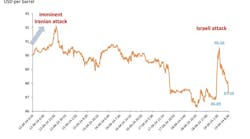

Crude oil prices declined across the board Dec. 28, giving back most or more than the gains from the previous session. In New York, the front-month crude contract dropped below $100/bbl as traders worried more about the troubled European economy and less about Iran’s threats to close the Strait of Hormuz.

Marc Ground at Standard New York Securities Inc., the Standard Bank Group, said, “Not only have concerns been raised about Euro-zone demand, but US demand for crude oil also has been brought into question as gasoline consumption figures dropped, according to Department of Energy reports. Oil also lost support as worries over an Iranian blockade of the Strait of Hormuz eased.”

The euro fell sharply to the lowest level since the start of this year compared with the dollar and to a 10-year low against the yen. “The dollar index is now back to the levels of August 2010—in other words, all the dollar debasement linked to QE2 [the Federal Reserve Bank's second quantitative easing program] has been wiped out. The flat price of crude oil came off with the rise of the dollar, but that still does not make any strong difference for European consumers. In euros, the price of oil is still near record levels and crude oil in dollars still has to fall a lot more before it starts to have any positive impact on European consumers,” said Olivier Jakob at Petromatrix in Zug, Switzerland.

“Even after more Iran saber-rattling, crude was unable to post gains, finishing down [in excess of] 2% for the session,” said analysts in the Houston office of Raymond James & Associates Inc. “Meanwhile, natural gas ended the session relatively flat.”

After the stock market climbed 5% last week, Raymond James analysts said, “Investors took money off the table yesterday as renewed concerns…for the Euro-zone stalled the yearend rally, with the Standard & Poor’s 500 Index falling 1.2% for the day.” Energy stocks underperformed the broader market as the Oil Service Index and the SIG Oil Exploration & Production Index declined 2.4% and 2.2%, respectively. However, stocks and energy prices were up in early trading Dec. 29.

Jakob said, “If the flat price of crude oil was reacting to euro-dollar moves, the European relative values were starting to price the potential bankruptcy of the [Zug-based] Petroplus [Holdings AG] refining system (OGJ Online, Dec. 28, 2011).” He noted, “Many traders are on holidays this week, and we could see a stronger market reaction to the Petroplus debacle next week. If the Petroplus system [the largest in Europe] shuts down, the European distillates premiums have in our opinion more room for improvement. Europe will have to increase its imports of diesel from India and the US Gulf Coast while Brent should be under pressure from the loss of sweet crude oil demand on the US East Coast, Petroplus, and the increased Libyan exports. To maintain the import economics of diesel to Europe, the European distillate physical premiums will have to be priced high enough.”

In other news, the US Department of Labor reported the number of initial applications for unemployment benefits rose last week after 3 weeks of declines, up 15,000 to a seasonally adjusted 381,000 filings. However, the less volatile 4-week average dropped to 375,000 applicants, the fewest since June 2008.

Also this week fixed mortgage rates rose slightly from record lows, but analysts said few homeowners are in a position to take advantage of the “best rates in history.” Although mortgage rates have remained below 5% all but 2 weeks this year, 2011 will be one of the worst ever for home sales, analysts said.

US inventories

The Energy Information Administration said Dec. 29 commercial US crude inventories increased 3.9 million bbl to 327.5 million bbl in the week ended Dec. 23, opposite the Wall Street consensus for a 2.5 million bbl draw. Gasoline stocks decreased 700,000 bbl to 217.7 million bbl in the same period, exceeding Wall Street’s expectation of a 500,000 bbl draw. Finished gasoline inventories increased while blending components inventories decreased. Distillate fuel inventories were up 1.2 million bbl to 140.4 million bbl, counter to market anticipation of a 700,000 bbl decrease.

The American Petroleum Institute earlier reported crude stocks increased 9.6 million bbl to 339.6 million bbl, with gasoline inventories up 1.9 million bbl to 215.7 million bbl and distillates climbing 544,000 bbl to 104.2 million bbl.

EIA said imports of crude into the US increased 1.4 million b/d to 9 million b/d last week. In the 4 weeks through Dec. 23, crude imports averaged 8.6 million b/d, down 8,000 b/d from the comparable period a year ago. Gasoline imports last week averaged 525,000 b/d while distillate fuel imports averaged 166,000 b/d.

However, input of crude into US refineries dropped 19,000 b/d to 14.6 million b/d last week with units operating at 84.2% of capacity. Gasoline production increased to 9.4 million b/d; distillate fuel production decreased to 4.9 million b/d.

EIA also reported the withdrawal of 81 bcf of natural gas from US underground storage in the week ended Dec. 23, leaving 3.5 tcf of working gas in storage. Gas stocks were up by 297 bcf more from the comparable week last year and 428 bcf above the 5-year average.

The latest reports apparently confirm Jakob’s earlier cautions that the large stock draws reported on the Gulf Coast for the week ended Dec. 16 were likely due to closure of the Houston Ship Channel due to fog, rather than increased demand.

Energy prices

The February contract for benchmark US sweet, light crudes dropped $1.98 to $99.36/bbl Dec. 28 on the New York Mercantile Exchange. The March contract gave back $1.95 to $99.51/bbl. On the US spot market, West Texas Intermediate at Cushing, Okla., was down $1.98 to $99.36/bbl.

Heating oil for January delivery declined 1.51¢ to $2.89/gal on NYMEX. Reformulated stock for oxygenate blending for the same month retreated 3.75¢ to $2.65/gal.

The January natural gas contract continued to slip, down 2.8¢ to $3.08/MMbtu on NYMEX. On the US spot market, gas at Henry Hub, La., decreased 1.8¢ to $3.07/MMbtu.

In London, the February IPE contract for North Sea Brent was down $1.71 to $107.56/bbl. Gas oil for January lost $6.25 to $918.25/tonne.

The average price for the Organization of Petroleum Exporting Countries’ basket of 12 benchmark crudes decreased 25¢ to $107.52/bbl.

Contact Sam Fletcher at [email protected].