Amine processes outperform in sweetening LNG plant feed

Richard Ochieng

Abdallah S. Berrouk

Cornelis J. Peters

Petroleum Institute

Abu Dhabi, UAE

Justin Slagle

Bryan Research & Engineering Inc.

Bryan, Tex.

Abu Dhabi Gas Liquefaction Ltd. (ADGAS) has compared the technical and economic performances of two modes for removing CO2 and H2S from sour natural gas feed to its Das Island liquefaction plant: the Benfield HiPure process1 and a simple amine-based processes.

At the time of the study, the LNG plant employed the Benfield process. Using the ProMax V3.2 process simulator,2 ADGAS evaluated process alternatives based on product purity, energy consumption, and overall economic performance. The economic analysis of the different processes is based on published equipment data.3-8

The simulation results support the feasibility of replacing the Benfield process with amine-based processes that achieve the same level of gas purity but with better economics.

Processes using such mixed amines as methyl-diethanolamine/diglycolamine (MDEA/DGA) and MDEA/diethanolamine (MDEA/DEA) proved more economic, with a 50% reduction in capital costs and 20%/year savings and 48%/year savings, respectively, on the stripping cost and on the power needed for solvent circulation.

The prospect of shutting down the existing potassium carbonate section, therefore, and retrofitting the unit to MDEA/DEA or MDEA/DGA appeared promising. This step would allow ADGAS to decrease operating costs and possibly increase capacity. This study shows that use of amine-based solvents in the future is preferable to the more costly Benfield/DEA alternative.

Natural gas treating

Many processes remove contaminants from natural gas feeds. Selection among these processes depends on economic feasibility and cleanup ability. Chemical and physical solvent processes, or combinations of both, have found extensive use in many LNG plants.

Removing both CO2 and H2S from natural gas before liquefaction allows the LNG to meet product specifications, prevents corrosion of process equipment, and meets environmental performance standards. Purified natural gas streams prepared for LNG production should typically contain no more than 1 ppm (vol) of H2S and 50 ppm (vol) of CO2.

Since the plant started up in 1977, ADGAS has employed the Benfield HiPure process at Das Island to purify sour natural gas to ultrasweet specifications before it moves to liquefaction. This process uses two independent but compatible circulating solutions in series to achieve the required gas purity.

The process consists of a DEA-promoted hot potassium carbonate section followed by a DEA section. Several studies have supported the choice of DEA as promoter.9-11 They have proven DEA as the most effective promoter for potassium carbonate over other amines such as monoethanolamine (MEA), diisopropylamine (DIPA), diglycolamine (DGA), and piperazine (PZ).

Besides the Benfield process's relatively high capital and operating costs and high stripping energy, reports of major process concerns of corrosion, erosion, and column instability are frequent for units that use the process, in particular for the hot potassium carbonate absorber.

Recent studies on MDEA-based processes have shown their commercial advantages over the Benfield process in that MDEA is less corrosive to carbon steel and the solution is stable and not as susceptible to degradation.12-16

Since MDEA is not very corrosive, concentrations of up to 50% can be used without damaging process equipment.7 14 Also, MDEA-based processes are simple with lower capital and maintenance costs than the Benfield process.

MDEA is known, however, for its low ability to absorb carbonyl sulfide (COS) and mercaptans. This disadvantage can be overcome by mixing MDEA with secondary amines, such as DEA or DIPA, or with an isomeric primary amine, such as DGA, known for increasing the mixture reaction rates with these sulfur and mercaptan compounds.17-19

Train No. 3

Fig. 1 shows the Benfield process used in ADGAS's Das Island plant.

The hot potassium carbonate absorption system consists of a split-flow absorber and a regenerator with no side draws. The carbonate absorber and regenerator are both vertical packed-bed columns. The treated gas from the carbonate absorber flows directly into the amine absorber.

The DEA amine system consists of an absorber and a stripper. All the columns are vertical and made of structured packing. After absorbing the acid gases, the rich solution from the absorber is pumped to the DEA regenerator, which has no condenser. The overhead gas is then fed to the middle of the carbonate regenerator, which does have a condenser.

Liquid from the carbonate regenerator's condenser then flows to the top of the DEA regenerator as reflux. Sweet gas leaving the DEA absorber will undergo further processing before being sent to the cryogenic section to produce LNG. The stripped acid gases from both the carbonate and DEA regenerators proceed to a sulfur-recovery unit, which processes them to produce molten liquid sulfur.

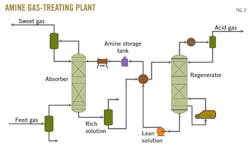

Fig. 2 shows the conventional amine-based flow scheme that functions as a base case to evaluate all the amine mixtures alternatives. Each case is modeled with operating data provided by ADGAS, some of which are presented in Table 1.

Process tool; results

The process calculations were completed with ProMax V3.2. The electrolytic property package was used to predict the H2S and CO2 absorption in both potassium carbonate and amine units of the Benfield process. The TSWEET kinetics model in ProMax predicted the relatively slow CO2-amine-carbonate kinetic reactions taking place in all absorbers.

Simulation outputs reasonably matched ADGAS's operating data (Table 1). Table 2 shows the comparison of ADGAS's Benfield process with the proposed MDEA-based alternatives.

The results show that a conventional single-amine MDEA system does not meet the CO2 requirement; adding a promoter, however, meets both acid gas specifications.

Simulations also show that promoted-MDEA systems are able to run at about 50% of the solvent's circulation rate required by the Benfield. Optimizing the alternatives shows that replacing ADGAS's Benfield with an MDEA/DGA system will reduce the solvent's regeneration energy by about 15% and 9% when MDEA-DEA is employed.

Apart from the 50% reduction in circulation rate, replacing the Benfield process with MDEA/DIPA system yields no savings in regeneration energy. Therefore, making an appropriate decision on MDEA/DIPA system requires an overall economic evaluation. As Table 2 shows, however, MDEA/DGA and MDEA/DEA are technically judged the best alternatives to replace the Benfield process.

Economics

In process economics, the total expenses on capital (capex) and operation (opex) of a plant are directly influenced by the design and operating parameters of the process.4 5 The circulation rate is considered the most important influence on the economics of gas treating with chemical solvents. Solvent circulation rate influences the size of pumps, lines, heat exchangers, and regeneration tower, and affects the capital cost of gas-treating plants. Circulation rates also influence the energy requirement for solvent regeneration because the reboiler heat duty is associated directly with the liquid rate.

Another factor that plays an important role in gas-treating economics is solution corrosivity, which determines the material of construction of units due to the high temperatures and solution acidity. Cost estimates of equipment and other costs related to capital investment play a crucial role in selection among design alternatives. Capital cost estimates combined with process operating cost and other expenses need to be fully considered, since the viability of a proposed change to an existing gas-treating unit depends on them.

The capital and operating costs are estimated for the Benfield process and its MDEA-based alternatives within the operating and economic environments of ADGAS's gas plants. The total capital cost includes all key process equipment shown in the process flow diagrams, plus a general facilities cost. Design parameters of such equipment as absorber and regenerator columns, flash vessels, and pumps are from plant-design data sheets. The rest of the equipment is sized in ProMax to provide information on equipment costs as required by the calculations.

The operating cost includes fixed general maintenance costs consisting of labor, local taxes, and general insurance. The process operating expenses are estimated through the unit cost of utilities and consumables with reference to the technical and economic performance parameters.

To enable complete investigation of the process, information on both equipment and operating costs comes from several sources, including vendor and public sources.3-5 7 8 20 Table 3 lists assumptions used in carrying out the economic analysis and evaluation. A comparison of economic gains for the existing process and its alternatives uses the economic potential and net present value-worth.

Capital, operating costs

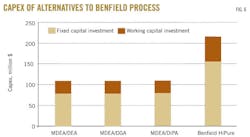

Total capex is divided into fixed capital investment and working capital investment. All cost estimates are presented in millions of US dollars, using the year 2000 cost index.4 5 7

The cost factors used to estimate all the costs involved in construction of the plant based on the purchase cost of individual equipment are estimated with Smith's Chemical Process Design and Integration.4

Equipment cost estimates for ADGAS's Benfield process are based on Mohammad, Peters, and Smith.4 5 20 The most expensive are the absorber and regenerator, which are responsible for about 45% of the fixed cost on investment. Cost factors for the effects of material of construction, temperature, and pressure are also included in the capital-cost estimation of the equipment.

This study did not include costs for such equipment as valves, steam jet ejectors, and pipes.

Total operating expense is divided into five sections: the fixed capital charges, direct production costs, plant overhead costs, general expenses, and utilities. Table 4 presents these expenses; 40% of the operating costs includes direct production costs and only 11% represents utilities, essentially steam and electricity.

Economic potential

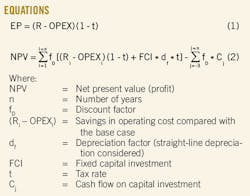

The economic potential (EP; Equation 1 of the box above) or net annual cash income is the revenue from annual sales of product minus the total annual cost of expense required to produce and sell the product excluding any annual provision for plant depreciation but including tax.

The estimated economic potential is $16.43 million/year with all the assumptions considered in the calculations. The product capacity is predicted from the ADGAS model developed in ProMax. Due to the uncertainties in both market price and production capacity, the economic potential will most likely shift to another value. Therefore, economic uncertainty and sensitivity analysis should be carried out to identify the limits of such estimation.

Because the market price of natural gas can change rapidly, economic analysis estimated the gross income of ADGAS's plant for a range of market prices published by the International Energy Agency5 and developed a probability normal distribution curve to allow for the uncertainties expected in market price of processed gas. The study settled on an average price of $3.5/MMbtu as the base case.

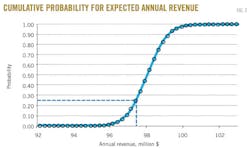

Random values of the respective annual revenue can be used to plot the cumulative probability curve shown in Fig. 3. The curve shows that the revenue for ADGAS will fall in the range $96-98 million/year. An unexpected change in market price makes it only a 27% chance that the annual revenue of ADGAS will fall below the predicted value. This probability distribution is used to predict ADGAS's profits under sales-price uncertainty.

Sensitivity analysis depends on pinpointing areas susceptible to economic changes, while economic analysis can only predict the relationships and magnitude of the estimated economic parameters rather than the exact cost of the plant.7 The major purpose of sensitivity analysis is to determine factors that are most sensitive to the profitability of a project. The analysis is always carried out to observe the effect of departures from estimated values.

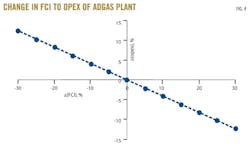

A 10% increase in fixed capital investment (FCI) will increase the operating cost of a process by 5% of its initial value. Because the operating cost of the process is affected, the economic potential is also directly affected. Fig. 4 shows that a 10% increase in FCI will reduce the economic potential by 10%. Therefore, for any additional process equipment, an additional cost of operation should be carefully estimated to avoid losses that may come with an increase in FCI.

Net present value

The net present value (NPV) is the total present worth of cash flows less the present worth of all capital investments (Equation 2).

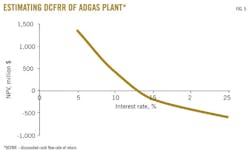

The first 3 years of the cash flow profile represents the construction of the plant. The capital cost is assumed to be invested in installments throughout construction. At low discount rates, the net annual cash flow is higher, and increasing the discount rate may lead to negative net annual cash flow after some time. At high discount rates, a bigger percentage of the capital-cost cash flow will increase (more negative) and more income will need to be spent to cover that gap. Therefore, for a more profitable operation, lower discount rates should be preferred.

At a discount rate of about 20%, the breakeven point will not occur for 22 years; a rate of 15% crosses the breakeven point after 14 years. The highest profit comes if the discount rate is as low as 2%. Fig. 5 shows that the estimated discounted cash flow rate of return on the ADGAS plant is about 12-15%, which gives a payback period of 10 years.

Economic analysis of alternatives

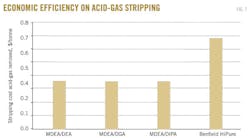

The capital cost of the Benfield process for ADGAS was compared with three MDEA-based alternatives (Fig. 6). This figure shows that considering such process alternatives as MDEA/DEA, MDEA/DIPA, and MDEA/DGA will reduce capital costs by 50%. For a given economic analysis, choosing a process with low initial installation cost might not be the best option, since the operating cost may be high, making the breakeven point unattainable.21 Therefore operating cost is another factor that will need to be analyzed before a final decision can be made on the alternatives.

The operating cost of a process is directly estimated from the fixed cost of investment. Therefore, using the opex to compare these alternatives would not be the best option, since the capital cost of the Benfield is already reported as the highest. However, more systematic means of considering the cost of stripping per unit mass of acid gas and the annual expenditure on power consumption yields a better evaluation criterion for these alternatives.

Fig. 7 shows a comparison of the estimated annual cost of power for all the alternatives. It shows that MDEA-based alternatives have considerably lower annual costs of power consumption. Replacing the Benfield process with any of the alternatives will save up to 48%/year of the expenditure on power.

The MDEA/DIPA system, however, would not be a good alternative because of its high costs of stripping. Therefore, making a decision based on operating cost will consider only MDEA/DGA or MDEA/DEA as a better alternative to the Benfield process.

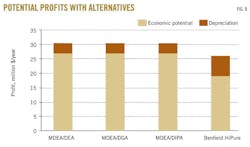

Fig. 8 shows that using any of the proposed alternatives can increase the economic potential of ADGAS by an average 37%/year (about $7 million/year) or 16.7%/year (about $4.4 million/year) on the net profit. The difference between the economic potential and net profit is that the latter includes depreciation (straight-line method) on the fixed capital costs.

Comparing the alternatives shows that the economic potential of the Benfield process is lower because of its high annualized cost. When a manufacturer invests money, it expects to receive a return during the time the money is being used. The amount of return demanded usually depends on the degree of risk assumed. This risk can be quantified in the form of the amount of capital invested.

Therefore, since the Benfield process has the highest capital investment, it can likely have the highest minimum acceptable rate of return regardless of the interest rate assumed. The higher annualized capital cost will reduce the economic potential of the project.

Introducing the effect of depreciation, however, will increase the profit of the Benfield process by a greater magnitude due to its high FCI. Fig. 6 shows the Benfield process has the highest expenses on capital; therefore, its minimum rate of return is likely to be higher than that of all the alternatives regardless of the amount of income earned.

It is clear that the amine-based processes, specifically MDEA/DGA and MDEA/DEA, promise better economics than the Benfield HiPure process.

Acknowledgment

GASCO and ADGAS operating companies of the Abu Dhabi National Oil Co. (ADNOC) provided financial support for this project.

References

1. Benson, H. E., and Parrish, R. W., "HiPure Process Removes CO2/H2S," Hydrocarbon Process, Vol. 53 (1974), pp. 81-82.

2. Bryan Research and Engineering, I., "ProMax," V. 3.2, Houston: Bryan Research and Engineering Inc., 2010.

3. Wells, G., Process Engineering with Economic Objective; London: Leonard Hills Books, 1973.

4. Smith, R., Chemical Process Design and Integration. England: John Wiley & Sons, 2005.

5. Peters, M., Timmerhaus, K., and Ronald, W., Plant Design and Economics for Chemical Engineers, 5th ed., New York: McGraw Hill, 2003.

6. Mohammad, R.M.A.Z., "Carbondioxide Capture from Flue Gas," dissertation, Delft: University of Twente, 2009.

7. Holland, F.A., and Wilkinson, J.K., "Process Economics," in Perry's Chemical Engineer's Handbook, 7th ed. New York: McGraw Hill, 1997.

8. EC-IEA, "Medium-Term Oil and Gas Markets," Paris: International Energy Agency, 2010.

9. Tondinca, T., Tanasie, C., Proll, T., and Cata, A., "Absorption with chemical reaction: evaluation of rate promoters effect on CO2 absorption in hot potassium carbonate," 17th European Symposium on Computer Aided Process Engineering-ESCAPE17, 2007.

10. Mahajani, V., and Danckwerts, P.V., "The stripping of CO2 from Amine-Promoted Potash solutions at 100º C.," Chemical Engineering Science, Vol. 38 (1983), p. 321.

11. Laddha, S.S., and Danckwerts, P.V., "The Absorption of CO2 by Amine-Potash Solutions," Chemical Engineering Science, Vol. 37 (1982), pp. 665-68.

12. Sohbi, B., Meakaff, M., Emtir, M., and Elgarni, M., "The Using of Mixed Amines in an Industrial Gas Sweetening Plant," World Academy of Science, Engineering and Technology, Vol. 31 (2007), pp. 301-06.

13. Polasek, J.C., and Iglesias, G.A., "Using Mixed Amines Solutions for Gas Sweetening," Tulsa: Proceedings of the 71st Annual Gas Processors Association Convention, 1992.

14. Meissner, R., and Wagner, U., "Low-energy process recovers CO2," OGJ, Feb. 7, 1983, p. 55.

15. Mandal, B., and Shyamalendu, S.B., "Simultaneous Absorption of CO2 and H2S Into Aqueous Blends of N-Methyldiethanolamine and Diethanolamine," Environ. Sci. Technology, Vol. 40 (2006), pp. 6076-84.

16. Lallemand, F., and Minkkinen, A., "Highly Sour Gas Processing in More Sustainable World," in Sustainable Industrial Processes, G.C.F. Gavani, S. Perathoner, and F. Trifiro, eds., Weinheim: WILEY-VCH Verlag GMBH and Co.KGaA, 2009.

17. Manning, F.S., and Thompson, R.E., Oilfield Processing of Petroleum: Volume 1: Natural Gas Vol. 1. Tulsa: PennWell, 1991.

18. Kidney, A.J., and Parrish, W.R., Fundamentals of Natural Gas Processing, London: Taylor and Francis Group, 2006.

19. Kohl, A., and Nielsen, R., Gas Purification, Houston: Gulf Publishing, 1997.

20. Mohammad, R., Schneiders, L., and Neiderer, J., "Carbon dioxide Capture from power plants: Part I: A Parametric Study of the technical Performance based on monoethanolamine," International Journal of Greenhouse Gas Control, Vol. 1 (2007), pp. 37-46.

21. Bullin, A., and Hall, R., "Optimization of Natural Gas processing plants including Bussiness Aspects," Tulsa: Proceedings of the 79th GPA Annual Convention, 2000.

The authors

Richard Ochieng ([email protected]) is research assistant at the department of chemical engineering of the Petroleum Institute of Abu Dhabi. He holds a BS in industry chemistry (2009; first class) from Makerere University of Uganda and MS from the Petroleum Institute (2012).

Abdallah Sofiane Berrouk ([email protected]) is assistant professor in the chemical engineering department of the Petroleum Institute. He holds a PhD (2007) in mechanical engineering from the University of Manchester, UK, and MSc (2003) in hydrocarbon enterprise from the University of Aberdeen, UK.

Cornelis J. Peters is distinguished professor at the Petroleum Institute. He holds a PhD (1986) and an MSc (1978) in chemical engineering from Delft University of Technology, the Netherlands.

Justin C. Slagle ([email protected]) is a consulting engineer for Bryan Research & Engineering, Bryan, Tex. He is responsible for BR&E's operations in the Middle East and Africa. Slagle holds a BS in chemical engineering from the University of Arizona.