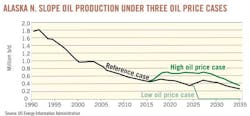

In its Annual Energy Outlook 2012 (AEO2012), the US Energy Information Administration presents three scenarios for oil markets: a high oil price case, a reference case, and a low oil price case. In the low oil price case, crude oil prices in 2035 are $62/bbl (in 2010 dollars) vs. $145/bbl in the reference case and $200/bbl in the high oil price case.

The outlook includes an examination of not only the impact of low prices on oil output, but also the potential impact of minimum pipeline throughput constraints on production, particularly that from Alaska's North Slope.

Oil production on the ANS has been declining since 1988, when average production peaked at 2 million b/d; output in 2011 averaged 562,000 b/d. This crude is transported to market through the TransAlaska Pipeline System (TAPS). Because TAPS needs to maintain throughput above a minimum threshold level to remain operational, EIA said, its projected lifetime depends on continued investment in ANS oil production that itself depends on future oil prices. In the low oil price case, ANS production would cease and TAPS would be decommissioned, which could occur as early as 2026, when projected operating costs exceed wellhead production revenues.

And the 48-in., 800-mile TAPS is currently the only way to transport ANS oil to the Valdez Marine Terminal and eventually to West Coast refineries and the markets they serve.

Operational effects

Low flow rates on oil pipelines can cause operational issues, particularly in cold temperatures. On June 15, 2011, TAPS operator Alyeska Pipeline Service Co. released the TAPS Low Flow Impact Study, which identified problems that might occur as ANS production progressively declines below 600,000 b/d, thereby resulting in declining TAPS throughput. These problems include potential water dropout from the crude oil, which could cause pipeline corrosion, potential ice formation in the pipe if the oil temperature were to drop below freezing, and potential wax precipitation and deposition, as well as potential displacement of the buried pipeline due to soil freezing and thawing as pipeline operating temperatures fluctuate.

Other potential operational effects at low flow rates include sludge dropout and the reduced ability to remove wax, as well as reductions in pipeline leak-detection efficiency, pipeline shutdown and restart, and the running of pipeline pigs that clean and check pipeline integrity.

The severity of potential TAPS operational problems is expected to increase as throughput declines, the report said, and the onset of TAPS low flow problems could begin at 550,000 b/d, absent any mitigation. As the types and severity of problems multiplies, the investment required to mitigate those problems is expected to increase. Because of the many diverse operational problems expected to occur below 350,000 b/d, considerable investment could be required to keep the pipeline operational below this throughput level, the report said.

EIA's analysis of Alaskan production assumed that the ANS oil fields would be shut down, plugged, and abandoned and TAPS would be decommissioned when two conditions were simultaneously met: 1) TAPS throughput was at or below 350,000 b/d and 2) total ANS oil production revenues were at or below $5 billion/year. These conditions are satisfied only in the AEO2012 low oil price case, when ANS oil production is shut down and TAPS is decommissioned in 2026.

About the Author

Marilyn Radler

Senior Editor - Economics

Covers worldwide oil and gas market developments, creates forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 1996 as Survey Editor. She holds a BA in Economics from the University of Texas at Austin. A Past President of the Houston chapter of the United States Association for Energy Economics, Marilyn currently serves as a USAEE council member.