US refiners are catching up on supply of both feedstock and product. The result is already showing up in the form of reduced crude and gasoline prices. But refiners may have done their job too well, as the prospect of burgeoning gasoline inventories later in the year may trim some of the fat margins they've enjoyed of late.

US refiners have been running all out to meet surprisingly strong gasoline demand in the country. At the same time, imports of gasoline into the US have been sustained at record levels.

But there are signs that the level of gasoline demand may have been overestimated. So with near-capacity utilization levels continuing amid a modest number of refinery turnarounds, the result may be inventories brimming over as demand weakens in the third quarter.

Supply up, demand down

Inventory levels are likely to rise for most of the third quarter as US gasoline supply reaches record levels, predicts Jacques Rousseau, analyst with Arlington, Va.-based Friedman Billings Ramsey Inc.

Rousseau contends that gasoline supply will remain at peak levels during the third quarter: "With minimal near-term refinery turnarounds, we expect the current output surge to continue and utilization rates to average around the 96% level during third quarter 2004.

"In addition, second quarter imports have averaged 2.7% above last year's levels, and we expect to see a continuation of this upward trend during the third quarter. Overall, we anticipate refined products supply to set an all-time record during the upcoming quarter."

He notes that gasoline consumption in the US has slowed down dramatically in recent months, falling from a 7% year-to-year increase in April to annual gains of 3% in May and 2% in June: ". . .We expect a further decline to historical 1% over the remainder of the year."

Furthermore, sees demand for gasoline, diesel, and jet fuel slipping this quarter vs. last quarter.

Consequently, Rousseau sees US refining marginsalready down by 24% from their recent highscontinuing to slump in the third quarter, in line with historical trends.

Demand overstated?

Has demand really collapsed so suddenly in response to higher gasoline prices?

Rousseau questions whether the reports of such surprisingly strong demand are in fact accurate.

"While second quarter refined products implied demand has historically witnessed a 1.5% year-over-year rise, second quarter [to date as of June 24] 2004 consumption has risen by 4.5% over last year's levels, primarily due to, in our view, the gasoline inventory building in the secondary and tertiary levels of the consumption chain," he said.

"However, we do not believe this high growth rate is accurate, since the implied demand calculation methodology does not currently capture rising inventories in these aforementioned levels, and as a result, has been overestimating the true second quarter US refined products consumption, in our view. Accordingly, we expect a decline in the demand growth rate to the historical 1-2% range over the remainder of the year."

Surprises ahead?

Nevertheless, there may be surprises ahead for US refiners apparently facing a rude adjustment from their recent euphoria over buoyant margins.

For one thing, even though inventories are rebuilding, they are rebuilding from a very low base. Rousseau acknowledges that total product inventories continue to remain near a 5 year, demand-adjusted low.

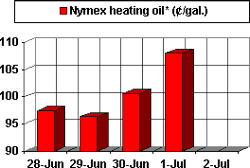

One surprise already has been felt: a contraseasonal surge in distillate demand as more power and industrial users switch to fuel oil in the wake of persistently high natural gas prices. A recent uptick in the futures strip for heating oil on the New York Mercantile Exchange points to worry about inventory levels heading into the fourth quarter. While diesel consumption has slowed from a strong year-to-year gain of 3.6% in the first half, Rousseau projects it at a gain of 2.3% in the second half, in line with the analyst's prediction of a slowdown in US economic growth and industrial production. Nevertheless, a 2.3% year-to-year gain is strong enough to help bolster the continuing run on fuel oil enough to keep a squeeze on distillate stocks in the final quarter.

All of this assumes no significant refinery outages or disruptions of supply. Given the prospect of turmoil in Venezuela during next month's recall referendum vote on President Hugo Chavez and the specter of another strong hurricane season along the Gulf Coast, that may not be a safe assumption.

And even if the going is smooth on these counts, the resulting lower margins still will be far better than refiners have suffered through in recent years.

(Author's e-mail: [email protected])

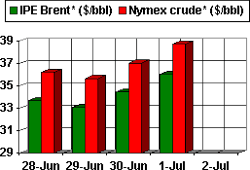

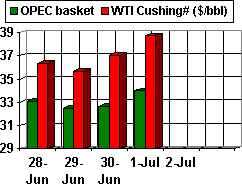

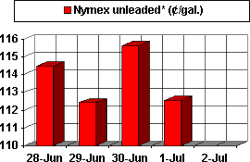

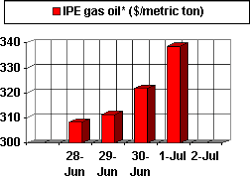

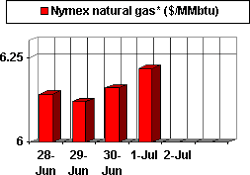

OGJ HOTLINE MARKET PULSE

Latest Prices as of June 5, 2004

June 2 price data unavailable at presstime

null

null

null

null

null

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.

null