MARKET WATCH: NYMEX, Brent crude oil price drop modestly

Crude oil prices dropped modestly on the New York market on Aug. 26 after a weekly government report showed an unexpected draw in US commercial crude oil inventories, helping light, sweet crude oil prices settle higher although the contract for October delivery remained under $39/bbl.

The US Energy Information Administration estimated crude oil inventories, excluding those in the Strategic Petroleum Reserve, decreased 5.5 million bbl for the week ended Aug. 21. That brought the total to 450.8 million bbl, EIA said in its Petroleum Status Report.

But total motor gasoline inventories increased 1.7 million bbl, which EIA called the middle of the average range. Both finished gasoline inventories and blending components inventories increased.

In refining news, Irving Oil Ltd. told the Wall Street Journal that it has stopped using shale oil from the Bakken formation in North Dakota and Montana for its 320,000-b/d refinery in Saint John, NB, where it is using cheaper crudes from Saudi Arabia.

Irving Oil Pres. Ian Whitcomb told WSJ during an interview last week that the Canadian refinery is not importing any Bakken crude. Refiners on the US and Canada East Coast now can import crude oil by tanker for less than the cost of moving it from North Dakota and elsewhere by rail.

WSJ reported PBF Energy Inc. and Phillips 66 both said they increased purchases of overseas crude during the second quarter. Phillips 66 Chief Executive Officer Greg Garland told investors that the trend of buying overseas crude instead of US crude moved by rail could reverse again.

US natural gas futures prices rose slightly Aug. 26 but remained just under $2.70/MMbtu. Analysts said record gas inventory and oversupply concerns likely could keep gas prices at about that level throughout 2015.

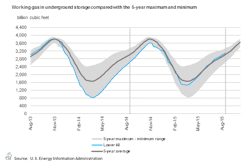

EIA estimated working gas in underground storage across the Lower 48 at a rounded 3.1 tcf as of Aug. 21. That represented a net increase of 69 bcf from the previous week. Stocks were 480 bcf higher than last year at this time, and 88 bcf above the 5-year average of a rounded 3 tcf, the Gas Storage Report said.

Energy prices

The October crude oil contract on the New York Mercantile Exchange settled down 71¢ to $38.60/bbl Aug. 26 while the November crude oil contract dropped 58¢ to $39.37/bbl.

The natural gas contract for September edged up less than a penny to $2.69/MMbtu. The Henry Hub, La., gas price gained 2¢ to $2.72/MMbtu.

Heating oil for September delivery dropped 1.4¢ to a rounded $1.38/gal. The price for reformulated gasoline stock for oxygenates blending for September was down 8¢ to a rounded $1.35/gal.

The October ICE contract for Brent crude dropped 7¢ to $43.14/bbl, and the November contract dropped 13¢ to $43.93/bbl. The ICE gas oil contract for September declined $5.50 to $424.75/tonne.

The average price for the OPEC basket of 12 benchmark crudes rose 4¢ to $40.51/bbl on Aug. 26.

Contact Paula Dittrick at [email protected].

*Paula Dittrick is editor of OGJ’s Unconventional Oil & Gas Report.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.