Market Movement

OPEC heads meet with Russia

Global oil prices continued their bullish run last week amid speculation that Russia will continue its oil production cut of 150,000 b/d through June.

Alí Rodríguez Araque, Organization of Petro- leum Exporting Countries secretary general, visited Russia early last week along with OPEC Pres. Rilwanu Lukman to urge the country to extend its production cuts beyond the first quarter. Rodríguez said that Russia's stance would influence OPEC members' decision to continue their own supply restrictions. OPEC ministers are due to meet Mar. 15 to discuss maintaining their production cuts through the second quarter. Russia is one of a number of non-OPEC oil exporters to consent to reducing oil production to help buoy world oil prices. "Much will depend on the success or failure of these meetings with the Russian leadership, since Russia is one of the main players on the world oil market," Rodríguez was quoted by Caspian News Agency as saying.

While in Russia, the secretary general met with Russian Prime Minister Mikhail Kasyanov and Minister of Energy Igor Yusufov, as well as certain Russian oil company chief executives. Lukman told OPEC News Agency that he was optimistic that the outcome of the meetings with Russian officials early last week would be "positive." Lukman said that many of the discussions had focused on "ensuring continued stability" in oil markets in the second quarter and beyond.

"If this [restraints on output] is not done, the healthy evolution of the market, as currently observed, would be disrupted," Lukman said.

Russia's desire for oil prices at $20-25/bbl is well in line with OPEC's target price band of $22-28/bbl, Lukman added.

High oil stocks still major concern

After his return from Russian, Rodríguez told OPECNA that OPEC is concerned over current high oil stock levels. This concern is heightened, Rodríguez said, when the high stock levels are paired with growth in non-OPEC producers' market share along with the seasonal second quarter demand slump.

"I am confident that, following our discussions in Moscow, the Russian authorities will decide to extend their support for our efforts to stabilize the market," Lukman said.

Rodríguez said that he expected a reply from Russia regarding its intentions to extend production cuts another quarter. As part of the outcome of the secretary general's meeting with Russia, he said that the two sides would hold joint seminars that would focus on better understanding where oil markets are headed.

"This is a very positive development," Lukman said, "since the more we can discuss the issues at hand, the better chance we have of approaching and understanding the various views that exist among the different oil industry players."

API numbers

Meanwhile, the latest American Petroleum Institute report "is likely to send mixed signals to the petroleum market," said Lehman Bros. in a recent report. "While crude oil prices may see some downward pressure, as supplies increased by 1.2 million bbl despite expectations of a draw, they should be supported somewhat by the large decline in gasoline inventories," Lehman said.

"Looking ahead, we continue to think that crude oil supplies will remain relatively flat over the next few months. We also think that crude oil prices are currently inflated beyond justifiable levels, especially when it is considered that total US crude oil inventories remain 4.8% above the 5-year average (and are at their second highest level for the year), despite aggressive production cuts initiated by OPEC on Jan. 1."

BULLETIN

Senators late last week settled into what could be a weeks-long debate over comprehensive energy bill legislation with several controversial items still undecided. The first round of debate at presstime centered on the government's possible role in encouraging an Alaskan gas pipeline to the Lower 48. The Senate adopted amendments designed to block producers from building the line to the Lower 48 via a shorter, northern route almost entirely in Canada vs. a southern route through Alaska. The bill also clarifies Alaska's regulatory authority over gas delivered from a southern pipeline to the Lower 48. A bipartisan plan to give North Slope producers a floor price for gas when market conditions are poor is still being debated; some smaller, Lower 48 producers complain it gives Alaska producers an unfair advantage. The bill also authorizes $20 million for an Alaska pipeline construction training program. Still to be considered: changes to automobile fuel efficiency standards, clean fuel programs, and a plan to lease part of the Arctic National Wildlife Refuge. The Senate is still likely to pass a bill, but final legislation remains uncertain, say lobbyists and lawmakers.

Industry Scoreboard

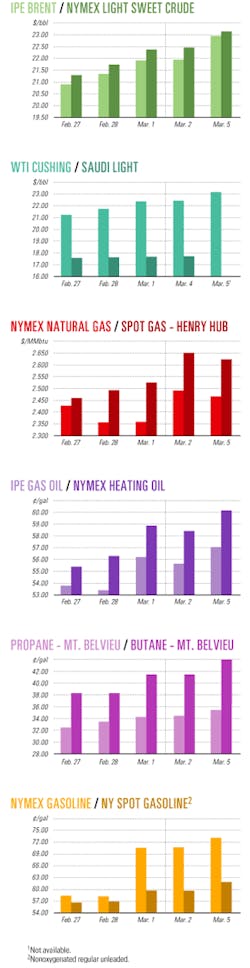

null

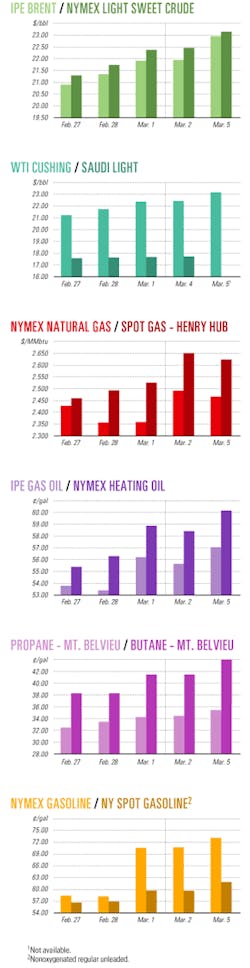

null

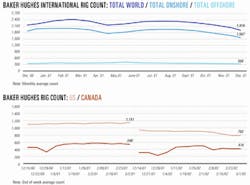

null

Industry Trends

Treasury financings completed by Canadian oil and natural gas exploration and production companies in 2001 rose by more than $4 billion (Can.) to $7.9 billion vs. those completed in 2000, reported research firm Sayer Securities Inc., Calgary.

"Within each category of financings (debt, equity, and royalty income trust units), there were major changes in how the industry accessed new money; [these changes resulted] from three main trends in the last year-the continuing decline of prime interest rates, the high price of oil and gas early in 2001, and the unprecedented level of activity in the merger and acquisition market," Sayer said.

Two trends from last year-the rise of Canadian natural gas prices and the fevered pace of M&A activity-hit record levels in 2001, according to Sayer.

"The price of natural gas reached its highest weighted average, monthly cash price in January, with AECO-C Hub topping out at $11.14/MMbtu," Sayer said. In addition, M&A transactions in 2001 hit $39 billion, an increase of 55% over the previous high of $25.1 billion set in 1998.

The prime rate, meanwhile, fell to its lowest point in the past 10 years, reaching a trough of 4% in November. "For most of the 1995 to early 2001 period, the rate wasellipse6-7%, coming down from a high of 14.75% in early 1990," Sayer noted.

Debt financings showed the largest year-on-year increase during 2001, rising 170% to $5.4 billion vs. the year prior, "easily surpassing the previous record high in 1998 of $3.7 billion," said Sayer (see table). "The drop in interest rates caused more companies to use long-term debt, as their costs are substantially lowered, and it also provided the opportunity to 'fix' their interest rates, rather than relying on uncertain floating rates," the firm noted.

The three largest debt financings were completed by PanCanadian Petroleum Ltd., $796.1 million; Alberta Energy Co. Ltd., $788.9 million; and Anderson Exploration Ltd., $622.9 million. "The 2001 financings by PanCanadian and AEC have the distinction of being the first and second largest debt financings, respectively, in the last 10 years," Sayer said.

AEC received an interest rate of 7.4% on the 2001 issue, according to Sayer. In comparison, in September 2000 "AEC completed another debt deal with a 30-year term for $444.2 million at a rate of 8.17%," the firm noted, adding, "The 0.77% difference in the rate of these two transactions results in an annual savings of $6.1 million on the current debt issue, or $182 million in total lower cost over the life of the bond."

Government Developments

Senate Majority Leader Tom Daschle (D-SD) late last month said he wants to direct North Slope producers and pipeline companies to build an arctic gas line paralleling the oil pipeline to Fairbanks and then the Alaska Highway to British Columbia. He also favors a guaranteed natural gas floor price for producers to make the pipeline project more attractive to industry when market prices are low.

Democrats have an energy bill pending in the Senate that includes an Alaskan gas line provision but it does not yet endorse a specific route (see Bulletin, Newsletter, p. 5, and related story, p. 30). A sweeping energy bill that passed the Republican-led House last August does not offer any specific government incentives to build a pipeline but calls on the government to approve the "southern" route sought by the Alaskan state government, members of the Alaskan congressional delegation, and now Daschle.

"I believe that if Alaska is going to benefit, if the United States is going to benefit, if American labor is going to benefit-I think if the environment is going to benefit-the southern route is the best way to do it," Daschle told reporters.

Meanwhile, the Senate bill-the debate of which began early this month-contains provisions first suggested by Senate Energy and Natural Resources Committee Chairman Jeff Bingaman (D-NM) to encourage construction of a natural gas line from Alaska to the Lower 48. Bingaman's provision provides federal loan guarantees of as much as $10 billion for the pipeline, as long as applications for permitting certificates are filed within 6 months of the bill's being passed.

The Senate bill also directs the secretary of energy "to study the feasibility of establishing a government corporation to build the pipeline if the private sector is unable to do so."

What the Senate bill does not include is a provision in the House bill that allows the Department of the Interior to lease the coastal plain of the Arctic National Wildlife Refuge.

ANWR leasing is so controversial that some lobbyists think the issue could derail final passage of a bill from Congress. ANWR drilling supporters say it is unlikely they have the votes to allow floor debate on their issue in the Senate.

Capitol Hill's biggest ANWR drilling supporter, Sen. Frank Murkowski (R-Alas.), ranking member of the energy committee and a gubernatorial candidate, is urging fellow lawmakers and the White House not to give up on the ANWR issue.

"Right now, US Senate Democrats want to tell Alaskans what we can and cannot do with our gas," Murkowski said. "Their enthusiasm for Alaskan gas doesn't reach an attempt to distract and divert efforts to open ANWR."

In early February, Murkowski met with North Slope producers and pledged to offer the same kind of legislative proposals Daschle just made (OGJ Online, Feb. 4, 2002). Murkowski at that meeting said that while producers do not have a preference for where the gas line should be built, a legislative ban was needed to prevent a northern "over the top" route that could pose environmental problems.

Canadians favor a northern route from Prudhoe Bay field east across the Beaufort Sea to the Mackenzie Delta and then south along the Mackenzie Valley.

In January, North Slope producers Phillips Petroleum Co., ExxonMobil Corp., and BP PLC all said they support legislation updating the 1977 Alaska Natural Gas Transportation System Act that first authorized permits for a gas line to the Lower 48.

Quick Takes

A MAJOR NEW North Sea gas pipeline is on the drawing board.

Marathon Oil Co., Houston, wants to assure adequate gas supplies for the growing UK market for the next 20 years and wants to enhance the existing North Sea infrastructure, including Marathon's Brae and Heimdal compression and processing facilities.

The proposed 675 km dry natural gas pipeline would connect the Norwegian Heimdal area of the North Sea to Bacton, on the southeast coast of the UK. It would terminate at or near the existing Bacton terminal and is expected to move some 900 MMcfd.

Marathon officials told OGJ they expect to get the gas to fill the new pipeline's capacity from both existing and future production in the UK and Norwegian sectors of the North Sea. But they won't know the exact source of the gas to be transported until Marathon completes its proposed open season, which runs through October. The pipeline would pass through the Marathon-operated UK Brae complex and pass near the UK Miller and Britannia complexes.

Centrica PLC, a UK-based natural gas retail marketer and producer, agreed to support the project as a potential purchaser of the transported gas.

Marathon said the pipeline could be operational in 2005.

THE UK NORTH SEA has another high-pressure, high-temperature (HPHT) field with the startup of Jade field.

Phillips Petroleum Co. UK Ltd., a unit of Phillips Petroleum Co., said that production of 60 MMcfd of natural gas and 4,500 b/d of oil has begun. Phillips and its partners expect to reach peak production of 200 MMscfd of gas and 16,000 b/d of oil in the third quarter.

Phillips called the event a "signpost" in the growing trend of developing technically daunting HTHP fields in the UK North Sea. Last year saw the startup of the even larger Franklin gas-condensate field, the second phase of TotalFinaElf SA's Elgin-Franklin HTHP project in the North Sea (OGJ, Sept. 10, 2001, Newsletter, p. 8). With the platform in place and production started, Jade field operator Phillips said it plans to drill the remaining development wells and further test the field's oil and gas potential with an exploration tail on one of the development wells. A possible second phase of investment in Jade development could follow.

Jade field, on Block 30/2c, was discovered in 1996 and was confirmed with an appraisal well drilled early the following year (OGJ, Mar. 17, 1997, p. 36). The field is being developed with an unmanned installation, which is connected via a 16-in. multiphase pipe-in-pipe pipeline to Phillips's Judy platform 12 miles south of Jade. Phillips holds 32.5% interest in Jade field. Other partners and their interests are BG Group 35%, Texaco North Sea UK Co. 19.93%, Agip (UK) Ltd. 7%, and OMV (UK) Ltd. 5.57%.

In other production news, a coalbed methane joint venture in Canada has begun production sales. PanCanadian Energy Corp., Calgary, and MGV Energy Inc., the Canadian unit of Fort Worth-based Quicksilver Resources Inc., said their coalbed methane JV in southern Alberta marks the "first significant CBM sales production reported in Canada." Six wells on the block are producing gas, while others are still being flare tested. The JV also will begin planning a proposed 250-well CBM development on its 1 million acre Palliser Block in southern Alberta. The two firms increased their capital program for the project late last year to $30 million (Can.) from $15 million (OGJ, Nov. 19, 2001, Newsletter, p. 8). In addition, the JV last year announced plans to expand its project beyond Palliser but did not identify which other blocks would be involved. To date, the JV has drilled 95 wells, which include 25 exploration and 58 pilot wells on Palliser Block. Presently, these shallow wells-at depths less than 1,000 m-are in "various stages of production testing," the JV said. More than 1 km of core has been collected from the exploration wells, the companies added. The JV estimates "anticipated stabilized flow rates" from each well in the development at 30-250 Mcfd of gas. According to initial test results, net reserves on the block could be 1-2 bcf of natural gas per section, the JV said. Palliser Block comprises 300 sections, which represents about half of the JV's total acreage. F

A PROPOSED LNG regasification plant in Mexico tops gas processing news.

Marathon Oil Co. and partners have announced plans for a proposed LNG regasification and power generation project near Tijuana in Baja California, Mexico.

With a potential start-up in 2005, the complex would have the capacity to regasify up to 750 MMcfd of LNG for local use and export to southern California. Project partners are Indonesia's Pertamina, Golar LNG Ltd. of Bermuda, and Grupo GGS SA de CV of Mexico.

Marathon said LNG for the Baja project would be supplied from various sources worldwide. Pertamina is expected to be a key supplier.

The LNG regasification and associated power generation project would be developed on the Pacific coast, south of Tijuana. The complex would consist of an LNG marine terminal, an offloading terminal, onshore LNG regasification facilities, and pipeline infrastructure. In addition, a 400 Mw natural gas-fired power generation plant would be constructed. Other companies previously have proposed similar projects (OGJ Online, Oct. 5, 2001). F

Elsewhere in gas processing, PTT PLC, formerly known as Petroleum Authority of Thailand, has awarded a $6.68 million contract to Foster Wheeler International Corp. for engineering and consultancy services for a new natural gas processing project. The facility will be PTT's fifth gas processing plant and will process 530 MMcfd of gas. The contract is in line with the Thai energy firm's recently revised strategy to place the $227 million project-which was shelved last year-back on the table. Foster Wheeler will oversee engineering, procurement, construction, and commission of the plant, which will be built alongside PTT's three existing gas processing trains at Mab Ta Phud, Rayong, about 220 km southeast of Bangkok. PTT's fourth gas plant is in Khanom, southern Thailand. F

PERU LEADS the recent exploration news.

The state-owned Perupetro said that it would auction concessions to four companies for Blocks 56, 57, and 58, which lie adjacent the Camisea natural gas fields.

The four companies-TotalFinaElf SA, Repsol-YPF SA, Occidental Petroleum Corp., and Hunt Oil Co.-declared their interest in the blocks last year (OGJ Online, Nov. 9, 2001). Hunt Oil represents the Camisea consortium, which is operated by Argentina's Pluspetrol SA.

Companies can bid for the blocks, to be offered separately, in all three auctions. Block 56, which holds 4 tcf of gas reserves in Pagoreni and Mipaya fields, will have a production contract. The other two blocks are being offered for exploration and development.

The plan is to develop gas on the new blocks for export. Camisea gas fields' 13 tcf of reserves are expected to more than cover the needs of the national market.

Hunt Oil also is leading a technical feasibility study for eventually exporting Camisea gas as LNG to the US and possibly to Mexico and is looking into the use of gas-to-liquids technology to monetize Camisea gas. In other Peruvian exploration news, Petro-Tech Peruana SA, a Peruvian company with US financing, is slated to sign on Mar. 18 a license contract with Perupetro, the state oil agency, for exploration and production of Block Z-6, off Peru's northern coast.

Block Z-6 is south of Z-2B, where Petro-Tech produces an average 12,800 b/d of crude oil and 60 MMcfd of associated gas. The license was approved by President Alejandro Toledo on Feb. 20.

Elsewhere on the exploration front, a unit of Murphy Oil Co., El Dorado, Ark., confirmed the commerciality of an oil find off Sarawak, Malaysia. Murphy Sarawak Oil Co. Ltd. has completed a three-well exploration and appraisal drilling program on Block SK 309 and neighboring Block SK 311. The first of the wells, West Patricia 5, was drilled to 4,068 ft TD and found 138 ft of net oil pay and 23 ft of net natural gas pay. It was the last appraisal well to be drilled under the current program, confirming the commercial viability of West Patricia field. "The West Patricia 5 culminates our West Patricia appraisal drilling program by confirming in excess of 30 million bbl of recoverable oil," said Claiborne P. Deming, Murphy president and CEO. Murphy plans to drill two more exploration wells and conduct additional 3D seismic operations on Blocks SK 309/311 this year.

A second well, South Acis 5, was drilled on Block SK 311 to 5,660 ft TD. The well found 127 net ft of natural gas pay. Murphy said that further evaluation is needed to assess the well's potential. Sepang 1, the third well, was drilled to 4,086 ft but was a dry hole. Murphy operates both shallow-water blocks, 25 miles northwest of Bintulu, holding 85% in each. Petronas Carigali Sdn. Bhd. holds the remaining interest.

Oil has been found in Glen Rose reef, Maverick basin, Tex. Saxet Energy Ltd., Houston, and The Exploration Co. (TEC), San Antonio, experienced an unexpected oil flow in late February while drilling at about 6,500 ft at the Comanche 1-111 well in Maverick County, Tex. The well produced 5,300 bbl of light, 40° gravity oil in about 24 hr from a reef in the Cretaceous Glen Rose, TEC said. The companies trucked the oil to a refinery, although a pipeline is 4 miles north in the adjoining Sacatosa field. The well bridged over near 6,400 ft, and Saxet is to cement casing and resume drilling toward permit depth, 9,000 ft. The well was always under control except that it could not be shut in, TEC said. Of about 50 wells TEC has drilled in the area,only Comanche 1-111 and one other about 20 miles north produced oil from the gas-prone Glen Rose, TEC said. The well site is in the Maverick basin about 20 miles east of Eagle Pass, Tex. The well is the first drilled by Saxet and TEC on a 95,000-acre lease.

Topping development news, Montreal-based Pebercan reported that its Canasi No. 5 well in Cuba, drilled to 3,705 m TD and completed late last year, penetrated two successive hydrocarbon pools totaling 1,472 m of gross pay.

On test, Canasi No. 5 flowed 3,500 b/d of oil. Flow from the well brings total production from Block 7 to 13,000 b/d of oil, 6,200 b/d of which is net to Pebercan, the company said. Shortly, Pebercan said, it would drill another well, the sixth to be drilled in Canasi field. Pebercan operates Block 7 on behalf of Cuban state oil company Cubapetroleo and is designated technical operator for the western half of the block. Sherritt Interational Corp., Toronto, is technical operator for the eastern half of the block. Pebercan is among a handful of Canadian and other foreign firms undertaking exploration, development, and improved recovery projects in Cuba (OGJ, Jan. 7, 2002, p. 38). Their efforts underpin the government's ambitious plans to more than double oil production by 2005. A US government embargo on Cuba prohibits US firms from investing in the Communist nation.

A NATURAL GAS storage facility expansion has been proposed in Mississippi.

Petal Gas Storage LLC, a unit of El Paso Energy Partners LP, said it would hold a nonbinding open season through Mar. 20 for as much as 5 bcf of firm natural gas storage capacity. Petal is gauging interest for an expansion of its Petal, Miss., storage facility with capacity to be available by Jan. 1, 2004.

"The recent announcement of several greenfield storage projects in Mississippi is evidence of the value of high-deliverability storage downstream of the 'hurricane belt,'" Petal said, referring to the commonplace shutdowns of gas-producing platforms in the Gulf of Mexico during hurricane season. Although Petal is asking mainly for 10-year contract terms, it will consider greater and lesser contract terms.

Petal's system ties in with natural gas transmission and storage systems, including Tennessee Gas Pipeline, Gulf South Pipeline, and Hattiesburg Gas Storage. Petal said it would build a new pipeline-beginning this summer-that would interconnect with its storage facility and other pipelines, including Transcontinental Gas Pipe Line, Southern Natural Gas, and Destin Pipeline.

EXXONMOBIL CORP. has begun the process to enter the Taiwanese retail market, which was recently opened to foreign competitors.

The company applied for a license to market its refined products in Taiwan and is negotiating with state-run Chinese Petroleum Corp. to use that company's facilities to process imported oil, once ExxonMobil gains a certain share of the market.

According to a statement accredited to CPC Chairman Regis W. Chen, ExxonMobil plans to buy products from CPC for resale in Taiwan until it secures a foothold in that market.

Once established, ExxonMobil plans to begin local production using CPC's facilities. ExxonMobil established a joint venture with Taiwan's Pan Overseas Corp. to import ExxonMobil products into Taiwan. That venture might be granted an import license this month at the earliest.