A burgeoning surplus of crude oil capacity among members of the Organization of Petroleum Exporting Countries looms on the horizon.

The world's surplus oil productive capacity could top 7 million b/d by 2005, up from about 3.3 million b/d in 2004. Most of this surplus will be in OPEC.

And who offers this bearish outlook? None other than OPEC itself. In its latest monthly oil market report, published last month, the OPEC Secretariat outlined a scenario for the call on OPEC oil in 2004. It's a sobering scenario for oil market watchers.

Demand vs. supply growth

The secretariat's analysis points to the cost of the organization's efforts to defend oil prices in a band at $22-28/bbl for a basket of OPEC marker crudes.

It noted that world oil demand growth has averaged 600,000 b/d/year in recent years, while non-OPEC oil supply has risen by an average 1 million b/d/year. Accommodating that disparity has meant a loss in market share for OPEC.

Monitoring various forecasts for global oil demand and non-OPEC supply in 2004, the secretariat comes up a with consensus of 1.1 million b/d for the former, give or take 400,000 b/d, and 1.1 million b/d for the latter. Some of those same forecasts peg their demand growth assumptions to this year's rate. However, the OPEC analysts note that incremental oil demand growth in 2003 would have been much lower had it not been for anomalous spurts of fuel-switching occasioned by nuclear outages in Japan and high natural gas prices in the US.

2004-05 outlook

The OPEC Secretariat took note of the projected spread between growth in non-OPEC supply and growth in demand as unchanged next year. That would make it the fifth consecutive year of zero or negative growth in that differential. In short: no room for OPEC production to grow.

But most forecasts call Iraqi oil production to resuscitate in 2004, adding an increment of about 1.5 million b/d beyond current levels. Once again, Iraq is an oil market wild card, only headed in a different direction from when persistent prospects of outage added a premium to oil prices in recent years. Now the concern is downside risk for prices from growth in Iraqi supply.

"This demonstrates the arduous task OPEC and other exporters face in accommodating Iraqi production against continued supply growth in non-OPEC producers, which is expected to match or even exceed forecast demand growth," the secretariat said.

No kidding. The OPEC 10 (excluding Iraq) alone is expected to boost its own productive capacity by 2.5 million b/d in 2004.

And the picture doesn't get any better for 2005. With global oil productive capacity expected to reach 87.3 million b/d in 2005, up from 82.3 million b/d in 2004, the productive capacity surplus will only grow. The secretariat pegs oil demand at 79 million b/d in 2004 and 80 million b/d in 2005.

Defending market share vs. price

Just how much market share will OPEC—especially the Saudis—give up in the next 2 years to continue to defend its price band?

It is reasonable to expect a limit to OPEC's countenance of non-OPEC supply growth. The group has its own internal problems as it is, with some members already restive over quotas as their productive capacity grows. Look for 2004 to be filled with talk of quota redesign.

OPEC's recent loss of market share was mitigated in part by high oil prices that were the result of outages in key OPEC nations Iraq, Nigeria, and Venezuela. These outages made it relatively easy for the nonafflicted OPEC members to sustain revenues while losing overall market share to the likes of Russia. But the afflicted countries not only are reviving their production levels, they're also feeling the (revenue) need to make up for lost production.

Even at that, continued cooperation with non-OPEC oil exporters has been necessary to sustain oil prices. In the next 2 years—unless demand growth unexpectedly exceeds expectations—that cooperation will be more important than ever. And nowhere it will it be more important—or challenging—than with Russia.

So who really cares what OPEC does Sept. 24 in Vienna? (Not that they'll do anything.)

That proposed Saudi investment of $25 billion in Russia's oil and gas sector may prove the ultimate market stabilizer.

(Online Sept. 12; author's e-mail: [email protected])

OGJ Hotline Market Pulse

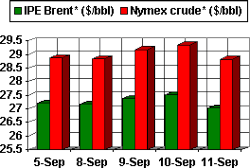

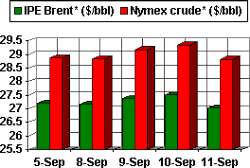

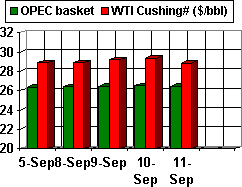

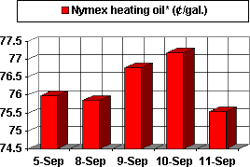

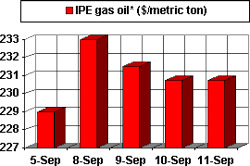

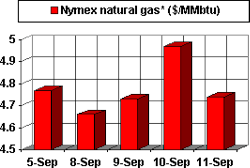

Latest Prices as of Sept. 12, 2003

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.