There is a compelling case to be made for oil prices remaining at $30-40/bbl (New York futures contract) through next year.

The lower end of that range would suggest just the state of the physical fundamentals of oil markets today. The higher end rolls in a premium for fear of supply disruptions.

Demand surge

The principal driver in the oil market today is the surprisingly persistent high demand level. Perhaps it should not be so surprising, given a booming global economy plus the fact that oil prices still are well below their inflation-adjusted peaks of the late 1970s and early 1980s.

But the demand surge is especially strong in the US and China, the world's two biggest oil consumers. And chronic shortage of other fuels is putting added pressure on oil demand in those countries (natural gas in the US and electricity in China), notes London-based Centre for Global Energy Studies.

"Even an easing of China's economic growth rate down to the 7-8% targeted by the government might not be enough to abate the growth in oil consumption, which has been boosted by companies installing private, oil-fired generators to allow them to avoid the impact of rolling electricity blackouts," CGES said in its July 19 monthly oil report.

In addition, as demand continues to grow in these two net oil-importing nationsboth with shrinking spare refining capacitythat puts a strain on the global oil transportation infrastructure.

This problem will be exacerbated in the fall as refiners find themselves trying to bolster heating oil stocks for the coming winter while tackling soaring gasoline demand amid near full capacity utilization.

OPEC's efforts

Meanwhile, the Organization of Petroleum Exporting Countries was so sure of the world's need for more oil that its consideration of carrying out the second, 500,000 b/d part of a 2.5 million b/d increase in group production quotas proved moot: It canceled the July 21 meeting where the question was to have been taken up.

Several OPEC ministers now acknowledge the obvious: That production over quota is now the de facto policy of the group.

Reports vary, but output in June was up by 740,000-880,00 b/d among the 10 members of OPEC still bound by quotas. A drop in Iraqi production owing to pipeline sabotage of 200,000 b/d offset some of the OPEC-10 gain.

There also are reports that OPEC members plan capacity increases in 2005 of 2-3 million b/d, compared with current capacity levels of 29-30 million b/d. If demand continues to ramp up next year at this year's pace and non-OPEC producers continue to falter, it could push the call on OPEC oil next year to more than 30 million b/d, making those capacity additions critical for keeping prices within $30-40/bbl.

"Unless there is a major disruption to oil supplies, there is no reason for [West Texas Intermediate] prices to remain above $40/bbl for any length of time, although news of each supply disruption, however temporary, will cause prices to spike," CGES said. "Equally, though, unless oil demand growth slows significantly in the second half of 2004, there is little likelihood that oil prices will fall below $30/bbl.

"It seems that oil prices are likely to remain in the $30-40/bbl range for some time yet. How long this lasts will depend on when oil demand begins to slow down in response to high prices and when the bottlenecks in energy supply begin to ease."

Of course, all this just focuses on the market physical fundamentals. Factor in the possible geopolitical scenarios, and there could be enough spikes outside the $30-40/bbl band to keep the annual average well above the midpoint of that range.

Assuming that the situation in Iraq gets no worse, the next focal point for geopolitical worrywarts is Aug. 15the date of the recall referendum election in Venezuela. Targeted President Hugo Chávez stands a good chance of defeating the recall or running for president in the fall if recalled next month. Odds are he will remain in place for years to come, absent civil war or coup. But then that very prospect is what could trigger a civil war or coup. Expect the political situation to worsen in Venezuela. While a strike by oil industry workers is far less likely this time, a general strike and possible sabotage of Venezuelan oil facilities could keep oil prices buoyed above $40/bbl even if Iraq were becalmed tomorrow.

(Author's e-mail: [email protected])

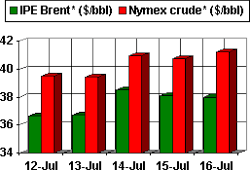

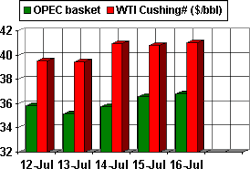

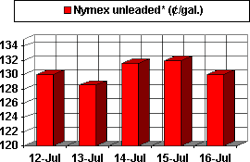

OGJ HOTLINE MARKET PULSE

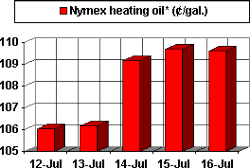

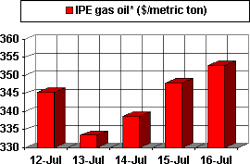

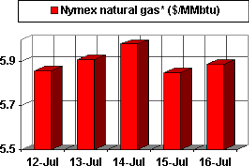

Latest Prices as of July 12, 2004

null

null

null

null

null

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.