A case for natural gas price stability

The forecast for US natural gas prices is: more of the same. Get used to it.

One need not be clairvoyant to predict the mid-to-long term direction of gas prices in North America. Simply look at recent price trends and project them out beyond the midpoint of the decade.

Since the beginning of this year, next-month futures contract prices on the New York Mercantile Exchange have stayed within $1 of $6/MMbtu. Since the end of the heating season in March, the variance from that $6 threshold never exceeded 70¢. And the current 12 month strip calls for a price of $6.38/MMbtu, while encompassing roughly $7/MMbtu projections for next January-February.

In a broader view, average monthly NYMEX gas prices have stayed mostly within a band of $4.50-6/MMbtu since the beginning of last year.

Differing price profiles

Graphing these recent price data would yield a plotted profile resembling the gently rolling hills of northeastern Oklahoma. Now compare that with the Rockies-like profile of graphed price data for the preceding 5 years. US gas futures monthly average prices during that timeframe ranged from a low of $1.64/MMbtu in December 1998 to a high of $8.72/MMbtu in January 2001. The swing in the winter of 2000-01 alone was more than $4/MMbtu. The combination of demand destruction and frenzied drilling in response to gas prices approaching $9/MMbtu at that time subsequently saw prices fall back to near $2/MMbtu by early 2002.

For the most part, the swing in prices during the past 18 months has been only about $2/MMbtu. After gas prices nudged up closer to $7/MMbtu in late May and early June, they've slipped back down to hold steady near $6/MMbtu; they are now projected to go no higher than $7/MMbtu, briefly, and no lower than $5.90/MMbtu, also briefly, in 2005.

It's a bit premature to say the peaks and valleys of the 1998-2002 gas price profiles are relegated to the dustbin of history. A number of factors could spike US gas prices in either direction. A steep slide in oil prices or an abnormally warm winter could send gas prices spiraling downward, but probably no further south than $4-5/MMbtu. A brutal hurricane season or a protracted freeze across the US in the beginning of the heating season could see that $7/MMbtu threshold tested early.

Outlooks

In the near term, the steady buildup in US gas storage levels has left working gas storage at 246 bcf higher than last year and likely to begin the next heating season at the same level as last season's or higher, notes Ron Denhardt, vice-president, Strategic Energy & Economic Research Inc., Winchester, Mass. And yet projections call for gas to trade at $1.50/MMbtu above the level of the same time last year.

"Weather-adjusted storage injections indicate that the supply-demand balance is 1-2 bcfd tighter than last year," he said. And yet if weather-adjusted injections average 2 bcfd less than last year and weather patterns remain the same, working gas storage could start the heating season at more than 3.2 tcf, the highest level in 10 years, says Denhardt.

"Unless there is extremely hot weather and/or there is a major loss in production from hurricanes, the fundamentals suggest that pressures should be for prices to decline during the next 3 months," he said, indicating a Henry Hub price of near $5/MMbtu.

Looking further out, Henry Hub prices are likely to remain below $6/MMbtu through 2014, according to Scott DePasquale, analyst with Energy Security Analysis Inc., Wakefield, Mass.

He contends that surging LNG imports and climbing US wellhead production will create downward price pressure the next several years, with Henry Hub falling to an average annual low of $4.29/MMbtu in 2008.

"While we are closely monitoring the decreasing rig efficiencies and increasing supply cost structures, demand growth will be low to moderate at best until 2008allowing new sources of supply to effectively rebalance the market over the near term," DePasquale said.

The current short-term production-growth phase will carry the market into next year, he predicts, but finding and development challenges are likely to catch up with the market by late 2005at which time ESAI expects a significant lull in US output.

Splitting the difference between ESAI's projected high and low prices leaves an average price near $5/MMbtu for the next 10 yearswhich sounds very much like long-term price stability at a level acceptable to both ends of the supply-demand equation.

(Author's e-mail: [email protected])

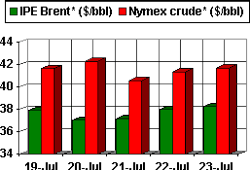

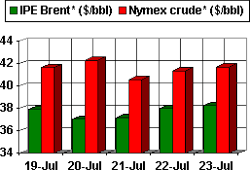

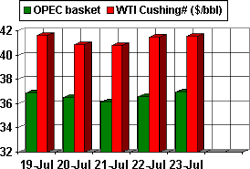

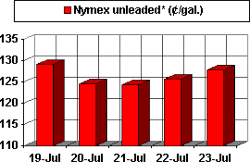

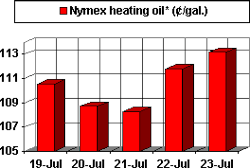

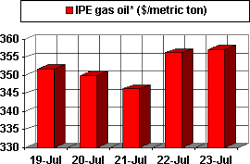

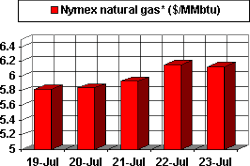

OGJ HOTLINE MARKET PULSE

Latest Prices as of July 26, 2004

null

null

null

null

null

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.