World-class deepwater natural gas discoveries offshore in the Indian Ocean have turned the East African margin into one of the planet's hottest exploration theaters.

Early exploratory wells have uncovered gross gas volumes approaching 100 tcf in place when the operators' high estimates are combined.

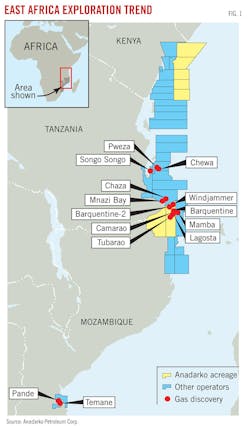

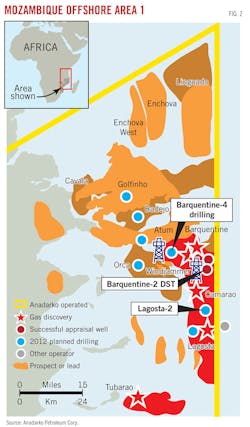

The industry holds licenses in force along a front of more than 800 miles offshore northern Mozambique, Tanzania, and Kenya (Fig. 1). Drilling density is sparse in the southern part of the trend and extremely light in the north.

The expanse of the deepwater play takes in, from south to north, the Rovuma, Mafia Deep, and Lamu basins. Exploration is also scarce in the onshore parts of the basins.

Farther south, the Mozambique Channel between Mozambique and Madagascar is also receiving closer scrutiny.

Anadarko's exploration program

Anadarko describes its multiple 2010 and 2011 discoveries as extending over tens of miles and made to order to support LNG projects (see LNG article, p. 122).

The company's "10 incredible wells," as one official described them, have found gas at this writing in mid-March only in Eocene and Oligocene rocks, leaving the younger Miocene and older Paleocene portions of Tertiary as targets to be pursued.

Anadarko has 3D seismic coverage of the block's entire deepwater expanse and had collected 2,516 ft of whole core, 95% sand, from its wells by the time it ran the first flow test a few weeks ago, said Frank Patterson, Anadarko vice-president exploration.

The company said the second rig, brought in to conduct well tests while the first rig continues drilling, would be looking for the pressure pulses that indicate communication between wells.

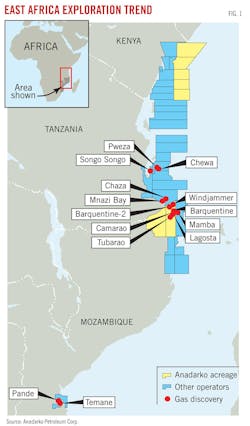

The gaseous northern part of the 2.6 million acre Offshore Area 1 is vast in areal extent with high-quality continuous sands and a very low dip rate.

In 2012, Anadarko will drill the Golfinho and Atum structures, which Patterson said may be connected to the big field.

It will also drill Orca, a deeper Paleocene prospect. Patterson recalls that the Windjammer and Barquentine discoveries had Paleocene pay but noted that Anadarko has not yet talked about their resource size.

Meanwhile, the southern part of the block "could be the development area for a new hub," Patterson said. Working its way south, where Patterson noted Anadarko has had shows of liquids, the company in 2012 will drill an appraisal to its Tubarao discovery. It also has the Barracuda and Black Pearl prospects ready.

Early work and unitization

Anadarko and its partners expect the large field, which extends into Eni-operated Offshore Area 4 seaward of Offshore Area 1, to be unitized, said Don MacLiver, Anadarko vice-president of operations.

Anadarko has already begun a dialog with Eni, he added.

Even with the gentle dip of the reservoir, however, the Anadarko group's advantage is that Offshore Area 1 is updip and appears to contain the larger share of the resource.

"We look for unitization to deliver efficiency," MacLiver said.

Patterson said Anadarko looks to make a final investment decision on the first two LNG trains in late 2013 and to begin gas sales in 2018. Meanwhile, Barquenjammer field, as the company calls its sprawling initial discovery by combining parts of the names of two of the initial discovery wells, is "massive and growing.

"Quite frankly, we don't know where this thing is going…it could be much bigger," he said in mid-March.

Each 5 million tpy LNG train is expected to consume 750 MMcfd or a total of 10-12 tcf of gas over the life of the project, MacLiver said. The nearest discovery lies only about 30 miles off the coast.

Cove Energy PLC, which holds exploration and production interests in Mozambique and Kenya and is selling an interest in Mnazi Bay field in Tanzania to Wentworth Resources Ltd., Dar es Salaam, noted that this could become one of the world's largest LNG projects.

Barquentine flow tests

The Anadarko group's second rig off Mozambique was moving in mid-March to conduct a second flow and interference test at the Barquentine-1 well (Fig. 2).

From there it will continue to the Lagosta and Camarao wells south of Barquentine.

On the first such test, at Barquentine-2, the Deepwater Millennium drillship (cover of this issue) worked in 5,400 ft of water as the well flowed at an equipment-constrained rate of 90-100 MMcfd of gas with minimal pressure drawdown (OGJ Online, Mar. 12, 2012).

Anadarko said these "exceptional flow characteristics confirmed the deliverability of this reservoir and indicated a low density of development wells may be sufficient to produce the reservoir."

Bob Daniels, Anadarko senior vice-president, worldwide exploration, said, "Using preset gauges in an offset well, we were able to confirm connectivity and reservoir continuity over a distance of more than 3 km.

"The test also proves the reservoir has very high permeability, meeting the quality specifications for the partnership's LNG development plans. This is a very encouraging way to start our testing program, which is an important component in the reserve certification process, as we focus on achieving FID (final investment decision) around the end of 2013."

Anadarko's partners in Offshore Area 1 are Mitsui E&P Mozambique Area 1 Ltd., BPRL Ventures Mozambique BV, Videocon Mozambique Rovuma 1 Ltd., Cove Energy Mozambique Rovuma Offshore Ltd., and Mozambique's state Empresa Nacional de Hidrocarbonetos EP.

Tanzania deep water

Statoil and ExxonMobil continued to deepen a deepwater wildcat offshore Tanzania in mid-March after reporting gas shows.

Zafarani-1, first well on 5,500 sq km Block 2 in the Mafia Deep subbasin, is projected to 5,150 m in 2,582 m of water. Without giving a depth, Statoil said the well had "encountered indications of natural gas in a good quality reservoir."

The two majors spudded the well in early January 2012 about 80 km off Tanzania and 160 km north-northwest of the Offshore Area 1 and 4 blocks off Mozambique.

The Zafarani well is also 100 km north of the Ophir Energy PLC-BG Group's Chaza gas discovery on Block 1 about 18 km off Mnazi Bay, Tanzania, in the Rovuma basin. Zafarani is 115-120 km south of Ophir-BG's Chewa and Pweza gas discoveries on Tanzania offshore Block 4 in the Mafia Deep subbasin and 75 km east-northeast of Songo Songo gas field (OGJ Online, Apr. 4, 2011).

Ophir-BG have tagged Pweza and Chewa, drilled in 2010, with contingent resources of 1.7 tcf and 611 bcf, respectively, and Chaza, drilled in 2011, with 92 bcf.

Ophir-BG plan to drill as many as five exploratory wells on Blocks 1, 3, and 4 in 2012 and have said those blocks and the shoreward East Pande block contain numerous untested leads and prospects with stacking potential.

Ophir said Tertiary-age river deltas along the coast have acted as provenance for high-quality slope channel and slope/basin-floor-fan (reservoir) sands.

The company said the Ophir-BG discoveries to date have chased stratigraphic plays with a strong structural influence but that the Anadarko-type basin floor fan purely stratigraphic play, mapped as extending into Block 1, is untested in Tanzania with 3D seismic yet to be acquired.

North of Block 4, Petrobras and Shell hold Block 5 off Dar es Salaam, and numerous blocks are under license even farther north in the Lamu basin off Kenya, which has no hydrocarbon production.

Statoil operates Block 2 on behalf of Tanzania Petroleum Development Corp. and has a 65% working interest, and ExxonMobil Exploration & Production Tanzania Ltd. has 35%. Statoil was awarded the Block 2 license in 2007.

North along trend

The scarcity of exploratory drilling north of Mozambique in Tanzania and Kenya, including the near absence of drilling in deep water, leaves untold potential there.

Tullow Oil PLC plans late 2012 drilling on three prospects in Kenya, including one on Block L8 offshore.

Last fall, a Total SA unit acquired a combined 40% interest in five exploratory blocks in the Lamu basin off Kenya (OGJ Online, Sept. 21, 2011). That included a 20% stake in the L5, L7, L11a, L11b, and L12 blocks from Anadarko Kenya Co., which remains operator. Total acquired a 15% interest in the same blocks held by Dynamic Global Advisors and a 5% interest from Cove Energy PLC, which retains 10% interest in the permits.

The companies shot 3,500 sq km of 3D seismic on the permits, which cover more than 30,500 sq km in 100-3,000 m of water.

Afren PLC has a 74% interest in the Tanga block mainly offshore northeast Tanzania in coastal to shallow water. The Orpheus prospect is on its drilling schedule for 2012. Tanga is directly south of and adjoins Kenyan blocks L17 and L18 in which Afren holds full interest.

The 756 sq km Mnazi Bay concession in coastal southeastern Tanzania in the Rovuma basin contains Mnazi Bay and Msimbati gas fields and has Tertiary, Cretaceous, and Jurassic potential. All four wells drilled to date encountered hydrocarbons, and the MB-1 well is producing 1.7-2.0 MMscfd of gas to the Mtwara power plant for local power generation.

Wentworth Resources said the Ziwani-1 exploratory well is being drilled 13 km west of the two gas fields.

Aminex PLC and Solo Oil PLC appear to have extended the Rovuma deepwater play by drilling gas pay in Cretaceous sandstone with the basin's first onshore discovery at Ntorya-1 in southeastern Tanzania. It was deepening the well to another target at this writing.

Anadarko notes that more than 50 wells have been drilled in and off Tanzania since the 1950s, two of which discovered the coastal Songo Songo and Mnazi Bay gas fields.

More recently, however, wildcats turned up two gas discoveries on offshore Block 4 in 2010 and one gas discovery on offshore Block 1 in April 2011. More drilling is expected this year.

Anadarko sees material potential in the deep water off Kenya, which is undrilled although drilling is expected to start soon. More than 36 wells have been drilled in Kenya since the 1960s.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com