At what point does drilling for natural gas become the driving factor in gas markets?

Let's set aside the issues of weather and storage that have dominated discussion of gas markets in recent months.

Market-watchers now are turning their attention to a continuing rise in the Baker Hughes Inc. count of US active rotary rigsespecially those drilling for gas. And there are preliminary reports of a slight uptick in US production this year.

The strong week-to-week storage injection pace and a relatively cool summer have put some pressure on gas prices lately. But the market is entering the shoulder-month limbo of long-term weather forecasts and of injection rate levels rendered moot by full capacity.

It's almost as if an attention-deficit market is compelled to turn to something else to fret about as the analysis focus du jour grows stale.

Rising rig count

The overarching concern for gas market bulls is that a repeat of 2001 may be in the offing.

That year, high gas prices spawned a frenzy in drilling activity that shot the US active gas rig count up to almost 1,200 by midyear. Yet the gas rig tally had collapsed to a little more than half that level in just 6 months. The resulting increase in gas production, coupled with a recession-and-weather-induced drop in demand, caused gas prices to plunge, and the rig count came tumbling down with them.

So the US gas rig count at present is 30% higher than a year ago, and data compiled by the US Energy Information Administration suggest that US gas production gained 1 bcfd in the first quarter. Is it time just yet to get out the worry beads?

A broader view of the situation would note that while the US rig count is up sharply vs. last year, it remains essentially at the midpoint between last year's low and 2001's peak. In fact, for the year to date, the monthly rig count has remained 100-150 units below the comparable months of 2001. The 30% year-to-year gain in the rig count would be more impressive if last year's number didn't represent a 30% year-to-year drop.

Indeed, Ohio-based WTRG Energy Economics Pres. James L. Williams expresses concern "that the natural gas rig count is not increasing at a faster rate, and [we] would be far more comfortable with another 50-60 rigs drilling for gas."

And while it appears that US gas production is climbingalthough some analysts have noted that EIA is given to downward revisions of these datathe increase must be placed in perspective. As with the rig count, year-to-year US monthly gas production increases of around 2-4% for the first 4 months of the year would register more strongly if production hadn't declined by a similar range year-to-year in 2002.

Drilling costs

Some analysts have suggested that more gas wells aren't being drilled than they are because of rising drilling costs hitting exploration and production companies.

The resulting squeeze on finding and development costs pares the return on investment in a well to an unacceptable level, the thinking goes.

But J. Marshall Adkins, Houston-based analyst with Raymond James & Associates Inc., St. Petersburg, Fla., disputes that notion. RJA calculations show that an average US gas well can exceed a 50% internal rate of return with an average natural gas price of $5/Mcf.

"While higher F&D costs are certainly putting some downward pressure on drilling returns, returns are also a function of current and future price realizations," he said. "In our view, the current high commodity price environment more than offsets these higher costs and results in very generous E&P returns."

So there is plenty of incentive to drill more wells. Even with last year's plunge in the rig count, the US saw the second highest number of gas well completions since 1986, Williams notes.

And yet production fell last year and this year is essentially flat with 2001. Declining wellhead deliverability has established itself firmly as a structural problem in US gas markets.

So don't look for a massive production surge to overturn gas markets this year.

And if you need something to obsess about for future gas prices, start looking for woolly caterpillars.

(Author's e-mail: [email protected])

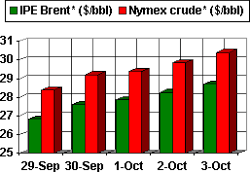

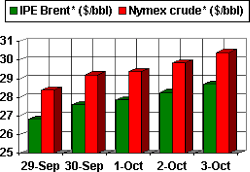

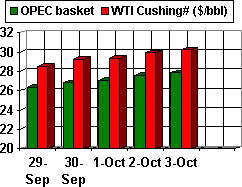

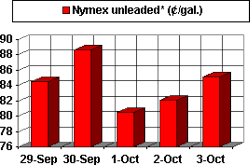

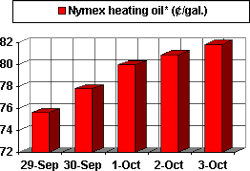

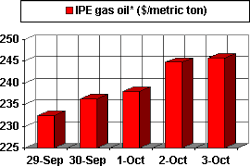

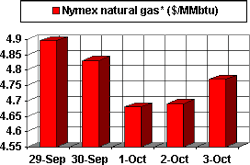

OGJ HOTLINE MARKET PULSE

Latest Prices as of Oct. 6, 2003

null

null

null

null

null

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.