Near-term pipeline plans grow, longer-term projects sag

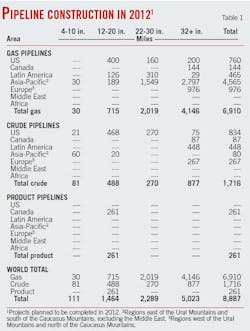

Planned pipeline construction to be completed in 2012 rose 6.7% from the previous year, with increases in planned crude and natural gas pipelines more than countering sharply reduced products pipeline construction plans.

Operators plan to complete installing 8,887 miles in 2012 alone (Table 1), with natural gas construction's share of the plans (more than 6,900 miles) making up nearly 78% of the total, based on reports from the world's pipeline operating companies and data collected by Oil & Gas Journal.

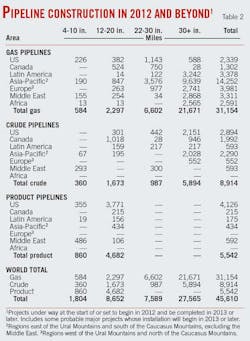

Looking forward to 2012 and beyond, however, for the fourth consecutive year less mileage is planned than had been the year before, as fiscal worries in a number of regions continue to weigh on large, long lead-time infrastructure projects such as pipelines.

Also in contrast to 2012 plans, long-term construction plans (2012 and beyond) saw growth in both crude and products lines, while plans for gas pipelines shrank, with expanded crude and NGL line plans in the US leading the way forward.

Larger long-term crude pipeline plans in the US, Canada, and Asia-Pacific boosted 2012 and beyond crude miles by 15% from global totals the previous year.

Planned product pipeline construction for 2012 and beyond registered increases in the US, Asia-Pacific, and Middle East.

As a whole, combining both current-year and forward estimates (Fig. 1), the US, Canada, Asia-Pacific, and Latin America saw increases in planned construction, with decreases seen in all other regions.

As 2012 began, operators had announced plans to build more than 45,500 miles of crude oil, product, and natural gas pipelines beginning this year and extending into the next decade, a 3.6% decrease from data reported a year ago (OGJ, Feb. 7, 2011, p. 113), but a slowdown in the rate of contraction after 2 consecutive years of more than 14% losses. The majority (more than 68%) of these plans is still for natural gas, but this segment continues to contract globally relative to crude and products.

Outlook

The downturn in worldwide pipeline construction trends reflects current fiscal unease, but runs counter to US Energy Information Administration energy consumption forecasts, which show continued growth.

EIA forecast world marketed energy consumption to increase by 53% through 2035 (using a 2008 baseline), a period that encompasses the long-term pipeline construction projections stated here.

Energy demand growth will be strongest, according to the midyear 2011 analysis, among countries outside the Organization for Economic Cooperation and Development, where economic growth remains high, according to EIA, driven in part by strong capital inflows and high commodity prices. This non-OECD growth will be led by China and India where combined energy use will more than double over the projection period to make up 31% of total global demand by 2035. China's energy demand will be 68% higher than US energy demand by the end of the projection period.

Fueling this energy demand growth is projected gross domestic product growth in non-OECD Asia of 5.3%/year through 2035—led by China at 5.7%/year, the highest projected growth rate in the world—compared with 3.4% worldwide. China's rate of growth is slightly lower than EIA projections from a year earlier, while non-OECD Asia and worldwide growth were both higher.

Structural issues that have implications for medium to long-term growth in China include the pace of reform affecting inefficient state-owned companies and a banking system carrying a large number of nonperforming loans, according to the EIA. There is also growing concern on the part of the Chinese government regarding a possible housing bubble. The development of domestic capital markets to help macroeconomic stability and ensure China's large savings are used efficiently supports medium-term growth projections, according to the EIA.

EIA described the acceleration of structural reforms as essential to stimulating potential growth and reducing poverty in India over the mid- to long-term. Even so, EIA projects 5.5%/year GDP growth in India 2008-35, up from 5.0% last year.

In April 2011, the EIA forecast a 0.5%/year increase in total US liquid fuels consumption, including both fossil liquids and biofuels to an average 21.9 million b/d in 2035 from 18.8 million b/d in 2009, with most of the increase accounted for by biofuels.

EIA projects US oil production climbing 11% from 5.36 million b/d in 2009 to 5.94 million b/d in 2035, with production increases stemming from enhanced oil recovery and shale oil plays.

The agency said that while total domestic natural gas production will grow to 26.3 tcf in 2035 from 21.0 tcf in 2009, shale gas production will grow to 12.2 tcf by 2035, when it will make up 47% of total US production, up considerably from 16% in 2009.

The 2011 outlook projects total US natural gas imports in 2035 slipping to 0.2 tcf. The reduction consists primarily of lower imports from Canada and higher net exports to Mexico as demand growth in both countries outpaces production growth.

EIA describes total 2035 US net imports of LNG in the 2011 outlook reference case as minimal and occurring largely during periods when world liquefaction capacity exceeds demand.

OGJ has for more than 50 years tracked applications for gas pipeline construction to the US Federal Energy Regulatory Commission. Applications filed in the 12 months ending June 30, 2011, (the most recent 1-year period surveyed) demonstrated the shift to smaller, more local projects in the US, vs. larger interstate pipeline construction.

• More than 285 miles of pipeline were proposed for land construction, and no miles for offshore work. For the earlier 12-month period ending June 30, 2010, more than 525 miles were proposed for land construction.

• FERC applications for new or additional horsepower at the end of June 2011, however, rose to more than 233,000 hp from slightly less than 200,000 hp as operators focused on boosting throughput of existing transmission lines.

Bases, costs

For 2012 only (Table 1), operators plan to build nearly 8,900 miles of oil and gas pipelines worldwide at a cost of more than $39.6 billion. For 2011 only, companies had planned more than 8,300 miles at a cost of more than $42.5 billion.

For projects completed after 2012 (Table 2), companies plan to lay more than 45,500 miles of line and spend roughly $203 billion. When these companies looked beyond 2011 last year, they anticipated spending roughly $241 billion to lay more than 47,000 miles of line.

• Projections for 2012 pipeline mileage reflect only projects likely to be completed by yearend 2012, including construction in progress at the start of the year or set to begin during it.

• Projections for mileage in 2012and beyond include construction that might begin in 2012 but be completed later.

Also included are some long-term projects judged as probable, even if they will not break ground until after 2012.

US average cost-per-mile for onshore pipeline construction (Table 4, OGJ, Sept. 5, 2011, p. 97) on FERC applications submitted by June 30, 2011, was $4.4 million. There were no offshore applications submitted.

US average cost-per-mile for offshore construction (Table 7, OGJ, Sept. 14, 2009, p. 69) on projects completed in the 12 months ending June 30, 2009, was $5.37 million. These costs were used again in this year's report due to the absence of offshore filings to FERC in the 12 months ending June 30, 2010 or 2011.

Based on historical analysis and a few exceptions and variations notwithstanding, these projections assume that 90% of all construction will be onshore and 10% offshore and that pipelines 32 in. OD or larger are onshore projects.

Following is a breakdown of projected costs, using these assumptions and OGJ pipeline-cost data:

• Total onshore construction (8,501 miles) for 2012 only will cost more than $37 billion:

—$442 million for 4-10 in.

—$5.8 billion for 12-20 in.

—$9.1 billion for 22-30 in.

—$22.2 billion for 32 in. and larger.

• Total offshore construction (386 miles) for 2012 only will cost more than $2 billion:

—$59.6 million for 4-10 in.

—$786 million for 12-20 in.

—$1.2 billion for 22-30 in.

• Total onshore construction (43,806 miles) for beyond 2012 will cost more than $193 billion:

—$7.2 billion for 4-10 in.

—$34.4 billion for 12-20 in.

—$30.2 billion for 22-30 in.

—$122 billion for 32 in. and larger.

• Total offshore construction (1,356 miles) for beyond 2012 will cost more than $9.6 billion:

—$966 million for 4-10 in.

—$4.6 billion for 12-20 in.

—$4.1 billion for 22-30 in.

Action

What follows is a rundown of some of the major projects in each of the world's regions.

Pipeline construction projects mirror end users' energy demands, and much of that demand continues to center on natural gas, with the industry remaining focused on how to get that gas to market as quickly and efficiently as possible. The following sections look at both natural gas and liquids pipelines.

North America—gas, NGL

BP PLC and ConocoPhillps withdrew their proposed 4-bcfd natural gas pipeline (Denali) extending from Alaska's North Slope to markets in Canada and the US in May, citing a lack of sufficient customer interest.

TransCanada Alaska meanwhile continued work on its Alaska Pipeline Project. TransCanada was awarded rights to build a North Slope gas pipeline under the Alaska Gasline Inducement Act in January 2008. AGIA requires TransCanada to meet certain requirements that will advance the project in exchange for a license providing up to $500 million in matching funds.

In June 2009, TransCanada agreed with ExxonMobil Corp. affiliates to work together on the pipeline. ExxonMobil will share expenses in advancing the project's technical, commercial, regulatory, and financial aspects, while TC Alaska remains the AGIA licensee. TransCanada already has NEB authorization for its project.

Alaska Pipeline Project closed its initial open season July 30, 2010, after receiving bids from potential natural gas shippers. The open season called on potential gas shippers to make bids of 20 years or more to reserve capacity on the proposed pipeline.

The Alaska Pipeline Project presented two alternatives for assessment by potential shippers, only one of which will move forward. One option would transport an estimated 4.5 bcfd of gas from Alaska's North Slope about 1,700 miles across Alaska to Alberta, Canada, where it could be sent on existing pipelines to North American gas markets. The second option would transport an estimated 3 bcfd of gas about 800 miles to Valdez, Alas., where shippers could liquefy the gas in a plant constructed by others and ship it on tankers to US and international markets.

During summer 2011, project scientists and technical experts conducted environmental and cultural field studies along the proposed pipeline route in Alaska. TransCanada plans to file the project's certificate of public convenience and necessity with the US Federal Energy Regulatory Commission in October 2012.

Alaska's Natural Gas Development Authority continues to develop plans for intrastate gas pipelines, including the Alaska Gasline Development Corp.'s 737-mile, 24-in. OD line intended to bring North Slope gas south. AGDC submitted its plan for the project—the Alaska Stand Alone Pipeline—to the Alaska legislature in July 2011. The plan included a revised project timeline with first gas in late 2018 instead of yearend 2015.

The plan called for public ownership of the line, noting that the lower borrowing costs would allow for the lowest possible tariff structure, with a private company to both build and operate the system. The plan also noted the apparent commercial feasibility of a 500-MMcfd LNG liquefaction anchor tenant for ASAP and estimated the cost of the pipeline at $7.5 billion, with a 30% margin of error.

The system as proposed will run from Prudhoe Bay following the Trans Alaska Pipeline System (TAPS) and Dalton highway corridors to near Livengood, northwest of Fairbanks, at which point it would follow the Parks highway corridor south to its terminus interconnect with the Beluga Pipeline near Big Lake (part of the Enstar Beluga distribution system). The system would include a 35-mile, 12-in. OD lateral to Fairbanks, with a capacity of 60 MMcfd.

In Canada, the proposed Mackenzie Valley pipeline would stretch more than 750 miles to transport Mackenzie River Delta gas to Alberta and beyond. Plans call for initial capacity of 1.2 bcfd, expandable to 1.9 bcfd. Canada's Joint Review Panel, examining the environmental and socioeconomic impacts of the $16.2 billion (Can.) project, approved it in December 2009. The National Energy Board followed suit in December 2010, and issued a certificate of public convenience and necessity for the project in March 2011, but Imperial Oil Ltd. had pushed its investment decision date out to 2013.

In addition to Imperial (34.4%), partners in the project include ConocoPhillips Canada (15.7%), Shell Canada (11.4%), ExxonMobil Canada (5.2%), and the Aboriginal Pipeline Group. Costs include $7.8 billion for the Mackenzie Valley mainline, $3.5 billion for the gas gathering system, and $4.9 billion for anchor-field development.

A number of projects are under evaluation to move NGLs, primarily ethane, produced in the Marcellus shale to potential consuming centers in both the Gulf Coast and Midcontinent.

Enterprise Products Partners LP announced last month that it had received sufficient transportation commitments to support development of its 1,230-mile Appalachia-to-Texas ethane pipeline (ATEX Express), running from the Marcellus-Utica shale areas of Pennsylvania, West Virginia, and Ohio to the US Gulf Coast. ATEX Express will have the capacity to transport up to 190,000 b/d from Appalachian production areas to Enterprise's storage and distribution assets in Texas.

Originating in Washington County, Pa., the first leg of the system would involve building about 595 miles of new pipeline extending to Cape Girardeau, Mo., closely paralleling an existing Enterprise pipeline. At Cape Girardeau, Enterprise will reverse a 16-in. OD pipeline and place it into ethane service.

At the southern end of the ATEX Express pipeline, Enterprise will build a 55-mile, 16-in. OD pipeline to provide shippers with access to its NGL storage complex at Mont Belvieu, Tex. Enterprise expects ATEX Express to enter service first-quarter 2014.

El Paso Midstream Group Inc., a subsidiary of El Paso Corp., suspended accelerated development efforts of its proposed Marcellus Ethane Pipeline System (MEPS) in 2011. MEPS conducted a binding open season from June 27, 2011, to Sept. 15, 2011, to obtain shipper commitments for ethane transportation service. El Paso said the project received "significant interest" and remained a viable alternative to transport Marcellus ethane to the Gulf Coast, but the responses did not support its accelerated schedule to meet a proposed in-service date of November 2014.

MEPS would transport as much as 60,000 b/d ethane from fractionation plants in the Marcellus shale to destination interconnect points with third-party ethane pipelines and storage near Baton Rouge, La. MEPS would use a combination of new pipeline and existing pipeline, expected to be acquired from Tennessee Gas Pipeline Co. and converted to ethane service.

Project Mariner, announced in 2010 by Sunoco Logistics Partners LP and MarkWest Energy Partners LP, would transport 50,000 b/d of Marcellus shale ethane to Philadelphia for shipment to US Gulf Coast chemical producers and European markets. Mariner West, a 65,000-b/d expansion of Project Mariner, would move ethane to Sarnia, Ont.

The combined projects would include 85 miles of new pipeline construction, using existing Sunoco infrastructure for the balance of each route. MarkWest would build ethane storage in the Philadelphia, Pa., and Nederland, Tex., areas as part of the project, using existing storage in Sarnia. MarkWest expects Mariner West to enter service mid-2013.

Both the Bakken and Permian plays also saw NGL pipeline proposals. Oneok Partners LP plans to build a 525-615-mile, 60,000 b/d pipeline to move unfractionated NGLs from the Bakken shale in the Williston basin in North Dakota to the partnership's Overland Pass Pipeline, a 760-mile NGL pipeline extending from southern Wyoming to Conway, Kan. Additional pumping could increase the new pipeline's capacity to 110,000 b/d.

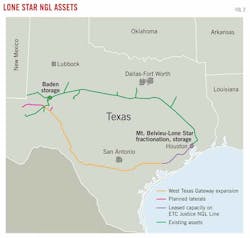

Lone Star NGL LLC, a joint venture of Energy Transfer Partners LP and Regency Energy Partners LP, will build a 530-mile NGL pipeline from Winkler County in West Texas to processing in Jackson County, Tex., moving Permian basin production eastward (Fig. 2). The new line will have a minimum capacity of 130,000 b/d, with the potential to expand, depending on commercial demand. Lone Star expects the pipeline to be completed by first-quarter 2013.

Enterprise Products Partners, Enbridge Energy Partners LP, and Anadarko Petroleum Corp. agreed to design and build a 580-mile NGL pipeline from Skellytown, Tex., to fractionation and storage in Mont Belvieu, Tex. The 280,000-b/d Texas Express Pipeline (TEP) will provide additional takeaway capacity to producers in West and Central Texas, the Rocky Mountains, southern Oklahoma, and the Midcontinent, according to the joint venture, and additional supplies to Gulf Coast petrochemical facilities. TEP can expand to roughly 400,000 b/d given sufficient market interest, said the companies.

Enterprise will build and operate the pipeline, with Enbridge building and operating the gathering systems. The venture expects the pipeline and gathering systems to begin service in second-quarter 2013, subject to regulatory approvals.

North America—crude

TransCanada announced plans in July 2008 for the Keystone Gulf Coast Expansion Project (Keystone XL), providing additional capacity of 500,000 b/d from western Canada to the US Gulf Coast by 2012. The expansion would boost Keystone system's total capacity to 1.1-million b/d at a total capital cost of about $12.2 billion. Keystone XL secured additional firm, long-term contracts for 380,000 b/d for an average of 17 years from shippers.

Keystone XL would include 1,980 miles of 36-in. OD line starting in Hardisty, Alta., and extending to a delivery point near existing terminals in Port Arthur, Tex. XL will also include 41 pump stations—33 in the US and 8 in Canada—at roughly 50-mile intervals. Each station will use two to three 6,500-hp electric pumps, providing a total of up to 19,500 hp/station. Each station could be expanded to 32,500 hp as part of boosting the combined Keystone system's throughput to 1.5 million b/d.

Keystone XL, however, became embroiled in US domestic politics, with the administration of President Barack Obama rejecting TransCanada's application in January 2012.

TransCanada will reapply for a Keystone XL permit, describing its rejection as one of the anticipated scenarios. The company said it expects a new application would be processed in an expedited manner, allowing for an in-service date of late 2014. TransCanada also said it would continue to work collaboratively with Nebraska's Department of Environmental Quality to determine the safest route for the pipeline and expects to complete this process in September-October 2012.

TransCanada also confirmed that its Cushing MarketLink project, designed to bring crude from Cushing, Okla., to Port Arthur, Tex. (OGJ Online, Jan. 27, 2011), could not proceed as a stand-alone pipeline without Keystone XL. The stretch from Cushing to Port Arthur would have comprised the final leg of Keystone XL, and the company had for a time considered accelerating its construction once Keystone XL had been permitted to help debottleneck the Cushing hub (OGJ Online, Nov. 18, 2011) but will not proceed with the project in XL's absence.

Enbridge bought ConocoPhillips's share of Seaway, joining with EPP in its ownership and jointly announcing that its flow would be reversed to deliver crude from Cushing to the Gulf Coast (OGJ Online, Nov. 16, 2011). Initial capacity of the reversed pipeline will be 150,000 b/d but will reach 400,000 b/d by early 2013, according to EPP.

EPP also said the companies plan to expand Seaway beyond 400,000 b/d. EPP stopped short, however, of saying it had cancelled the 800,000-b/d Wrangler pipeline outright, saying only that its "plans for bringing crude down from Cushing had obviously changed" (OGJ Online, Sept. 29, 2011).

TransCanada held a binding open season for the 150,000-b/d Cushing MarketLink pipeline earlier in 2011 and told OGJ that the Seaway reversal would not affect its plans to build the pipeline. Following US rejection of the Keystone XL application, however, these plans were scrapped.

Enbridge plans to build the Northern Gateway Pipeline to transport 525,000 b/d of oil sands crude from near Edmonton to a tanker terminal in British Columbia for shipment to China, other parts of Asia, and California. A line running parallel to the crude line would ship 193,000 b/d of condensate from the coast to Alberta.

Enbridge expects to build Northern Gateway in 2013-16, pending regulatory approval of filings made in 2009. Commissioning and start-up would occur 2014-15. Enbridge would also operate the Kitimat terminal. The terminal would have 2 mooring berths, 14 storage tanks for petroleum and condensate, and be called on by roughly 225 ships/year.

Enbridge, however, was still involved in discussions with First Nations representatives attempting to thwart construction of the pipeline. The Gitxsan Nation reached agreement with Enbridge to become a partner in the project in December 2011. Environmentalists have also voiced concerns regarding the project. Northern Gateway's Joint Review Panel, mandated by the Ministry of the Environment and the National Energy Board, will hold community hearings January-April 2012.

North America—products

Kinder Morgan Energy Partners LP will build and operate a new 136-mile, 16-in. OD pipeline to transport gasoline, jet fuel, and diesel from refineries in Norco, La., to an existing petroleum transportation hub in Collins, Miss., owned by Plantation Pipe Line Co. From this hub the products can move to major markets in the southeastern US.

Kinder Morgan is partnering with Valero Energy Corp. in the joint venture. The pipeline will have an initial capacity of 110,000 b/d with the ability to expand to more than 200,000 b/d. Pending receipt of environmental and regulatory approvals, Kinder Morgan expects Parkway to enter service by mid-2013.

Latin America

The 1,700 km, 48-in. OD Gasoducto del Noreste will deliver 3.2 bcfd of Bolivian gas to Argentina as early as 2015. The Bolivian government, Argentine-state Enersa, and Gazprom are developing the $2.67 billion project.

Argentina approved plans for the pipeline in December 2010. The project will move supplies from Bolivia to the Argentine provinces of Chaco, Corrientes, Formosa, and Misiones and later to Cordoba and Santa Fe. It is estimated that construction will take 3 years and will cost about $1.8 billion.

The large transmission pipeline is part of 4,144 km (2,573 miles) of overall pipeline construction planned between the two countries. A 38-in. OD section of pipe running 48 km between Bolivia's Margarita gas field and Salta, Argentina, entered service July 2011.

Petrobras and Odebrecht plan to build the 1,085-km Gasoducto Andino del Sur to move natural gas from Camisea to Juliaca near Lake Titicaca and the Port of Ilo. The pipeline would draw on fields operated by both Petrobras and Repsol YPF and deliver the gas to copper mines and other end-users, including both residential and industrial customers in Cusco, Arequipa, Matarani, and Ilo. The project is expected to enter service in 2013-14, with cities en route before the planned terminus in Ilo likely to get gas before completion of the entire line.

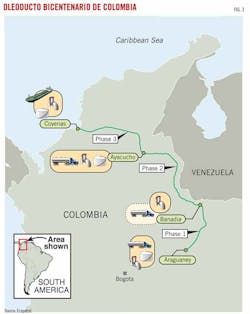

Colombia's Ecopetrol is joining with six other firms to build and operate a 450,000-b/d oil pipeline system that will transport crude from Araguaney, in the Casanare Department of central Colombia, to the Covenas Export Terminal on the Caribbean Sea (Fig. 3). Ecopetrol said all phases of the project are due for completion by yearend 2012 or start of 2013. The first phase includes a 40,000-b/d truck off-loading site in Banadia completed in December 2010. Remaining phases include construction of the 120,000-b/d Araguaney-to-Banadia line, which began construction in 2011, and the 330,000-b/d Banadia-to-Covenas line, scheduled to start building in August 2012.

Ecopetrol will hold a 55% stake in Oleoducto Bicentenario de Colombia (OBC), the company that will build, own, and operate the new line. The other partners are Pacific Rubiales 32.8%, Petrominerales 9.6%, Hocol 0.96%, Grupo C&C Energia Barbados 0.5%, Rancho Hermoso SA-Canacol Energy Ltd. 0.5%, and Vetra Exploracion & Produccion Colombia 0.5%.

Asia-Pacific

PetroChina put the trunkline of its second West-East Pipeline (WEPP II) into service in 2011. The pipeline is part of the larger Asian Gas Pipeline, running from Turkmenistan to eastern China. The Chinese trunkline section covers 3,400 miles, connecting Xinjiang province to Guangzhou and Shanghai. The development also calls for 1,240 miles of branch lines, which the company expects to complete in 2012. WEPP II will carry 30 billion cu m/year from Central Asia to consuming centers in China.

PetroChina's WEPP III will run between Xinjiang and Guangdong province, including a western section from Xinjiang to Zhongwei, running parallel to WEPP II, and an eastern section from Zhongwei to Shaoguan, Guangdong. Branch lines could bring total scope to 8,000 km, including the possibility of extending into Fujian province. PetroChina expects to place the western section in service in 2012 and the eastern in 2014.

The first stage of the 4,700-km East-Siberia Pacific Ocean oil pipeline, including construction of a 2,400-km oil pipeline from Taishet to Skovorodino near the Chinese border and of a rail oil terminal at Kozmino on Perevoznaya Bay at a combined cost of $14.1 billion, was inaugurated in December 2009.

The first phase of the line carries up to 30 million tonnes/year (tpy) of oil, about half of it earmarked for China via a branch pipeline from Skovorodino to the oil hub of Daqing in northern China and the other half shipped to Kozmino via rail. The full ESPO line will eventually carry 80 million tpy.

The second stage involves building a pipeline link between Skovorodino and Kozmino to replace the rail line by 2014. Work began in January 2010.

The 50 million tpy shipped along the Skovorodino-Kozmino route would largely be exported to Japan but hinge entirely on the combination of continued development of the Siberia's other fields and Russia's continued desire to export to Japan.

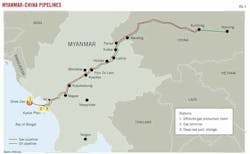

Myanmar awarded China National Petroleum Corp. exclusive rights to construct and operate the proposed Myanmar-to-China crude oil pipeline. This line and a companion natural gas pipeline would transport hydrocarbons from the Bay of Bengal across Myanmar to southwestern China (Fig. 4). Plans call for the 440,000-b/d crude pipeline to run between Maday Island in western Myanmar through Ruili in China's southwestern Yunnan province and on to a new 200,000-b/d refinery in Anning. Both the pipeline and refinery are to begin operation by 2013.

CNPC began building a large oil import port at Kyaukpyu, Myanmar, in October 2009 to serve as the pipeline's input point. The port will be able to receive vessels up to 300,000 dwt and will have storage capacity of 600,000 cu m.

The natural gas pipeline is scheduled to begin carrying 12 billion cu m/year to southwestern China in 2013. Route preparation began in mid-2010, with the first pipes welded in August 2011. The pipeline will parallel the route of the crude pipeline to Ruili. From there it will run to Kunming, the capital of Yunnan province, before extending to Guizhou and Guangxi in South China.

The crude line will transport oil carried by tanker from the Middle East, while the gas line will carry material from Myanmar's offshore A-1 and A-3 blocks. Total estimated project costs are $1.5 billion for the oil pipeline and $1.04 billion for the gas pipeline.

The new pipelines will give China better access to Myanmar's resources and will speed deliveries and improve China's energy security by bypassing the congested Malacca Strait, which currently ships most of China's imported crude oil.

Europe

Construction of the 1,200-km Nord Stream natural gas pipeline, extending through the Baltic Sea from Vyborg, Russia, to Greifswald, Germany, began Apr. 9, 2010. Russia's Gazprom put the first 27.5 billion cu m/year Nord Stream line into service in 2011, with a parallel line of the same capacity to follow in 2012. Nord Stream had laid 917 km of the second line as of January 2012, with completion expected by third quarter. The line passes through Russian, Finnish, Swedish, Danish, and German waters.

A joint venture consisting of Gazprom (51%), Wintershall AG (15.5%), E.ON Ruhrgas AG (15.5%), NV Nederlandse Gasunie (9%), and GDF Suez (9%) is building the pipeline. For the two-leg option, the total cost for the offshore project will amount to more than €7 billion, with Gazprom investing an additional €1.3 billion in its onshore section.

The Ostsee-Pipeline-Anbindungs-Leitung (OPAL) pipeline, a Wintershall-Gazprom (Wingas) joint venture extending 470 km to link Nord Stream to Eastern Europe, connected to Nord Stream in August 2011. Wingas is also building the 440-km North European gas pipeline (NEL), which will transport Nord Stream gas from Greifswald to Rehden in Lower Saxony. NEL is scheduled to come on stream in fourth-quarter 2012 and has a planned capacity of 20 billion cu m/year.

Gazprom and Eni SPA agreed in December 2007 to build the South Stream gas pipeline under the Black Sea and through Bulgaria. The subsea section will be 900-km long, reaching a maximum depth of 2,250 m. The overland branches of the pipeline will run northwest to Slovenia and Austria and southwest to Greece and Italy.

Bulgaria and Russia reached agreement in January 2008. Intergovernmental agreements have also been reached with Serbia, Hungary, Greece, Slovenia, and Austria. In December 2011, Turkey granted Gazprom permission to lay South Stream though its exclusive economic zone in the Black Sea.

On completion, the €15.5 billion line could distribute gas to northern and southern Europe, with an estimated capacity of 30 billion cu m/year. Participants plan to deliver first gas through South Stream by December 2015.

Gazprom also completed a feasibility study in November 2010 with Romania's Transgaz SA for a potential future leg of the pipeline. Austria's OMV AG and Gazprom signed a cooperation agreement in April 2010 for construction of the Austrian section of South Stream from the Austrian-Hungarian border to the Baumgarten distribution hub.

OMV also continues to advance the 56-in. Nabucco pipeline, which will bring some combination of Central Asian, Caspian, and Middle Eastern gas to the Baumgarten hub in Austria near the Slovakian border at a rate of 31 billion cu m/year, before moving it on to Western Europe.

Feasibility studies have led to a two-stage construction plan. The first phase calls for 2,000 km of pipe between Ankara, Turkey, and Baumgarten, allowing 8 billion cu m/year of gas from the existing Turkish pipeline network to be transported through the line by 2014. Second-stage construction would build eastward from Ankara to the Iranian and Georgian borders, bringing total pipeline length to 3,300 km.

Turkey wants Iranian gas for Nabucco. The US supports construction of Nabucco, citing the need to move gas into Europe through economically viable and secure routes but would likely oppose Iranian exports through it.

Turkmenistan is building a 620-mile domestic East-West gas pipeline to transport gas from its Southern Yolotan-Osman field near the border with Afghanistan to its Caspian Sea coastal region but has remained noncommittal as to whether the gas would then be moved across or around the Caspian potentially to supply Nabucco or follow a different path, maintaining for the time being that it has enough gas to supply multiple export routes.

Nabucco is expected to cost around $11 billion and would have a capacity of 31 billion cu m/year. It has six shareholders: Turkey's Botas, Bulgaria's Bulgargaz, Romani's Transgaz, Hingary's MOL, Austria's OMV, and Germany's RWE. The project received a setback in November 2011, however, as Azerbaijan reached agreements for its own pipeline through Turkey (see sidebar above).

To deliver gas from Bovanenkovo field Russia is building a multiline transmission system connecting the Yamal Peninsula and central Russia. Construction calls for 1,420-mm (56-in.) OD pipes designed to work at higher pressures than existing Russian lines.

Total pipeline length will exceed 2,400 km, consisting of the Bovanenkovo-Ukhta pipeline (1,100 km, 140 billion cu m/year) and the Ukhta-Torzhok gas pipeline (1,300 km, 81.5 billion cu m/year). Connection to the Ukhta hub will allow shipment through the Yamal-Europe pipeline.

Gazprom began building the 72-km subsea section of the Bovanenkovo-Uktha line, crossing Baidarate Bay, in August 2008. Construction of the main trunkline began in December 2008.

Gazprom anticipates beginning production and shipment of Bovanenkovo gas in May 2012. Gazprom's most recent investment program increased the cost of the Bovanenkovo-Uktha line to 259.9 billion rubles (about $8.2 billion) from 140.9 billion rubles, with most of the increase attributed to line pipe costing 170% more than had been anticipated. Russian pipe producer Chelyabinsk Tube-Rolling Plant (ChTPZ) supplied 1,420-mm OD, 23 and 27.7-mm WT, X80 grade pipe for the project.

Galsi SPA and Snam Rete Gas SPA signed a memorandum of understanding in November 2007 to construct the Italian section of the planned 8 billion cu m/year Galsi natural gas pipeline, which will deliver Algerian gas to Italy via Sardinia.

Galsi shareholders are Sonatrach, Edison SPA, Enel SPA, Hera Trading, Regione Sardegna, and Wintershall AG.

The project envisions four pipeline segments: 640 km onshore between Hassi R'mel gas field in Algeria and El Kala on the Algerian coast; 310 km between El Kala and Cagliari on Sardinia in water as deep as 2,850 m; 300 km between Cagliari and Olbia on the northern Sardinian coast; and 220 km between Olbia and Pescaia, southeast of Florence, in water as deep as 900 m.

Sonatrach will deliver 3 billion cu m/year into the system, Enel, 2 billion cu m/year, and Hera Trading, 1 billion cu m/year.

Work on the line was under way in January 2009, with service expected by 2014. The European Commission gave the project a €120 million grant in March 2010 as part of its economic recovery package for the continent. Environmental concerns on the part of elected officials in Sardinia have, however, slowed progress.

Middle East

Iran and Pakistan continued laying the groundwork during 2011 toward building the long-contemplated gas export line from Iran. The $7 billion project would transport as much as 2.2 bcfd of natural gas from the South Pars field in the Persian Gulf through 1,850 km of 56-in. OD line (Iran, 1,100 km; Pakistan, 750 km).

The Iran-Pakistan pipeline would be an extension of Iranian Gas Trunkline (IGAT) VII, which began flowing gas in September 2010. Running 907 km from Assaluyeh to Iranshahr in Iran's Sistan-Baluchestan province, the 56-in. OD line can carry 1.8 bcfd of South Pars gas, with National Iranian Gas Co. planning expansion to 2.9 bcfd.

The export pipeline will enter Pakistan in southern Balochistan, running to Sindh province where the country's main pipeline hub lies. From Sindh, gas would travel through SSGC's existing distribution network. Iranian gas entering Pakistan will be used by independent power producers, according to FACTS Global Energy. Pakistani officials, however, have left open the possibility of extending the main trunkline past Sindh if China decides to participate in the project.

Pakistan and Iran signed an agreement in June 2010 for initial deliveries of 750 MMcfd beginning in 2014. As recently as January 2012 Pakistan reiterated that the pipeline would be completed as soon as possible, despite increased United Nations sanctions against Iran.

Abu Dhabi is building a 500-km CO2 pipeline as part of the Masdar Initiative's carbon capture and sequestration projects. Abu Dhabi Future Energy Co. (Masdar) launched the project in 2008 with the stated goal of building the world's first zero-carbon sustainable city.

Abu Dhabi was to inject captured CO2 into oil and gas reservoirs for use in enhanced oil recovery operations. Difficulty reaching commercial terms with Abu Dhabi National Oil Co. (ADNOC) for receipt of the CO2 have, however, delayed progress on the 8-14 in. OD pipeline network, with ADNOC saying it can now source natural gas for EOR purposes more cheaply. An in-service date before 2015 appears unlikely.

Africa

Nigeria, Algeria, and Niger hope to start gas exports via the proposed 30 billion cu m/year Trans-Sahara gas pipeline in 2015. Once built, the 4,127-km line would transport gas from the Niger Delta in southern Nigeria through Niger and into Algeria and Europe. Cost estimates for the project are $20 billion.

According to the feasibility report published by engineering company Penspen Consulting, TSGP would consist of a 48-56-in. pipeline from Nigeria to Algeria's Mediterranean coast at Beni Saf and subsea pipelines of 20-in. between Beni Saf and Spain.

Nigeria's militant Movement for the Emancipation of the Niger Delta (MEND) has said it would attack any such pipeline. Algeria, Niger, and Nigeria signed an agreement in July 2009 to build the TSGP. Russia's OAO Gazprom announced around the same time that it would invest in the TSGP through a 50-50 joint venture, called Nigaz, with state-owned Nigerian National Petroleum Corp. Gazprom said Nigaz intends to explore for gas and to develop infrastructure for its development and transport—up to and including a section of pipeline that could form part of the TSGP.

No date has yet been given for the start of work on the TSGP, however, and Algeria's invitation in August 2010 for India to join the project was seen by some to indicate the project might be in trouble.

Nigerian President Goodluck Jonathan said in May 2011 that the country is looking for private investors in the project.

Smaller domestic pipeline projects in Nigeria include Shell's Otumara-Saghara-Escravos project and Total's Obite-Ubeta-Rumuji (OUR) 42-in. OD gas export pipeline.

The OUR pipeline includes a fiber-optics based leak and shock detection system along its entire 45.6-km length, monitored in the control room of Nigerian Liquefied Natural Gas's Bonny LNG plant. OUR will transport gas produced at OML 58 to the Bonny plant. Total signed right-of-way agreements with affected landowners in February 2011.

Shell Petroleum Development, meanwhile, contracted Saipem to install the Otumara-Saghara-Escravos gas pipeline. The 42-km pipeline, with OD from 2-12 in., will pass through swampy terrain and includes a major river crossing.

The pipeline will transport around 30 MMcfd of processed associated gas from the Otumara and Saghara fields in the western Niger Delta. This will be sent through the Escravos-Lagos system to the domestic market, helping to reduce flaring. Shell expects the project to be complete by early 2013.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.