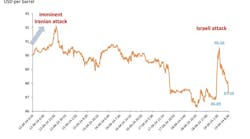

US light, sweet crude oil prices dropped on the New York market May 26 on the strength of the dollar and on concerns that the market cannot sustain recent price rallies.

Global oil supplies continued to exceed global demand by more than 1.5 million b/d during the second quarter, but that disconnect is set to narrow over the rest of the year, said Barclays Research Inc. analysts said in a May 27 research note.

“That does not mean that the worst is over,” said Miswin Mahesh. “A combination of summer-driving season demand and changing perceptions about a rebound,” could cause the US light, sweet oil price curve to flatten by the fourth quarter. As a result, a flattening WTI course will help flush crude out of storage.”

Barclays said it expected the Brent-US light, sweet crude spread will narrow to $3/bbl during the fourth quarter compared with $6/bbl in the third quarter.

Mahesh expects no change in policy when the Organization of Petroleum Exporting Countries is scheduled to meet June 5 in Vienna.

Goldman Sachs analysts Damien Courvalin and Raquel Ohana issued a note saying that the horizontal oil rig count increased for the week ended May 22, the first weekly increase since Nov. 26, 2014. Courvalin and Ohana saw this as an indication that producers might be leaning toward resuming more drilling.

“We believe that should WTI crude oil prices remain near $60/bbl, US producers will ramp up activity given improved returns with costs down by at least 20%,” the Goldman Sachs analysts said. “Last week’s rig count is a first sign of this response and suggests that producers are increasingly comfortable at the current costs-revenue-funding mix.”

Goldman Sachs suggests US production will fall slightly through the third quarter before picking up in 2016.

The US Energy Information Administration plans to issue its weekly oil and products inventory report on May 28, which is 1 day later than normal because of the Memorial Day holiday, during which time markets in the US were closed.

Energy prices

The July crude oil contract on the New York Mercantile Exchange dropped $1.69 on May 26 to settle at $58.03/bbl. The July contract fell $1.67 to settle at $58.48/bbl.

The natural gas contract for June declined 6.5¢ to a rounded $2.82/MMbtu. The Henry Hub, La., gas price was $2.82/MMbtu on May 26, down 6¢ from May 22. There was no trading on May 25.

Heating oil for June fell 5¢ a rounded $1.90/gal. The price for reformulated gasoline stock for oxygenates blending for June decreased 5.6¢ to a rounded $2/gal.

The July ICE contract for Brent crude fell $1.80 to $63.72/bbl while the August contract dropped $1.76 to $64.31/bbl, respectively. The ICE gas oil contract for June was down $20.75 to $585.25/tonne.

The average price for the OPEC’s basket of 12 benchmark crudes for May 26 was $60.73/bbl, down 45¢.

Contact Paula Dittrick at [email protected].

*Paula Dittrick is editor of OGJ’s Unconventional Oil & Gas Report.