Sam Fletcher

OGJ Senior Writer

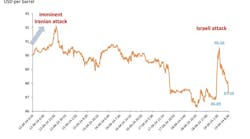

After weeks of vacillating around $75/bbl, the price of crude climbed to consecutive new 7-week highs the last two September sessions and the first trading day in October, closing at the end of the week above $80/bbl for the first time since Aug. 10.

The November contract for benchmark US light, sweet crudes rose a total of 5% in the two September sessions, climbing as high as $80.18/bbl in intraday trading Sept. 30 before closing at $79.97/bbl, up $2.11 for the day on the New York Mercantile Exchange on reports of unexpected large declines in US petroleum product inventories and other positive economic news.

A weak dollar and China’s strengthening manufacturing activity lifted the closing price another 2% to $81.58/bbl Oct. 1, after hitting an intraday high of $81.71/bbl. At the end of the week, crude was up 6.6%, its biggest 1-week gain since mid-February. The reformulated blend stock for oxygenate blending rose a total of 14.69¢ over the 3 days of trading, with the November contract closing at $2.09/gal Oct. 1, also at a 7-week high.

During the week, the government reported a decline in initial unemployment claims that exceeded expectations, adding to the bullish market. Also, China’s purchasing managers’ index for September increased at its quickest pace in 4 months. Adding to the upward pressure on crude prices, Ecuador—the smallest member of the Organization of Petroleum Exporting Countries—declared a state of emergency in a reported coup with President Rafael Correa held by police in a wage dispute until freed in a military raid. Observers feared civil unrest could curb production.

Stock declines encouraging

Traders already were encouraged by the Energy Information Administration’s report of declines in US inventories with crude down 500,000 bbl to 357.9 million bbl in the week ended Sept. 24, gasoline down 3.5 million bbl to 222.6 million bbl, and distillate fuel down 1.3 million to 173.6 million bbl (OGJ Online, Sept. 29, 2010).

At Standard New York Securities Inc., part of the Standard Bank Group, analyst Leon Westgate said Oct. 1, “West Texas Intermediate closed above its 200-day [moving average] for the first time since mid-August, though crude oil still remains well within recent ranges [$70-80/bbl]. We expect that range-bound nature to continue, particularly given the large stock overhang, though, for the moment at least, the weaker dollar and positive run of economic data from the US appear to have sent the bears into hibernation.”

The third quarter ended with WTI “about the same price level ($79.97/bbl) as at the start of 2010 ($79.36/bbl), but returns on WTI indices are still down due to the contango losses,” said Olivier Jakob at Petromatrix, Zug, Switzerland. Reiterating a warning from the start of the year, Jakob said, “The price of WTI is too high to make a profit on a passive investment in WTI indices in a contango structure. At the start of 2010 we did not expect that passive investors in WTI indices would be printing positive returns in 2010 and at current levels we do not expect that they will make a positive return in 2011 neither.”

Crude indices have not provided a positive return for investors this year “despite some major financial institutions telling their customers that a return to backwardation was imminent in the third quarter,” said Jakob. He cautioned, “We are still in a situation that would require a return to $90/bbl WTI by the end of December for passive investors to be just break even on their 2010 investments in WTI oil indices.”

However, the high price necessary to offset the WTI contango losses “would push oil into destruction economics (lower demand, higher supply) that will then generate a supply and demand rebalancing (as we remain in an environment of spare capacity both upstream and downstream) that then starts to work against the flat price gains,” Jakob said.

(Online Oct. 4, 2010; author’s e-mail: [email protected])