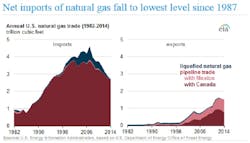

US net imports of natural gas totaled 1,171 bcf in 2014, down 9% from the level in 2013 and continuing an 8-year decline, according to the US Energy Information Administration. This was the lowest level since 1987.

“As US dry natural gas production has reached record highs, lower domestic prices have helped to displace natural gas imports,” EIA said.

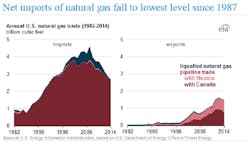

Imports by pipeline from Canada, which account for nearly 98% of all US gas imports, were the main driver of the decrease in total imports. Net imports from Canada represented 7% of total US gas consumption in 2014, down from 11% in 2009.

The agency noted that US gas exports also decreased in 2014, but at a slower rate than the decrease in imports, and were still 9% above the previous 5-year average. Gas exports to Mexico, which account for nearly 50% of US gas exports, increased 12% in 2014.

Net imports of LNG in 2014 totaled 43 bcf, down 54% from the level in 2013 and continuing a 5-year decline. LNG exports increased from 2013 levels, but not enough to offset a nearly 40% decrease in total LNG imports in 2014.

As highlighted in EIA’s most recent analysis of gas imports and exports, net imports of gas have varied significantly around the country, and new production from shale and other tight resources has helped to displace imports in certain regions.

As late as 2008, inflows of gas from Canada were equivalent to 50-80% of New York’s gas consumption. In 2014, however, pipeline outflows of US-produced gas crossing into Canada through New York state exceeded pipeline inflows of Canadian gas into that state, as increased production from the Marcellus region outpaced regional demand.

Gas exports to Mexico through pipelines crossing the international border in Texas, California, and Arizona increased to a record 706 bcf in 2014 to meet increasing demand from new gas-fueled electric power plants in Mexico. Higher production of gas from the US Gulf Coast and the Eagle Ford shale in South Texas contributed to the increase in exports to Mexico.