Is the Organization of Petroleum Exporting Countries taking a just-in-time approach to supplying the world oil market?

Well, no. The term, a popular business buzzword of the 1990s, is a misnomer here. But there is little doubt that OPEC remains determined to match its supply to seasonal oil demand. That in turn has prevented refiners from building product stocks to comfortable levels in anticipation of robustly rising demand, especially ahead of the US summer driving season. But the situation is more complicated than it appears.

Keeping stocks tight

Keeping refiners from building up inventories has proven a winning strategy in support of high oil prices the past 2 years, according to Centre for Global Energy Studies.

This trend is continuing this year, leaving refiners straining to meet demand with current processing levels, CGES noted, citing growing concerns about the adequacy of US refining capacity to meet domestic gasoline demand this summer.

"With inventories low, US refiners must run flat out to make gasoline, requiring record levels of crude oil imports over the coming summer," the London think tank said in its April monthly oil market report. "Even so, the world's biggest oil consumer will need to import record volumes of finished gasoline and blending components from refiners in Europe and elsewhere."

Consequently, there will be greater global competition, not only for the increasingly scarce sweet crude prized for gasoline yield but also for finished gasoline and blending components.

It's not as if OPEC is keeping a prone-to-bloat market on an especially short leash. The group's latest quota cut, effective Apr. 1, is largely irrelevant: The 10 OPEC members bound by quotas in March produced almost 1.5 million b/d over what was then the quota, according to CGES. However, non-OPEC supply is falling seasonally, and the consultancy projects second quarter world oil demand will jump 3% on the year. The latter factor is spurred by rambunctious growth in Chinese oil demand and by continued strength in US gasoline demand.

Terrorism's specter

The need to build crude oil stocks is especially crucial, given the problems today in Venezuela, Nigeria, and especially the darkening specter of terrorist attacks on Persian Gulf area oil facilities.

It is impossible to contemplate the recent terrorist suicide attacks near the Iraqi oil terminals at Basra and Khor al-Amaya without thinking of the Iran-Iraq tanker war of the 1980s, of 2002's Limburg supertanker terrorist attack, and of the underprotected waters of the Straits of Malacca.

Last year, just ahead of the onset of Gulf War II, OGJ reported that terrorist attacks by Al-Qaeda posed more of a threat to shipping in the Persian Gulf than Iraq did (OGJ Online, Mar. 19, 2003).

OGJ Middle East Correspondent Eric Watkins then reported:

"Following its attack on the Limburg, Al-Qaeda made no secret of its plans to undermine the world's economy by mounting an attack on marine oil transport routes. 'We can imagine the magnitude of the dangers that threaten the Western economic lifeline,' Al-Qaeda said in a statement then. The Middle East, said Al-Qaeda, sits on the West's 'largest [oil] reserves, produces its largest quantities [of oil imports], and has [control of] all its channels and routes. The strike on the French oil tanker was not an incidental strike at a passing tanker but a strike on the international oil-carrying line in the full sense of the word.'"

Supply concerns

Quota cuts or not, there may not be enough surplus capacityOPEC or otherwiseto handle a repeat of early 2003, with any combination of significant supply outages from Iraq, Venezuela, and Nigeria, in tandem with growing concern over a terrorist threat aimed at critical oil infrastructure.

With demand remaining so bullish, every OPEC member probably could flout its new quota this year without concern over depressing prices much.

Despite the new quota, there are indications that such flouting may already be under way. According to A.G. Edwards & Sons Inc. analyst Bill O'Grady, tanker reports suggest that a record number of crude oil cargoes left the Middle East early in April, following a drop in March exports.

In fact, OPEC cheating now may prove to be the "just-in-time" supply at the margin that's needed in order to keep a truly severe oil price shock from hitting the market this year.

(Author's e-mail: [email protected])

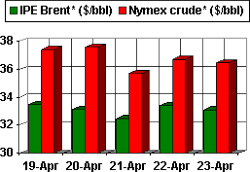

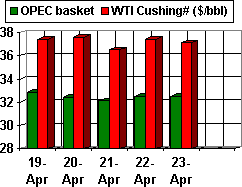

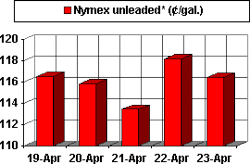

OGJ HOTLINE MARKET PULSE

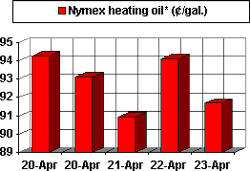

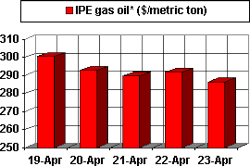

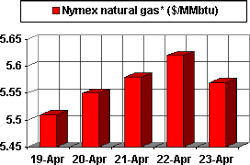

Latest Prices as of Apr. 26, 2004

null

null

null

null

null

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.