Sam Fletcher

Senior Writer

The front-month contract for benchmark US crudes jumped past $112/bbl Apr. 9 following a report that inventories of crude, gasoline, and distillate fuel fell to unexpectedly low levels in the week ended Apr. 4.

The May contract for US sweet, light crudes hit an intraday high of $112.21/bbl before closing at a record $110.87/bbl on the New York Mercantile Exchange. Heating oil and the May IPE contract for North Sea Brent crude also hit new highs in intraday trade as did the April gas oil contract in London.

Prices slipped in the Apr. 10 session but remained near record highs, with markets still concerned about tight supplies and the weak US dollar. Crude prices were essentially flat Apr. 11 but managed a gain for the week as the International Energy Agency in Paris again reduced its estimate of global crude demand for 2008.

The May contract for benchmark US light, sweet crudes increased 3¢ to $110.14/bbl Apr. 11 on the New York Mercantile Exchange. West Texas Intermediate gained $3.91/bbl during the calendar week, set a new record high, but fell 7¢ short of registering the highest weekly close, said Olivier Jakob at Petromatrix, Zug, Switzerland. "Brent gains were at par at [an increase of] $3.85/bbl. Heating oil made much stronger gains, [up] $8.41/bbl while reformulated blend stock for oxygenate blending (RBOB) was adding only $2.12/bbl. Natural gas was up 6.2%," he said.

Jakob said: "WTI continues to be tightly correlated to the movements of the dollar index. However, while in the previous week WTI had spent the week slightly below the correlation, this last week it was slightly above. The main reason why the correlation is so strong is that is has become a self-fulfilling trade with very few volunteers to trade against it until it is proven broken. Gold, which had also been strongly correlated to the dollar, has not followed the correlation as strongly as oil, and the gold to crude ratio continues to come off. For the oil to dollar correlation to be broken would require a set of fundamental numbers bearish enough to be a no-brainer."

IEA's demand estimate

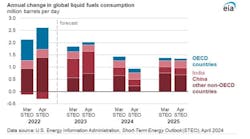

In its Apr. 11 report, IEA reduced its estimate of global crude demand for 2008 by 310,000 b/d to 87.2 million b/d on the downgrading of global gross domestic product prospects by the United Nation's International Monetary Fund, coupled with "a change in former Soviet Union methodology and baseline data revisions," officials said.

On the other hand, IEA increased its estimate of 2007 demand, up 140,000 b/d to 86 million b/d. "As a result of these divergent shifts, demand growth in 2008 is now expected at almost 1.3 million b/d, or 1.5% over 2007," the agency reported.

Its estimate of global oil supply fell by 100,000 b/d in March to 87.3 million b/d, due to reduced supplies from the Organization of Petroleum Exporting Countries, the North Sea, and non-OPEC Africa. "Non-OPEC supply growth in 2008 is trimmed to 815,000 b/d on a broad swathe of adjustments in the Americas, Africa, and Europe," IEA said.

It said, "OPEC crude supply fell by 265,000 b/d in March to 32.1 million b/d, on field maintenance in the UAE, Nigeria, and Venezuela. Pipeline and power outages highlighted ongoing risks to production in Iraq and Nigeria amid effective spare capacity of just 2.3 million b/d. Weaker economic growth cuts the 2008 call on OPEC by 300,000 b/d to 31.6 million b/d."

Global refinery throughput weakened in March, as poor margins curbed crude runs in all regions of the Organization for Economic Cooperation and Development. IEA's estimated first quarter 2008 global throughput remained unchanged at 74 million b/d. However, it reduced second quarter estimates by 200,000 b/d to 73.7 million b/d, in line with weaker demand.

IEA's reduction of its world demand outlook was "actually the largest revisions made since [the Sept. 11, 2001, terrorist attacks on the US], and the total lack of immediate market response is showing to the IEA what OPEC has been saying all along, and that is that the oil futures market is currently not trading the oil fundamentals," said Jakob. "At the time of the IEA release, the dollar was trending lower, and there are just not any volunteers ready to trade a bearish IEA report against the dollar." Analysts in the Houston office of Raymond James & Associates Inc. said, "We continue to believe that both the IEA's demand and non-OPEC supply numbers are too high."

The US dollar fell against most major currencies as finance ministers of the Group of Seven leading nations met in Washington, D.C., Apr. 11-13.

(Online Apr. 14, 2008; author's e-mail: [email protected])