oil discovery made off Equatorial Guinea on Block G in the Rio Muni basin. The discovery, called Elon, was made by the G-8 well that found 157 ft of net oil pay, Amerada Hess said. The well was drilled to 5,977 ft TD in 210 ft of water. Elon is 15 miles northeast of Amerada Hess's Ceiba field and 6 miles southeast of the recently announced Akom discovery, made in late February by the G-7 well-drilled to 8,140 ft TD in 1,456 ft of water-which found 162 ft of net oil pay. "Importantly, the G-8 well has established an extension of the play fairway into the shallower water portion of the Rio Muni basin," explained Brian Maxted, Amerada Hess's executive, West Africa operations. Amerada Hess holds 85% working interest in and is operator of Block G. South Africa's Energy Africa Ltd. holds the remaining 15% interest in the block. Brigham Oil & Gas LP, a unit of Austin-based Brigham Exploration Co., reported that it lost surface control Mar. 24 while drilling a natural gas development well, Burkhart No. 1, at a depth of 10,370 ft in Providence field near Bay City, Tex., in Matagorda County. The well was the first offset to the field's discovery well, Stauback No. 1. Brigham said it was drilling Burkhart No. 1 in a shallower formation than the lower Frio interval, which is now producing in the Staubach No. 1 discovery. Burkhart No. 1 then "encountered a high-pressure Frio gas reservoir," Brigham said. Houston-based Cudd Pressure Control Inc. was contacted to regain control of the well and to free the drill string, which became stuck following an associated gas kick and the subsequent loss of circulation. Cudd estimated a 4-7 day timeframe to bring the well under control. At presstime, the well was venting natural gas into the atmosphere but was not on fire, and there was no condensate on the ground, a Brigham spokesman told OGJ. The incident did not affect production from Staubach No. 1, which is producing 2,000 b/d of oil and 5.5 MMcfd of gas, Brigham said. Staubach No. 1 was drilled near yearend 2001 when it logged 36 ft of apparent net pay in the Lower Frio sands at 11,500 ft (OGJ Online, Dec. 20, 2001). Members of Thailand's government cabinet endorsed amendments to extend and ease terms of an oil and natural gas exploration concession in the Gulf of Thailand held by Harrods Natural Resources Inc. Harrods Energy (Thailand) Ltd. was given a 1-year extension until September 2002 to drill an exploration well on Block B2/38. That well was supposed to have been drilled before September 2001 as part of the first 3-year obligation period in which the firm was committed to spend a minimum $3 million. The Thai government also agreed to let Harrods Energy convert obligation works on Block B11/38. Instead of the original agreement to shoot an 8,550 sq km 3D seismic survey in the second year of the second 3-year obligation period, Harrods Energy is now obligated to drill two wells in the third year of that period. Harrods Natural Resources is owned by London's Harrods department store magnate Mohammed al Fayed. Government officials vehemently denied charges by the opposition Democrat party that Thai Prime Minister Thaksin Shinawatra agreed to those changes because of his personal friendship with the Egyptian-born magnate.

CHINA PETROLEUM & CHEMICAL CORP. (Sinopec) said it plans to build 450 retail gasoline stations with foreign companies this year, as China lifts the ban on foreign investment in the retail fuels business.

This will be the first wave of about 1,500 such sites to be built with Royal Dutch/Shell Group, ExxonMobil Corp., and BP PLC in the next 3 years.

In addition, Sinopec will build 1,000 independent retail outlets this year. In the last 2 years, Sinopec has invested 35 billion yuan to expand its retail business. It now owns about 24,000 gasoline stations in southern and eastern China, vs. 8,000 3 years ago. In total, China has 75,000 retail stations.

China had banned foreign investment in the oil products retail business until it joined the World Trade Organization in December last year.

Under WTO rules, China agreed to open its oil retail markets 3 years after joining the WTO and oil wholesale markets 5 years after its entry.

MARINER ENERGY INC., Houston, has begun production from its King Kong-Yosemite project in the Gulf of Mexico. The project flowed at 140 MMcfd as of Mar. 19 and was expected to reach platform capacity of 150 MMcfd with the addition of a third well, Mariner said.

The project, on Green Canyon Blocks 472, 473, and 516, as of mid-March was producing from two subsea wells and will produce from a third once the wind and waves allow a day's worth of work to be finished, the company said. The wells are in 3,800 ft of water.

All three wells are connected to a subsea manifold that ties back 15 miles to Agip Petroleum Co. Inc.'s Allegheny minitension leg platform on Green Canyon 254. Agip is a partner in the Mariner project along with Noble Drilling Exploration Co. (OGJ Online, June 19, 2001).

The Yosemite well and the two King Kong wells were developed jointly.

UNITS OF El Paso Corp. (EPC), Houston, top pipeline news this week.

EPC said it plans to increase the capacity of its proposed Seafarer natural gas pipeline system to 1 bcfd from 800 MMcfd. The 163 mile, 26-in. system-formerly referred to as the Bahama Cay pipeline-will transport gas from the planned El Paso Global LNG regasification terminal at Grand Bahama Island to West Palm Beach, Fla. (OGJ Online, Oct. 2, 2001).

EPC has not disclosed details about the proposed Bahamas LNG terminal. However, the company is recommissioning the Elba Island, Ga., LNG terminal and holds interests in the remaining three US LNG terminals. It also is a participant in plans to develop LNG regasification terminals on Mexico's Baja California peninsula, to serve California and northern Mexico markets; and at Altamira, Tamaulipas state, on Mexico's eastern coast, to serve rapidly growing power demand for gas in northeastern Mexico.

The pipeline project will comprise two line sections, one to either side of the boundary of the US Exclusive Economic Zone in the Atlantic Ocean. The first section, to be built and owned by a unit of EPC, will extend 88 miles from the Grand Bahama Island LNG terminal to the international boundary. Another EPC unit will develop and operate the remaining 75 mile section, which will connect to the Florida Gas Transmission pipeline system.

The system, which is slated to come on line in the summer of 2005, will help meet fuel requirements for Florida's burgeoning power generation market, EPC said.

Separately, EPC unit Tennessee Gas Pipeline Co. filed an application with the Federal Energy Regulatory Commission for permission to construct the South Texas expansion project, which will extend from Tennessee Gas's existing South Texas system in Hidalgo County to a new, open-access gas line being constructed in northern Mexico.

The proposed project will include construction of a 9.3 mile, 30-in. lateral, which will transport 314 MMcfd of natural gas to the US-Mexico border to feed the growing power generation market in Mexico. The project also will include a 7 mile, 24-in. loop along Tennessee Gas's Donna Line and a new compressor station, both in Hidalgo County.

The line, which El Paso estimates will cost $39.8 million, is slated to come on line Aug. 1, 2003. The new pipeline's capacity has been subscribed in full, El Paso said, through binding contracts signed previously by US and Mexican power producers and marketing companies.

IN DRILLING NEWS, Crowley Marine Services Inc., Seattle, has moved the 312 sq ft concrete island drilling structure Orlan from Prudhoe Bay, Alas., to Sovietskaya Gavan in the Russian Far East for Sakhalin I Project operator, Exxon Neftegas Ltd., a subsidiary of ExxonMobil Corp.

The Orlan, formerly the Glomar Beaufort Sea I Concrete Island Drilling System, was purchased from Global Marine Drilling Co. and will be used for oil production off Russia.

It was moved from its stack site near Northstar Island off Prudhoe Bay using two Crowley Sea Victory Class 7200 bhp twin screw oceangoing tugs with more than 110 tons bollard pull each. Arctic ice management was handled by Crowley with a third tug contracted for the job, the 23,200 bhp Arctic Kalvik. The certified Ice Class Lloyds +100 A1 Arctic Class 4 tug offered high bollard pull, icebreaking ability and was outfitted with tow gear for arctic and ocean towing.

"The Orlan has a 34-ft draft and consists of four basic components-a steel mud base, a concrete brick caisson, and two steel deck barges on which the drilling rig, support equipment, and quarters are mounted," said Craig Tornga, general manger of Alaska Services for Crowley Marine Services.

Crowley has moved the Orlan seven times without incident, including its move into the Arctic from Japan in 1984.

When the tow arrived off Barrow, Alas., on Sept. 4, 2001, the Crowley team set up the Arctic Kalvik with the Sea Victory and Sea Venture for the ocean tow from Barrow to Russia. Because of the large size of the tow, the tugs were refueled along the way by a Russian tanker. On Oct. 14, 2001, Crowley delivered the Orlan to Russia, cleared the structure through customs and began arrangements to put the Orlan down in the Sovetskaya Gavan harbor.