The Organization of Petroleum Exporting Countries' decision at their last ministerial meeting to cut production quotas by 900,000 b/d, effective Nov. 1, took the market by surprise.

Many analysts had been arguing against a cut, claiming that stock levels were too low and that such a move could skyrocket oil prices in the fourth quarter. But burgeoning output from Iraq and Russia spooked OPEC into observing the precautionary principle on price defense. The result: Oil prices are still within a couple of dollars where they were when the cuts were announced.

Now some analysts are beginning to warn darkly of a need for OPEC to cut production early next year to avoid a price collapse. Will OPEC spring another surprise at the Dec. 4 ministerial meeting in Vienna?

Parallels to late '90s?

Herman Franssen, president of International Energy Associates, Washington, DC, insists that OPEC, minus Iraq, will need to cut production by 1-2 million b/d next year to head off a price plunge. The differential depends on the degree to which Iraq is able to restore its oil exports to 2 million b/d. That would keep OPEC's basket price close to the unofficialbut more true than the official price bandtarget of $25/bbl.

Speaking at a conference in London in early November, Franssen and Nordine Ait-Laouissine, a consultant and former Algerian oil minister, both saw parallels between recent developments and the price collapse of the 1990s. Just as then, oil prices are high, and inventories are building steadily.

OPEC in disarray

Also reminiscent of the late 1990s is an OPEC perceived to be in disarray about the group's direction.

While the recent quota cut reflected unanimous concern within the group over Iraq's return to the market, there are signs of a growing schism in OPEC, according to London analysts Global Insight: "OPEC ministers also seem to lack a clear sense of direction. A number of pronouncements throughout October suggest not only that they have no clear idea of where the market is heading but that they have no clear or unified idea of how they as a group should respond."

Global Insight cited support for a quota increase from Kuwait and Venezuela, and Venezuela was joined by Iran in voicing concerns over OPEC's dwindling market share. Saudi Arabia, in turn, reaffirmed its support for the $25/bbl OPEC basketthe middle of the group's target price band. Qatar, whose oil minister is now the president of OPEC, insists that OPEC must ensure that oil stocks are drawn down this winter in order to avoid price weakness next year.

Furthermore, Global Insight noted the return of the "missing barrels" issue (shades of the late 1990s) as global oil supply-demand figures aren't meshing with numbers on reported stocks among the Organization for Economic Cooperation and Development countries. In particular, US crude and gasoline stocks still look very tight, but worldwide the supply situation seems to be easing. A large discrepancy between the two numbers muddles the picture for OPEC.

"Unfortunately, the scope for error in both estimates is large," the London analysts said.

Global Insight's analysts see the easing-supply scenario as more likely, with rising non-OPEC output, reviving Iraqi production, and quotabreaking by Algeria and Nigeria pushing oil prices down through the second quarterbelow the bottom of OPEC's price band. Downward price pressure would continue through 2005 as more non-OPEC production builds up, in this scenario.

There's not much support for production restraint being voiced by the non-OPEC exporters. Russia, Mexico, and Norway have been lukewarm on that score lately.

The London analysts point to recent comments by Russia's oil minister that he considers prices above $25/bbl damaging to the world economy as evidence that "Russia is in no mood to prop prices up near the top of OPEC's band."

However, the Global Insight report was produced before the recent brouhaha involving OAO Yukos and its jailed CEO Mikhail Khodorkovsky, which sent tremors through Russia's oil companies and their prospective investors. Russian President Vladimir Putin could gain advantage by expressing solidarity with OPEC's price defense and offering a production cut. This would give the politically popular appearance of reaffirming his dominion over Russia's oil oligarchs, without further alarming foreign investors who would recognize the gesture as hollowRussia's oil output always declines in winter because of weather-related logistical problems.

In the end, how can the Saudis, with so much at stake domestically now, afford to let oil prices collapse?

(Author's e-mail: [email protected])

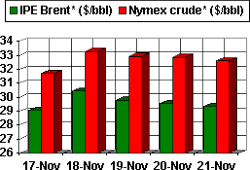

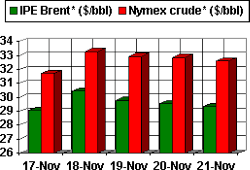

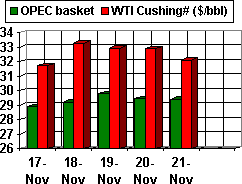

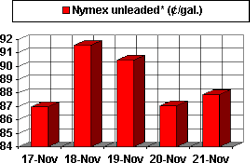

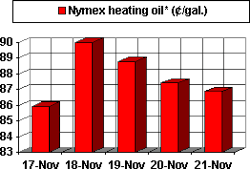

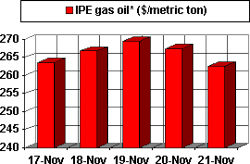

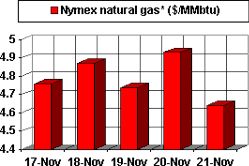

OGJ HOTLINE MARKET PULSE

Latest Prices as of Nov. 21, 2003

null

null

null

null

null

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.