Labor, material needs estimated for US construction of jack ups

Mark J. Kaiser

Brian F. Snyder

Center for Energy Studies

Louisiana State University

Baton Rouge

Jack up rig construction in the US generates an average of $374 million in direct revenue each year and employs about 2,500 people in the Gulf Coast. Although employment is small relative to other offshore industries, such as equipment manufacturing, drilling contractors, and offshore supply vessel construction, the jack up rig construction market is important regionally and in a cultural sense because of its long tradition in the region.

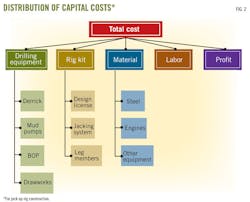

This article follows a top-down approach to estimate labor and material requirements of US rig construction. The cost to construct a rig is decomposed into five elements-drilling equipment, rig kit, labor, material, and profit. For each element a cost module is developed. The cost estimation procedure is illustrated on a moderate-environment LeTourneau Super 116E rig constructed in 2010. The authors conclude by estimating the US market size and labor requirements of jack up construction.

Rig construction

Two US shipyards build rigs: the LeTourneau yard in Vicksburg, Miss., and the Keppel AmFELS yard in Brownsville, Tex. Between 2000 and 2012, the LeTourneau yard delivered 11 rigs, and the Keppel AmFELS yard delivered 14 rigs. Approximately two jack ups have been delivered each year over the past decade at a total value of $3.9 billion.

Cost components

During the contracting process, shipyard personnel estimate the costs of construction to develop a bid price. Rig construction requires capital, labor, and materials, and a budget for each cost component is developed. Capital is recovered through a profit margin assessed on each rig built; labor and material costs are estimated with an engineering-based approach and quotes from industry suppliers.

Capital. The capital costs of shipyard operation are minimal and consist of open land with access to a waterway, enclosed work spaces for welding and fabrication, several cranes, and a launching system. In Asia, launching is frequently conducted via drydock, while in the US, launching is performed via slipway or "walking."

Labor. Labor is required to fit, weld, and assemble steel components, attach drilling equipment, and certify, inspect, and manage construction. Major work requirements during rig-building include welding of steel components, assembly of piping systems, installation of equipment, outfitting, material-handling, engineering, and management.

Materials. Materials include steel, drilling equipment, the rig kit, engines and generators, and various other manufactured goods. Steel is used in rig construction because of its strength, durability, corrosion resistance, weldability, and price. Drilling equipment includes the derrick, top drive, blowout preventer, mud and pipe handling systems, and other systems. It is frequently purchased as a package from an integrated supplier. The rig kit includes the jacking systems, design license, and other components sold by the design firm. In the case of LeTourneau rigs, kits typically include leg components, cranes, and capstans. Engines and generators provide the power and electricity to power a rig. Other material includes outfit material, piping, electrical system components, pumps, and safety equipment.

Supply chain distribution

Labor costs directly enter local economies, but material costs are distributed across greater geographic regions and often represent a greater percentage of the total cost in rig construction. Fig. 1 shows the major manufacturing centers for steel and equipment used on rigs built in US yards.

For LeTourneau-designed rigs, leg steel is fabricated in Longview, Tex. Lower strength 34,000 or 51,000 psi (34-51 ksi) steel is widely available throughout the shipbuilding industry and is typically ABS A, ABS AH36, or similar grades. Globally, several hundred mills produce ABS-certified products, including 36 in the US, mostly in the Midwest, Southeast, Pennsylvania, and West Virginia.

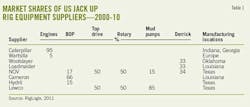

Table 1 shows the major suppliers of equipment in US-built rigs during 2000-10. Engines are typically sourced from Caterpillar. Caterpillar marine engines are assembled at the Lafayette, Ind., and Griffin, Ga., manufacturing facilities. BOPs are sourced from Cameron, Hydril, or National Oilwell Varco (NOV). Derricks are sourced from Woolslayer, Loadmaster, or NOV, and most other drilling equipment from either Lewco (a division of LeTourneau) or NOV.

Much of the drilling equipment used in jack up rigs is assembled in and around Houston and other locations in Texas and South Louisiana. Cameron operates manufacturing facilities in Ville Platte, La.; NOV operates manufacturing facilities in and around Houston and Pampa, Tex.; Woolslayer (now Lee C. Moore, A Woolslayer Company) operates a manufacturing facility in Tulsa; Loadmaster operates a manufacturing facility in Broussard, La.; and LeTourneau drilling systems operates manufacturing facilities in Longview and Houston.

Cost estimation and adjustment

A top-down approach is used to estimate the cost components of rig construction. Since most rigs built in the US in recent years have been LeTourneau Super 116Es, the authors emphasize this design, but the methodology presented is completely general.

The cost to construct a rig is broken into five elements: drilling equipment, rig kit, labor, material, and shipyard profit (Fig. 2). For each of the elements, a cost estimation module is developed.

The drilling equipment and rig kit modules apply fixed prices and do not vary with other input. For all other modules, the output cost is a function of user input and module parameters. User input includes capital costs, lightship displacement, and installed power. If any of these are unknown, empirically derived relations may be substituted. Module parameters include wages and productivity assumptions.

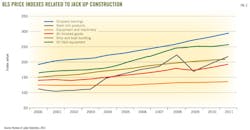

All price assumptions and output costs are in 2010 dollars and reflect average market conditions during 2005-10. To apply the estimation procedure to a future time period, output is multiplied by a forecast adjustment factor. The adjustment factor is given by It/I2010, where It is the value of the appropriate Bureau of Labor Statistics (BLS) producer price index at time t, and I2010 is the index value in 2010 (Table 2; Fig. 3).

Capital expenditures

The total capital cost of the rig is user input for several component modules. In many cases, capital costs may be known and input directly; if unknown, they are estimated based on rig specifications.

Data source

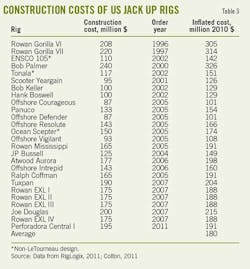

Cost data for all rigs ordered in the US from 1996 through 2011 were assembled from the commercial data provider RigLogix. Contract costs are publicly reported because most drilling operators are public companies, and rig construction represents a significant investment for the firm. The use of public data is subject to reporting bias because costs may not be reported similarly and may differ in the inclusion of owner-furnished equipment or finance costs. All data were inflated to 2010 dollars with the BLS shipyard producer price index and the order date.

Rig construction cost

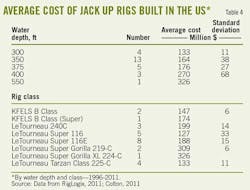

Table 3 depicts the nominal and inflated construction costs of all US-built rigs ordered between 1996 and 2011. A total of 26 rigs were built in the US during this time. All rigs are independent-leg cantilever units, and all but three were LeTourneau designs. Inflation-adjusted prices range from $101 million to $326 million, with an average of $180 million.

Jack up costs by water depth and design class appear in Table 4. Costs generally increase with increasing water-depth capacity, and within a water-depth class, costs are reasonably similar because of similar build locations and contract execution dates. In some cases, prices range widely for similar rigs. For example, the Offshore Defender, Resolute, Courageous, Intrepid, and Vigilant are all LeTourneau Super 116s, built at the Brownsville, Tex., shipyard and ordered in 2005 and 2006. The Defender and Courageous cost $87 million each, while the Resolute and Intrepid cost $143 million. The difference in cost results from contract options and timing. Defender and Courageous were built as options executed in 2005 but based on contracts written in 2004, while the other rigs were new contracts written in 2005 and 2006 at a time of higher demand.

Regression model

Jack up cost estimates use a multifactor regression model based on descriptor variables specific to the rig class, user preferences, and data availability. Predictor variables include hull length, hull width, order date, drilling depth, maximum water depth, and environmental design. Costs are expected to be positively correlated with all variables.

Hull width was correlated with hull length, water depth, order date, and harsh environment variables. Multicolinearity was also found between the harsh environment indicator and the hull length and order date variables. These variables were not allowed to enter the model together. The best model for the 26 rigs in the sample was specified by:

Cost = –96 + 0.42 · WD + 0.003 · DD + 103 · HARSH

where cost is in million dollars, WD is water depth (ft), DD is drilling depth (ft), and HARSH is an environmental indicator variable (1 if harsh, 0 otherwise). All the coefficients are of the expected sign and statistically significant, and the model explained 77% of the variance in cost. According to the generalized relation, every 100 ft of increased water depth capability increased construction cost by $42 million; each 1,000 ft of drilling depth capability increased cost by $3 million, and the premium for harsh environment rigs was $103 million.

Labor cost module

Labor cost is determined as the product of the number of man-hours required and the average hourly wage. The number of hours required is estimated from the capital costs divided by the productivity. The labor cost relation is thus:

Labor cost = (Capital costs ÷ Productivity) × Wage

where capital costs are measured in dollars, productivity is measured in dollars of value produced per hour of labor ($ output/hr labor), and wages are measured in dollars per hour ($/hr). Capital cost is a user input. Wages and productivity are input on the basis of empirical data.

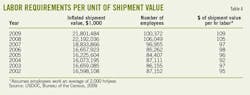

Hourly wages in rig building are expected to be similar to the shipbuilding industry because of the commonalities in the work requirements. In Table 5, the costs of labor at US shipyards including fringe benefits are depicted in inflation-adjusted terms. The inflated dollars per hour (the last column of Table 5) is calculated under the assumption that all employees work an average of 2,000 hr/year. Labor costs in US shipyards appear relatively stable over time and range from $35/hr to $38/hr from 2002 to 2009.

The number of man-hours required to construct a jack up rig depends on the rig type, nation of build, preassembly status, and shipyard. Because jack up productivity in US yards is confidential, estimating the labor requirements in support of rig construction requires use of a suitable proxy. Steel weight or compensated gross tonnage has been used to represent the man-hours required to construct a ship; however, jack up rigs are structurally different from other ship types, and their compensated gross tonnage factors are not well defined.

This analysis uses the average revenue generated by one unit of labor for the entire US shipbuilding industry as a proxy for the relationship between labor and revenue for the rig-building industry. This method assumes that productivity is similar between the US rig and shipbuilding industries, which is likely to be reasonable as long as the technology employed in shipbuilding is roughly similar to that used in rig-building. This assumption is difficult to validate given the data constraints associated with rig construction but provides a consistent way to estimate market revenue and infer employment in support of rig construction and is amenable to the available data.

Table 6 divides the annual shipment value from all US shipyards by the annual number of hours worked to yield productivity in terms of shipyard revenue per hour of labor. One hr of labor generated between $92 to $109 of vessel value from 2002 to 2009, or on average $100 of vessel value, which is approximately equal to the productivity in Keppel's Singaporean yards in 2010. The labor required to construct a vessel is estimated by multiplying vessel cost by the inverse of productivity. Thus, a $200 million jack up rig can be expected to require approximately 2 million man-hr of labor in construction, which is consistent with anecdotal reports and conversations with rig-construction engineers.

Material module

The major material costs relate to steel, rig engines, and a varied group of other materials.

Steel submodule

The two grades of steel typically used in rig construction include low-carbon steel for structural elements such as legs, decks, railings, walkways, and deck plating and high-strength, low-alloy steel for critical components and extreme conditions. Three categorizes of steel components are considered: hull steel (typically 34-51 ksi), leg steel (typically 100 ksi), and miscellaneous steel (typically 72-90 ksi).

Steel costs are estimated separately for each component (x = hull, legs, miscellaneous) and summed. Costs are calculated as the weight of steel (in tons) multiplied by the price per ton. Each component is assumed to be a proportion of lightship displacement:

Steel costx = Percent weightx × Light-

ship displacement × Steel pricex

Lightship displacement is a user input. The proportion of lightship displacement attributable to the leg, hull, and miscellaneous steel is estimated from known weight distributions of a sample of rigs (Table 7). Although the sample size is small and based on both generic and actual rigs, interval ranges are not expected to vary significantly across rigs. Approximately 20-30% of a rig weight is made up of steel in the legs and spud cans, while 40-60% is made up of steel in the hull, jacking houses, and cantilevers.

Table 8 depicts the weight distribution of a 300 ft moderate environment rig. Fifty-three percent of the rig is composed of 34-51 ksi steel in the hull, 23% is composed of 100 ksi steel in the legs, and 7% is composed of miscellaneous 72-90 ksi steel throughout the rig. From Tables 7 and 8 it can be assumed that for a moderate-environment, 300 ft water depth rig, 20-30% of steel is leg steel, 40-60% is hull steel, and 5-10% is miscellaneous steel.

Steel prices vary with changing market conditions and depend on yield strength, shape, and quantity ordered. Deliveries are negotiated on a per-rig basis and are not publicly reported; however, hull steel prices are expected to be similar to North American A36 plate which varied from $267/ton to $1,080/ton between 2001 and 2011.

The authors assume that leg steel costs $4,000-7,000/ton, hull steel costs $700-1,100/ton, and miscellaneous steel costs $1,000-1,500/ton. Hull steel costs are estimated with confidence because prices for shipbuilding steel are widely reported, although highly variable over time. Prices for leg steel are less certain because they are not widely tracked. Miscellaneous steel is a minor cost component.

Engine submodule

Engines and generators are a large component of material costs. While most rigs use a version of the Caterpillar 3516, a number of versions and options are available, and prices vary with market conditions.

Based on a 2012 survey of generator set prices, generator sets are assumed to cost $400-600/Kw delivered. Table 9 provides the installed power on selected rig designs. If the actual power of a rig is known, it may be input; otherwise, power is assumed to range from 8 Mw to 11 Mw.

Other materials submodule

Other materials include piping, wiring, and other electrical equipment; pumps, heating and cooling systems; kitchen equipment; lifeboats and other safety equipment; and capstans, cranes, navigational equipment, furniture, and other outfit materials. Consumables include paint, electricity, fuel, and welding supplies.

The costs of these supplies are difficult to generalize, but in the shipbuilding industry they typically account for 20-25% of total vessel costs. Material costs for rigs are assumed to represent a proportion of total costs similar to that of ship construction.

Rig kit module

Rig kit costs depend on the rig design and the scope of the kit and are purchased separately. All kits include a design license and jacking systems.

In LeTourneau rigs, kits also include leg components, anchor winches, cranes, and certain components for the cantilever and spud cans, but the precise components are negotiable. Between 2007 and 2009, LeTourneau reported income of $418 million for work on 15-18 rig kits, giving an average cost of $23-29 million/kit during this time. Recent contract costs for LeTourneau Super 116E rig kits are shown in Table 10.

Rig kits are assumed to cost $25-45 million/rig. Rig kits are likely to scale in proportion to the size of the rig, and for rigs larger than the Super 116E, kits will be more expensive.

Drilling equipment module

Drilling equipment is not included in the rig kit. Drilling equipment includes derricks, mud pumps, top drives, BOPs, drawworks, automated pipe-handling systems, and solids-control systems. Drilling equipment costs vary with the drilling capabilities of the unit.

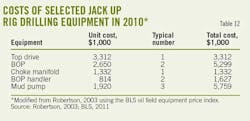

Recent contract costs for jack up rig drilling equipment systems are shown in Table 11. Table 12 shows the costs of specific drilling components adjusted to 2010 dollars. Costs for a complete drilling package range from $20 million to $70 million. The two highest costs reported in Table 11 are for Gusto MSC CJ70 jack ups, a high-specification, harsh-environment design.

For rigs such as the Super 116E, costs for a complete drilling package range between $20 million and $50 million.

Profit module

Profit margins are the proportion of revenue attributable to net income. The US jack up construction industry competes with international markets with lower labor costs and higher productivity; as a result, profit margins are expected to be low on a relative basis. For example, from 2006 to 2010, Rowan's drilling products division (principally composed of the LeTourneau shipyard) received an average profit margin of –2.7% and a maximum of 9.7%. In contrast, Keppel's marine division averaged a 13.6% profit margin over the same period.

Low profit margins do not adequately protect a firm from the risks of cost overruns, and this analysis assumes that profit margins below 5% are unsustainable. Profit margins above 10% are unlikely due to international competition.

The authors select a range of 5-10% as representative of the US industry and apply this range in subsequent calculations.

Illustration

The cost estimation procedure employed is illustrated with a hypothetical moderate-environment LeTourneau Super 116E constructed in the Gulf Coast in 2010. The rig is assumed to have an operational water depth of 375 ft, a drilling depth capability of 30,000 ft, and hull dimensions of 243 ft by 206 ft.

Costs, profits

Capital costs. Application of the capital cost model requires the user to substitute the operational water depth, drilling depth, and environmental design into the capital expenditure regression model described previously to obtain $164 million. Capital cost is the primary input in the labor, material, and profit modules.

Labor costs. Labor requirements are determined by the product of the capital cost and the inverse productivity metric. For hourly compensation of $34-38/hr and productivity of $90-100/hr, labor costs range from $51 million to $69 million (Table 13).

Material costs. The water depth, length, and breadth of the rig are substituted into an empirically derived weight relation developed by the authors:

D = 49,316 – 3,233WD + 0.563WD2 + 0.12LB

to yield 12,575 tons. Table 14 partitions this mass among rig components based on the assumed weight distribution described for leg steel (20-30%), hull steel (40-60%), and miscellaneous steel (5-10%). Steel costs range from $14 million to $37 million and are dominated by the costs of leg steel because of its high unit costs, even though the hull contributes the majority of the weight.

Installed power is assumed to range from 8 Mw to 10 Mw and is multiplied by the unit cost ($400-600/Kw) yielding generator costs of $3-6 million. Other material costs are assumed to range from 20% to 25% of capital costs, or $33-41 million.

I Rig kits for LeTourneau rigs are assumed to cost $25-45 million. Drilling equipment is assumed to cost $20-50 million.

I Profits are assumed to be 5-10% of capital costs, or $8-16 million.

Cost distribution

Table 15 shows the distribution of construction cost along with cost estimates provided by industry personnel. The costs of leg steel are included in the rig kit.

Approximately one third of costs are associated with shipyard labor, and over half of costs are associated with materials, mostly in the drilling equipment package and rig kit. The total expected costs range from $145 million to $237 million with an average of $191 million.

This matches closely with the $195 million purchase price of a LeTourneau Super 116E ordered from the AmFELS shipyard in 2011.

US jack up market size

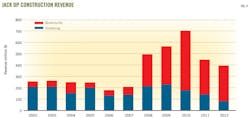

The annual inflation-adjusted value of the US jack up rig industry is shown in Table 16 by shipyard. The total value of deliveries ranged from $129 million in 2005 and 2006 to $986 million in 2008.

The 3-year average of delivery value is a better measure of annual industry revenues because payments for shipbuilding are spread throughout construction. On average, the rig-building industry generates $374 million in revenue each year.

Table 16 and Fig. 4 show the distribution of estimated revenue at the two jack up shipyards in the US. In the early part of the decade, the LeTourneau Vicksburg yard dominated rig construction, but by 2005 the AmFELS Brownsville yard had surpassed LeTourneau in revenue.

In 2011, the Vicksburg shipyard was sold to Cameron, a flow equipment manufacturer, along with the LeTourneau Technologies drilling-equipment manufacturing division. The Vicksburg shipyard delivered the Joe Douglas to Rowan in late 2011, and as of early 2012 the Vicksburg shipyard has no newbuild orders and has stopped building rigs. Barring a major change in market conditions, work in the yard is unlikely to resume.

US jack up labor market

US shipyard productivity varies between $90 to $110 of revenue generated for each hour of input labor. This productivity range and the 3-year average value of revenue yield the total annual employment in the rig-building industry given in Table 17. Between 2000 and 2010, an estimated 800-3,900 people were directly employed by the jack up construction industry. Table 18 shows the distribution of employment by shipyard.