MARKET WATCH: NYMEX, Brent crude prices settle higher on Saudi oil hike

Oil prices rose on the New York and London markets Mar. 3 after Saudi Arabia raised the official price for its oil by $1/bbl for US delivery and $1.40/bbl for delivery to Asia, suggesting firm demand. Crude prices also supported by news about more unrest in Libya targeting an oil field.

US light, sweet crude prices closed slightly above $50/bbl Mar. 3 after trading in a somewhat limited range while awaiting the weekly inventory report from the Energy Information Administration for the week ended Feb. 27, which showed supplies built again to remain at record levels.

Commercial crude oil inventories, excluding the Strategic Petroleum Reserve, increased by 10.3 million bbl from the previous week. The current total is 444.4 million bbl, EIA’s petroleum status report said.

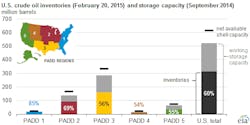

“Crude oil inventory data for the week ending Feb. 20 show that total utilization of crude oil storage capacity in the United States stands at approximately 60%, compared with 48% at the same time last year," EIA said.

"Most US crude oil stocks are held in the Midwest and Gulf Coast, where storage tanks were at 69% and 56% of capacity, respectively, as of Feb. 20…Capacity is about 67% full in Cushing, Okla., compared with 50% at this point last year. Working capacity in Cushing alone is about 71 million bbl, or more than half of all Midwest working capacity and about 14% of the national total.”

Andy Lebow, Jefferies LLC senior vice-president for energy, said higher Saudi prices “would indicate that demand for their crude may be marginally better, and that is bullish.” Last year, Saudi Arabia repeatedly cut its oil prices for the US and Asia.

In central Libya, militants attacked al-Dhahra oil field, which started production in 1962, oil officials in Tripoli told reporters. Al-Dhahra is operated by al-Waha Oil Co., which is run by National Oil Corp.

In other international news, oil prices rose slightly as Israeli Prime Minister Benjamin Netanyahu gave a speech to the US Congress, analysts noted.

World oil traders are monitoring international negotiations on Iran’s nuclear talks. US Sec. of State John Kerry met with Iranian Foreign Minister Javad Zarif in Switzerland for a second day of talks on Mar. 3.

Gasoline inventories

EIA estimated total US motor gasoline inventories were unchanged last week, and levels were well above the upper limit of the average range for this time of year. Finished gasoline inventories increased while blending components inventories decreased last week.

Distillate fuel inventories decreased by 1.7 million bbl last week, and EIA said levels were in the lower half of the average range for this time of year. Propane-propylene inventories fell 4.2 million bbl for the week ended Feb. 27, but that level was well above the upper limit of the average range.

US refinery inputs averaged more than 15.1 million b/d during the week ended Feb. 27, which was 130,000 b/d less than the previous week’s average. Refineries operated at 86.6% of their capacity last week. Gasoline production decreased, averaging more than 9.5 million b/d. Distillate fuel production decreased last week, averaging more than 4.6 million b/d.

US crude oil imports averaged 7.4 million b/d, up by 89,000 b/d from the previous week. Over the last 4 weeks, crude oil imports averaged 7.3 million b/d, 1.6% below the same 4-week period last year.

Total motor gasoline imports, including both finished gasoline and gasoline blending components, last week averaged 640,000 b/d while distillate fuel imports averaged 367,000 b/d.

Energy prices

The New York Mercantile Exchange April crude oil contract was up 93¢ to $50.52/bbl Mar. 3 and the May contract increased 98¢ to $52.50/bbl.

The natural gas contract for April edged up 1¢ to a rounded $2.71/MMbtu. The Henry Hub, La., gas price was $2.93/MMbtu, up 9¢.

Heating oil for April climbed 5.2¢ to a rounded $1.94/gal. Reformulated gasoline stock for oxygenate blending for April delivery was up 5¢ to a rounded $1.95/gal.

The April ICE contract for Brent crude oil gained $1.48, settling at $61.02/bbl, and the May contract climbed $1.59 to $61.78/bbl. The ICE gas oil contract for March increased 75¢ to $585.25/tonne.

The average price for the Organization of Petroleum Exporting Countries’ basket of 12 benchmark crudes on Mar. 3 was $56.13/bbl, down 80¢.

Contact Paula Dittrick at [email protected].

*Paula Dittrick is editor of OGJ’s Unconventional Oil & Gas Report.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.