The last meeting of the Organization of Petroleum Exporting Countries proved a predictable, humdrum affair.

Not so the group's next ministerial meeting, slated for Sept. 24 in Vienna. That event features some interesting undercurrents that could have long-term impacts on oil markets. A new approach to OPEC quotas could be on table. Not on the table but just as significant is the prospect of d

Quota changes

According to sources contacted by this writer, OPEC may be beginning to move toward new guidelines for adjusting its quota system.

OPEC governors meeting at the end of August have drafted a proposal for new guidelines for allocating production quotas that will be presented to ministers at the Sept. 24 meeting, the sources say. While the proposal does not include recommendations for changing quotas, it does reportedly lay out the parameters for future changes. How ministers react to these new guidelines might well indicate the viability of efforts to change quotas.

Among the new guidelines underpinning the determination of future quota allocations are members' oil reserves, historic and current production levels and capacities, domestic oil consumption, and per capita income from oil. Most of these new guidelines would favor the biggest producers, such as Saudi Arabia, and big producers with large populations, such as Nigeria. Not faring so well would be members such as Indonesia, which continues to grapple with the prospect of becoming a net oil importer as early as this decade.

OPEC long has been loath to tinker with its approach to setting production quotas. But members such as Nigeria, Algeria, and Libya have been lobbying for a more equitable distribution of quota levels, in order to reflect their burgeoning reserves and production capacities.

Don't expect any action on reassignment of quotas at the Sept. 24 meeting. Even with the sensitivity of the issue, that is overshadowed by the uncertainty over the status of Iraq. While most observers expect Iraq to remain within the organization, no one has a good handle on what Iraq's productive capacity will be in the near to middle term. However, it is a safe bet to say that at soon as it is able, Baghdad will lobby for the maximum quota to reflect not only its status as OPEC's No. 2 reserves holder but also its desperate need for oil revenue to help rebuild the war-shattered country. Any concessions toward a new quota regimen will likely favor the largest reserves holders and producers in the group, at the expense of the smaller contributors. And that could set the stage for a future shakeup within OPEC, the first since Ecuador and Gabon departed the group in the 1990s. But don't expect the departure of lesser members such as Indonesia to have any more impact on oil markets than those of Ecuador and Gabon.

Russia-Saudi accord

What really has set oil market observers buzzing was the Sept. 3 accord signed by Russia and Saudi Arabia agreeing to a 5-year oil and natural gas cooperation agreement that the Russians said could lead to deals totaling as much as $25 billion, notably investments in Russia's oil and gas sector.

Some have speculated that the accord signals a baby step toward future coordination on oil prices and production levels. The two nations have been at odds in the past 2 years when Saudi-led OPEC efforts to trim production to bolster oil prices were rebuffed by Russia. In the earlier standoffs, Russia blinked-somewhat, that is, with a face-saving reduction that would have happened seasonally anyway. But the confrontation underscored the growing muscle of Russian oil companies.

So are the tea leaves auguring for Russia to replace Indonesia in OPEC? While Indonesia's days in OPEC may indeed be numbered, don't count on Russia cooperating with OPEC beyond enlightened self-interest to avoid a price collapse, much as it has done to a limited extent along with Norway, Oman, Mexico, and Malaysia.

The Kremlin's move may in fact may be dictated by more-local concerns. The growing political clout of Russian oil companies-particularly the political aspirations of OAO Yukos Pres. Mikhail Khodorkhovsky-is a serious concern for the administration of President Vladimir Putin, who signed the Saudi accord. Along with the government's investigation of a Khodorkovsky associate for alleged fiscal malfeasance, the Kremlin-Riyadh accord could be another shot across the bow of Russian oil companies.

(Online Sept. 5; author's e-mail: [email protected])

OGJ HOTLINE MARKET PULSE

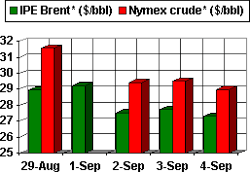

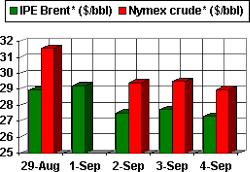

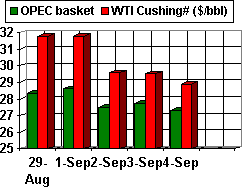

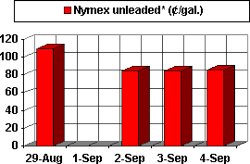

Latest Prices as of Sept. 5, 2003

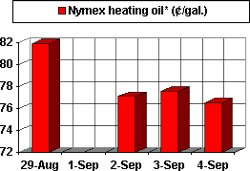

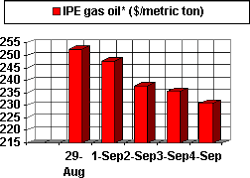

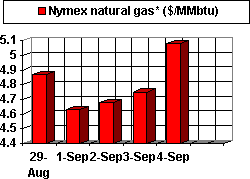

(There are no NYMEX prices for Sept. 1 because of the Labor Day holiday)

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price. @New contract