GENERAL INTEREST — Quick Takes

Waxman seeks FTC probe of higher gasoline prices

US Rep. Henry A. Waxman (D-Calif.), the House Energy and Commerce Committee's ranking minority member, has asked the US Federal Trade Commission to investigate a gasoline price surge in the Golden State.

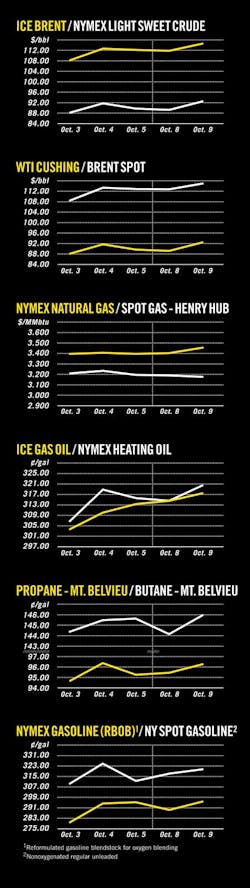

"Over the past week, retail gasoline prices in California have soared by more than 50¢/gal to a record price of $4.67/gal," Waxman said in an Oct. 9 letter FTC Chairman Jon Leibowitz. "There has been no similar surge in gasoline prices nationwide."

Waxman noted that the most common explanation is that a series of refinery accidents and temporary shutdowns have created a California supply crunch. US Energy Information Administration data show that West Coast gasoline inventories are "unusually low for this time of year—at the lower edge of the 5-year range," he added.

"Periods of tight gasoline supply require special vigilance because of the opportunities for market manipulation—especially when individual market participants possess substantial market share as is the case in California," Waxman said.

His request came just days after California Gov. Edmund G. Brown Jr. (D) directed the state's Air Resources Board to immediately let refineries make an early transition to winter-blend gasoline, which typically isn't sold until after Oct. 31.

"[Gasoline] prices in California have risen to their highest levels ever, with unacceptable cost impacts on consumers and small businesses," Brown said on Oct. 7.

He said shutdowns at refineries operated by ExxonMobil Corp. and Tesoro Refining Corp. tightened supplies. ExxonMobil's plant came back online on Sept. 5 and Tesoro's was due to resume operations within a week, Brown indicated.

ARB responded by issuing a regulatory advisory on Oct. 7 permitting the manufacturing, importing, distributing and sale of gasoline meeting a 9 psi Reid Vapor Pressure limit, the federal summertime RVP limit, through Oct. 31.

"All other requirements of the California reformulated gasoline regulations, including other fuel properties, specifications, record-keeping, and reporting requirements, shall remain in effect," the notice continued.

Those operating under the regulations should continue to distribute and sell gasoline which meets current California RVP limits where such supplies are available, it said.

European offshore safety measure advances

Oil and gas operators seeking licenses to drill offshore Europe would have to prepare major hazard reports and prove they have the financial strength to repair any environmental damage under an offshore safety proposal advancing in the European Parliament.

But in a change welcomed by offshore operators, a draft law approved by the Industry, Research, and Energy Committee Oct. 9 would take the form of a directive rather than a regulation.

European Union agencies have been working on a centralized approach to offshore safety regulation since the Macondo disaster in the Gulf of Mexico in 2010.

An original proposal would have established a regulation directly binding EU member states. A directive would establish goals but leaves achievement of the goals to individual states, a measure of flexibility considered crucial operators in countries with active offshore industries and established safety regimes.

Oil & Gas UK Chief Executive Malcolm Webb welcomed the change, which follows a similar move by another committee.

"We strongly believe this is the best way to achieve the European Commission's objective of raising offshore safety standards across the EU to the high levels already present in the North Sea," he said. "A regulation would do exactly the opposite and weaken the UK's already world-class offshore health and safety regime."

The initiative remains subject to negotiations before a vote of the full European Parliament.

Total, ExxonMobil swap interests offshore Norway

Total SA and ExxonMobil Corp. have agreed to swap interests in producing and undeveloped North Sea acreage off Norway.

Total said it will transfer to ExxonMobil a 5.6% interest in the PL089 license, a 2.52% interest in Sygna oil field, a 2.8% interest in Statfjord East oil field, and a 6.18% interest in Snorre oil field.

In exchange it will receive a 4.7% interest in Oseberg oil field and a 4.33% interest in the Oseberg transportation system along with a 100% interest in the PLO29c license and a 30% interest in the PLO29b license, which cover part of the undeveloped Dagny oil and gas discovery.

Total will make a "minor cash compensation" to ExxonMobil.

Exploration & Development — Quick Takes

Energy XXI signs gulf exploration venture

Houston independent Energy XXI (Bermuda) Ltd. agreed to acquire certain shallow-water Gulf of Mexico interests from ExxonMobil Corp., and the two companies also entered an exploration joint venture in the gulf.

The acquisition covers 5,000 gross acres on Vermilion Block 164, currently producing 1,100 boe/d net, Energy XXI said. The asset has produced 44 million boe since its discovery in 1957.

In the oil-focused JV, Energy XXI and ExxonMobil plan to explore for oil and gas on nine contiguous blocks adjacent to Vermilion Block 164 in shallow water on the shelf.

Energy XXI will operate the venture and serve as operator for the initial prospect, Pendragon. Drilling is expected to start by yearend.

The independent has completed five acquisitions totaling $2.5 billion since its founding in October 2005. Its assets are in the gulf offshore Louisiana and onshore along the Gulf Coast.

Surmont Energy applies for SAGD project

Surmont Energy Ltd., Calgary, has submitted applications for a thermal oil sands development it calls Wildwood on acreage 65 km south of Fort McMurray, Alta., in which it earned an 80% interest through 3D seismic work and core-hole drilling (OGJ Online, Mar. 27, 2012).

The private company plans to use steam-assisted gravity drainage to produce 12,000 b/d of bitumen from the Cretaceous McMurray reservoir. Production would start in 2015 or 2016, peaking in 1-2 years and lasting 24 years or more.

The planned central processing facility is designed to include a gas-fired cogeneration power plant, but Surmont said it is in discussions for supply of primary or back-up power from the local grid.

Surmont and privately held Bounty Developments Ltd., Calgary, which holds a 20% interest, plan further exploration of their 12,000-acre block of oil sands leases.

India taking bids for data repository

India's Directorate General of Hydrocarbons will hold a meeting Oct. 12 at its headquarters in Noida, outside New Delhi, for companies interested in building and operating its Hydrocarbon Exploration and Production National Data Repository (NDR).

The Ministry of Petroleum and Natural Gas has identified establishment of the NDR as an initial step in its move toward open-acreage licensing for oil and gas exploration and production (OGJ Online, Aug. 28, 2012).

DGH, the ministry's regulatory branch, is soliciting international bids from prospective contractors to build, populate, and operate the NDR. It has published a tender document on its web site. Bidding closes on Dec. 13.

Eni group finds Barents gas-condensate off Norway

A group led by Eni SPA has drilled a gas-condensate discovery in the Barents Sea off Norway that the Norwegian Petroleum Directorate estimates to contain 175-250 bscf recoverable.

The 7220/10-1 exploratory well in PL 533, 45 km northwest of Snohvit field, encountered two gas columns in sandstones of Cretaceous and Jurassic age at the Salina structure on the west flank of the Loppa high.

NPD said the well encountered a 38-m gas-condensate column in the Knurr formation, the primary target, and a 54-m gas-condensate column in the Sto formation.

The well was not formation tested, but coring, wireline logging, and fluid sampling proved good reservoir quality in the sandstone. Total depth is 2,371 m below mean sea level in 348 m of water. Eni operates PL 533 with 40% interest, and Lundin Petroleum AB, RWE Dea, and Det norske oljeselskap ASA have 20% each.

Lundin Petroleum's next Barents Sea well, likely to spud this month, targets the Juksa and Snurrevad prospects on PL 490. Lundin Petroleum is operator of PL 490 with a 50% interest.

Saudis have gas discovery in northern Red Sea

Saudi Aramco is reported to have drilled a natural gas discovery in the northern Red Sea.

The company plans to drill more wells to delineate the discovery, which lies 15 miles offshore Duba and across the Red Sea from Hurghada, Egypt.

Drilling & Production — Quick Takes

Total starts Alta production offshore Norway

Total has started production from Alta gas-condensate field offshore Norway, expecting average flow to reach 14,000 boe/d, including 2,500 b/d of condensate, next year.

Alta, part of the PL102c license on North Sea Block 25/5, is a subsea completion in 119 m of water tied back to Total's Skirne/Byggve subsea template connected with the Heimdal host platform 24 km southwest.

Alta produces from Middle Jurassic Brent sandstone at a depth of about 2,700 m. The Norwegian Petroleum Directorate lists original reserves estimates of the 2010 discovery at 300,000 standard cu m of oil and 1.4 billion standard cu m of natural gas.

Total E&P Norge is operator with a 40% interest. Other interests are Petoro 30%, Centrica 20%, and Det Norske 10%.

BP starts gas flow from Devenick field

A group led by BP Exploration Operating Co. Ltd. started gas production from Devenick field in the UK Central North Sea.

Initial rate is 100 MMscfd of gas. The field is estimated to hold 430 bscf of recoverable gas and to remain on production until 2025. The UK sanctioned the project in late 2010.

Devenick gas flows through a subsea manifold through highly-insulated flowlines and high-pressure control and safety systems to Marathon's East Brae platform 34 km to the south. From East Brae the gas continues to the UK grid via the SAGE pipeline system and the St. Fergus terminal.

Licensees in Devenick are BP 50%, Britoil PLC 38.7%, and RWE Dea UK SNS Ltd. 11.3%.

OMV to develop Latif gas field in Pakistan

OMV AG and partners will drill four wells and lay a 50-km pipeline to develop Latif natural gas field in the Sindh province of Pakistan (OGJ Online, May 4, 2010).

The pipeline will carry production to OMV's sour gas processing plant at Sawan gas field, where production is declining.

Early production from Latif field, on which three appraisal wells have been drilled, has been handled by OMV's Kadanwari processing plant.

OMV plans to start production through the Sawan plant in 2013 and to produce 5,700 boe/d in 2014. It estimates plateau production at 18,000 boe/d.

In addition to the drilling and laying of the pipeline, the €107 million development project will include new wellhead compression and reception and metering facilities at Sawan.

In a statement, OMV said the project was enabled by a September change in the Pakistani petroleum policy allowing it to collect gas prices for discoveries and incremental production higher than were available earlier but that still, according to OMV Executive Board Member Jaap Huijskes, "well below competitive fuels."

Contract let for north Caspian field work

Lukoil-Nizhnevolzhskneft has let a contract to Saipem for transportation and installation of facilities at Vladimir Filanovsky oil field under development in the northern Caspian Sea (OGJ Online, May 4, 2012).

The agreement covers an ice-resistant fixed platform, a central processing platform, a riser block platform, and a living quarters module, all connected by catwalk bridges.

Drilling is scheduled to start in December 2014 from the 15,200-tonne fixed platform, which will be able to accommodate the drilling of 11 horizontal wells.

The 21,000-tonne central processing platform will have two processing lines with capacities of 3 million tonnes/year each. Treated formation water will be reinjected.

The quarters module will accommodate 125 workers.

Development of the field will require the laying of more than 330 km of subsea and 350 km of onshore pipelines. Lukoil also plans to build an onshore receiving facility with tank storage capacity of 80,000 cu m in the Republic of Kalmykia.

When Lukoil reported the 2005 Filanovsky discovery, it called it Russia's largest strike in a decade (OGJ Online, Jan. 26, 2006).

Lukoil reports Filanovsky's combined confirmed and estimated recoverable crude reserves at 153.1 million tons and gas reserves at 32.2 billion cu m. It plans to commission the field at the end of 2015.

PROCESSING — Quick Takes

Marathon Petroleum to buy BP's Texas City refinery

Marathon Petroleum Corp. has signed a definitive agreement to buy BP PLC's 451,000-b/cd Texas City, Tex., refinery and related assets for as much as $2.5 billion.

The sale of the high-conversion refinery is part of a strategy BP disclosed early last year to cut its US refining capacity by half (OGJ Online, Feb. 1, 2011). As part of that strategy, it agreed in August to sell its 251,000-b/d refinery in Carson, Calif., to Tesoro Corp. (OGJ Online, Aug. 13, 2012).

When it announced that strategy, BP said any transaction involving the Texas City refinery would be negotiated to fulfill regulatory obligations associated with the Mar. 23, 2005, explosion and fire that killed 15 people and injured 170 others.

Marathon will pay a base purchase price of $598 million and an estimated $1.2 billion for inventories. Under an earn-out provision, Marathon could pay as much as an additional $700 million over 6 years.

In addition to the refinery, the agreement covers three intrastate NGL pipelines linked to the facility, an allocation of BP's Colonial Pipeline Co. shipper history, four terminals, retail marketing contract assignments for about 1,200 branded sites, and a 1,040-Mw cogeneration facility.

According to OGJ's 2011 Worldwide Report, the Texas City refinery has major processing capacities including 29,700 b/cd of delayed coking, 163,800 b/cd of fluid catalytic cracking, 124,200 b/cd of cyclic catalytic reforming, 54,000 b/cd of catalytic hydrocracking for distillate upgrading, 63,000 b/cd of hydrocracking for resid upgrading, and 409,000 b/cd of various catalytic hydrotreating (OGJ, Dec. 5, 2011, p. 30).

BP said it has divested assets worth $35 billion since the beginning of 2010 and expects the total to reach $38 billion by the end of 2013.

JV to design, build petchem plant in Mexico

ICA Fluor, an industrial engineering partnership of Irving, Tex.-based Fluor Corp. and Empresas ICA, is part of a joint venture that has been awarded an engineering, procurement, and construction contract by Braskem Idesa SAPI.

The JV company includes Odebrecht (40%; based in Brazil), Technip (40%; France), and ICA Fluor (20%). It will design and build the $3 billion Etileno XXI petrochemical complex in the Coatzacoalcos/Nanchital region of the Mexican state of Veracruz. The complex will include a 1 million tonne/year ethylene cracker and two high-density polyethylene plants and start up in June 2015.

According to Technip, the complex will also include a low-density polyethylene plant using BASEL Lupotech technology; storage, waste treatment, and utilities, including a 150-Mw combined-cycle power and steam cogeneration plant; a logistics platform for shipment of 1 million tpy of polyethylene via rail, truck, or bagged; and administrative, maintenance, control room, and other buildings. The plant will start up in June 2015.

Shell lets Quest project contract to Fluor

Shell Canada Ltd. let a contract to Fluor Corp. for engineering, procurement, and construction of its Quest carbon capture and storage (CCS) project in Alberta. Shell announced the decision to proceed with the project linked with the Scotford Upgrader near Edmonton, Alta., last month (OGJ Online, Sept. 5, 2012).

The Athabasca Oil Sands Project, a consortium of Shell, Chevron Canada Ltd., and Marathon Oil Corp., owns the upgrader. The Quest facility will capture more than 1 million tonnes/year of carbon dioxide and transport it through an 80-km pipeline to an injection facility to the north. The Albertan and Canadian governments are providing financial assistance.

The project is expected to cut direct CO2 emissions by the upgrader by as much as 35%.

TRANSPORTATION — Quick Takes

Partners release gas pipeline cost estimate

The proposed 800-mile natural gas pipeline from Alaska's North Slope to a planned gas liquefaction plant and export terminal in south-central Alaska would be "a megaproject of unprecedented scale and challenge" costing $45-65 billion, said three ANS producers and TransCanada Corp.

It also would consume up to 1.7 million tons of steel, employ 15,000 workers at its construction peak, and establish a permanent workforce of more than 1,000 in Alaska by its completion in 5-6 years, according to ExxonMobil Corp., ConocoPhillips Co., BP PLC, and TransCanada.

"This opportunity is challenged by its cost, scale, long lead times, and reliance on interdependent oil and gas operations with declining production," they said in an Oct. 1 letter to Gov. Sean Parnell (R).

"The facilities currently used for producing oil need to be available over the long term for producing the associated gas for an LNG project," the pipeline project partners continued. "For these reasons, a healthy long-term oil business, underpinned by a competitive fiscal framework and LNG project fiscal terms that also address [Alaska Gasline Inducement Act] issues, is required to monetize North Slope natural gas resources."

Parnell, who received the letter on Oct. 3, said that it met a critical benchmark he laid out in his January state of the state address when he called on the companies to provide more specific numbers for the project and identify a timeline by the end of 2012's third quarter.

He said the companies also reached a third benchmark from his January address when he asked them to complete discussions with the Alaska Gasline Development Corp., the LNG facilities developer, on possibly consolidating their work. The APP partners said in their letter that a framework has been established between the two state-sponsored entities to share information, Parnell said.

Gazprom to build third, fourth string of Nord Stream

Gazprom has decided to build third and fourth strings of the Nord Stream trans-Baltic natural gas pipelines. The company made the announcement at commissioning of Nord Stream's second string in Portovaya Bay, the Baltic coast of Russia.

One of the new strings might deliver Russian gas to the UK, Gazprom said. The company plans to sign a memorandum of understanding regarding the new construction by Jan. 31, 2013.

Nord Stream AG welded the final joint of the pipeline's second string earlier this year (OGJ Online, Aug. 30, 2012).

Nord Stream extends 1,224 km from Portovaya Bay to the German coast near Greifswald. Commercial gas supplies via Nord Stream's first string started Nov. 8, 2011 (OGJ Online, Nov. 14, 2011). The company completed stringing of the second line on Apr. 18 (OGJ Online, Mar. 29, 2012). Total capacity of the twin lines measures 55 billion cu m/year.

Nord Stream partners are Gazprom 51%, Wintershall 15.5%, E.On Ruhrgas 15.5%, Gasunie 9%, and GDF Suez 9%.

Chevron confirms a fourth train for Gorgon

Chevron Corp. reported that a fourth train will be constructed as part of the Gorgon LNG project on Barrow Island, Western Australia. Geryon field, discovered in 2001, and Chandon field, discovered in 2006, will supply the new 5.2 million tonne/year capacity LNG train.

This will bring the Gorgon project output capacity to 20.8 million tpy. Chevron confirmed the plan while hosting a group of investors around a recent site visit.

Geryon and Chandon will supply about 11 tcf of gas to the project. Gas from both fields is low in carbon dioxide and high in deliverability. Nevertheless the news has been a surprise since previous plans were to hold the gas from these two fields until the Gorgon and Jansz fields began to run down.

The fourth train work will include construction of a fourth LNG storage tank on Barrow and the laying of a third pipeline to feed the project. An environmental impact assessment has already been lodged with the Western Australian government and front-end engineering and design on the proposed expansion will begin late this year.

Gorgon area manager Colin Beckett said the successful appraisal of pre-2009 fields discovered in the region as well as development drilling on existing discoveries had given Chevron the confidence to declare a fourth train viable without affecting the gas input for the first three trains.

The fourth train will be leveraged off existing infrastructure on Barrow Island to achieve the new train at the lowest cost. Although no figure was mentioned analysts believe a fourth train expansion would cost about $10 billion (Aus.).

First LNG production from the Gorgon-Jansz project is still slated for 2014.