OGJ Newsletter

GENERAL INTEREST — Quick Takes

Total to sell $15-20 billion in assets

Total SA outlined plans to sell $15-20 billion worth of assets by yearend 2014, and the sales could include upstream assets, refineries, and pipelines, executives said.

Total Chairman and CEO Christophe de Margerie outlined Total's plans to investors during a presentation in London on Sept. 24. Total will use income from the sales to reinvest in projects it already owns and to finance exploration, he said.

Most of the divestiture will come from the exploration and production division, de Margerie said, although he declined to name specific assets. Total's plan to sell assets to help grow its profitability follows similar divestiture efforts by BP PLC and ConocoPhillips.

Total also plans to grow its production an average 3%/year during 2011-15, which is up from its earlier comments that it was seeking to grow production an average 2.5%/year during that time.

After 2015, Total hopes to accelerate production growth to reach 3 million boe/d in 2017.

Of the 3 million boe/d target, 70% of the projects are either in production or in development, executives noted.

Meanwhile, an ongoing restructuring of refining and chemical operations is expected to pay off for Total in savings of $650 million/year by 2015 through improved efficiencies.

Shell to buy BP's stake in Draugen oil field

Norske Shell agreed to buy BP PLC's 18.36% nonoperated interest in Draugen oil field offshore Norway in the Norwegian North Sea for $240 million.

Shell operates Draugen. BP's net production averages some 6,000 b/d of oil. The transaction, subject to regulatory approval, is expected to close by yearend.

With the Draugen announcement, BP has agreed to sell $33 billion in assets since Jan. 1, 2010. BP expects to divest $38 billion in assets during 2010-13.

Nexen shareholders okay takeover plan

Two classes of Nexen Inc. shareholders have approved a "plan of arrangement" connected with the proposed takeover of the company by CNOOC Ltd. of China (OGJ Online, July 23, 2012).

Nexen said the plan received support of 99% of votes cast by common shareholders and of 87% of votes cast by preferred shareholders at a special meeting on Sept. 20.

The $15.1 billion takeover remains subject to government approvals.

Summit Midstream to acquire Uinta basin assets

Summit Midstream Partners LLC, Dallas, agreed to acquire ETC Canyon Pipeline LLC for $207 million from La Grange Acquisitions LP, a wholly owned subsidiary of Energy Transfer Partners LP.

Canyon gathers and processes natural gas in the Piceance and Uinta basins in Colorado and Utah.

The gas gathering and processing systems consist of more than 1,600 miles of pipe, 440,000 hp of compression, processing assets with total capacity of 97 MMcfd, and two natural gas liquid injection stations.

The acquisition, subject to regulatory approvals, is expected to be finalized in fourth quarter.

Exploration & Development — Quick Takes

BSEE issues Shell permit for limited activities

The US Bureau of Safety and Environmental Enforcement issued Shell Offshore Co. a permit for limited activities on its Beaufort Sea leases nearly a week after the company announced it was scaling back its 2012 Alaskan offshore drilling plans to not penetrate oil-bearing zones (OGJ Online, Sept. 17, 2012).

Royal Dutch Shell PLC announced on Sept. 17 that its subsidiary was making this move after its Arctic offshore spill containment dome was damaged 3 days earlier during a final test in the Chukchi Sea, where the company also holds federal leases.

BSEE said its Sept. 20 action follows its Aug. 30 authorization for Shell to conduct similar preparatory activities there in anticipation of potential development activities.

"BSEE continues to closely monitor Shell's ongoing approved preparatory drilling activities in the Chukchi Sea, and today's approval of limited work in the Beaufort Sea must also meet the same rigorous safety, environmental protection, and emergency response standards," said James A. Watson, the US Department of the Interior agency's director.

Activities authorized under the new permit include creation of a mudline cellar, a safety feature which ensures that the blowout preventer is protected below the sea floor, and drilling and setting of the first two casing strings into shallow zones which do not contain crude, according to BSEE.

It said Shell may not begin these operations in the Beaufort Sea until the subsistence whaling season there has ended and the US Bureau of Ocean Energy Management gave its approval.

Environmental organizations criticized BSEE's action. "Given Shell's recent record in the Arctic, it makes no sense for [BSEE] to continue to grant them concessions in our nation's Arctic Ocean," Alaska Wilderness League Executive Director Cindy Shogan said.

"'Preparatory activities' are still drilling, and the [Obama] administration seems to be bending over backward to allow Shell to go forward, despite its poor performance," she said.

Bowleven moving to monetize Cameroon finds

Great progress has been made towards monetizing the existing gas and oil discoveries on the Etinde permit in the Gulf of Guinea offshore Cameroon, said Bowleven PLC, Edinburgh.

The fields on Block MLHP-7 are expected to be key contributors to proposed phase one development, and Block MLHP-5 will be the focus for the second phase.

A draft exploitation authorization application has been submitted to Cameroon authorities, and supporting workshops are under way. The workshops are intended to expedite approval of the final application that Bowleven expects to submit before the current exploration phase ends in December.

A memorandum of understanding for a 10-year supply of gas from Etinde to a proposed fertilizer plant in Cameroon was signed in April by the prospective owners Ferrostaal AG and Cameroon's state SNH and Bowleven. A gas sales term sheet is at an advanced negotiating stage, and discussions to conclude pricing and other terms continue. Financing options are under consideration.

Meanwhile, Bowleven has spudded the IM-5 appraisal-development well on MLHP-7. The primary objective is to determine reservoir and fluid properties of the Middle Isongo sands. The secondary objective is to explore the potential of the Intra Isongo reservoir sands. Upper Isongo reservoir sands, which were encountered as gas bearing in the previous four IM wells, are prognosed to be beneath the gas-water contact and hence water bearing at this location.

The well, 1 km south of IM-3, is projected to 3,475 m in 56 m of water and has been designed to enable suspension as a future producing well.

The jack up has been contracted for a minimum of two firm wells. The location and timing of the second well remain flexible pending results from technical work and IM-5's outcome.

Bowleven is at an advanced stage of discussion with a preferred bidder regarding farmout of part of its interest in the Bomono permit. Drilling locations have been identified, and site preparation is under way. Drilling depends on securing a land rig and may slip into 2013, beyond the first exploration phase of the PSC. Bowleven has submitted a request to SNH to accommodate this potential eventuality.

Eni has oil, gas-condensate discovery off Ghana

A group led by Eni SPA plans delineation drilling around a potentially commercial oil and gas-condensate discovery on the Offshore Cape Three Points block off Ghana.

Sankofa East-1X, the first oil discovery on the block, encountered 28 m of gas-condensate and 76 m of gross oil pay in Cretaceous sandstones. It flowed at the rate of about 5,000 b/d of high-quality oil on a production test on which test equipment capacity restricted the rate. Eni said the well went to 3,650 m in 825 m of water 50 km offshore.

The company noted that engineering studies are in progress for the development and commercialization of the block's gas reserves in accordance with the principles sanctioned in the memorandum of understanding recently signed by Eni, Vitol Upstream Ghana Ltd., and Ghana National Petroleum Corp. with Ghana's ministery of energy. The MOU focuses particularly on the domestic gas market, in which Eni and its partners wish to play a prominent role.

Eni Ghana Exploration & Production Ltd. is block operator with 47.222% interest. Vitol has 37.778% and GNPC 15% plus an option for a further 5%.

Jordan awards two oil shale exploration blocks

Jordan has signed a memorandum of understanding with Global Oil Shale Holdings, London, that covers exploration and production of the Attarat Umm Ghudran and Isfir Al Mahatta blocks in central and southern Jordan.

Global Oil Shale said it will mount an aggressive drilling campaign "so that the company can delineate the area it plans to retain for development," adding, "We intend to complete our preliminary assessment over the next 12 months."

Drilling & Production — Quick Takes

Crimson completes Eagle Ford well in Zavala County

Crimson Exploration Inc., Houston, completed its KM Ranch No. 2H well in the Eagle Ford shale in Zavala County, Tex., and reported gross initial production rate of 457 b/d of oil and 326 Mcfd of natural gas.

The well was drilled to 12,875 ft, including 5,250 ft of perforated lateral and 16 fracturing stages.

Crimson has 50% working interest in the well, and the company previously delayed completion to further understand optimal completion techniques beginning developed by other area operators.

Crimson has 6,550 net acres in Zavala and Dimmit counties (OGJ Online, July 12, 2012).

Allan D. Keel, Crimson president and chief executive officer, said, "We believe the progression of improved results by Crimson and other offset operators has demonstrated that the Eagle Ford is an economically viable play in this part of the trend. Recent higher initial production rate wells drilled by other operators in the eastern portion of Zavala County, and immediately adjacent to Crimson's leasehold, have been completed with average effective lateral lengths of approximately 7,500 ft."

Crimson's next phase of development in this area will involve drilling laterals longer than 7,000 ft, he said.

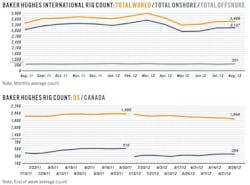

Seadrill orders ultradeepwater drillship

Seadrill Ltd. signed a turnkey contract to build an ultradeepwater drillship at the Samsung shipyard in South Korea. The project value is estimated at $600 million, including project management, drilling and handling tools, spares, interest, and operations preparations.

The drilliship, slated for delivery during fourth-quarter 2014, will be of the same design as drillships already under construction at Samsung for Seadrill (OGJ Online, Apr. 4, 2011).

It will have capacity to work in 12,000 ft of water, targeting operations such as the Gulf of Mexico, Brazil, and West and East Africa. The design calls for a seven-ram configuration of the blowout preventer (BOP) stack with handling capacities and storage for a second BOP.

The drillship will have a hook load capability of 1,250 tons.

In addition, Seadrill announced Sept. 24 that it agreed on a fixed-price option to build another drillship at the yard, with delivery scheduled for first-quarter 2015.

With the current strong demand there is limited availability of rigs in 2014, and Seadrill executives believe the option likely will be exercised.

Statoil starts work on IOR research center

Aiming to boost its oil-recovery rate on the Norwegian continental shelf to 60%, Statoil has begun construction of a 240 million krone ($41.7 million) research center for improved recovery at Trondheim, Norway.

At a ground-breaking ceremony, Statoil Chief Executive Officer Helge Lund said Statoil fields offshore Norway for the first time last year achieved an average recovery rate of 50%. The average recovery rate of the Norwegian continental shelf is 47%, according to Statoil.

DNO restarts West Bukha flow offshore Oman

DNO International ASA has restarted production at West Bukha oil field on Block 8 offshore Oman after repairing a blocked pipeline connecting the field with Bukha field.

The company shut in production in March when the pipeline became blocked during routine pigging (OGJ Online, July 18, 2012). The field then was producing about 7,000 b/d of oil and 25 MMcfd of natural gas.

After cutting and replacing a 4.3-km section of the 12-in. pipeline, DNO brought two wells in the field back onstream at combined rates of 10,000 b/d of oil and 25 MMcfd of gas.

It has drilled a third well, which awaits completion and testing, and is drilling a fourth.

DNO holds a 50% interest in the block. LG International of South Korea holds the other 50%.

Rosneft, Gazprom sign offshore co-op pact

Rosneft and Gazprom have signed a cooperation agreement under which they will jointly operate infrastructure for oil and gas field development offshore Russia.

According to a press statement by Rosneft, the companies will "strengthen cooperation to identify the most efficient methods and solutions to drive exploration of Russia's continental shelf and resource and development and replacement by combining technical and financial capacities."

The statement said the agreement "covers the companies' intention to join forces so as to ensure compliance with the terms of international agreements and Russian legislation governing environmental protection and safety and the protection and preservation of offshore natural and mineral resources."

PROCESSING — Quick Takes

Westlake Chemical to start up ethylene expansion

Westlake Chemical Corp., Houston, will perform planned maintenance and an expansion of the Petro 2 ethylene unit at the company's complex in Lake Charles, La., in first-quarter 2013.

This expansion will increase ethane-based ethylene capacity by about 104,000-109,000 tonnes/year. The unit will be offline about 50 days, said the company's announcement.

Expansion of the P2 unit was announced in April 2011 and originally slated for completion in fourth-quarter this year (OGJ, July 2, 2012, p. 78). Westlake spokesperson Dave Hansen told OGJ the decision to move the work was made to ensure the "site work is optimized and the downtime is minimized."

In the 2011 announcement, Westlake Chemical said the expansion plans were in response to new low-cost ethane and other light NGLs becoming available as a result of shale gas production. Expansion of Petro 1, originally set for yearend 2014, is scheduled for 2015, said Hansen.

Before the projects were announced, capacity of the crackers was 567,000 tpy and 522,000 tpy, according to OGJ figures for 2011.

Refinery to expand in northeastern India

Numaligarh Refinery Ltd. (NRL), which operates a 3 million tonne/year (tpy) refinery in the Golaghat district of Assam in far-northeastern India, plans to increase crude-distillation capacity to 8-9 million tpy.

At its annual general meeting this month, the company said it is studying a pipeline project for crude supply needed for the expansion.

Projects now under way at the refinery include facilities to produce paraffin and microcrystalline wax and a naphtha splitter to supply 160,000 tpy of petrochemical-grade naphtha to the Assam Gas Cracker Project, which will be operated by Brahmaputra Cracker and Polymer Ltd. at Lepetkata in the Dibrugarh district.

NRL owns a 10% interest in that project, which will be able to produce 220,000 tpy of high density and linear low density polyethylene, 60,000 tpy of polypropylene, 55,000 tpy of raw pyrolysis gasoline, and 12,500 tpy of fuel oil.

NRL's owners are state-owned Bharat Petroleum Corp. Ltd. (61.65%) and Oil India Ltd. (26%) and the government of Assam (12.35%). Major processing units at the refinery now are a 306,000 tpy delayed coker, a 1.1 million tpy hydrocracker, and a 225,000 tpy gasoline plant including a catalytic reformer and a naphtha hydrotreater.

Oil products plant considers adding GTL capacity

Calumet Specialty Products Partners LP, Indianapolis, earlier this month said it is considering adding a 1,000-b/d gas-to-liquids plant to its Karns City, Pa., specialty products plant.

This would be the first GTL commercial installation in North America, as far as OGJ can determine; a few larger projects are under study and planning (OGJ, Sept. 19, 2011, Newsletter). ARCO installed a 70-b/d pilot GTL in 1999 at its then-owned Cherry Point, Wash., refinery (OGJ, Aug. 9, 1999, p. 24). ARCO subsequently merged with BP, which took over the refinery and soon after dismantled the plant, BP has told OGJ. In 2009, BP also shut down a 300-b/d GTL demonstration plant at Nikiski, Alas., which had opened in 2003.

Design for the Calumet plant is to be completed by late 2012, followed by site engineering and a decision to begin building in first-half 2013. Production could begin in second-half 2014.

Calumet has commissioned Pasadena, Tex.,-based Ventech Engineers International LLC to design and deliver the GTL plant that will use an "autothermal reformer" from Haldor Topsoe Inc. and Fischer-Tropsch technology from Velocys Inc.

Haldor Topsoe's ATR is a technology for reforming natural gas into synthesis gas, a mixture of hydrogen and carbon monoxide. In the GTL plant, said the Calumet announcement, this synthesis gas will move through Velocys's FT process, converting it into long-chain hydrocarbons, typically paraffins, naphthenes, and aromatic compounds.

Repeated calls by OGJ to Calumet's president and its vice-president for operations were not returned. Nevertheless, a GTL expert, familiar with the Karns City plant and the chosen technologies, told OGJ that the economics of the installation would be questionable if the GTL plant were producing only transportation fuels, specifically diesel, the more typical products of a GTL process.

But, he said, because Calumet's operation of the Pennsylvania plant to make high-margin lubes and petrochemical building blocks "changes the picture." He added that lubes and specialty petchems are low-volume products, unlike commodity transport fuels.

The plant will be built as transportable modules at Ventech's plant in Southeast Texas, then moved to Karns City for installation and interconnection with the existing lube oil plant.

Lukoil unit resumes olefins production

Stavrolen, a subsidiary of Lukoil, has resumed full production of ethylene and propylene at its complex in the Stavropol region of Russia after completing repairs to the ethylene unit, which was damaged by fire in mid-December 2011.

The complex has one of the largest pyrolysis units in Russia, with capacity of 350,000 tonnes/year of ethylene.

The complex resumed polypropylene production in March using propylene purchased from another Lukoil subsidiary, Karpatneftekhim, Kalush, Ukraine, and other Russian petrochemical manufacturers.

TRANSPORTATION — Quick Takes

Gazprom, Summa Group eye LNG bunker fuel

Gazprom and Summa Group have signed a memorandum of understanding indicating their intent to use LNG as a bunker fuel for marine vessels, including those owned and operated by Summa Group, an engineering, construction, and logistics conglomerate based in Moscow.

The companies initially will consider cooperation in the North Sea and Baltic Sea, including LNG supply and development of bunkering infrastructure, especially LNG storage facilities.

Later they'll consider development of cooperation in the Black Sea, Mediterranean Sea, and regions of the Pacific.

"The tough mandatory restrictions on emissions for marine vessels carrying out transportation operations in the Baltic and North Seas to be imposed after 2015 is the most important factor of switching to alternative fuel," said Alexander Medvedev, deputy chairman of the Gazprom Management Committee. "LNG is the only fuel that meets the requirements for limitation of emissions by ship engines without the need to install expensive filters, and it is favorably priced compared to low-sulfur petrochemicals."

He said the requisite technologies for vessels, ship engines, and storage facilities "are available and tested."

Oneok Partners holds open season for Bakken line

Oneok Partners LP launched an open season for its previously announced Bakken Crude Express Pipeline. Scheduled to conclude Nov. 20, the open season provides potential shippers the opportunity to execute long-term contracts in exchange for priority service.

The proposed BCEP is a 1,300-mile crude oil pipeline with the capacity to transport 200,000 b/d of light, sweet crude oil from multiple points in the Williston basin in North Dakota and Montana to the Cushing hub in Oklahoma.

Construction of the BCEP system tentatively is slated to begin in early 2014 with completion by mid-2015.