Asia, Middle East lead modest recovery in global refining

Warren R. True

Chief Technology Editor—LNG/Gas Processing

Leena Koottungal

Survey Editor/News Writer

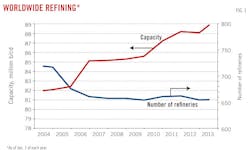

Growth in world crude oil distillation capacity resumed in 2012, if only slightly, after turning down in 2011 (OGJ, Dec. 5, 2011, p. 30) following slow growth in 2010, according to the latest OGJ Refinery Survey.

Again in 2012, closings and rationalizations dominated Western European and North American refineries, as in 2010 and 2011. The two developed regions continued to see sales of plants and mergers of companies.

Capacity decline continues to characterize countries of the Organization for Economic Cooperation and Development, as they work to recover from the 2008 global recession and, in Europe, struggle to manage debt crises in several countries.

OGJ survey data show Western Europe continuing to lose plants, one more in 2012 after two closed in 2011; total capacity has fallen by more than 400,000 b/cd. North America's held in number, while capacity data even advanced, mostly with completion of a huge expansion at a Southeast Texas refinery—that almost immediately was forced to close for up to a year to deal with the effects of faulty design.

New data for Asian refineries, however, show total regional capacity grew by more than 700,000 b/cd; Middle Eastern refineries, with several new plants and expansions under way (see details below), officially remained level with capacities for 2011.

For 2012, OGJ's survey data show total global capacity at slightly less than 89 million b/cd with no net gain in the number of plants. That's a growth of more than 700,000 b/cd from 2011.

The 2012 figures suggest global refining capacity and numbers of refineries are stabilizing. For 2010, capacity had fallen by 175,000 b/d from 88.23 million b/cd; the number of refineries by seven. For 2009, global capacity stood at 87.2 million b/cd for 661 refineries; for 2008, 85.6 million b/cd for 655 refineries.

Fig. 1 shows the trends in operating refineries and worldwide capacity.

Largest refining companies

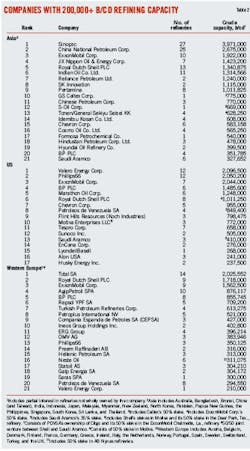

Table 1 lists the top 25 refining companies that own most worldwide capacity. Table 2 lists companies whose plants total more than 200,000 b/cd of capacity in Asia, the US, and Western Europe. Capacities from Tables 1 and 2 include partial interests in refineries that the companies do not wholly own.

Major changes in Table 1 positions since Jan. 1, 2012, are few: Chevron and Phillips swapped ranks as well as Marathon and OAO Lukoil.

Other changes in capacity that appear in Tables 1 and 2 are due to adjustments in declared capacity.

In Table 2, refineries in the lower tier in Asia saw some shifting around mostly moving up or down a spot. S-Oil Corp., however, managed to move to No. 12 from No. 16 for 2012. For the US, Valero has moved into the top spot for company-wide capacity, pushing Phillips 66 to No. 2. And in Western Europe, Royal Dutch Shell PLC moved ahead of ExxonMobil to the No. 2 spot.

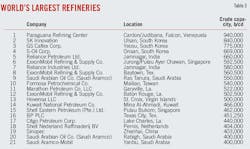

Table 3 lists the world's largest refineries with a minimum capacity of 400,000 b/cd. OGJ data show that S-Oil Corp.'s refinery in Onsan, South Korea, moved to No. 4 from No. 7 in 2011 on the strength of raising its crude capacity to 669,000 b/cd from 564,000 b/cd. And Marathon Petroleum Co. LLC's Garyville, La., plant moved to No. 11 from No. 13 after raising its crude capacity to 522,000 b/cd from 490,000 b/cd.

Table 4 lists regional process capabilities as of Jan. 1, 2011.

Asian refining growing

In September, the US Energy Information Administration issued its latest country review for China. It noted that China has been increasing refining capacity to meet strong local demand growth and to process a wider range of crude oils.

EIA cited FACTS Global Energy (FGE), Honolulu, which projected China would be adding a net 5 million b/d of capacity 2011-20. That pace will raise capacity countrywide to more than 16 million b/d.

At mid-2012, two refiners—China Petroleum & Chemical Corp. (Sinopec) and China National Petroleum Corp.—dominated China's refining, accounting for 46% and 31%, respectively, of the capacity. Sinopec, said EIA, holds about 5 million b/d of total oil processing capacity in China by 2012 and has a large presence in coastal and southern regions.

CNPC also has been building refineries in southern China and was to commission its 200,000-b/d Pengzhou refinery in Sichuan by late this year.

China National Offshore Oil Co. (CNOOC), China's third-largest state-owned refiner, commissioned its first refinery in 2009, the 240,000-b/d Huizhou plant in the center of Guangdong province. Sinochem plans to commission a refinery in Quanzhou in southern Fujian province in 2013.

Under orders from the country's National Development and Reform Commission, China refining is modernizing many smaller refineries, called "teapot" refineries with capacities that range 40,000-120,000 b/d, accounting for about 16% of total refinery capacity, said EIA.

OGJ subscribers can now download, free of charge, the text version of the OGJ Worldwide Refining Report 2012 tables from www.ogj.com. Scroll down to "Surveys & Statistics," click "OGJ Subscriber Surveys," then "Worldwide Refining." This link also features the previous editions of this report as well as a collection of other OGJ Surveys from previous years. Subscribers and nonsubscribers may purchase Excel spreadsheets of the survey data by sending an email to [email protected] or calling (800) 752-9764. For further information, please email [email protected], or call Leena Koottungal, OGJ Survey Editor/News Writer (713) 963-6239.

In 2011, the NDRC issued guidelines to eliminate refineries smaller than 40,000 b/d by 2013 to encourage economies of scale and energy efficiencies. In response, several local refineries are expanding or merging with larger plants to avoid closing.

Because the government restricts the feedstock that independent refineries can use, said EIA, these refineries tend to process heavy fuel oil and heavier, sour crudes.

In October, Reuters reported that China's September crude runs had hit a record of 9.43 million b/d following start-up of new capacity earlier in the year. It cited China's National Bureau of Statistics, which said that in September, China had processed more than 284 million bbl of crude oil, up by 7% over year-earlier runs.

This month, December, trial production was to have started at a new 200,000-b/d refinery built by PetroChina in China's southwestern province of Sichuan, according to media coverage in March. Sichuan's first major refinery, in the city of Pengzhou, is to process production from northwest China and Kazakhstan.

In June, CNOOC started building 60,000 b/d of crude processing in the eastern part of the country to boost its fledging refining and fuels-marketing businesses. The new plant, to be built in Taizhou City in Jiangsu province on the central eastern coast of the country, is costing about $1.6 billion and is to begin operating in 2015, according to company officials and local media.

The investment, including 10 main processing facilities, would come on top of an existing plant on the same site that produces mainly asphalt and fuel oil.

CNOOC is operating its first major refinery in Huizhou, Guangdong province, with a capacity of 240,000 b/d. The state company plans to add 200,000 b/d of refining capacity there by around 2014.

Elsewhere, CNOOC calls its investment in Taizhou in the eastern coastal Zhejiang Province, an "integrated petrochemical project" instead of a "refinery," saying it would become a key lubricants producer, China Energy News reported. It would also produce feedstock oil for petrochemicals, LPG, and fuel oil.

Also earlier this year, in southern Guangdong, Venezuela Petroleos de Venezuela SA (PDVSA) is partnering with CNPC to build a 400,000-b/d refinery to be completed in 2015 and cost $8.3 billion. It is to be the first of three refineries Venezuela plans to help build in China.

In a prepared statement, the South American state company said it was currently selling China about 600,000 b/d. China, in turn, agreed to lend Venezuela about $38 billion in exchange for the oil shipments.

Also earlier this year, Total and Kuwait Petroleum Corp. signed a preliminary agreement on a refining and petrochemicals joint venture in southern China in partnership with Sinopec. The Zhanjiang project, in southern Guangdong province, consists of a 300,000-b/d full-conversion refinery integrated with petrochemicals and marketing, said the Total announcement.

The planned refining and petrochemicals effort will process Kuwaiti crude and produce refined products and petrochemicals.

Also in March 2012, Sinopec said it plans to double refining capacity at the Luoyang refinery in central Henan province over the next 5-8 years to meet rising local fuel demand. The refinery has nameplate capacity of 200,000 b/d, but actual capacity is less as a result of crude transportation bottlenecks among other problems.

Like China, India has several refinery expansion plans under way or envisioned.

The World Bank's IFC, its investment unit, announced earlier this fall it would help finance the $480 million oil refinery expansion of HPCL Mittal Energy Ltd. (HMEL), a joint venture between Hindustan Petroleum Corp. Ltd., Mumbai, and Mittal Energy Investment Pte. Ltd., Singapore.

The project is to increase capacity at the Guru Gobind Singh refinery in Punjab to 11.2 million tonnes/year (tpy) from 9 million tpy. Each partner holds 49% of the joint venture; financial institutions hold the remaining 2%.

Local media also reported that Numaligarh Refinery Ltd. plans to increase capacity at its refinery in the Golaghat district of Assam to as much as 9 million tpy from 3 million tpy.

In late 2011, Indian Oil Co. had announced plans to raise its total refining capacity to 2.46 million b/d by 2020-21 with two new refineries and a major expansion (OGJ Online, Nov. 16, 2011).

Plans included construction of a 300,000-b/d refinery in the western part of the country as well as expansions in two phases at the 274,000-b/d Gujarat Refinery at Koyali, Vadodara: to 360,000 b/d by 2016-17 and to 460,000 b/d by 2020-21.

Nearing completion in the meantime is the 300,000-b/d Paradip Refinery in Orissa (OGJ Online, Nov. 22, 2010). Last year, the Ministry of Petroleum and Natural Gas estimated the refinery would start up first-quarter next year. Indian Oil Co. has issued no recent update.

Also, earlier this year, Reliance Industries Ltd. announced it had selected Technip to provide technology and engineering for the refinery offgas cracker expansion at its 1.24-million-b/d Jamnagar refinery and petrochemical complex in Gujarat.

The project will increase ethylene capacity to more than 3.2 million tpy from about 1.9 million tpy and boost capacities of related products (OGJ Online, May 3, 2012).

In March, HMEL commissioned its 180,000-b/d Guru Gobind Singh Refinery near Bathinda in Punjab (OGJ Online, Mar. 29, 2012). In April, media reported that HMEL was considering doubling the new refinery.

The grassroots refinery had been running crude oil since August 2011, but full commissioning had been delayed until Mar. 29 (OGJ Online, Nov. 2, 2011).

Processing capacities include delayed coking, fluid catalytic cracking, and continuous catalytic reforming. A propylene production plant is integrated with the refinery, which is connected to a crude oil terminal at Mundra, Gujaat, by a 632-mile, 28-30-in. pipeline.

Also in April, commodity trader Trafigura Pte. Ltd., Singapore, announced it would invest as much as $130 million to earn 24% in the 120,000-b/d Cuddalore refinery under construction by Nagarjuna Oil Corp. Ltd. in Tamil Nadu (OGJ, Dec. 6, 2010, p. 50). Trafigura said commercial operations are to begin during first-half 2013.

Downstream units of the refinery, 180 km south of Chennai on the Bay of Bengal, will include a fluid catalytic cracker and delayed coker. Other investors in the project are Nagarjuna Fertilizers & Chemicals Ltd., Tata Petrodyne, Uhde GMBH, Tamil Nadu Industrial Development Corp. Ltd., and Creative Projects & Contracts Pvt. Ltd.

Finally, the year began with an announcement from Reliance Industries Ltd., Mumbai, that it would expand petrochemicals production at its 1.24-million b/d Jamnagar refinery. The $10-12 billion expansion with take up to 4 years, once all contracts are let.

In May, Reliance let a contract to Fluor Corp. for project management services for the new petcoke gasification plant and expansion of petrochemical facilities at Jamnagar. Fluor's contract also covers expansion of the refinery's off-gas cracker and downstream petrochemical plants, a captive power plant, and related facilities (OGJ Online, May 3, 2012).

Later, in May 2012, Reliance selected Technip to provide technology and engineering for the refinery offgas cracker expansion. The project will increase ethylene capacity to 3.248 million tpy from 1.883 million tpy and boost capacities of related products (OGJ Online, May 3, 2012).

China and India are only the most active countries in the region in adding refining capacity but by no means the only ones.

Media reports earlier this fall said Indonesia's OSO Group planned to build a $4.8 billion refinery in joint venture with State Oil Co. of the Azerbaijani Republic (SOCAR) near Batam Island. Planned capacity is 600,000 b/d upon opening in 2017.

In Vietnam, the country's official news agency said in October that construction of the Nghi Son refinery, to be the country's largest, was likely to start before yearend in the central province of Thanh Hoa, 134 miles south of Hanoi.

Investors include Petro Vietnam, Kuwait Petroleum International, Japan's Idemitsu Kosan Co., and Mitsui Chemicals. Total capital investment will approach $8 billion.

Vietnam's only operating refinery, the 130,500-b/d Dung Quat refinery, sits on the country's central coast. Media reports said Vietnam has four other planned oil refineries.

Asian refining losses

While several Asian developing nations were building their refining capacities, others—mainly highly developed Australia and Japan—were reducing their refining footprints.

Asian media reported in July that JX Nippon Oil & Energy Corp., the country's largest refiner, had shut down units at its 240,200-b/d Mizushima-B refinery in western Japan.

The closure, to cover most of the rest of 2012, was in response to discoveries that some inspection records were improperly maintained. Included initially were the 95,200-b/d No. 2 crude distillation unit and the 110,000-b/d No. 3 crude unit.

The company was also examining 18 of 26 LPG tanks at the refinery after investigation discovered false inspection records going back to 2000.

In July, Dow Jones reported Cosmo Oil Co.'s plans permanently to close the 140,000-b/d Sakaide refinery in western Japan by July 2013. The move follows government regulations that encourage refining capacity cuts amid falling local demand.

In July 2010, Japan's Ministry of Economy, Trade, and Industry promulgated rules requiring refineries to raise, by March 2014, residual cracking capacity to a designated percentage of overall crude capacity. The move was to force refiners to accommodate heavier—and therefore cheaper—crude oil. The new rules force oil refiners either to close existing crude units or build new secondary units to process the heavy residue.

Showa Shell Sekiyu KK had permanently closed in September 2011 its 120,000-b/d Ogimachi crude unit near Tokyo. Idemitsu Kosan Co. will permanently close a 120,000-b/d crude unit at its Tokuyama refinery in western Japan in March 2014.

JX Nippon announced plans in October to stop refining oil at its Muroran unit on Hokkaido by March 2014, Japanese business media reported.

It said JX Nippon Oil will cut about 13% of its group's refining capacity, equivalent to output of 180,000 b/d. The company also said it might reduce group refining capacity by 200,000 b/d by the end of March 2014.

In Australia, Caltex Australia Ltd. announced in July plans to close by mid-2014 or later its 125,000-b/d Kurnell refinery on Botany Bay, south of Sydney. The company is converting the location into a fuels import terminal at a cost of about $705 million (OGJ Online, July 27, 2012).

Combined with Shell's plans to close its 79,000-b/d Clyde refinery, originally set for 2013, Australian refining will lose about 27% of its capacity. The two closures have sparked some in the country to proclaim the death of Australian refining.

In June, Shell Australia moved up to September its closure of the Clyde refinery. That follows the decision made in July 2011 to convert the plant to a fuels import terminal (OGJ Online, June 7, 2012).

The state and future of Australian refining was the subject of analysis by FGE earlier in 2012 than Caltex's announcement.

Using the closing of the Clyde refinery as a point of reference, FGE said that decision alone would prompt changes to supply and distribution patterns in Australia. "The Australian refining industry has been under pressure for many years, but strength in the Australian dollar, higher oil prices, lower processing of indigenous oil, and low regional refinery utilization rates have resulted in domestic refining being less attractive in comparative terms," said the analysis.

With Clyde's closing, Australia will cement its place as the "largest importer of diesel, second largest importer of jet fuel, and third largest importer of gasoline in Asia."

The analysis noted that opportunities for refiners, traders, and shippers to capture new markets in Australia would continue, "most [Australian] marine storage is controlled by the domestic refiners [which] will continue to be a fundamental part of supply arrangements."

The effect of other closures or curtailments, said FGE, "will depend on the specific refinery," but Caltex's Kurnell and ExxonMobil's Altona at Melbourne refineries "primarily supply by pipeline/truck, therefore will have minimal effect on marine shipments into nonrefinery ports. Closure [or] curtailment of other refineries will impact marine movements into nonrefinery ports."

Middle East expansions

The other global area to see refining growth is the Middle East, or more specifically the gulf states.

In January, Saudi Aramco completed an agreement with China's Sinopec Group to build a 400,000-b/d refinery in Yanbu on the Red Sea.

Under the initial agreement, Aramco holds 62.5% in the joint venture formed to develop the Yanbu Aramco Sinopec Refining Co.; Sinopec owns the rest.

Construction of the refinery was already under way, as it was originally a joint venture with ConocoPhillips, which pulled out in April 2010. The plant is on schedule to be completed by September 2014 and is estimated to cost $8-10 billion. The refinery will process heavy crude from Saudi Arabia's Manifa oil field, under development to produce 900,000 b/d.

Aramco has said the new Yanbu refinery, which joins two existing refineries at Yanbu, will produce 90,000 b/d of gasoline, 263,000 b/d of ultralow sulfur diesel, and 6,300 tonnes/day (tpd) of petcoke as well as 1,200 tpd of sulfur.

Media reports in the region said Aramco also plans to reactivate a project to expand the Ras Tanura refinery, which was to add 400,000 b/d of new capacity to the existing 550,000 b/d.

In August, Saudi Aramco extended by 1 month the deadline to bid for construction of another new refinery, this one in Jizan, a province on Saudi Arabia's border with Yemen. Aramco projects capacity at the Jizan refinery at 400,000 b/d when it is completed in 2017.

Aramco is also building the 400,000 b/d Satorp refinery in the eastern Saudi Arabian city of Jubail with France's Total; it is planned to start up next year.

Elsewhere in the gulf, Bahrain Petroleum Co. completed plans to expand its 260,000-b/d refinery to 450,000 b/d. The plans call for an investment of $6.1 million.

North America

Another article elsewhere in this issue reviews prospects specifically for US refining and finds more to be optimistic about than might have been believed (p. 100). But most of the news in the previous 12 months has been characterized by plants closings and consolidations.

The main bright note for US refining came in July when the EIA reported that net petroleum distillate exports for April 2012 set a monthly record (www.eia.gov/todayinenergy). In fact, 2011 saw the US become a net exporter of petroleum products for the first time in 62 years, it said.

Rising distillate exports, the report said, have driven the US "transformation from a net petroleum product importer to a net petroleum product exporter over the last several years." EIA monthly data indicated that net exports of distillate fuels in April registered 981,000 b/d. The agency said it was the highest volume since monthly US trade data have been recorded.

In the first 4 months of this year, gross distillate exports averaged 947,000 b/d, a 215,000-b/d (29%) increase compared with the same period in 2011. This average was supported by an April number that was the strongest so far in 2012 at slightly less than 1.1 million b/d, a 206,000-b/d (24%) increase over April 2011.

The April exports, said the EIA report, also represented the second highest monthly total ever. Sustained high levels of gross distillate exports were being supported by growth in global demand for distillate fuels, especially in developing economies outside the Organization for Economic Cooperation and Development, said EIA.

But by far the biggest refining story in North America this year centered on the massive expansion at Motiva Enterprise LLC's Port Arthur, Tex., refinery.

The 325,000-b/d, $10 billion expansion, largest at a US refinery in nearly 40 years and designed for feedstock flexibility, was dedicated on May 31, raising capacity to 600,000 b/d and making it the largest US refinery (OGJ, June 11, 2012, Newsletter).

On June 9, however, the new crude distillation unit sprung leaks traced to massive corrosion; a fire ensued and the expansion was shut down. Motiva has since traced the problem to faulty design. The unit will not restart before the end of first-quarter 2013, if then.

Motiva Enterprises is a refining and marketing joint venture owned by affiliates of Royal Dutch Shell PLC and Saudi Aramco.

Less sensational but more pervasive is the ownership rationalization rolling through US refining, with closings and sales that again this year have capped overall capacity growth.

In October, Marathon Petroleum Corp. announced it would pay $2.5 million to buy BP PLC's 451,000-b/d Texas City, Tex., refinery, site of a May 2005 explosion and fire that killed 15 people (OGJ, Oct. 15, 2012, Newsletter).

Sale of the high-conversion refinery is part of a strategy BP disclosed early last year to cut its US refining capacity by half (OGJ Online, Feb. 1, 2011). As part of that strategy, it agreed in August to sell its 251,000-b/d refinery in Carson, Calif., to Tesoro Corp. (OGJ Online, Aug. 13, 2012).

In addition to the refinery, the sales agreement covers three intrastate NGL pipelines linked to the plant.

Tesoro's deal to buy BP's Carson refinery near its 97,000-b/d Wilmington refinery south of Los Angeles is estimated to be worth $2.5 billion.

BP announced early last year that it planned to focus its US fuels business on its refineries in Cherry Point, Wash.; Whiting, Ind.; and Toledo, Ohio. BP acquired the refinery in its 2000 takeover of ARCO.

The sale, subject to regulatory approvals, is expected to close before mid-2013.

Also in October, Connacher Oil & Gas Ltd., Calgary, said it had closed the sale of its 100% interest in Montana Refining Co. to a subsidiary of Calumet Specialty Products Partners LP, Indianapolis (OGJ Online, Oct. 2, 2012).

Aftertax proceeds, including the value of inventory and working-capital adjustments, was $201 million. Montana Refining operates a 9,500 b/d heavy-oil refinery in Great Falls, Mont. Processing capacities include 2,800 b/d of fluid catalytic cracking, 1,000 b/d of catalytic reforming, and 1,100 b/d of hydrotreating.

In February, Hovensa LLC shut down its 350,000-b/d St. Croix, US Virgin Islands, refinery. The location is now an oil storage site. Operated by a joint venture of Hess Corp. and PDVSA, the refinery could not stem losses in recent years.

The closing holds implications for supply of refined products to the US East Coast, which experienced some product shortages in summer 2012 along with higher prices.

In late 2011, Sunoco had announced it was closing its 330,000-b/d refinery in Philadelphia if it could find no buyer.

But in July, Sunoco said it had formed Philadelphia Energy Solutions with the Carlyle Group to keep the refinery open (OGJ, July 9, 2012, p. 25). Carlyle will be majority owner.

Sunoco previously had closed its 178,000-b/d refinery at Marcus Hook, Pa. (OGJ Online, Feb. 28, 2012). Sunoco's two Philadelphia-area refineries and the nearby 185,000-b/d Trainer refinery, which ConocoPhillips was shutting down, accounted for half of East Coast refining capacity in August 2011, according to EIA data.

Trainer, however, was purchased by Delta Air Lines for $180 million in an effort to ensure jet fuel for its eastern US operations (OGJ Online, May 1, 2012).

Another idle East Coast refinery—Valero Energy Corp.'s 190,000-b/d plant in Delaware City, Del.—was bought by PBF Holding Co. LLC in June 2010 and restarted in October 2011.