OGJ Newsletter

GENERAL INTEREST — Quick Takes

Chesapeake puts some DJ basin assets up for sale

Chesapeake Energy Corp., Oklahoma City, has put 503,863 net acres of its oil and natural gas holdings in the Denver-Julesberg basin up for sale. The acreage includes the Niobrara shale play of northern Colorado.

Meagher Energy Advisors issued a prospectus on behalf of Chesapeake saying the acreage is separated into five areas. The holdings are spread across various counties in Colorado and Wyoming, including the Colorado counties of Arapahoe and Weld.

Chesapeake is selling various assets in efforts to raise up to $11.5 billion to help reduce debt.

Previously, Chesapeake announced a $4 billion unsecured term loan syndicated to a large group of institutional investors (OGJ Online, May 15, 2012).

Pacific Rubiales to hike CGX stake, involvement

Pacific Rubiales Energy Corp., Toronto, will expand its investment in the Guyana oil play along South America's northeastern margin with the purchase of a further 85.7 million shares of CGX Energy Inc. for $30 million.

Also, Pacific Rubiales will provide technical operational assistance to CGX and have an option to participate in each of the next wholly owned commitment wells to be drilled on the Corentyne and Annex offshore petroleum production licenses in Guyana by funding 50% of the exploratory well costs and certain seismic costs in exchange for 33% interest in the respective PPLs.

Pacific Rubiales already owns 58.7 million shares of CGX, and the new purchase will expand its stake in CGX to 35%. Pacific Rubiales said, "This investment is strategic to the company's objective of being the leading Latin American independent explorer and producer of hydrocarbons."

NAL merger into Pengrowth approved

Canadian producers Pengrowth Energy Corp. and NAL Energy Corp., both of Calgary, expect to close a business combination on May 31 in which Pengrowth will be the surviving entity. Derek Evans, Pengrowth president and chief executive officer, will retain those positions.

The companies said on May 23 that NAL shareholders had approved the combination, which directors of both firms approved in March.

The combined company will have total production of 100,000 boe/d, including light and heavy oil in Alberta and Saskatchewan, and proved plus probable reserves of 434 million boe.

Exploration & Development — Quick Takes

Crown Point drilling on Antrim Argentina sites

Crown Point Ventures Ltd., Calgary, having completed the acquisition of Antrim Argentina SA's Argentine assets, said combined sales are now 1,759 b/d of oil equivalent, 35% oil and liquids.

Management expects production increases from a fracture stimulation program of five wells on the Las Violetas concession since the end of the first quarter. A six-well drilling program is planned in this year's second half.

On the El Valle concession, Crown Point is in the midst of a seven-well program with one well completed and ready to go on production, a second well under completion, and a third well cased as an oil well.

Until recently, sales of oil and gas from Tierra del Fuego to the Argentina mainland generated value-added tax of 21% that Antrim Argentina was able to retain due to favorable tax laws. Antrim reported VAT income of $2.2 million (US) in 2011 and $2.1 million in 2010. However, on May 16 Argentina issued a decree removing the province's tax-free status.

In the short to medium term, Crown Point said, the change is expected to have a modestly negative impact on the combined company's income but not on its reserves.

The policy change's impact on Crown Point may be mitigated to some degree by ongoing local efforts to have it reversed or revised, potential reductions in the conditions and terms of the concession extensions currently being negotiated with the Tierra del Fuego government, the continuation of the trend in rising natural gas prices in Argentina, and-or an increase in the proportion of Crown Point's production that is derived from natural gas production from the TDF assets, which attracts the higher Gas Plus pricing.

Talisman-Petronas to inherit Kinabalu oil fields

Petroleum Nasional Bhd. will assign operatorship of the Kinabalu oil fields offshore Sabah at the end of 2012 to a combine of Talisman Malaysia Ltd. and Petronas Carigali Sdn. Bhd., who will invest more than $1 billion on production and enhanced oil recovery.

A production-sharing contract with current operator Shell expires in late December, and a new one will be signed that gives Talisman 60% interest and Petronas Carigali 40%.

The mature Kinabalu Main, Kinabalu East, and Kinabalu Far East fields have "significant development upside," Talisman said without giving figures. The PSC is adjacent to the Talisman-operated Sabah exploration block.

Talisman said the agreement is the first of a new "progressive volume-based" PSC to be awarded by Petronas that was specifically designed to incentivize contractors to improve oil recovery and increase production from mature oil fields.

CNOOC tests oil discovery in Liaodong Bay

CNOOC Ltd. said it has tested the Luda 21-2 oil discovery in southern Liaodong Bay of Bohai Gulf at 608 b/d from the "thickest oil layers found in the exploration of Bohai clastic rocks in recent years."

The LD 21-2 well went to 2,831 m in 20 m of water and encountered a combined 170 m of oil pay. It is in the inverted structure belt of LD 22-27 with its south part adjacent to LD 27-2 oil field.

Agiba finds Western Desert Cretaceous near-giant

Agiba Petroleum Co. has made a Cretaceous oil and gas discovery in Egypt's Western Desert initially judged to have 150-250 million bbl of oil in place.

The Emry Deep-1X well on the Meleiha concession 290 km southwest of Alexandria production tested at 3,500 b/d of 41° gravity oil and 1 MMscfd of associated gas. Drilled to 3,628 m, it encountered more than 250 ft of net pay in multiple good-quality Lower Alam El Bueib sandstones. Appraisal drilling is planned.

Eni SPA, which owns a 56% working interest in the concession through its International Egyptian Oil Co. affiliate, said full-field development foresees an early production phase from the current well to be followed by the drilling of development wells in 2012 to reach 10,000 b/d within months with production treated at Meleiha field facilities.

Eni said, "This result confirms that the Meleiha concession still holds significant untapped deep exploration potential and that the recently acquired 3D seismic survey has boosted the potential of the deep Lower Cretaceous and Jurassic formations."

IEOC's partners in Meleiha are OAO Lukoil 24% and Mitsui 20%. Agiba, a joint operating company owned by Egyptian General Petroleum Corp. 50%, IEOC 40%, and Mitsui Oil Exploration Co. Ltd. 10%, is operator of the Emry Deep project.

Drilling & Production — Quick Takes

DOE picks 13 projects for drilling research grants

The US Department of Energy has selected for further development 13 projects designed to reduce risks and improve environmental protections during ultradeepwater drilling. Negotiations for the new projects will lead to $35.4 million of awards, DOE's Fossil Energy Office (FEO) said on May 21. The projects' total value will be more than $56 million over 4 years with $21.2 million of shared costs provided by the research partners, it noted.

FEO said the projects will address use of intelligent casing and smart materials to monitor displacement in new and better ways during casing cementing; and assess corrosion, stress cracking, and scale at extreme temperatures and pressures.

Grants include $3,174,127 to Brine Chemistry Solutions LLC of Houston (which will provide $807,640) over 3 years to develop the necessary data, models, and experimental tools to more accurately assess corrosion, stress cracking, and chemical deposit buildup at extreme temperatures and pressures; $10,985,402 to Deepflex of Houston (which will provide $9,410,005) over 3 years and 9 months to design, manufacture, and test flexible fiber reinforced pipe for use in 10,000 ft water depths; and $7,105,948 to GE Global Research in Niskayuna, NY (which will provide $6,331,586), over 4 years for similar flexible fiber reinforced pipe design, manufacturing, and testing research for use in water 10,000 ft deep.

FEO said the contracts will be administered by the Research Partnership to Secure Energy for America, under the management of FEO's National Energy Technology Laboratory.

BLM issues preliminary EA for oil shale projects

The US Bureau of Land Management's White River field office in Meeker, Colo., has released a preliminary environmental assessment (EA) for two proposed oil shale research, demonstration, and development (RD&D) leases about 35 miles southwest of the Colorado community. Public comments will be accepted through June 16, BLM said on May 18.

It said ExxonMobil Exploration Co. and Natural Soda Holdings Inc. have submitted operating plans for the in situ development of oil shale. Each proposed RD&D lease is a 160-acre tract with an associated preference lease area of up to 480 contiguous acres, BLM said. The preference lease areas are reserved for possible conversion to a commercial lease, pending the results of the companies' RD&D work and additional BLM review, it said.

Kent Walter, White River field office manager, noted that the RD&D leases give companies the opportunity to test technologies and determine if they are commercially viable. "This critical [RD&D] work will also help us answer important questions about the water demands and potential impacts of commercial-scale development, so that we can forge a responsible and orderly path forward if the technology proves viable," he said.

The proposals, which encompass adjacent areas and are analyzed in one EA, stem from a November 2009 call for oil shale RD&D lease nominations, which followed an initial round of nominations in 2007 in which six RD&D leases were issued. To date, technological and economic conditions have not combined to support a sustained commercial oil shale industry in the US, BLM said.

BLM held a 30-day public scoping period last spring to identify issues and concerns related to the two proposals, as well as public meetings in Meeker and Rifle, Colo., before it drafted the preliminary EA, it indicated.

Husky using ethanol-plant carbon dioxide for EOR

Husky Energy Inc., Calgary, is capturing and liquefying carbon dioxide from its ethanol plant in Lloydminster, Sask., for use in enhanced oil recovery pilot projects in nearby heavy oil fields.

The project converts about 250 tonnes/day of CO2 at the 130 million l./year ethanol plant into a high-pressure liquid stored in 900,000-gal "buckets," which trucks carry to the oil fields for vaporization and injection.

The company received $14.5 million from the federal government to develop and demonstrate the carbon-capture and storage technologies. The Saskatchewan government provided funding for field pilots.

Husky produces heavy oil from relatively shallow deposits within 100 km of Lloydminster with a variety of techniques, including primary production, horizontal wells, cyclic steam stimulation, and steam-assisted gravity drainage. It also uses cold heavy oil production with sand (CHOPS).

Last year in the Lloydminster area it produced 60.3 million b/d of heavy oil via primary production, including CHOPS and horizontal technologies, 17.4 million b/d of heavy oil from thermal operations, and 2.3 million b/d of medium-gravity oil from waterflooded fields in the Wainwright and Wildmere areas.

Mild winter helps North Dakota boost oil production

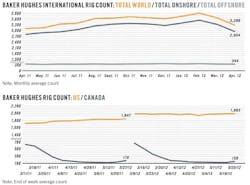

A mild, dry winter during 2011-12 enabled producers to boost oil production from North Dakota's Bakken formation in the Williston basin where advances in unconventional drilling continue to be made, according to Steve Carroll, ConocoPhillips drilling and completion manager.

Speaking during a May 16 onshore drilling conference hosted by the International Association of Drilling Contractors in Houston, Carroll noted the 2011-12 winter was in stark contrast to the 2010-11 winter, which was one of the harshest winters in memory for North Dakota.

North Dakota has surpassed Alaska to become the second oil-producing state in the US, following Texas, the North Dakota Industrial Commission Department of Mineral Resources announced during May. State statistics showed North Dakota produced 17.8 million bbl during March, averaging an all-time high of 575,490 b/d. The number of wells in the state reached a record 6,921 in March compared with 6,729 in February.

ConocoPhillips has 626,000 net acres in the Williston basin with Bakken potential. Plans for 2012 include having 9-10 rigs under contract in the Bakken/Three Forks by yearend, Carroll said. The company has reduced horizontal drilling time by developing new methods and best practices.

On May 1, ConocoPhillips's refineries, pipelines, and chemical plants spun off to form a separate company, Phillips 66.

PROCESSING — Quick Takes

API blasts EPA rejection of petitions

The American Petroleum Institute strongly criticized the US Environmental Protection Agency 3 days after it rejected petitions from API, two other oil and gas industry associations, and a refiner to waive requirements for cellulosic biofuels that the petitions said do not exist.

"In all cases, the objections raised in the petition either were or could have been raised during the comment period on the proposed rule, or are not of central relevance to the outcome of the rule because they do not provide substantial support for the argument that the Renewable Fuel Standard program should be revised as suggested by petitioners," EPA told API, American Fuel & Petrochemical Manufacturers, Western States Petroleum Association, and Coffeyville (Kan.) Resources Refining & Marketing on May 22.

"EPA's mandate is out of touch with reality and forces refiners to pay a penalty for not using imaginary biofuels," Bob Greco, API's downstream and industry operations director, said on May 25. "EPA's unrealistic mandate is effectively an added tax on making gasoline."

Greco said the Clean Air Act requires EPA to determine the mandated volume of cellulosic biofuels each year at "the projected volume available." However, in 2011 EPA required refineries to use 6.6 million gal of cellulosic biofuels even though, according to EPA's own records, none were commercially available, Greco said.

EPA has denied API's 2011 petition to reconsider the mandate and continues to require these nonexistent biofuels this year, he indicated. Greco called the action "regulatory absurdity and bad public policy."

BPNA settles CAA charges at Whiting, Ind., refinery

BP North America Inc. (BPNA) agreed to pay an $8 million fine and spend more than $400 million to install state-of-the-art air pollution controls at its Whiting, Ind., refinery to settle charges that it violated the Clean Air Act, the US Department of Justice and Environmental Protection Agency jointly announced.

They said the May 23 settlement will lead to installation of innovative pollution controls at the refinery, including extensive new controls on the plant's flaring devices. BPNA agreed to limit the amount of waste gas sent to the devices in the first place, and implement innovative, cutting-edge controls to ensure proper combustion efficiency for any gases which are burned there, DOJ and EPA said.

EPA added that the requirements, similar to those included in a recent settlement with Marathon Petroleum Corp., are part of its national effort to reduce emissions from flares at refineries and petrochemical plants.

DOJ said in addition to the controls on the refinery's flares, this settlement will also result in reduced emissions by imposing some of the lowest emission limits in refinery settlements to date, enhancing controls on waste water containing benzene, and providing for an enhanced leak detection and repair program. The settlement also requires BPNA to spend $9.5 million on projects at the refinery to reduce greenhouse gas emissions, it added.

BPNA agreed to perform a supplemental environmental project in which it will install, operate, and maintain a $2 million fence line emission monitoring system at the Whiting refinery, and make the data collected publicly available by posting the information on a web site. Fence line monitors will continuously monitor benzene, toluene, pentane, hexane, sulfur dioxide, hydrogen sulfide and all compounds containing reduced sulfur, according to DOJ and EPA.

Joining in this settlement were the state of Indiana, the Sierra Club, Save the Dunes, the Natural Resources Defense Council, the Hoosier Environmental Council, the Environmental Law and Policy Center, the Environmental Integrity Project, Susan Eleuterio, and Tom Tsourlis, DOJ said. The consent decree is subject to a 30-day public comment period and final court approval, DOJ added.

GAIL selects Axens technology for petchem plant

GAIL (India) Ltd. will build a new ethylene dimerization unit at Pata, using Axens' AlphaButol technology. The unit will have production capacity of 20,000 tonnes/year of high purity 1-butene.

The technology is designed to ensure a flexible and reliable source of high quality comonomer 1-butene for downstream polyolefins applications, said the Axens announcement.

GAIL operates a gas-based integrated petrochemical plant of 410,000 tpy polymer capacity that is further being expanded to a capacity of 900,000 tpy.

The company also owns 70% of the Brahmaputra Cracker and Polymer Ltd., which is setting up a 280,000 tpy polymer plant in Assam.

Further, GAIL is a copromoter with 17% equity stake in ONGC Petro-additions Ltd., which is implementing a greenfield petrochemical complex of 1.1 million tpy ethylene capacity at Dahej in the Gujarat state.

Paraxylene plant nears completion in Algeria

Naftec SPA, a unit of Sonatrach, is nearing mechanical completion on a paraxylene (PX) production plant in Skikda, Algeria, according to technology licensor GTC Technology, Houston.

Expected to be fully operational later this year, the plant will incorporate CrystPX technology, licensed by GTC Technology, to recover PX from reformate feedstock, and GT-IsomPX, a process using ISOXYL catalyst from Sud-Chemie AG, a subsidiary of Clariant, to isomerize the C8 aromatics into additional PX.

TRANSPORTATION — Quick Takes

Shell sells more of Prelude floating LNG project

Following Royal Dutch Shell PLC's recent deal to sell 17.5% of its Prelude floating LNG project in Browse basin permit WA-44-L offshore Western Australia to Japan's Inpex Oil & Gas (OGJ Online, Mar. 19, 2012), the supermajor has agreed to sell a further 15% to Asian buyers.

Shell will sell 10% of Prelude to South Korea's Kogas and 5% to Taiwan's CPC Corp.

Kogas recently announced a decision to establish an Australian subsidiary to facilitate its plans to invest in Prelude and the company already has approval from the South Korean Ministry of Knowledge Economy to buy 3.64 million tonnes/year of LNG from Shell's global LNG supply inventory.

In addition, this month Shell signed a heads of agreement to supply CPC with 2 million tpy of LNG for 20 years beginning in 2016 from its global portfolio, which includes Prelude.

Japan Australia LNG buys into Browse LNG project

Japan Australia LNG (MIMI) Pty. Ltd. will acquire a 14.7% interest in the Woodside Petroleum Ltd.-operated Browse LNG project, buying the stake from Woodside for $1.9 billion (Aus.).

The move reduces Woodside's stake to 31.3%, but does not affect the company's operator status.

MIMI also will purchase 1.5 million tonnes/year of LNG from the proposed project subject to completion of the equity change. The deal is open to preemption rights from the other Browse partners, namely BHP Billiton, BP PLC, Chevron Corp., and Royal Dutch Shell PLC.

Woodside and MIMI have agreed to a joint marketing agreement under which the parties would jointly market comingled LNG volumes to primarily Japanese customers. In addition, MIMI has offered assistance in obtaining competitive financing for the Browse LNG development if and when the deal is completed.

Analysts see the deal as a major step in moving towards a final investment decision for the project by mid-2013.

Even so, there is some way to go before this point is reached. Woodside has been keen to develop the project through government-serviced shore facilities at James Price Point on the Kimberley coast, but its JV partners (including the yet-to-be-finalised MIMI) are less enthusiastic about this destination and speculation is rife that they prefer existing infrastructure on the Burrup Peninsula in the Pilbara.

The rumor mill has prompted Western Australian Premier Colin Barnett to declare that the decision as to where Browse gas will be processed lies with his government. "It is not a private decision," he said, adding, "It is a government decision."

Barnett's comments have raised the possibility that the Premier could use state agreement acts to force the Browse partners to develop an LNG facility at James Price Point.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com