In its August Oil Market Report the International Energy Agency’s forecast shows stronger-than-anticipated global oil demand and non-OPEC supply growth swinging into contraction next year.

A rebalancing has clearly begun, IEA said. However, the process is likely to be prolonged as a supply overhang is expected to persist through 2016—suggesting global inventories will pile up further, the agency noted.

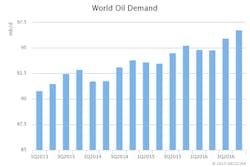

Demand

IEA forecasts global oil demand to grow 1.6 million b/d in 2015, 300,000 b/d above last month’s report and averaging 94.2 million b/d, as economic growth solidifies and consumers response to lower oil prices.

“This represents the biggest growth spurt in 5 years and a dramatic uptick on a demand increase of just [700,000] b/d in 2014,” IEA said.

IEA’s latest 2016 forecast also rises 400,000 b/d to 95.6 million b/d—an above-trend 1.4 million b/d gain—on higher baseline numbers and expectations of a more robust economy.

The second-quarter 2015 global demand estimate has been revised up 380,000 b/d from last month to 93.5 million b/d as baseline non-OECD data has been adjusted up alongside notable upgrades to demand estimates for China, Russia, and Brazil. The latest Chinese oil demand numbers show relatively robust gains despite recent cracks in the country’s economic data.

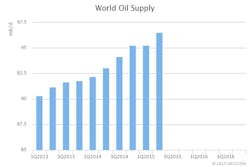

Supply

According to IEA data, world oil supply fell nearly 600,000 b/d in July to 96.6 million b/d, mainly on lower non-OPEC output, while OPEC crude oil production held steady near a 3-year high.

Non-OPEC oil output declined by almost 600,000 b/d in July to 58.1 million b/d, due to slowing US supply and seasonal North Sea maintenance. Total supplies were nevertheless nearly 1.2 million b/d above a year ago, with the Americas accounting for most of the growth.

As lower prices and spending cuts take their toll, non-OPEC supply growth is to slow sharply to 1.1 million b/d this year from a 2014 record of 2.4 million b/d, and then contract by 200,000 b/d in 2016, IEA forecasts.

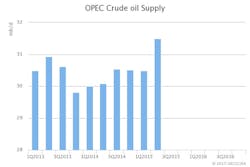

OPEC crude output inched 15,000 b/d lower in July to 31.79 million b/d as Saudi output eased and offset record high Iraqi production and increased Iranian flows. The ‘call on OPEC crude and stock change’ rises to 30.8 million b/d in 2016, up 1.4 million b/d on this year due to a stronger demand outlook and stalling non-OPEC supply growth.

Inventories

Even with the slowdown in non-OPEC production and higher demand growth, a sizeable surplus remains. IEA’s latest balances show that while the global inventory overhang will ease from a staggering 3 million b/d in the second quarter of 2015—the highest since 1998—the projected oversupply persists through the first half of 2016.

“Assuming OPEC production continues at around 31.7 million b/d—its recent 3-month average—through 2016, the second half of 2015 sees supply exceeding demand by 1.4 million b/d, testing storage limits worldwide,” IEA said.

The surplus drains down to about 850,000 b/d in 2016, with fourth-quarter 2016 marking the first quarter of a potential stock draw. This outlook does not include potentially higher Iranian output in the case of sanctions being lifted.

Prices

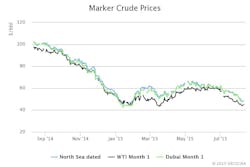

Benchmark crude prices fell sharply during July and into early August, weighed on by crude oversupply and a strong US dollar. By early-August, front month futures prices had dropped around 25% from end-June levels.

Losses on US WTI were steeper than other benchmarks due to the resilience of US domestic production and stubbornly high inventories at the Cushing, Okla., storage hub.

Given the current overhang in crude markets, the front-month contango structure—where oil for immediate delivery is cheaper than future months—remained relatively steady.