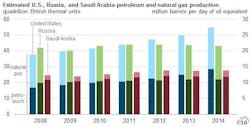

EIA: US held spot as world’s largest producer of petroleum, gas in 2014

US production volumes of petroleum and natural gas remained tops in the world in 2014, exceeding that of both Russia and Saudi Arabia, according to estimates from the US Energy Information Administration.

EIA specifies that its petroleum production figures encompass crude oil, natural gas liquids, condensates, refinery processing gain, and other liquids such as biofuels.

Despite the 50% decline in crude oil prices that occurred in the second half of last year, US petroleum production still increased 3 quadrillion btu (quads)—1.6 million b/d—in 2014. US petroleum production since 2008 has increased more than 11 quads, spurred by dramatic growth in Texas and North Dakota.

US gas production increased 5 quads—13.9 bcfd—over the past 5 years. Combined hydrocarbon output in Russia increased 3 quads and in Saudi Arabia 4 quads over the past 5 years.

EIA notes that total production in both the US and second-placed Russia is almost evenly split between petroleum and gas. While total petroleum and gas production estimates for the US and Russia in 2011 were roughly equivalent, US production by 2014 exceeded Russian production by almost 12 quads.

A report from Cedigaz this week highlighted the challenges in the coming years faced by the Russian gas industry, where stagnating domestic demand and weakening export markets have created a situation of overproduction, made worse by western sanctions and low oil and gas prices (OGJ Online, Apr. 8, 2015).

With the overall increase, the US in 2014 produced nearly twice the petroleum and gas as third-placed Saudi Arabia. Saudi Arabia’s total production—which heavily favors petroleum—was nearly unchanged from 2013.

EIA last week reported that in 2014 Saudi Arabia, the Organization of Petroleum Exporting Countries’ only true swing producer, earned a third of total OPEC oil revenues, which were down 11% on the year (OGJ Online, Apr. 1, 2015).