US motorists complaining about the high price of gasoline are a little like those folks who sued McDonald's for making them fat.

Perhaps they need to be reminded that voracious appetites, even for the things they enjoy and take for granted, aren't immune to the law of unintended consequences. (Or the laws of supply and demandtry to find a 39¢ McDonald's burger these days.)

Demand rising

Even with so-called record average US gasoline prices, US gasoline demand is on the rise.

Demand for motor gasoline in the US is up 3.3% year to date compared with the same time a year ago, notes James M. Rollyson, analyst with St. Petersburg, Fla.-based Raymond James & Associates Inc.

"Furthermore, recent reports from both the US Department of Energy and [American Automobile Association] suggest gasoline consumers are not likely to cancel their road trip plans this summer," Rollyson noted in a June 1 research report.

Indeed, the national media were filled with reports ahead of the Memorial Day holiday weekend, which marks the start of the summer driving season, that US motorists will be taking to the road at levels not seen since before the Sept. 11, 2001, terrorists attacks on the US.

Rollyson points out that US gasoline demand has grown at an average 1.9%/year during the past decade. Yet US gasoline demand this year is on track to post its highest growth rate since 1995, he notes, despite a 35% hike in gasoline prices.

Rollyson cites these reasons for the seeming paradox: a strong US economy combined with rising sales of sport utility vehicles, a modest build in tertiary (unmeasured) gasoline inventories, increased gasoline demand from new ethanol mandates, and low gasoline prices (relatively speaking, in inflation-adjusted terms and as a percentage of total US household budgets).

SUV sales in fact were up 18% last year, while nontruck car sales fell 4%. And there are signs that more consumers are "topping off" their tanks, contributing to the tertiary inventory bulge. When your vehicle has a 25-30-gal fuel tank, that can add up.

But are the higher-mileage SUVs alone the biggest contributor to the surge in gasoline consumption in the US? As it turns out, US motorists are simply driving a lot more. Looking at US Department of Transportation data, the number of average vehicle miles traveled per vehicle rose steadily during 1960-99, with just a slight dip during the oil crises of the 1970s. The number slipped again during 2000 and 2001, apparently in response to the infrastructure-related gasoline price spike in 2000 and the 2001 terrorist attacks. But it resumed its upward path in 2002.

All of this occurs, of course, as public sentiment prevents the construction of a new refinery pretty much anywhere in the US and as the federal and state governments fiddle endlessly with fuel formulations and restrictions on fuel additives.

A paradox?

So is gasoline demand growth in the face of record gasoline prices a paradox?

Not when you consider that prices are a "record" in nominal terms only, as inflation-adjusted prices remain more than a third below the all-time peak of nearly $3/gal in 1981.

Moreover, today's money buys a lot more of the stuff. As New Republic Senior Editor Gregg Easterbrook notes, writing in his magazine's online web log, in the 1950s, per-capita real income was less than half what it is today.

"That means that for the typical American in the 1950s, gasoline cost twice as much, in terms of buying power, as today's gasoline," he wrote. "Adjusted for inflation and for buying power, the purported 'record'-priced gasoline at your pumps now is substantially cheaper than the gasoline your parents bought."

He also pointed out the higher quality and less-polluting nature of US gasoline today.

Sounds pretty much like a bargain. So why the howls of anguish from motorists?

Maybe those McDonald's litigants weren't really all that fat, after all.

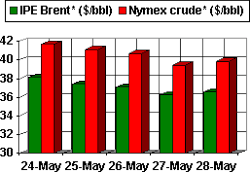

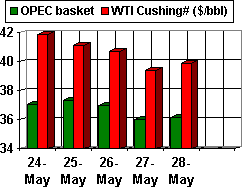

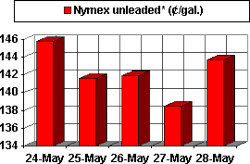

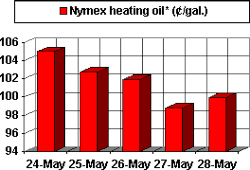

OGJ HOTLINE MARKET PULSE

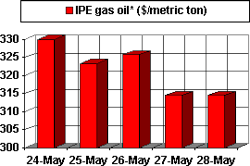

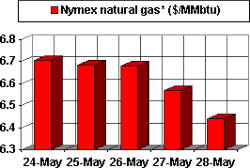

Latest Prices as of May 31, 2004

null

null

null

null

null

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.